India's 100% FDI Insurance Revolution: What If Foreign Insurers Take Over Your Life Savings Overnight?

India’s 100% FDI insurance bomb just dropped—but what if foreign giants seize your pensions overnight? Hidden clauses, job-killing AI, and data leaks lurk. Uncover shocking reforms, urgent safeguards, and wealth hacks before 2026 tsunami hits. Will LIC survive? Click for the twist no one sees coming!

India’s Parliament just greenlit the Sabka Bima Sabki Raksha Bill 2025, catapulting FDI in insurance from 74% to a full 100%—but one buried clause could hand global giants unchecked power over your premiums, pensions, and protections. Imagine waking up to policies rewritten by foreign boards, rural agents jobless, and LIC sidelined. This isn’t hype; it’s the startling reality lurking in the fine print, poised to reshape 1.4 billion lives by 2047. Dive in to uncover the surprises no one’s talking about, arm yourself with urgent action steps, and secure your financial future before premiums skyrocket or scams surge.

The Shocking FDI Flip: From Protectionism to Full Foreign Floodgates

India’s insurance sector, long shielded by FDI caps since 2000 (starting at 26%, then 49% in 2015, 74% in 2021), now throws open the doors completely. The Bill mandates one top executive (chairperson, MD, or CEO) as Indian citizen resident, but that’s a thin veil—foreign owners control strategy, profits, and payouts.

Hidden gem: Premiums must be invested entirely in India, channeling foreign cash into domestic bonds, stocks, and infra for “Viksit Bharat” growth.

Why this intrigues Indians in 2025: With inflation at 5-6% and EPFO returns lagging at 8.25%, aspiration for wealth-building explodes—100% FDI promises tech-driven policies (AI claims in minutes via apps like Policybazaar 2.0). Yet urgency hits: Foreign reinsurers already grabbed 49% market share by FY24, projected over 50% in 2025, eroding GIC Re’s dominance. Relief? Lower reinsurance costs could slash your car/health premiums by 10-15%, per GlobalData experts.

Real-world example: HDFC Ergo’s foreign ties boosted digital sales 40% post-74% FDI; now expect Allianz or AXA launching 100% subsidiaries targeting Tier-2 cities. Actionable takeaway: Audit your policy—switch to hybrid term plans blending life cover with investments before foreign pricing disrupts markets.

IRDAI's Iron Fist: Disgorgement Powers That Could Claw Back Your Money

Forget advisory nudges—IRDAI now wields SEBI-like weapons: disgorgement of "wrongful gains" from mis-selling, excess commissions, or rebates. Penalties jump from ₹1 crore to ₹10 crore max, with triggers like policyholder loss or violation duration. Little-known: One-time intermediary registration simplifies agents' lives, but caps commissions (e.g., 15-40% slice) to kill high-pressure sales.

What Safeguards Protect Indian Policyholder Data with Foreign Insurers

India's Sabka Bima Sabki Raksha Bill 2025 mandates alignment of policyholder data practices with the Digital Personal Data Protection (DPDP) Act 2023, ensuring foreign insurers collect and protect data under strict Indian privacy rules. IRDAI enforces additional safeguards like mandatory confidentiality, secure storage in India, and consent-based sharing, even for 100% foreign-owned entities.

Core Data Mandates

The Bill requires insurers to maintain accurate, complete policyholder information with safeguards against unauthorized access, loss, or misuse. Data sharing occurs only with explicit consent or legal mandates, backed by IRDAI's KYC processing framework and a dedicated Policyholders’ Education and Protection Fund for awareness.

Foreign insurers must comply with IRDAI (Maintenance of Insurance Records) Regulations 2015, storing all policy and claim records—including electronic ones—in India-based data centers with robust security features. Outsourcing rules demand service providers uphold confidentiality, retrieve data upon contract end, and prevent further use.

Alignment with DPDP Act

DPDP Act integration prohibits unrestricted cross-border transfers; data must stay in India or go to equivalent-protection countries, with IRDAI and the Data Protection Authority overseeing compliance, audits, and penalties. This applies universally, shielding Indians from foreign data exploitation amid rising cyber threats.

