“Learn how to lodge an insurance claim if the nominee is illiterate (uses thumb impression) or a minor in India. Step-by-step process, required documents, IRDAI rules 2024 & expert tips for smooth settlement. Avoid claim rejection – read now! “

In India, insurance policies are a vital tool for financial security, ensuring that loved ones are protected in unforeseen circumstances. However, complexities can arise when the nominee tasked with claiming the insurance payout faces challenges, such as being illiterate and using a thumb impression or being a minor. As of 2025, with the insurance sector evolving under the guidance of the Insurance Regulatory and Development Authority of India (IRDAI), understanding the procedure to lodge an insurance claim in such cases is more critical than ever.

This blog post provides a detailed, step-by-step guide on how to navigate the insurance claim process when the nominee is illiterate or a minor. Packed with the latest data, practical insights like “insurance claim process “, “nominee illiterate thumb impression”, and “minor nominee insurance claim”, this article aims to offering valuable information to readers.

Understanding the Role of a Nominee in Insurance

Before diving into the procedure, let’s clarify the role of a nominee in an insurance policy. A nominee is an individual designated by the policyholder to receive the insurance proceeds upon the policyholder’s demise. In India, the nominee can be a spouse, child, parent, or even a trusted friend, depending on the policyholder’s preference.

However, challenges arise when the nominee is:

- Illiterate: Unable to read or write, relying on a thumb impression for legal documentation.

- A Minor: Below 18 years of age, legally incapable of managing financial transactions independently.

According to IRDAI data from 2024, over 60% of life insurance policies in rural India have nominees who are either minors or lack formal education, making this a widespread concern. With this in mind, let’s explore the insurance claim process tailored to these scenarios.

Procedure to Lodge a Claim When the Nominee Is Illiterate and Uses a Thumb Impression

