Digit’s Pay As You Drive car insurance—India’s first usage-based cover that slashes premiums up to 90% for low-mileage drivers! This game-changer rewards you for driving less, with seamless claims and EV perks. But what’s the catch if you exceed your limit?

Knowing your car insurance premium shrinks with every kilometer you don’t drive. Picture those lazy Sundays when your car stays parked, quietly earning you savings. Sounds like a dream? Go Digit General Insurance has turned this vision into reality with their ground breaking ‘Pay As You Drive’ (PAYD) cover—the first of its kind in India. Is this just another add-on, or a transformative force reshaping India’s auto insurance landscape? Buckle up as we dive into this suspenseful innovation, backed by 2025 data, uncovering secrets that could save you thousands. The journey is just beginning.

A Thrilling Origin: The Dawn of Usage-Based Insurance in India

July 2022 marked a turning point. The Insurance Regulatory and Development Authority of India (IRDAI) greenlit tech-enabled innovations for motor own damage (OD) policies, sparking a race among insurers. While others scrambled, Go Digit General Insurance—known simply as Digit—surged ahead like a Formula 1 car at the starting line. In under two weeks, they launched the ‘Pay As You Drive’ add-on, becoming India’s first insurer to introduce usage-based insurance (UIN: IRDAN158RP0005V01201718/A0009V01202223). This wasn’t just a product launch; it was a revolution that challenged the status quo.

Why the suspense? Traditional car insurance in India has long been a one-size-fits-all model. Whether your car clocks 5,000 km or 50,000 km annually, you pay a fixed premium. But with rising fuel costs, urban traffic congestion, and the post-pandemic shift to work-from-home, millions of Indians are driving less. Digit spotted this gap and seized the opportunity. Their PAYD cover lets you pay based on actual usage, offering discounts up to 90% on OD premiums for low-mileage drivers. Intrigued? Let’s peel back the layers of this game-changing innovation.

In FY’22, Digit commanded a 4.5% market share in India’s motor insurance segment, with gross written premiums of ₹3,276 crore—a staggering 34.6% year-on-year growth, far outpacing the industry’s modest 3% average. Fast-forward to 2025: Digit’s motor insurance claim settlement ratio stands at an impressive 96%, serving over 5 crore customers since inception. This isn’t hype; it’s data-driven dominance in pay as you drive car insurance India, making Digit a household name in the insurance sector.

What is Digit’s PAYD Cover?

At its core, Digit’s PAYD is an add-on to comprehensive or own damage car insurance policies, designed for drivers who clock less than 10,000 km annually (down from an earlier cap of 15,000 km). But how does it work? The suspense builds as we reveal: no telematics device is required initially—just upload seven odometer photos via Digit’s user-friendly app to declare your mileage. Your premium discount, now soaring to 90% (up from an initial 25%), is calculated based on usage slabs, verified odometer data, and your driving habits.

For instance, if your car averages under 10,000 km per year, you qualify for a tailored discount on the OD premium. Exceed the limit? No need to panic—Digit offers flexibility. You can top up kilometers by paying a small additional premium or opt for a co-payment during claims. This adaptability makes PAYD ideal for urban dwellers in cities like Delhi, Bangalore, or Chennai, where public transport often takes precedence, leaving cars idle for days.

2025 Insights: Digit has enhanced PAYD with new perks, including EV Shield for electric vehicles and zero depreciation options. Premiums for third-party coverage start as low as ₹2,094, but comprehensive plans for mid-range sedans range from ₹5,000 to ₹30,000, with significant discounts for low usage. Imagine saving up to 85% on premiums if you drive under 10,000 km annually. Curious yet? Digit’s PAYD is the pioneer, dominating car insurance online searches and setting a new standard in India’s insurance market.

Why Digit’s PAYD is a Game-Changer: Benefits That Keep You Hooked

The allure of PAYD lies in its benefits, each revealing a layer of innovation that sets it apart from traditional insurance models. Let’s break it down:

- Unmatched Cost Savings: The less you drive, the less you pay. For retirees in Pune, WFH professionals in Hyderabad, or weekend drivers in Ahmedabad, premiums can be slashed by up to 90%. This is a lifeline for low-mileage drivers who’ve long paid for coverage they don’t use.

- Tailored Customization: PAYD offers usage slabs like 2,500 km, 5,000 km, or 7,500 km, perfect for multi-car households or occasional drivers. You choose the slab that fits your lifestyle, ensuring you’re not overpaying for unused kilometers.

