In the realm of financial convenience, credit cards have transformed into indispensable tools that empower individuals to engage in transactions, access credit facilities, and savor a plethora of privileges. Among the numerous credit card alternatives accessible, the HDFC Bank Millennia Credit Card emerges as a versatile selection that caters adeptly to the contemporary way of life. Boasting an array of attributes, incentives, and adaptability, this credit card has captivated the attention of a multitude of users. Within this discourse, we will delve into the pivotal facets of the HDFC Bank Millennia Credit Card, scrutinizing its merits, characteristics, and its alignment with the requisites of present-day consumers.

Table of Contents

- Introduction

- Attributes and Merits

- 2.1 Lucrative Cashback Provisions

- 2.2 Reward Points Framework

- 2.3 Lifestyle Perquisites

- 2.4 Seamless Contactless Transactions

- Qualifications and Application Procedure

- 3.1 Eligibility Requirements

- 3.2 Application Protocol

- 3.3 Essential Documentation

- Charges and Levies

- 4.1 Annual Subscription Fees

- 4.2 Applicable Interest Rates

- 4.3 Penalties for Delayed Payments

- Comparative Examination

- 5.1 HDFC Millennia vs. Other Credit Cards

- User Experience and Testimonials

- Strategies for Maximizing Rewards

- Safeguard Measures

- 8.1 Robust Countermeasures Against Fraud

- 8.2 Ensuring Secure Online Transactions

- Inference

- Frequently Posed Queries

- 10.1 Principal Attributes of the HDFC Bank Millennia Credit Card

- 10.2 How to Initiate the Application for the Millennia Credit Card

- 10.3 Overview of the Yearly Card Fee

- 10.4 Existence of a Reward Points Expiry Date

- 10.5 Mechanism of the Cashback System

Introduction

The HDFC Bank Millennia Credit Card constitutes a financial instrument meticulously tailored to cater to the evolving requisites of the tech-savvy generation. In light of the rapid assimilation of digital services into our daily lives, this credit card is painstakingly fashioned to extend seamless transactions, alluring incentives, and lifestyle benefits that harmonize seamlessly with the sensibilities of the modern-day consumer.

About HDFC Bank Credit Card –

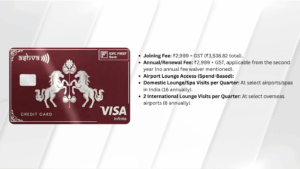

- Complimentary access to airport lounges at domestic and international airports

- Convert credit card spends of Rs 2500 or more into Smart EMIs post your purchases with competitive interest rates and flexible repayment tenures

- Complimentary air accidental cover and emergency overseas hospitalization cover worth lakhs

- Get lucrative vouchers on meeting minimum monthly spending criteria

Other Amazing Offers –

- Leverage revolving credit facilities at nominal interest rates

- Get liability waivers on fraudulent transactions and Credit Card loss, upon prompt reporting

- You earn rewards on all spends that can be redeemed for exciting gifts, vouchers or free flight tickets

Fees & List of all charges

- Joining Fees: Starting at Rs 500 + GST (Depending upon the card selected)

- Annual Fees: Starting at Rs 500 + GST (Depending upon the card selected)

Documents Needed

- Address Proof – Aadhaar, Passport, Latest utility bills

- ID proof – PAN, Voter ID, Passport

- Income proof – Bank Statement, Salary Slips

Eligibility Criteria

- Required Age: 21-65 years

- Employment status: Salaried or Self-Employed

- Minimum Income: Rs 20,000 per month (Salaried)

- Minimum Income: Rs 50,000 per month (Self-Employed)

- Credit score: 700+

- You should be citizen of India or a Non-Resident Indian

Attributes and Merits

2.1 Lucrative Cashback Provisions

A standout characteristic of the HDFC Bank Millennia Credit Card is its notably generous cashback program. Cardholders are presented with the opportunity to avail cashback across diverse categories encompassing dining, shopping, travel, and more. This incentivizes patrons to indulge in their preferred activities while simultaneously amassing a portion of their expenditures as cashback rewards.

2.2 Reward Points Framework

This credit card ushers in an all-encompassing reward points framework, allowing users to accrue points with each transaction they undertake. These points hold the potential to be exchanged for an expansive assortment of alternatives, ranging from shopping vouchers and gift cards to travel reservations. This versatility empowers cardholders to cherry-pick rewards that impeccably align with their proclivities.

2.3 Lifestyle Perquisites

Beyond conventional financial advantages, the Millennia Credit Card extends lifestyle benefits that transcend the ordinary. These encompass price cuts on cinema tickets, access to airport lounges, and exclusive collaborations with affiliated vendors. This augmentation elevates the holistic encounter of the cardholder and confers upon it the status of a prized adjunct to their chosen lifestyle.

2.4 Seamless Contactless Transactions

In consonance with the prevailing trend of contactless transactions, the HDFC Bank Millennia Credit Card is equipped with cutting-edge NFC (Near Field Communication) technology. This empowers users to consummate swift and secure payments through a simple tap of their card on compatible terminals, introducing an added layer of convenience to their financial interactions.