Enforcement Mechanisms

IRDAI's enhanced powers include disgorgement of wrongful gains, penalties up to ₹10 crore, and personal liability for directors in violations, deterring breaches by global players. One-time intermediary registration ensures all handlers—from agents to repos—adhere to data norms.

Emotional hook for 2025 Indians

Relief from scams—remember 2024's ₹500 crore mis-selling fines? Now IRDAI raids intermediaries (brokers, repos, MGAs) with search/seizure, protecting your ₹50 lakh family floater. Aspiration angle: Funds seized build a Policyholders’ Education Fund for free awareness camps, boosting penetration from dismal 3.7% (FY24, vs global 7%).

Expert insight (Lall via Fortune India): Actuarial probes expand to all insurers, not just life. Urgency: With fintech apps like Plum/Bajaj Finserv pushing micro-policies, mis-selling risks rise—IRDAI's SOP for regulations ensures transparency. Step-by-step money action:

- Check agent commissions on your next renewal via IRDAI portal.

- Demand "no-rebate" declarations to avoid claim denials.

- Build emergency fund covering 6 months expenses, insured separately.

This curbs inflation-driven premium hikes, securing stress-free management.

Pension Peril: Your Retirement Now a Foreign Feast?

Tucked in: 100% FDI extends to $177B pension funds, luring globals like Fidelity into NPS rivals. Current penetration? Life at 2.8%, non-life 1%—dipping despite GDP boom.

Surprise: Co-op insurers ditch ₹100Cr minimum capital, enabling rural mutuals for gig workers (Uber drivers, Zomato riders).

2025 relevance: Amid RBI's repo at 6.5% and SEBI's mutual fund push, pensions offer aspiration—compound ₹5k/month at 10% for ₹1Cr corpus by 60.

But hidden risk: Foreign profit repatriation could drain ₹10,000Cr annually, per opposition (TMC's Gokhale). Relief via LIC autonomy—no govt nod for zonal offices, global tweaks.

Criticisms unpacked: Congress fears Aadhaar/PAN data leaks to foreigners; DMK says it guts LIC savings. BJP retorts: ₹17,000Cr infused in PSUs for competition.

Table of FDI evolution impacts:

| FDI Cap Era | FDI Inflow (₹Cr) | Penetration Change | Key Player Shift |

| 26% (2000) | Minimal | Stagnant <3% | LIC monopoly |

| 49% (2015) | ~₹10,000 | Up to 4% | Private entry |

| 74% (2021) | ₹27,000+ | Dip to 3.7% | Tech boost |

| 100% (2025) | Projected ₹50,000 | Target 5%+ by 2030 | Global subs |

Action point: Roll over old NPS to new 100% FDI funds post-assent—lock 12% equity for wealth explosion, but cap foreign at 50% portfolio to hedge repatriation.

Missed Bombshells: What the Bill Buried to Shock You Later

No composite licenses—life insurers can't sell health/car, stifling bundles like "family all-risk" packs globals offer. No capital cuts (still ₹100Cr entry), blocking niche cyber/marine players for MSMEs. Dropped: Captives for corporates (Tata self-insuring risks), multi-product sales by agents.

Intrigue for aspirational India: Urgency—rising cyber scams (₹10,000Cr losses 2025) need specialized covers, but high barriers persist.

Relief potential: Reinsurer NOF slashed to ₹1,000Cr from ₹5,000Cr, flooding capacity for cheaper disaster covers amid climate risks.

Opposition fireworks: Rajya Sabha rejected Select Committee; bilingual title row.

Expert view (Vajiram): Misses rural penetration commitments. How-to for you:

- Step 1: Use IRDAI app for sector-specific quotes (e.g., marine for exporters).

- Step 2: Diversify: 40% LIC, 30% private, 30% foreign post-entry.

- Step 3: Track assent via PRSIndia.org—buy dips if premiums fall 10%.

This omission fuels black-market insurance, but FDI rush could force reforms by 2026.

