How HDFC and ICICI Banks’ credit card charge hikes from July 1, 2025, impact you. Learn about new fees on gaming, wallets, and utilities, plus tips to save. Stay informed with the latest on India’s credit card market!

As India’s financial landscape evolves, major private sector banks like HDFC Bank and ICICI Bank are set to implement significant changes to their credit card charges and banking services, effective July 1, 2025. These updates, announced through official notifications, have sparked widespread discussion among cardholders and financial experts. With the credit card market in India nearing 11 crore cards, led by giants like HDFC, ICICI, and SBI, these revisions will impact millions of users. This blog post dives deep into the details of the new credit card fees, their implications, and actionable tips to navigate these changes.

Understanding the Credit Card Charge Hike: What’s Changing?

Starting July 1, 2025, HDFC Bank and ICICI Bank will introduce revised credit card charges and banking service fees, targeting specific transaction categories such as online gaming, digital wallets, utility payments, and more. These updates reflect the banks’ efforts to align with evolving market dynamics, curb misuse of reward programs, and address regulatory pressures from the Reserve Bank of India (RBI). Below is a detailed breakdown of the changes.

HDFC Bank Credit Card Charges: Key Updates

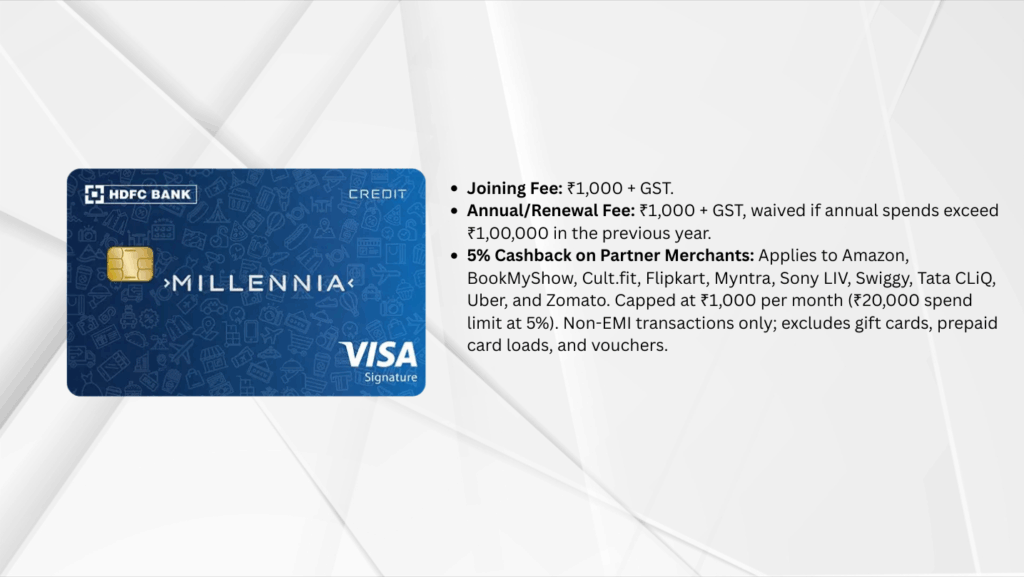

HDFC Bank, a leader in India's credit card market with over 3 lakh new cards issued in January 2025, has introduced targeted fees to promote fair usage. Here are the key changes:

- Online Skill-Based Gaming Transactions:

- If you spend more than Rs 10,000 per month on platforms like Dream11, Rummy Culture, Junglee Games, or MPL, a 1% fee will apply to the entire monthly spend in this category.

- The fee is capped at Rs 4,999 per month.

- No reward points will be earned on these transactions, discouraging the use of credit cards for excessive gaming spends.

- Digital Wallet Loading:

- Loading more than Rs 10,000 per month into third-party wallets like PayTM, Mobikwik, Freecharge, or Ola Money will incur a 1% charge on the total amount.

- This fee is also capped at Rs 4,999 per month.

- Utility Payments:

- For utility payments exceeding Rs 50,000 per month, a 1% fee will be charged, capped at Rs 4,999.

- Notably, insurance payments are excluded from this category and will not incur additional charges.

- Rent, Fuel, and Education Transactions:

- The 1% fee on rent payments remains unchanged.

- Fuel transactions above Rs 15,000 will attract a 1% fee, capped at Rs 4,999 per transaction.

- Education payments made directly through official college or school websites or their POS machines will remain fee-free.

- Reward Point Restrictions:

- Following earlier changes in 2024, HDFC Bank capped reward points at 2,000 per month for utility transactions (effective September 1, 2024) and discontinued reward points for education payments via third-party apps like CRED or Mobikwik.

These revisions aim to prevent the misuse of personal credit cards for business transactions or reward point accumulation, ensuring equitable use of credit card benefits.

ICICI Bank Credit Card and Banking Charges: What’s New?

ICICI Bank, which issued 1.8 lakh new cards in January 2025, has also revised its fee structure. Key updates include:

- Credit Card Service Fees:

- Starting November 15, 2024, ICICI Bank discontinued rewards on government transactions and capped fuel surcharge waivers for spends exceeding Rs 1,00,000 per month.

- A 1% fee applies to utility payments above Rs 50,000 and fuel transactions over Rs 10,000.

- The threshold for annual fee reversal has been lowered from Rs 15 lakh to Rs 10 lakh, excluding rent and education payments.

- Banking Service Charges:

- Cash deposits, cheque deposits, demand drafts (DD), and pay orders (PO) now carry a fee of Rs 2 per Rs 1,000, with a minimum of Rs 50 and a maximum of Rs 15,000. Previously, the fee was Rs 50 for amounts up to Rs 10,000 and Rs 5 per Rs 1,000 beyond that.