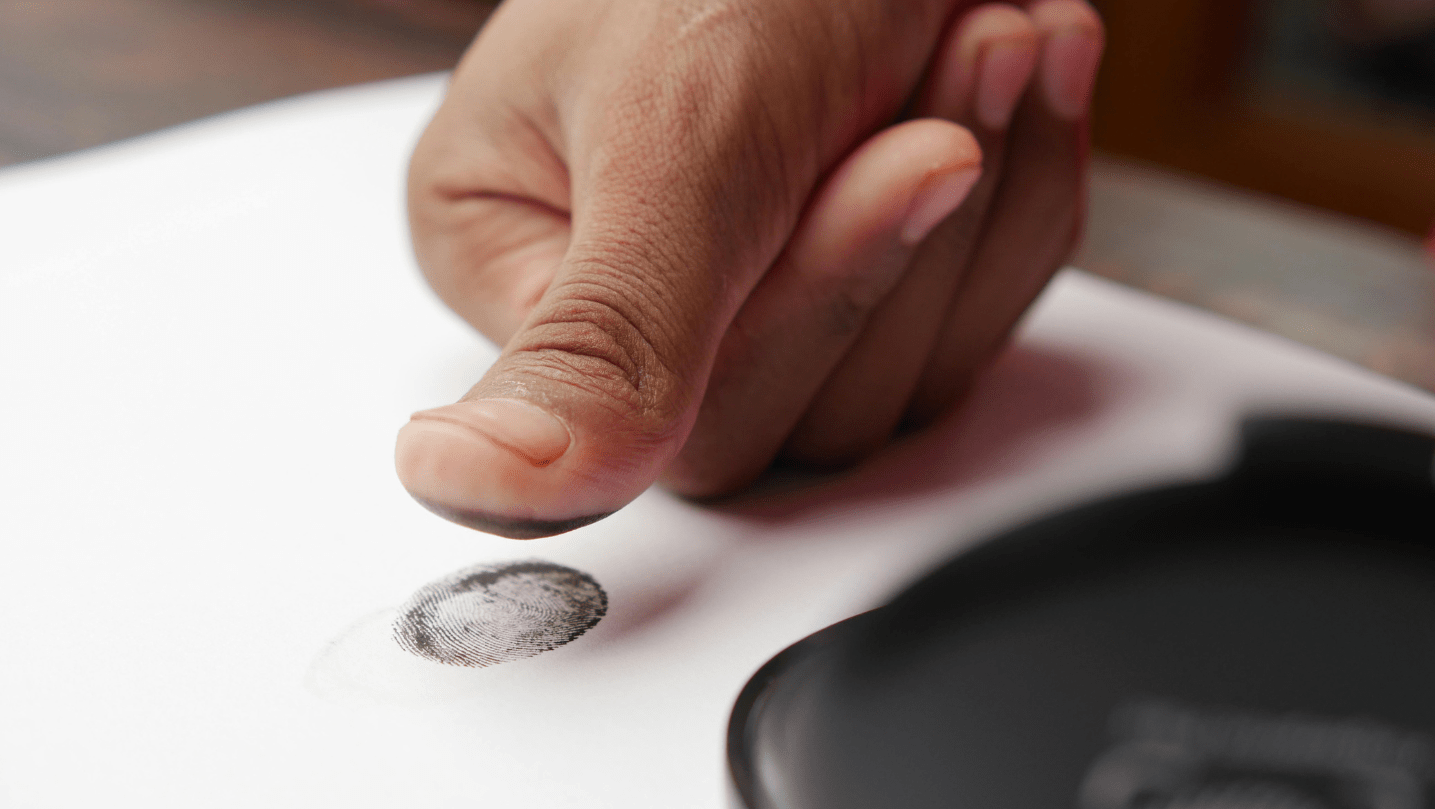

When the nominee is illiterate and affixes a thumb impression instead of a signature, the insurance claim process requires additional steps to ensure authenticity and compliance with legal standards. Here’s how it works in 2025:

Step 1: Notify the Insurance Company

The first step remains unchanged—promptly inform the insurance provider of the policyholder’s death. This can be done by:

- Visiting the nearest branch.

- Calling the insurer’s helpline (most companies offer toll-free numbers).

- Submitting an online claim intimation via the insurer’s website or app.

Provide basic details such as the policy number, date, place, and cause of death. If the nominee is illiterate, a family member, friend, or agent can assist with this step.

Step 2: Gather Required Documents

The insurance company will request a set of documents to process the claim. These typically include:

- Death Certificate: Issued by the local municipal authority.

- Policy Document: The original insurance policy bond.

- Claim Form: Provided by the insurer, to be filled out.

- Identity Proof of Nominee: Aadhaar card, voter ID, or any government-issued ID with the thumb impression.

- Bank Account Details: For direct claim payout, linked to the nominee’s identity.

For an illiterate nominee, the claim form must be completed with assistance, and the thumb impression replaces the signature.

Step 3: Attestation of Thumb Impression

Since the nominee cannot sign, their thumb impression must be legally validated. As per the IRDAI (Protection of Policyholders’ Interests) Regulations and banking norms:

- The thumb impression on the claim form and other documents must be attested by two independent witnesses.

- One witness should ideally be a bank official or an authorized representative known to the insurer, while the other can be a person known to the nominee (e.g., a family member or local authority).

- A certificate from the attesting witnesses stating that the contents of the documents were explained to the nominee in their native language is often required.

This step ensures that the illiterate nominee understands the claim process and consents to it, preventing fraud or misrepresentation.

Step 4: Submission of Documents

Submit the completed claim form and supporting documents to the insurer. This can be done:

- In person at the branch.

- Via a registered post or courier.

- Online, if the insurer offers a digital submission portal (a family member or agent can assist here).

Step 5: Verification and Processing

The insurer verifies the documents, including the authenticity of the thumb impression. In 2025, many insurance companies use biometric verification linked to Aadhaar to streamline this process. The IRDAI mandates that claims be settled or rejected within 30 days of receiving all documents, unless an investigation is warranted (extending up to 6 months).

Step 6: Claim Payout

Once approved, the claim amount is transferred to the nominee’s bank account. For illiterate nominees without a bank account, the insurer may:

- Issue a cheque in the nominee’s name, which can be encashed with assistance.

- Coordinate with a bank to open an account using the thumb impression, adhering to RBI guidelines for illiterate account holders.

Procedure to Lodge a Claim When the Nominee Is a Minor

When the nominee is a minor (under 18 years), the process involves a legal guardian or appointee, as minors cannot directly receive or manage insurance proceeds. Here’s the detailed procedure:

Step 1: Appoint a Legal Guardian or Appointee

At the time of purchasing the policy, the policyholder should designate an appointee—a trusted adult (e.g., a parent, sibling, or relative)—to manage the claim if the nominee is a minor. If no appointee was named:

- A legal guardian must be appointed through a court order or family consensus, depending on the circumstances.

- The guardian’s identity proof and relationship to the minor must be documented.