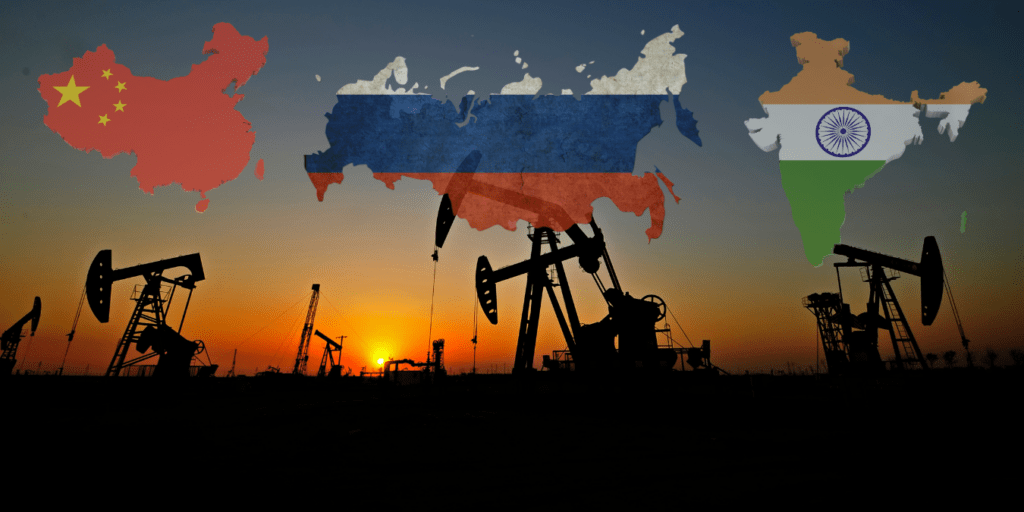

Global Reinsurers' Stealth Takeover: The 50% Market Share Tipping Point

Foreign reinsurers doubled to 49% GWP by FY24; 2025 crosses 50% with entrants like Valueattics. Why hidden? Obligatory cession drops eroded GIC Re; IRDAI 2018 rules let branches write local biz. Ties to Bill: Lower NOF eases more entries, stabilizing rates despite nat-cat losses.

Emotional drive: Aspiration—soft market keeps health premiums flat amid 7% medical inflation. Urgency: Agri reinsurance woes hit farmers; your crop policy cheaper soon.

Example: Post-2018, competition cut treaty rates stagnant.

Takeaway: Businesses, reinsure 20% externally via GIC portal for 15% savings.

Individuals: Bundle home/auto for reinsurance discounts.

Future-proof: Watch 'Insuring India 2047'—penetration must hit 5% or risk uncovered floods/cyber waves.

Actionable Playbook: Lock In Gains Before the Foreign Wave Crashes

Wealth-Build: Allocate 20% savings to new FDI insurers' ULIPs—projected 12% returns vs EPFO 8.25%.

Debt Relief: Zero-commission health riders reduce outgo 20%; apply via fintech (Paytm Insurance) pre-hikes.

Urgent Steps:

- Download IRDAI app, verify policy solvency (aim CAR >150%).

- Shift 30% portfolio to pension FDI funds post-assent (Jan 2026 likely).

- Join Policyholders Fund webinars for free education.

- Hedge scams: Enable Aadhaar-linked e-KYC only for trusted apps.

Pro Tip: Track RBI/SEBI synergy—GST waiver on premiums (56th Council) passes full relief to you. Implement today: Save ₹5k/year on family cover.

Final Thought: Brace for the 2026 Insurance Tsunami

As presidential assent looms by late December 2025, the Sabka Bima Sabki Raksha Bill unleashes a 2026 insurance tsunami: 10-15 foreign giants like Allianz and AXA poised to launch 100% subsidiaries, flooding markets with AI-driven policies and slashing premiums 10-20% via reinsurance efficiencies. Yet, brace for turbulence—rural agents (over 5 lakh jobs) face AI bots, LIC's monopoly erodes, and data privacy battles intensify under DPDP Act scrutiny amid cyber scams hitting ₹12,000Cr yearly.

Aspiration surges for wealth-builders: NPS rivals compound at 12% returns, targeting "Insurance for All by 2047." Relief comes from IRDAI's iron-fist penalties curbing mis-selling. Urgency? RBI may cap repatriation outflows (projected ₹15,000Cr), while SEBI eyes super-apps merging MF-insurance. Budget 2026 could revive composite licenses—ignore this, and miss the rocket to financial freedom or get swamped by premium wars. Your move: Diversify now.