“Protect your money and personal data from SIM card scams! Learn how SIM swap fraud works, real-life examples, and actionable tips to secure your phone number. Stay ahead of scammers targeting your SIM card and avoid costly identity theft. Read now to safeguard your digital life!”

In today’s digital age, our smartphones have become indispensable tools for communication, banking, and personal management. However, this convenience comes with its own set of risks. One of the most alarming threats is the rise of SIM card scams, which can lead to significant financial losses. This blog post will delve into the various types of SIM card scams, how they work, and what you can do to protect yourself.

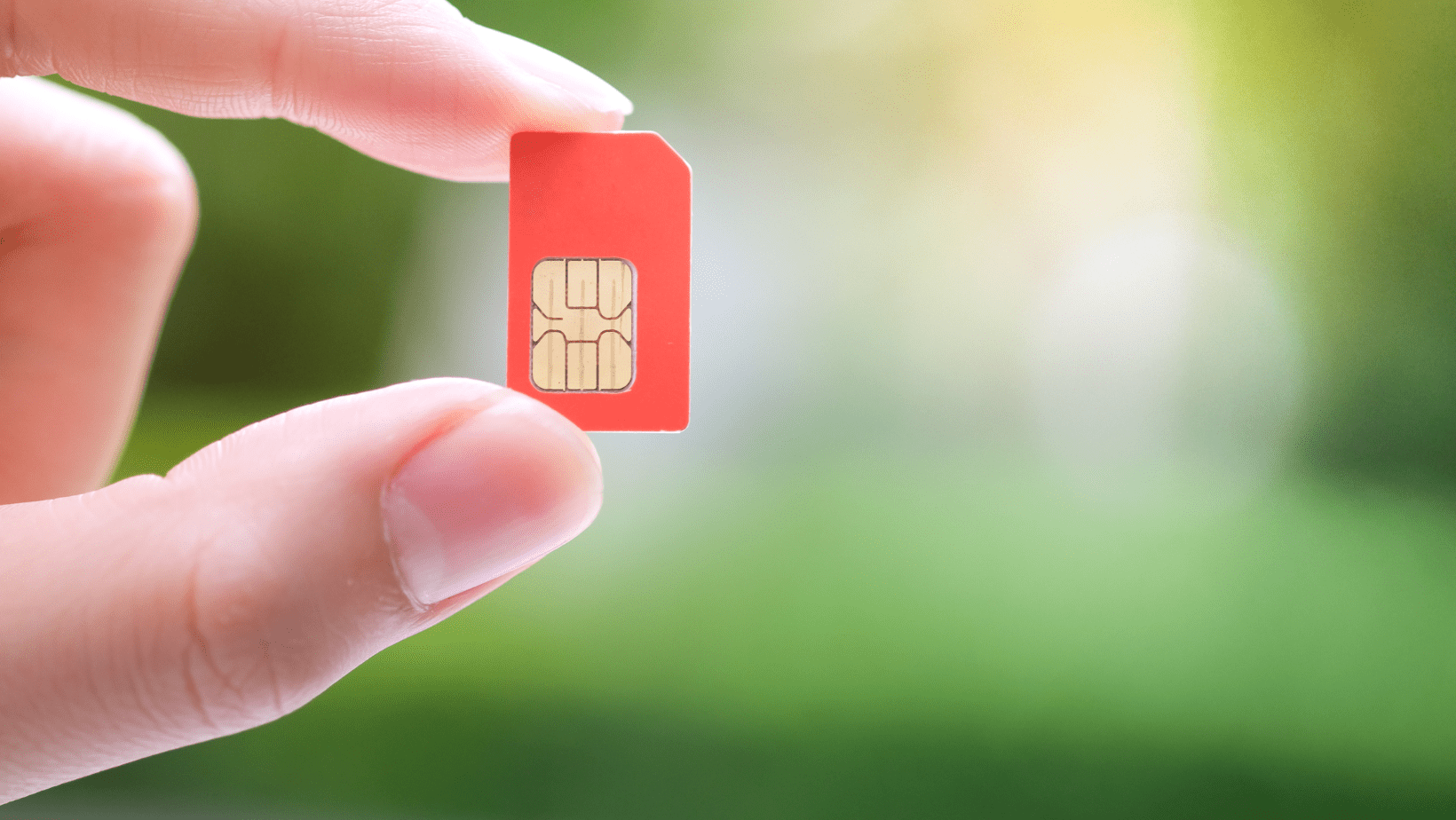

The SIM card in your phone is more than just a small piece of plastic; it is the gateway to your personal and financial information. Scammers have found ways to exploit this tiny card to gain access to your bank accounts, social media profiles, and other sensitive data. Understanding how these scams work and taking proactive measures can help you safeguard your information and your money.

What Are SIM Card Scams?

SIM card scams, also known as SIM swapping or SIM hijacking, occur when fraudsters gain control of your phone number by tricking your mobile carrier into transferring it to a new SIM card in their possession. Once they have control of your number, they can bypass two-factor authentication (2FA), access your online accounts, and steal your money.

According to the Federal Trade Commission (FTC), SIM swap fraud has surged in recent years, with losses amounting to millions of dollars annually. In 2022 alone, the FBI reported a 400% increase in SIM swap-related complaints, highlighting the growing sophistication of these scams.