- ATM transaction fees have increased:

- For non-ICICI Bank ATMs, after three free transactions, the fee is now Rs 23 for financial transactions (up from Rs 21) and Rs 8.5 for non-financial transactions.

- For ICICI Bank ATMs, regular savings account holders will pay Rs 23 per financial transaction beyond the first five in a month (up from Rs 21).

- Debit card fees:

- The annual fee has risen from Rs 200 to Rs 300.

- The replacement debit card fee has increased from Rs 200 to Rs 300.

- Discontinued Charges (Effective July 1, 2024):

- ICICI Bank eliminated fees for cheque/cash pick-up, charge slip requests, dial-a-draft transactions, outstation cheque processing, and duplicate statement requests, providing some relief to customers.

These changes reflect ICICI Bank’s focus on streamlining operations while aligning with regulatory guidelines.

Why Are Banks Hiking Charges?

The credit card charge hikes by HDFC and ICICI are driven by several factors:

- Regulatory Pressure:

- The RBI has tightened norms on unsecured loans due to rising delinquencies, as seen in its November 2023 macro-prudential measures. Higher risk weights on unsecured loans, including credit cards, have prompted banks to adjust fee structures to mitigate risks.

- Market Dynamics:

- With India’s credit card market growing to 10.89 crore cards by January 2025, banks like HDFC, ICICI, and SBI dominate, issuing nearly 90% of new cards. However, a 2.1% drop in credit card spending (from Rs 1.89 lakh crore in December 2024 to Rs 1.85 lakh crore in January 2025) indicates cautious consumer behavior, pushing banks to recover revenue through fees.

- Curbing Misuse:

- Banks have noted that some cardholders exploit reward programs by using personal credit cards for business expenses or high-value transactions. The new fees and caps aim to promote fair usage and prevent reward point abuse.

- Operational Costs:

- Rising operational costs, including those for digital infrastructure and ATM services, have led banks to revise charges for cash deposits, cheque processing, and ATM transactions.

Impact on Cardholders: What Does This Mean for You?

The credit card fee hikes will affect various user groups differently:

- Frequent Online Gamers: If you spend heavily on platforms like Dream11 or MPL, the 1% fee on spends above Rs 10,000 could add up, especially without reward points.

- Digital Wallet Users: Regular users of PayTM, Mobikwik, or similar platforms will face additional costs for loading funds beyond Rs 10,000 monthly.

- Utility Bill Payers: Households with high utility bills (above Rs 50,000) will incur a 1% fee, impacting those who rely on credit cards for convenience.

- Fuel and Rent Payers: The 1% fee on fuel transactions above Rs 15,000 and unchanged rent payment fees will affect frequent travelers and renters.

- General Banking Customers: Increased ATM fees and debit card charges will impact everyday banking, particularly for those who frequently use non-home bank ATMs.

However, there are silver linings:

- Insurance payments are exempt from utility fees at HDFC Bank.

- Education payments via official channels remain fee-free.

- ICICI Bank’s discontinuation of certain charges (e.g., cheque pick-up) provides minor relief.

How to Navigate the New Charges: Actionable Tips

To minimize the impact of these credit card fee hikes, consider the following strategies:

- Monitor Your Spending:

- Track your monthly spends on online gaming, digital wallets, and utility payments to stay below the Rs 10,000 or Rs 50,000 thresholds.

- Use budgeting apps to categorize and manage your expenses effectively.

- Opt for Direct Payments:

- For education payments, use official college or school websites or POS machines to avoid fees and retain reward points.

- Pay utility bills directly through service providers or bank accounts to bypass the 1% fee on high-value transactions.

- Leverage Alternative Payment Methods:

- Choose the Right Credit Card:

- Evaluate your spending patterns and select cards that align with your needs. For example, Amazon Pay ICICI Credit Card offers 5% cashback for Prime members on Amazon spends, while Flipkart Axis Bank Credit Card suits Flipkart loyalists.

- Premium cards like ICICI Bank Emeralde Credit Card offer benefits like unlimited lounge access and low forex mark-up, ideal for frequent travelers.

- Convert to EMIs:

- Use HDFC Bank’s Smart EMI facility or ICICI Bank’s EMI conversion for big-ticket purchases to spread costs over 3–24 months, reducing financial strain.

- Be cautious of interest rates, though some merchants offer no-cost EMIs.

- Stay Informed:

- Regularly check official bank notifications for updates on fees and reward programs.

- Review your credit card statements to identify unexpected charges.

- Contact Customer Care:

- For queries, reach out to ICICI Bank at 1860 120 7777 or HDFC Bank customer care to clarify charges or request fee waivers for high spenders.

The Bigger Picture: India’s Credit Card Market in 2025

India’s credit card market is booming, with HDFC Bank, SBI Cards, and ICICI Bank leading the charge. The industry added 8.2 lakh new cards in January 2025, but a 4.7% decline in HDFC Bank’s credit card spending and rising delinquencies highlight challenges. The RBI’s stringent regulations and banks’ corrective measures aim to ensure financial stability, but they also mean higher costs for consumers.

The NPCI’s tier-based lounge access policy for RuPay cardholders, effective January 1, 2025, further underscores the industry’s shift toward tiered benefits based on spending. Cardholders must adapt to these changes by choosing cards that offer maximum value for their spending patterns.

Stay Proactive, Stay Informed

The credit card charge hikes by HDFC Bank and ICICI Bank effective July 1, 2025, mark a significant shift in India’s banking landscape. By understanding the new fees, monitoring your spending, and leveraging alternative payment methods, you can minimize costs and maximize benefits. Whether you’re a frequent gamer, traveler, or utility bill payer, staying informed and strategic will help you navigate these changes effectively.