IDFC FIRST Bank’s 2025 GST payment revolution is here, offering credit card, UPI, and branch payments for all Indians—customers or not! Authorized by RBI, this game-changing facility simplifies tax compliance with instant confirmations and robust security. Serving 35 million customers, the bank’s digital-first approach drives financial inclusion and fuels India’s cashless economy. Will this spark a nationwide tax transformation?

India’s financial ecosystem is undergoing a transformative shift, with seamless digital solutions becoming the cornerstone of modern banking. At the forefront of this evolution is IDFC FIRST Bank, a private sector bank that has introduced a ground breaking GST payment facility in 2025, designed to simplify tax compliance for both customers and non-customers. By enabling Goods and Services Tax (GST) payments through credit cards, debit cards, UPI, internet banking, and its extensive branch network, IDFC FIRST Bank is redefining accessibility and convenience in tax payments. This initiative aligns with India’s broader vision of fostering a digital-first economy while promoting financial inclusion and compliance.

This comprehensive blog post delves into IDFC FIRST Bank’s innovative GST payment system, its features, step-by-step payment process, and its role in shaping India’s financial landscape. Packed with the latest 2025 insights, this article aims to provide taxpayers, businesses, and financial enthusiasts with a clear understanding of how this service enhances tax compliance and supports India’s digital transformation. Let’s explore how IDFC FIRST Bank is paving the way for a seamless and inclusive tax payment experience.

IDFC FIRST Bank: A Trusted Partner for GST Collections

Private Sector Authorization and Government Backing

In 2025, IDFC FIRST Bank has solidified its position as one of the few private sector banks authorized by the Government of India and the Reserve Bank of India (RBI) to collect GST payments. This authorization highlights the bank’s robust infrastructure, adherence to regulatory standards, and commitment to supporting India’s taxation ecosystem. As a trusted partner, IDFC FIRST Bank ensures secure, efficient, and compliant GST transactions, making it a reliable choice for taxpayers across the country.

The bank’s inclusion in this elite group of authorized institutions underscores its technological prowess and dedication to fostering a transparent financial system. This move aligns with the government’s push to integrate advanced digital solutions into public services, ensuring taxpayers have access to reliable and user-friendly platforms.

A Vision for Universal Banking

IDFC FIRST Bank positions itself as a universal bank, offering a comprehensive suite of financial services that cater to diverse customer segments, including retail, MSMEs, startups, and corporates. With a customer base of 35 million and a business portfolio of ₹5,10,032 crores as of June 30, 2025, the bank is a significant player in India’s financial sector. Its GST payment facility is a natural extension of its mission to provide inclusive, accessible, and technology-driven banking solutions.

By opening its GST payment services to non-customers, IDFC FIRST Bank demonstrates its commitment to financial inclusion, ensuring that all taxpayers, regardless of their banking affiliation, can benefit from its digital infrastructure. This approach not only broadens the bank’s reach but also reinforces its role as a catalyst for India’s digital economy.