Qualifications and Application Procedure

3.1 Eligibility Requirements

To ascertain eligibility for the HDFC Bank Millennia Credit Card, potential candidates typically need to satisfy specific income criteria, the specifics of which might fluctuate based on the geographical location of the applicant. The bank also factors in the applicant’s credit history and assorted variables when adjudging the application.

3.2 Application Protocol

The process of applying for the Millennia Credit Card has been streamlined and is often executably carried out online via the official website of the bank. Aspirants are mandated to furnish personal and financial particulars, whereupon the bank meticulously evaluates the submission prior to rendering a decision.

3.3 Essential Documentation

Aspirants are obligated to furnish documentary evidence inclusive of proofs of identity, residency, and income. These records bear paramount significance, serving to authenticate the credentials of the aspirant and thereby facilitating the bank’s appraisal of their eligibility for the credit card.

Charges and Levies

4.1 Annual Subscription Fees

The HDFC Bank Millennia Credit Card bears a stipulated annual subscription fee, the quantum of which is contingent upon the specific variant of the card chosen. Nonetheless, certain iterations of the card might extend a waiver of the annual fee contingent upon the patron meeting predetermined expenditure criteria.

4.2 Applicable Interest Rates

Concomitant with any credit card, the Millennia Credit Card imposes an interest rate, invoked in instances wherein the cardholder fails to liquidate the outstanding dues in their entirety by the stipulated payment due date.

4.3 Penalties for Delayed Payments

Deferred payments attract additional charges that exert an impact upon the cardholder’s credit score and overall financial standing. Adhering meticulously to the payment schedule assumes paramount importance to preclude the imposition of such penalties.

Comparative Examination

5.1 HDFC Millennia vs. Other Credit Cards

Within a fiercely competitive landscape, undertaking a comparative analysis between the HDFC Bank Millennia Credit Card and analogous offerings emerges as a pivotal endeavor. A judicious evaluation of parameters spanning rewards, fees, interest rates, and auxiliary perks equips potential cardholders with the insights essential for making a well-informed choice.

User Experience and Testimonials

Acquiring an understanding of the firsthand experiences of extant users furnishes invaluable insights into the card’s tangible performance. Myriad online platforms host discussions and evaluations concerning the HDFC Bank Millennia Credit Card, illuminating its strengths and potential limitations.

Strategies for Maximizing Rewards

To extract maximal utility from the HDFC Bank Millennia Credit Card, patrons can adopt specific strategies. These might encompass channeling expenditures into categories that proffer heightened cashback rates, remaining attuned to specialized promotional offers, and judiciously redeeming accrued reward points to extract optimum value.

Safeguard Measures

8.1 Robust Countermeasures Against Fraud

Analogous to contemporary credit cards, the Millennia Credit Card is fortified with an array of security mechanisms designed to shield users from fraudulent transactions. These encompass instantaneous transaction alerts, dual-factor authentication, and the capacity to promptly immobilize the card in the face of suspected malfeasance.

8.2 Ensuring Secure Online Transactions

As online transactions gain ubiquity, the HDFC Bank Millennia Credit Card is equipped to facilitate secure digital payments through encryption and authentication protocols. This augments the confidence quotient for users engaging in online shopping and transactions.

Inference

In the domain of credit cards sculpted to harmonize with the modern lifestyle, the HDFC Bank Millennia Credit Card shines resplendently. Imbued with an amalgam of cashback rewards, versatile redemption choices, and robust security measures, it stands testament to HDFC’s unwavering commitment to aligning with the evolving financial aspirations of its clientele.

Frequently Posed Queries

10.1 Principal Attributes of the HDFC Bank Millennia Credit Card

The HDFC Bank Millennia Credit Card proffers cashback incentives spanning diverse categories, a reward points structure, lifestyle advantages, and the proficiency for contactless transactions.

10.2 How to Initiate the Application for the Millennia Credit Card

Prospective applicants can embark on the journey to acquire the HDFC Bank Millennia Credit Card via the bank’s official website by furnishing imperative personal and financial minutiae.

10.3 Overview of the Yearly Card Fee

The annual fee for the HDFC Bank Millennia Credit Card is contingent upon the specific variant chosen. Certain variants might grant exemption from the annual fee subject to the fulfillment of stipulated expenditure criteria.

10.4 Existence of a Reward Points Expiry Date

Indeed, reward points amassed via the HDFC Bank Millennia Credit Card could potentially possess an expiry date. Prudence dictates a scrutiny of the terms and conditions for precise elucidation.

10.5 Mechanism of the Cashback System

The cashback mechanism associated with the HDFC Bank Millennia Credit Card entails the provision of a percentage of cashback on eligible transactions encompassing dining, shopping, and travel. The accumulated cashback is then credited to the cardholder’s account.

In Conclusion

The HDFC Bank Millennia Credit Card serves as a paragon of the confluence between financial innovation and lifestyle augmentation. Encompassing bespoke features, rewards, and security protocols, it caters aptly to the dynamic demands of individuals in quest of convenience and value within their financial undertakings. Whether it’s the act of procuring cashback on routine expenditures or gaining access to exclusive lifestyle privileges, this credit card stands as a testament to the ever-evolving canvas of modern banking.