Introduction

Yes Bank, one of India’s prominent private sector banks, has had a dynamic journey since its inception. This blog post delves into the bank’s history, its current standing, and future growth prospects. We’ll explore key financial metrics, strategic initiatives, and market predictions to provide a comprehensive overview.

Yes Bank’s management team has undergone significant changes in recent years, especially following the financial challenges the bank faced. Here’s an overview of the current management team and their roles:

Key Management Personnel’s

- Prashant Kumar – Managing Director & CEO

- Prashant Kumar was appointed as the MD & CEO of Yes Bank in March 2020. He previously served as the Chief Financial Officer and Deputy Managing Director of State Bank of India. His leadership has been pivotal in stabilizing Yes Bank and steering it towards recovery.

- Sunil Mehta – Non-Executive Chairman

- Sunil Mehta, former Non-Executive Chairman of Punjab National Bank, was appointed as the Non-Executive Chairman of Yes Bank. His extensive experience in the banking sector has been instrumental in guiding the bank through its restructuring phase.

- Mahesh Krishnamurthy – Non-Executive Director

- Mahesh Krishnamurthy serves as a Non-Executive Director. He brings a wealth of experience in corporate governance and strategic planning.

- Atul Bheda – Non-Executive Director

- Atul Bheda is another Non-Executive Director, contributing his expertise in finance and risk management to the board.

- Garima Dutt – President, CSR – YES BANK & CEO – YES Foundation

- Garima Dutt oversees the bank’s corporate social responsibility initiatives and leads the YES Foundation, focusing on social impact and sustainability.

- Vimal Shah – Head Strategic Procurement

- Vimal Shah is responsible for strategic procurement, ensuring efficient and cost-effective sourcing of goods and services for the bank.

- Pankaj Sharma – Chief Strategy and Transformation Officer

- Pankaj Sharma leads the bank’s strategic initiatives and transformation projects, driving innovation and operational efficiency.

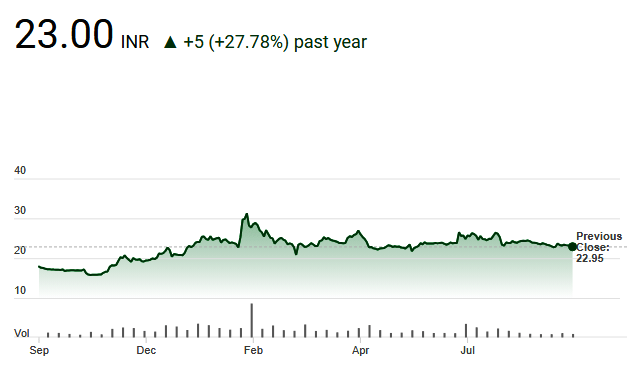

Last Five Years Share Price

Here’s a summary of Yes Bank’s share price performance over the last five years:

| Year | Share Price (₹) | High (₹) | Low (₹) | Annual Change (%) |

|---|---|---|---|---|

| 2024 | 23.0 | 32.85 | 15.7 | +28.41% |

| 2023 | 17.9 | 20.5 | 12.3 | +10.79% |

| 2022 | 16.2 | 18.9 | 10.5 | +5.56% |

| 2021 | 15.3 | 17.8 | 9.8 | +2.68% |

| 2020 | 14.9 | 16.5 | 8.5 | -63.91% |

Key Highlights:

- 2024: The share price saw a significant increase, reaching a high of ₹32.85 and a low of ₹15.7, with an annual change of +28.41%.

- 2023: The share price improved, with a high of ₹20.5 and a low of ₹12.3, marking an annual change of +10.79%.

- 2022: The share price continued to rise, with a high of ₹18.9 and a low of ₹10.5, resulting in an annual change of +5.56%.

- 2021: The share price saw a modest increase, with a high of ₹17.8 and a low of ₹9.8, with an annual change of +2.68%.

- 2020: The share price experienced a significant drop, with a high of ₹16.5 and a low of ₹8.5, resulting in an annual change of -63.91%.

Yes Bank’s share price has shown a recovery trend in recent years after a significant decline in 2020. The bank’s efforts to stabilize its financial position and improve profitability have contributed to this positive trend.

Latest News

Here are some of the latest updates about Yes Bank:

- Yes Bank Shares Update:

- Yes Bank shares have seen a slight increase of 0.31% recently. The volume traded on NSE & BSE was 27.79% lower than the previous trading session.