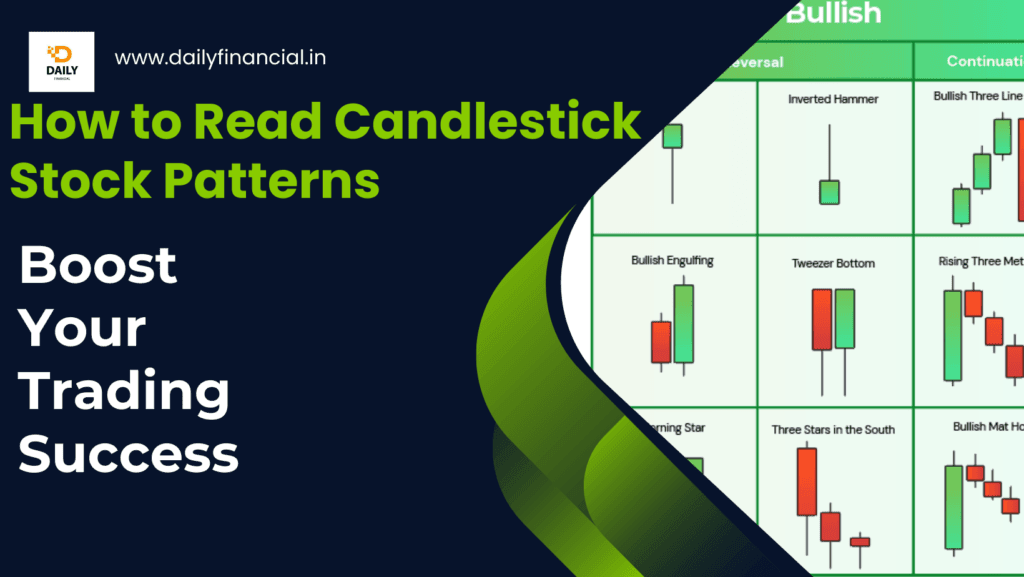

How to Read Candlestick Stock Patterns and Boost Your Trading Success

Why Do Joint Accounts Fail in Income Tax? Top 7 Reasons Explained

How to Block Unauthorized Transactions in SBI Internet Banking?

Lokpal’s ₹5 Crore BMW Tender Triggers Storm: Why an Anti-Corruption Body’s Luxury Car Plan Has India Seeing Red

Key Features of IDFC FIRST Bank’s GST Payment Facility

Versatile Payment Channels for All Taxpayers

IDFC FIRST Bank’s GST payment system is designed to cater to the diverse needs of Indian taxpayers. The facility offers a range of payment options, ensuring flexibility and convenience:

- Credit and Debit Cards: Taxpayers can use cards issued by IDFC FIRST Bank or other financial institutions, providing a seamless payment experience. This option is particularly appealing for those seeking to leverage reward points or manage cash flow effectively.

- UPI (Unified Payments Interface): As one of India’s most popular digital payment methods, UPI integration allows for instant GST payments, making it a preferred choice for tech-savvy users.

- Internet Banking: IDFC FIRST Bank’s intuitive online banking platform enables registered users to pay GST effortlessly, with secure and streamlined processes.

- Nationwide Branch Network: For those who prefer traditional banking, payments can be made via Demand Drafts (DD), cheques, or cash at any of the bank’s 1,016 branches across India, covering over 60,000 cities, towns, and villages.

This multi-channel approach ensures that taxpayers, whether urban professionals or rural entrepreneurs, can choose a method that suits their preferences and technological access.

Inclusive Access for Customers and Non-Customers

A standout feature of this initiative is its inclusivity. Unlike traditional banking services that prioritize existing customers, IDFC FIRST Bank’s GST payment facility is open to everyone. This accessibility empowers small businesses, freelancers, and individuals who may not have an account with the bank to utilize its advanced payment infrastructure. By removing barriers, the bank fosters a more inclusive financial ecosystem, aligning with India’s goal of universal access to financial services.

Seamless Digital Experience with Instant Confirmations

The GST payment process is designed for efficiency and user satisfaction. Upon completing a payment, taxpayers receive instant confirmation and can download or print their GST challan directly from the portal. This feature eliminates delays in acknowledgment, simplifying record-keeping and ensuring compliance with GST regulations. The bank’s focus on a frictionless experience reflects its customer-centric approach and technological innovation.

Robust Security and Compliance

Given the sensitive nature of tax payments, IDFC FIRST Bank prioritizes security. The bank employs 128-bit SSL encryption for online transactions, ensuring data protection and secure processing. Additionally, its collaboration with government agencies ensures compliance with regulatory standards, making the platform future-ready for further enhancements.

Step-by-Step Guide to Paying GST with IDFC FIRST Bank

To make GST payments straightforward, IDFC FIRST Bank provides a clear and user-friendly process. Below is a detailed guide for both digital and in-person payments:

Online GST Payment Process

- Login to the GST Portal

Access the official GST portal at https://services.gst.gov.in/services/login. - Create a GST Challan

Navigate to the “Payments” section, select “Create Challan,” and enter the required GST details, such as GSTIN and tax amount. - Choose E-Payment Mode

Select “E-Payment” and choose from Net Banking, Credit Card, Debit Card, or BHIM UPI as the payment method. - Select IDFC FIRST Bank

From the list of authorized banks, choose IDFC FIRST Bank as your payment gateway. - Complete the Payment

Enter your card details, UPI ID, or net banking credentials to finalize the transaction. Ensure you verify the details before submission. - Download the GST Challan

Upon successful payment, download or print the GST paid challan for your records. You can also track the payment status by navigating to “Services > Payments > Track Payment Status” and entering your GSTIN and CPIN number.