As per a 2024 survey by the National Insurance Academy, 35% of policies with minor nominees lack an appointed guardian, leading to delays in claim settlement.

Step 2: Notify the Insurance Company

Similar to the illiterate nominee process, inform the insurer of the policyholder’s death, providing policy details and death-related information. The appointee or guardian typically handles this step.

Step 3: Collect Necessary Documents

The documents required are slightly modified for a minor nominee:

- Death Certificate: Of the policyholder.

- Policy Document: Original bond.

- Claim Form: Filled by the appointee/guardian.

- Identity Proof of Minor: Birth certificate, Aadhaar card, or school ID.

- Identity Proof of Appointee/Guardian: Aadhaar, PAN, or voter ID.

- Proof of Guardianship: Court order or appointee declaration from the policy.

- Bank Account Details: In the minor’s name, managed by the guardian, or in the guardian’s name with a declaration to use funds for the minor’s benefit.

Step 4: Submission of Documents

The appointee or guardian submits the documents to the insurer through the preferred channel (branch, post, or online). The claim form must be signed by the guardian, not the minor.

Step 5: Verification and Approval

The insurer verifies the guardian’s authority and the submitted documents. This may involve cross-checking with legal records or contacting the appointee for clarification. The 30-day settlement rule applies here as well.

Step 6: Claim Disbursement

The payout is transferred to:

- A bank account in the minor’s name, managed by the guardian until the minor turns 18.

- The guardian’s account, with a legal undertaking that the funds will be used for the minor’s welfare (e.g., education or living expenses).

Once the minor reaches 18, they can claim full control over the funds, provided the guardian has preserved them.

Key Considerations for Both Scenarios

- IRDAI Guidelines: The IRDAI’s Protection of Policyholders’ Interests Regulations, updated in 2023, emphasize fair treatment of nominees, ensuring illiterate or minor nominees are not disadvantaged.

- Aadhaar Integration: Aadhaar-based biometric authentication simplifies identity verification for thumb impressions and minor nominees.

Timelines

- Insurers must settle claims within 30 days of document submission, or pay interest (2% above the bank rate) for delays beyond 45 days, as per IRDAI norms.

Assistance Options

- Insurance Agents: Agents are duty-bound to assist nominees, especially in rural areas where illiteracy is common.

- NGOs and Legal Aid: Organizations like the Consumer Education and Protection Foundation offer free support for claim-related issues.

Challenges and Solutions

Challenges

- Illiteracy Barriers: Lack of awareness about the process can delay claims.

- Minor Nominee Disputes: Absence of an appointee or family disagreements can complicate guardianship.

- Documentation Errors: Incorrect or incomplete forms lead to rejections.

Solutions

- Digital Tools: Insurers like LIC and SBI Life have introduced voice-assisted apps in regional languages for illiterate nominees.

- Awareness Campaigns: IRDAI’s 2024-25 outreach programs target rural policyholders, explaining nominee rights.

- Simplified Forms: Standardized claim forms with pictorial guides are being rolled out.

Latest Data and Statistics

- Insurance Penetration: As per IRDAI’s annual report (2024-25), insurance penetration in India reached 4.5%, with rural areas accounting for 40% of new policies.

- Claim Settlement Ratio: Life insurers reported a 98.5% claim settlement ratio in 2024, reflecting improved processes.

- Digital Claims: Over 25% of claims are filed online, reducing paperwork hassles for nominees.

Lodging an insurance claim when the nominee is illiterate or a minor may seem daunting, but with the right steps and support, it’s manageable. In India’s insurance ecosystem is more inclusive, leveraging technology and legal safeguards to protect vulnerable nominees. Whether it’s attesting a thumb impression or appointing a guardian, following the outlined insurance claim process ensures a smooth payout.

For further assistance, contact your insurer’s helpline or visit the IRDAI website (www.irdai.gov.in).

-

Why Car Insurance Companies Are Now Tracking Your Driving Habits — And What You Can Do About It

-

Is Nvidia’s AI Dominance Finally Over? Why Google’s Multibillion-Dollar Chip Partnership With Meta Is the Biggest Threat Nvidia Has Ever Faced

-

Block’s Bold AI Strategy Unveiled as Nasdaq Tumbles — One Company’s Growth Play Amid Market Chaos

-

Cash App and Square Owner Block Announces Massive Job Cuts as It Moves Aggressively to Automate Operations with AI