Types of SIM Card Scams

SIM Swap Fraud

SIM swap fraud occurs when scammers trick your mobile carrier into transferring your phone number to a new SIM card that they control. Once they have your number, they can intercept calls and texts, including verification codes sent by your bank or other services. This allows them to gain access to your accounts and steal your money.

SIM Cloning

SIM cloning involves creating a duplicate of your SIM card. Scammers use specialized hardware to copy the data from your SIM card onto another card. This allows them to use your phone number and access your accounts without your knowledge.

Phishing Attacks

Phishing attacks involve tricking you into revealing your personal information, such as your SIM card number, through fake emails, texts, or websites. Scammers use this information to gain control of your phone number and access your accounts.

How Do SIM Card Scams Work?

- Gathering Personal Information

Scammers start by collecting personal information about their targets. This can include your full name, address, date of birth, and even your Social Security number. They often obtain this data through phishing emails, data breaches, or social engineering. - Contacting Your Mobile Carrier

Armed with your personal information, the scammer contacts your mobile carrier, posing as you. They claim to have lost their phone or SIM card and request a replacement. If successful, the carrier deactivates your SIM card and activates a new one in the scammer’s possession. - Bypassing Two-Factor Authentication (2FA)

Many online accounts use 2FA, which sends a verification code to your phone number. With control of your SIM card, the scammer can intercept these codes and gain access to your email, bank accounts, cryptocurrency wallets, and more. - Draining Your Accounts

Once inside your accounts, scammers can transfer funds, make unauthorized purchases, or even sell your personal information on the dark web.

Why Are SIM Card Scams on the Rise?

- Increased Reliance on 2FA

While 2FA is a valuable security tool, its reliance on SMS verification codes makes it a weak link. Scammers exploit this vulnerability by targeting your phone number. - Lax Security Measures by Mobile Carriers

Some mobile carriers have inadequate security protocols, making it easier for scammers to impersonate customers and request SIM swaps. - The Growing Value of Personal Data

With the rise of online banking and digital assets, personal data has become a lucrative target for cybercriminals.

How to Protect Yourself from SIM Card Scams

- Use App-Based 2FA

Instead of relying on SMS-based 2FA, use app-based authentication methods like Google Authenticator or Authy. These apps generate codes locally on your device, making them harder to intercept. - Set Up a PIN or Password with Your Carrier

Many mobile carriers allow you to set up a PIN or password for account changes. This adds an extra layer of security and makes it harder for scammers to perform a SIM swap. - Monitor Your Accounts Regularly

Regularly check your bank accounts, email, and other online accounts for suspicious activity. Early detection can help you minimize damage. - Be Cautious with Personal Information

Avoid sharing sensitive information online or over the phone. Be wary of phishing attempts and use strong, unique passwords for your accounts. - Contact Your Carrier Immediately

If you lose service unexpectedly or receive a notification about a SIM card change, contact your carrier immediately. This could be a sign that a scammer is attempting a SIM swap.

What to Do If You’re a Victim of a SIM Card Scam

- Contact Your Mobile Carrier

Inform your carrier about the unauthorized SIM swap and request that your number be restored to your original SIM card. - Freeze Your Accounts

Contact your bank, credit card companies, and other financial institutions to freeze your accounts and prevent further unauthorized transactions. - Change Your Passwords

Reset the passwords for all your online accounts, especially those linked to your phone number. - File a Report

Report the incident to your local law enforcement agency and the FTC. This can help authorities track down the scammers and prevent future attacks. - Monitor Your Credit

Consider placing a fraud alert or credit freeze on your credit reports to prevent identity theft.

The Role of Mobile Carriers in Preventing SIM Card Scams

Mobile carriers play a crucial role in combating SIM card scams. Some steps they can take include:

- Implementing Stronger Authentication Measures

Carriers should require multiple forms of identification before processing SIM swap requests. - Educating Customers

Providing customers with information about SIM card scams and how to protect themselves can help reduce the risk of fraud. - Monitoring for Suspicious Activity

Carriers should monitor for unusual account activity, such as multiple SIM swap requests, and flag them for further investigation.

The Future of SIM Card Security

As SIM card scams continue to evolve, so too must our defenses. Emerging technologies like eSIMs (embedded SIMs) and blockchain-based authentication could offer more secure alternatives to traditional SIM cards. Additionally, increased collaboration between mobile carriers, law enforcement, and cybersecurity experts will be essential in staying ahead of scammers.

Your SIM card is more than just a piece of plastic—it’s a gateway to your digital life. By understanding how SIM card scams work and taking proactive steps to protect yourself, you can safeguard your money and personal information from falling into the wrong hands. Stay vigilant, stay informed, and remember: your phone number is worth protecting.

-

Spirit Airlines Bankruptcy and Flight Cancellations — The Real Reason!

Spirit Airlines just canceled hundreds of flights across 15+ US airports — and the list keeps growing. Fort

-

Gold and silver rates today: Latest Rates in all Major Cities February 20, 2026

Gold prices exploding ₹15,649/g? Silver crashes 23%—now rebounding at ₹270/g! Uncover shocking volatility secrets, city tables (Delhi to

-

Indian Stock Market Trends: Sensex & Nifty Plunge on Geopolitical Tensions

Sensex crashes 1,200 pts! Nifty bleeds—oil shock or buy signal? 7.4% GDP hides secret rebound clues. ONGC surges