In-Person Payment at Branches

For those preferring traditional methods:

- Visit any IDFC FIRST Bank branch.

- Submit payment via Demand Draft, cheque, or cash.

- Request a GST payment receipt from the branch staff.

This dual approach ensures that taxpayers across India, regardless of their location or digital literacy, can fulfill their GST obligations with ease.

The Digital Advantage: IDFC FIRST Bank’s Tech-Driven Approach

A Fintech-Like Banking Experience

IDFC FIRST Bank distinguishes itself by blending traditional banking with fintech-like innovation. With a 100% digital core banking system, the bank offers paperless processes, rapid transaction processing, and an integrated payment ecosystem. Its mobile banking app, praised for its user-friendly interface, supports a range of services, from GST payments to UPI transfers and credit card management.

As of June 30, 2025, the bank serves 35 million customers with deposits of ₹2,56,799 crores and loans of ₹2,53,233 crores, reflecting 25.5% and 21.0% year-on-year growth, respectively. This scale, combined with a tech-driven approach, positions IDFC FIRST Bank as a leader in India’s digital banking revolution.

Enhancing Customer Experience

The bank’s digital platforms are designed with user experience (UX) and user interface (UI) at their core, offering:

- Intuitive Navigation: Simplified menus and clear instructions for seamless transactions.

- Real-Time Updates: Instant notifications and confirmations for payments.

- Integrated Services: A single app for banking, tax payments, investments, and more.

This focus on digital excellence ensures that GST payments are not only secure but also effortless, catering to the needs of a diverse user base.

Impact on India’s Economy and Taxpayers

Promoting Financial Inclusion

By extending GST payment services to non-customers, IDFC FIRST Bank bridges the gap between traditional banking and underserved populations. Small businesses, startups, and self-employed professionals, particularly in rural and semi-urban areas, benefit from access to a robust digital payment platform. This initiative supports India’s financial inclusion goals by making essential financial services available to all.

Simplifying Tax Compliance

The availability of multiple payment options reduces the complexity of GST compliance. Taxpayers can choose their preferred method, whether it’s a quick UPI transaction or an in-person payment at a branch. This flexibility minimizes administrative burdens and encourages timely tax payments, contributing to a more compliant tax ecosystem.

Boosting India’s Digital Payments Ecosystem

IDFC FIRST Bank’s GST payment facility aligns with India’s push towards a cashless economy. With UPI transactions soaring in 2025 and digital payments becoming the norm, the bank’s integration of UPI and card-based payments for GST strengthens the digital payments landscape. This move encourages taxpayers to adopt electronic transactions, supporting the Digital India initiative.

2025 Trends in India’s Banking and Tax Payment Landscape

The Indian banking sector in 2025 is witnessing unprecedented growth in digital adoption. Key trends include:

- UPI Dominance: UPI continues to lead as India’s preferred payment method, with billions of transactions monthly.

- Contactless Payments: Credit and debit card usage is rising, driven by contactless technology and reward programs.

- Government Integration: Banks are increasingly integrating with government portals to streamline tax and public service payments.

IDFC FIRST Bank’s GST payment facility taps into these trends, offering a customer-centric platform that aligns with India’s digital and financial aspirations. The bank’s focus on ethical banking, with waived fees on 36 essential savings account services, further enhances its appeal as a customer-first institution.

Final Thought: A New Era for GST Payments in India

IDFC FIRST Bank’s introduction of a GST payment facility accessible via credit cards, debit cards, UPI, internet banking, and branches marks a significant milestone in India’s financial evolution. By prioritizing inclusivity, security, and digital innovation, the bank empowers taxpayers to fulfill their GST obligations with unparalleled ease and efficiency. This initiative not only simplifies tax compliance but also reinforces IDFC FIRST Bank’s commitment to universal banking and financial inclusion.

As India strides towards a digitally inclusive economy, IDFC FIRST Bank stands out as a reliable partner, offering world-class financial solutions that cater to the needs of every taxpayer. Whether you’re a small business owner, a freelancer, or a corporate entity, this GST payment facility ensures that tax compliance is seamless, accessible, and integrated into your financial journey. For a hassle-free GST payment experience in 2025, IDFC FIRST Bank is your trusted ally in navigating India’s dynamic financial landscape.

For more information, visit www.idfcfirstbank.com.