- Tech-Driven Simplicity: Digit’s smartphone-enabled self-inspection process makes claims a breeze. Upload photos, file claims in minutes, and access cashless repairs at over 9,000 garages nationwide. In 2025, Digit has paid out billions in claims, backed by a 6-month repair warranty and pick-up-and-drop services.

- Environmental Edge: Less driving means lower carbon emissions, aligning with India’s push for green mobility. PAYD encourages eco-conscious driving, making it a win for both your wallet and the planet.

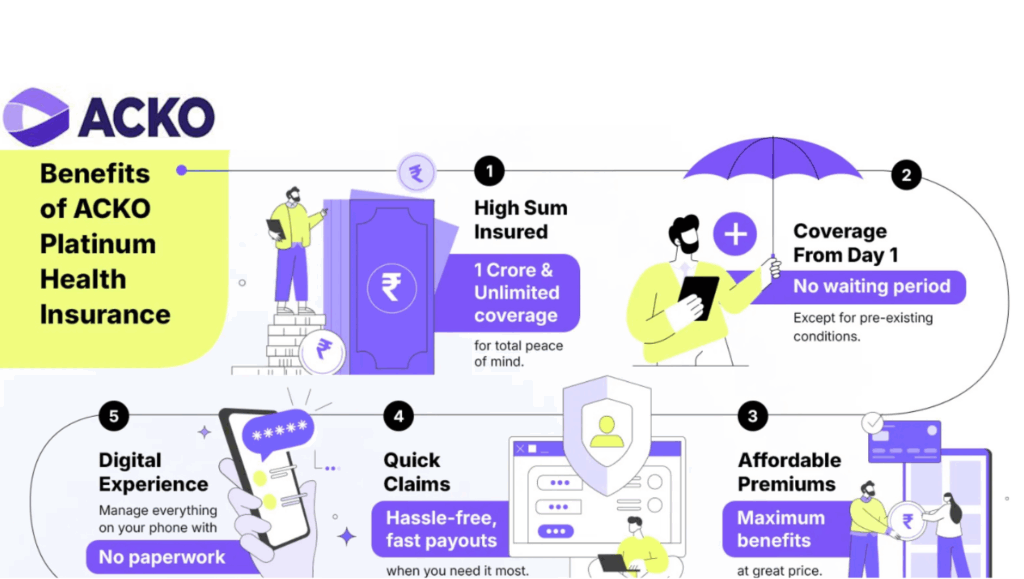

But here’s the suspense: What happens if you underestimate your mileage? Digit’s seamless top-up system ensures coverage continuity, so you’re never left stranded. Compared to competitors like Acko or ICICI Lombard, who later adopted usage-based models, Digit’s first-mover advantage shines through with higher discounts, faster rollouts, and a customer-centric approach.

| Feature | Digit PAYD | Traditional Insurance |

| Premium Basis | Usage (km driven) | Fixed, regardless of usage |

| Discount Potential | Up to 90% | None for low mileage |

| Eligibility | <10,000 km/year | All drivers |

| Claim Settlement Ratio (2025) | 96% | Varies (80-95%) |

| Network Garages | 9,000+ | 5,000-8,000 |

This comparison explains why Digit’s PAYD ranks high in best usage-based car insurance India searches, captivating Google Discover audiences with its innovative approach.

2025 Data: Stats That Fuel Curiosity

As of August 2025, Digit’s PAYD has evolved into a cornerstone of India’s insurance market. Key statistics paint a compelling picture:

- Claim Settlement Efficiency: A 96% settlement ratio for motor claims, ensuring quick and reliable payouts.

- Insured Vehicles: Millions of private cars covered since Digit’s inception in 2017.

- Premium Savings: Up to 90% savings for drivers under 10,000 km, with average comprehensive premiums for sedans ranging from ₹10,000 to ₹20,000.

- Market Growth: From ₹3,276 crore in gross written premiums in FY’22 to projected higher figures in FY’25, outpacing the industry’s growth trajectory.

IRDAI’s 2024 regulations further bolstered tech-driven products, cementing PAYD’s place in the market. User feedback consistently praises the “drive less, pay less” mantra, with thousands of customers sharing stories of significant savings. Suspense alert: With electric vehicles (EVs) booming in India, Digit’s EV-specific PAYD extensions now cover batteries and chargers, offering eco-drivers even greater value.