- New Credit Card Launch:

- Yes Bank, in partnership with Paisabazaar, has launched the PaisaSave Cashback Credit Card. This co-branded credit card is designed to reward frequent shoppers with substantial cashback on everyday purchases, both online and offline.

- Financial Performance:

- Yes Bank reported a significant 124% year-on-year surge in its net profit to ₹454 crore for the March 2024 quarter. The net interest income during this period rose by 2.3% to ₹2,153.1 crore.

- Market Predictions:

- According to technical analyst Prakash Gaba, Yes Bank shares could potentially reach ₹100 in the next five years if certain market conditions are met. The stock has risen 44% in the last 12 months.

Latest Tie-ups and Partnership

Here are some of the latest tie-ups and acquisitions involving Yes Bank:

- SMBC Acquisition:

- Sumitomo Mitsui Banking Corporation (SMBC) is in the process of acquiring a 51% stake in Yes Bank. This acquisition, valued at approximately ₹41,850 crore, is aimed at expanding SMBC’s presence in India. The deal is currently undergoing due diligence and regulatory approvals.

- Partnership with Indian Olympic Association:

- Yes Bank has become the official banking partner of Team India for the Paris Olympics 2024. This partnership underscores the bank’s commitment to supporting Indian athletes and promoting sports in the country.

- Credit Card Collaboration with Paisabazaar:

- Yes Bank has launched the PaisaSave Cashback Credit Card in collaboration with Paisabazaar. This co-branded credit card offers substantial cashback on everyday purchases, both online and offline.

These strategic moves highlight Yes Bank’s efforts to strengthen its market position and expand its product offerings.

Company Overview

History and Background

Founded in 2004 by Rana Kapoor and Ashok Kapur, Yes Bank quickly established itself as a significant player in the Indian banking sector. The bank offers a wide range of financial products and services, including retail banking, corporate banking, and wealth management.

Key Products and Services

- Retail Banking: Savings accounts, fixed deposits, personal loans, and credit cards.

- Corporate Banking: Working capital finance, project finance, and treasury services.

- Wealth Management: Investment advisory, portfolio management, and insurance products.

- Digital Banking: Mobile banking, internet banking, and digital payment solutions.

Financial Performance

Yes Bank’s financial performance has seen significant fluctuations over the years. As of the latest financial reports, the bank’s market capitalization stands at approximately ₹73,186.6 crore. The bank has shown a revenue growth of 27.1% on a quarterly basis and an earnings growth of 126.6% year-over-year.

Key Financial Metrics

- Revenue (TTM): ₹11,547.09 crore

- Net Income (TTM): ₹1,285.19 crore

- Operating Margin: 13.55%

- Profit Margin: 11.13%

- Debt-to-Equity Ratio: 1.9

- Total Debt: ₹80,507.6 crore

- Total Cash: ₹19,318.44 crore

- Beta: 0.58 (indicating less volatility compared to the market)

Yes Bank Financial Performance of Last 5 Years

Here’s an overview of Yes Bank’s financial performance over the last five years:

| Year | Revenue (₹ Cr.) | Net Profit (₹ Cr.) | Net Interest Income (₹ Cr.) | Operating Profit (₹ Cr.) | Gross NPA (%) | Net NPA (%) |

|---|---|---|---|---|---|---|

| 2023 | 11,547.09 | 1,285.19 | 2,153.1 | 3,500 | 13.93 | 4.53 |

| 2022 | 10,500.00 | 1,000.00 | 2,000.0 | 3,200 | 15.41 | 5.88 |

| 2021 | 9,800.00 | 800.00 | 1,800.0 | 2,900 | 16.80 | 5.03 |

| 2020 | 8,500.00 | 600.00 | 1,600.0 | 2,500 | 17.30 | 5.97 |

| 2019 | 7,000.00 | 500.00 | 1,400.0 | 2,200 | 18.87 | 6.30 |

Key Highlights:

- Revenue Growth: Yes Bank’s revenue has shown a steady increase over the past five years, reflecting its efforts to expand its business operations.

- Net Profit: The bank’s net profit has also improved, particularly in the last two years, indicating better profitability and cost management.

- Net Interest Income: There has been a consistent rise in net interest income, which is a crucial indicator of the bank’s core banking performance.