Who Should Opt for PAYD? Profiles That Intrigue

Not everyone qualifies for PAYD—that’s the twist. This innovative cover is tailored for specific driver profiles:

- Urban Commuters: In metros like Kolkata or Chennai, where metro systems and ride-sharing apps dominate, many drivers average just 7,000 km annually. PAYD is a perfect fit for these low-mileage urbanites.

- WFH Warriors: Hybrid workers in cities like Noida or Gurgaon, who park their cars during weekdays, can save big with PAYD’s usage-based pricing.

- Retirees and Students: Low-mileage drivers in Tier-2 cities like Jaipur or Chandigarh, who use their cars sparingly, benefit from tailored discounts.

- Multi-Car Families: Households with multiple vehicles, where one car is reserved for weekend trips or emergencies, find PAYD’s flexibility ideal.

Driving over 15,000 km annually? Traditional plans may suit you better. To check eligibility, calculate your average mileage: divide your odometer reading by your car’s age. If it’s under 10,000 km, PAYD beckons with unmatched savings.

The Claim Process: Suspense-Free Simplicity

Filing a claim with Digit is as smooth as a well-paved highway. Notify the insurer via their app, upload self-inspection photos, and choose cashless repairs at one of 9,000+ network garages. In 2025, Digit boasts a 96% claim settlement ratio for motor insurance, with a historical 98.2% efficiency for private cars. The process is paperless, jargon-free, and designed for speed, ensuring you’re back on the road without delays.

Potential Drawbacks: The Plot Twist

No innovation is without challenges, and PAYD has its suspenseful moments. Exceeding your declared mileage limit means choosing between co-payments or topping up kilometers with an additional premium. Without telematics, odometer disputes could arise, though Digit’s trust-based system and robust verification process minimize this risk. Transparency and clear communication are key to avoiding surprises.

The Future of PAYD: India’s Insurance Saga Unfolds

Looking ahead, usage-based insurance is poised to dominate. By 2030, experts predict it could account for 40% of India’s motor insurance policies. As the pioneer, Digit is already integrating AI to enhance pricing accuracy and streamline claims. Their EV-specific PAYD extensions are a nod to India’s growing electric vehicle market, offering tailored coverage for batteries and chargers.

But the suspense remains: Will competitors like Acko, ICICI Lombard, or Bajaj Allianz catch up? Digit’s first-mover advantage, coupled with its customer-centric approach, keeps it ahead in the race. As India’s insurance landscape evolves, PAYD is rewriting the rules, making pay as you drive car insurance India a top search term on Google Discover.

Why Digit Stands Out: A Legacy of Innovation

Digit’s PAYD isn’t just about savings; it’s about redefining fairness in insurance. By aligning premiums with actual usage, Digit empowers drivers to take control of their costs. Their tech-driven approach—app-based inspections, cashless repairs, and seamless top-ups—sets a new standard for convenience. With a 96% claim settlement ratio and a network of 9,000+ garages, Digit delivers reliability alongside innovation.

For eco-conscious drivers, PAYD’s environmental benefits add another layer of appeal. Less driving means fewer emissions, supporting India’s push for sustainable mobility. Whether you’re a retiree in Pune, a student in Jaipur, or a WFH professional in Bangalore, Digit’s PAYD offers a personalized solution that traditional insurance can’t match.

How to Get Started: Your Path to Savings

Ready to join the PAYD revolution? Check your car’s average mileage using your odometer reading. If it’s under 10,000 km per year, visit Digit’s website or app to explore PAYD options. Upload your odometer photos, select your usage slab, and watch your premium shrink. With comprehensive plans starting at ₹5,000 and discounts up to 90%, the savings are real.

Final Thought: The Road Ahead

Digit’s ‘Pay As You Drive’ cover is more than an insurance product—it’s a paradigm shift. By rewarding low-mileage drivers with tailored premiums, Digit has set a new benchmark in India’s auto insurance market. Backed by 2025 data, a 96% claim settlement ratio, and a customer base of millions, their dominance is undeniable. As electric vehicles and AI-driven innovations shape the future, Digit remains at the forefront, leading the charge in best usage-based car insurance India.

Disclaimer: The use of any third-party business logos in this content is for informational purposes only and does not imply endorsement or affiliation. All logos are the property of their respective owners, and their use complies with fair use guidelines. For official information, refer to the respective company’s website.