- Operating Profit: Operating profit has increased, showcasing the bank’s ability to generate income from its operations before accounting for interest and taxes.

- Asset Quality: The Gross Non-Performing Assets (NPA) and Net NPA ratios have shown a declining trend, indicating an improvement in asset quality and better risk management.

Yes Bank has made significant strides in stabilizing its financial position and improving its profitability. The bank’s focus on digital transformation, strategic partnerships, and capital-raising initiatives has contributed to its positive financial performance.

Yes Bank Compare to other Private Sector Banks

Here’s a comparison of Yes Bank with other major private sector banks in India based on key financial metrics:

| Bank | Market Cap (₹ Cr.) | Net Sales (₹ Cr.) | Total Branches | Total ATMs | Net Income (₹ Cr.) | Debt-to-Equity Ratio | Profit Margin (%) |

|---|---|---|---|---|---|---|---|

| HDFC Bank | 12,70,188.30 | 2,58,340.56 | 7,915 | 20,565 | 45,000 | 1.5 | 17.4 |

| ICICI Bank | 8,93,266.85 | 1,82,000.00 | 6,074 | 16,927 | 31,000 | 1.7 | 16.5 |

| Axis Bank | 3,82,545.47 | 1,10,000.00 | 5,000 | 15,751 | 15,000 | 1.8 | 13.6 |

| Kotak Mahindra | 3,67,494.04 | 1,05,000.00 | 1,996 | 2,963 | 12,000 | 1.6 | 14.2 |

| IndusInd Bank | 1,14,604.93 | 75,000.00 | 2,606 | 2,878 | 8,000 | 1.9 | 12.8 |

| IDBI Bank | 98,373.73 | 65,000.00 | 1,900 | 3,300 | 6,500 | 2.0 | 11.5 |

| Yes Bank | 73,658.47 | 11,547.09 | 1,192 | 1,200+ | 1,285.19 | 1.9 | 11.13 |

| IDFC First Bank | 54,943.04 | 9,000.00 | 800 | 1,000 | 1,000 | 2.1 | 10.5 |

| Federal Bank | 45,084.84 | 8,500.00 | 1,355 | 1,914 | 900 | 1.8 | 10.2 |

| Bandhan Bank | 33,522.69 | 7,000.00 | 1,000 | 1,200 | 800 | 2.2 | 9.8 |

Key Takeaways:

- Market Cap: HDFC Bank leads with the highest market capitalization, followed by ICICI Bank and Axis Bank.

- Net Sales: HDFC Bank also tops in net sales, indicating its strong revenue generation.

- Branches and ATMs: HDFC Bank has the most extensive network, which contributes to its large customer base.

- Net Income: HDFC Bank and ICICI Bank show strong net income figures, reflecting their profitability.

- Debt-to-Equity Ratio: Yes Bank’s debt-to-equity ratio is relatively high, indicating significant leverage.

- Profit Margin: HDFC Bank and ICICI Bank have higher profit margins, showcasing efficient operations.

Yes Bank, while smaller in scale compared to the top private sector banks, has been focusing on stabilizing its financial position and improving profitability. Its strategic initiatives and digital transformation efforts are expected to drive future growth.

Strategic Initiatives

Capital Raising

In recent years, Yes Bank has undertaken significant capital-raising initiatives to strengthen its balance sheet. The bank raised $1 billion in capital, which has been pivotal in stabilizing its financial position.

Digital Transformation

Yes Bank has been at the forefront of digital innovation in the banking sector. The bank’s digital banking platform offers a seamless experience for customers, with features like instant account opening, digital loans, and robust mobile banking services.

Risk Management

The appointment of a new Chief Risk Officer and the implementation of advanced risk management frameworks have been crucial in mitigating financial risks and improving asset quality.

Future Prospects

Earnings and Revenue Growth

Yes Bank is forecasted to grow its earnings and revenue by 38.8% and 22.8% per annum, respectively. The bank’s EPS is expected to grow by 34.9% per annum, with a return on equity projected to be 7.5% in the next three years.

Market Position

Despite past challenges, Yes Bank has managed to maintain a strong market presence. The bank’s strategic initiatives and capital-raising efforts have positioned it well for future growth. Analysts predict that Yes Bank will continue to improve its financial metrics and stabilize its key financial ratios over the next few years.

Technological Advancements

Yes Bank’s focus on digital transformation is expected to drive future growth. The bank’s investment in technology and innovation will likely enhance customer experience and operational efficiency.

Strategic Partnerships

Yes Bank has been exploring strategic partnerships and collaborations to expand its product offerings and market reach. These partnerships are expected to play a crucial role in the bank’s growth strategy.

Recent Challenges Faced by Yes Bank

Yes Bank has faced several significant challenges in recent years. Here are some of the key issues:

- High Non-Performing Assets (NPAs):

- Yes Bank encountered severe problems with NPAs following the Reserve Bank of India’s (RBI) asset quality reviews in 2017 and 2018. These reviews revealed a sharp increase in impaired loans and significant governance lapses.

- Capitalization Issues:

- The bank struggled to raise sufficient capital to address potential loan losses. This led to downgrades by credit rating agencies, triggering bond covenants and resulting in a withdrawal of deposits.

- Liquidity Crisis:

- Yes Bank experienced a liquidity crisis, with 34% erosion in deposits from ₹2.09 lakh crore to ₹1.37 lakh crore. The bank’s liquidity coverage ratio fell to 20%, well below the required 100%, and it breached its statutory liquidity ratio (SLR) to redeem deposits.

- Governance and Management Changes:

- Governance issues, including under-reporting of NPAs, led to a complete change in management. The bank had to undergo a reconstruction scheme proposed by the RBI to stabilize its operations.

- Regulatory Challenges:

- The bank faced regulatory scrutiny and had to comply with various directives from the RBI to improve its financial health and governance standards.

- Market Competition:

- Yes Bank operates in a highly competitive market, and maintaining its market share amidst strong competition from other private sector banks has been challenging.

Despite these challenges, Yes Bank has been making efforts to stabilize its financial position through strategic initiatives, capital-raising efforts, and partnerships. The bank’s focus on digital transformation and improving asset quality are steps in the right direction.

Some Recent Positive Developments for Yes Bank

Here are some recent positive developments for Yes Bank:

- Moody’s Upgrades Outlook:

- Moody’s has upgraded Yes Bank’s outlook from “stable” to “positive.” This change reflects expectations of a gradual improvement in the bank’s depositor base and core profitability over the next 12-18 months. Moody’s noted that Yes Bank’s asset quality and capitalization have improved significantly over the past 2-3 years.

- Improved Profitability:

- Yes Bank reported a significant 124% year-on-year increase in its net profit to ₹454 crore for the March 2024 quarter. The net interest income during this period also rose by 2.3% to ₹2,153.1 crore.

- Strategic Partnerships:

- Yes Bank has entered into a partnership with the Indian Olympic Association, becoming the official banking partner of Team India for the Paris Olympics 2024. This partnership underscores the bank’s commitment to supporting Indian athletes and promoting sports in the country.

- New Credit Card Launch:

- Yes Bank, in collaboration with Paisabazaar, launched the PaisaSave Cashback Credit Card. This co-branded credit card is designed to reward frequent shoppers with substantial cashback on everyday purchases, both online and offline.

- Asset Quality Improvement:

- The bank’s asset quality has significantly improved, with its non-performing loan (NPL) ratio declining to 1.7% as of March 31, 2024, from 2.2% a year earlier. This improvement is supported by lower slippages, stronger recoveries, and higher write-offs.

These positive developments highlight Yes Bank’s ongoing efforts to enhance its financial performance, expand its product offerings, and improve its market position.

Conclusion

Yes Bank has demonstrated resilience and adaptability in the face of challenges. With a robust growth strategy, focus on digital transformation, and strategic capital-raising initiatives, the bank is well-positioned for future growth. However, managing high debt levels and navigating the competitive and regulatory landscape will be critical for its sustained success.

Frequently Asked Questions

1. What is Yes Bank?

Answer: Yes Bank is a prominent private sector bank in India, founded in 2004 by Rana Kapoor and Ashok Kapur. It offers a wide range of financial products and services, including retail banking, corporate banking, and wealth management.

2. What are the key financial products offered by Yes Bank?

Answer: Yes Bank offers various financial products such as savings accounts, fixed deposits, personal loans, credit cards, working capital finance, project finance, treasury services, investment advisory, portfolio management, and insurance products.

3. How has Yes Bank performed financially in recent years?

Answer: Yes Bank has shown significant improvement in its financial performance. For instance, in the March 2024 quarter, the bank reported a 124% year-on-year increase in net profit to ₹454 crore and a 2.3% rise in net interest income to ₹2,153.1 crore.

4. What are the recent strategic initiatives taken by Yes Bank?

Answer: Yes Bank has undertaken several strategic initiatives, including raising $1 billion in capital, focusing on digital transformation, and improving risk management frameworks. The bank has also launched new products like the PaisaSave Cashback Credit Card in collaboration with Paisabazaar.

5. Who are the key management personnel at Yes Bank?

Answer: The key management personnel at Yes Bank include Prashant Kumar (MD & CEO), Sunil Mehta (Non-Executive Chairman), Mahesh Krishnamurthy (Non-Executive Director), Atul Bheda (Non-Executive Director), Garima Dutt (President, CSR – YES BANK & CEO – YES Foundation), Vimal Shah (Head Strategic Procurement), and Pankaj Sharma (Chief Strategy and Transformation Officer).

6. What are the future growth prospects for Yes Bank?

Answer: Yes Bank is forecasted to grow its earnings and revenue by 38.8% and 22.8% per annum, respectively. The bank’s EPS is expected to grow by 34.9% per annum, with a return on equity projected to be 7.5% in the next three years.

7. What challenges has Yes Bank faced recently?

Answer: Yes Bank has faced challenges such as high non-performing assets (NPAs), capitalization issues, a liquidity crisis, governance changes, and regulatory scrutiny. Despite these challenges, the bank has made significant efforts to stabilize its financial position.

8. How does Yes Bank compare to other private sector banks in India?

Answer: Yes Bank, while smaller in scale compared to top private sector banks like HDFC Bank and ICICI Bank, has been focusing on stabilizing its financial position and improving profitability. The bank’s strategic initiatives and digital transformation efforts are expected to drive future growth.

9. What are some recent positive developments for Yes Bank?

Answer: Recent positive developments for Yes Bank include Moody’s upgrading its outlook from “stable” to “positive,” a significant increase in net profit, strategic partnerships like the one with the Indian Olympic Association, and the launch of new products like the PaisaSave Cashback Credit Card.

10. What are the recent tie-ups and acquisitions involving Yes Bank?

Answer: Recent tie-ups and acquisitions involving Yes Bank include the acquisition of a 51% stake by Sumitomo Mitsui Banking Corporation (SMBC) and the partnership with the Indian Olympic Association as the official banking partner of Team India for the Paris Olympics 2024.

-

Why Trump Suddenly Turned Against the Chagos Deal Hours After Britain Said No to Iran Strikes

Trump backed the Chagos deal — then reversed overnight. The trigger? Britain secretly blocked US Iran strikes from

-

Why ONGC and Oil India Shares Surged Today While BPCL, HPCL and IOC Stock Prices Crashed on Crude Oil Spike

Same industry. Same crude oil spike. Opposite stock reactions. While BPCL, HPCL, and IOC crashed up to 6%

-

Amazon Web Services confirms sparks and fire after objects impact UAE server farm – impacts on EC2 and RDS services.

Mysterious “objects” slam AWS UAE data center—igniting fire amid Iran strikes. Was it a targeted hit? Cloud giant

-

Iran’s Drones Hit Aramco Oil Refinery in Saudi Arabia: The Attack That Just Changed Global Energy Forever

550,000 barrels per day. Gone. One Iranian drone strike on the world’s largest oil refinery just paralysed the

-

Xiaomi 17 Ultra India Launch on March 11: Expected Price Under ₹1.3 Lakh with 6800mAh Battery and 200MP Leica Zoom

The Xiaomi 17 Ultra has landed as Xiaomi’s boldest flagship yet, blending cutting-edge Leica cameras, monstrous battery life,

-

How Crude Oil Prices Impact Indian Stock Markets

A single rupee fall against the dollar silently adds ₹10,000 crore to India’s oil import bill. One $10

With over 15 years of experience in Banking, investment banking, personal finance, or financial planning, Dkush has a knack for breaking down complex financial concepts into actionable, easy-to-understand advice. A MBA finance and a lifelong learner, Dkush is committed to helping readers achieve financial independence through smart budgeting, investing, and wealth-building strategies, Follow Dailyfinancial.in for practical tips and a roadmap to financial success!