Handling Suspended GSTIN Registrations: A Survival Guide for Indian Businesses in 2026

GSTIN Suspended Overnight? Your Business is Paralyzed! Discover the shocking 2025 AI traps killing SMEs, secret 15-min revival hacks, and tools slashing risks 95%. From Lucknow chaos to global export wins—don’t lose lakhs! What ONE mistake could save you? Unlock now before it’s too late!

A suspended GSTIN can paralyze your business operations overnight, blocking invoices and eroding customer trust. From Lucknow’s bustling markets to Mumbai’s corporate hubs, thousands of Indian SMEs face this nightmare annually due to simple compliance slips.

Common Reasons Behind GSTIN Suspensions

GST authorities suspend registrations primarily for non-filing of returns, where monthly filers missing six consecutive GSTR-3B filings or quarterly filers skipping two quarters trigger automatic action. Major discrepancies between GSTR-1 sales data and GSTR-3B summaries, or mismatches with GSTR-2B input credits, flag potential evasion, leading to Form GST REG-31 notices and immediate suspension under Rule 21A(2A).

- Non-Filing of GST Returns: Missing six consecutive monthly GSTR-3B returns or two consecutive quarterly returns triggers automatic suspension under Rule 21A, the leading cause affecting over 60% of cases.

- Discrepancies in Returns: Major mismatches between GSTR-1 (outward supplies) and GSTR-3B (summary), or GSTR-2B (ITC available) and GSTR-3B claims, flagged via Rule 21A(2A) after Form GST REG-31 notice.

- Non-Payment of Taxes: Filing returns without paying the reported liability, even if filed on time, leads to suspension due to unpaid dues plus interest.

- Fraudulent Input Tax Credit (ITC): Claiming ITC from fake invoices, non-existent suppliers, or cancelled GSTINs invites immediate suspension and scrutiny.

- Ignoring Departmental Notices: Failing to respond to Form GST REG-31 or other alerts within 7-15 days escalates issues to suspension.

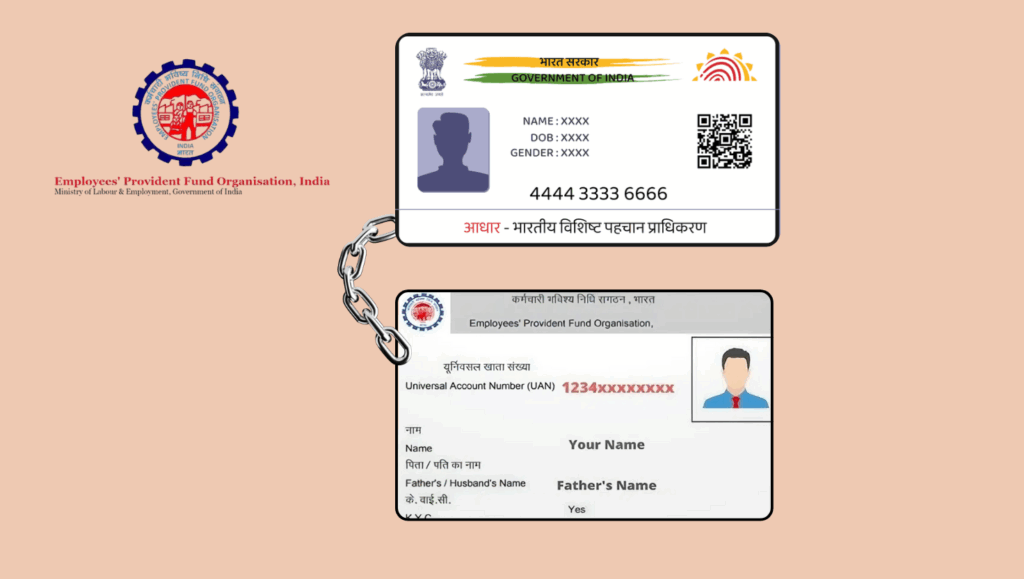

- Outdated Business Information: Not updating Aadhaar, bank details, address, or authorized signatories within 30 days, especially post-2025 mandates under Rule 10A.

- Operating from Undeclared Premises: Conducting business from unverified or changed locations without portal updates.

- E-way Bill or Invoice Mismatches: Frequent discrepancies in e-way bills, HSN codes, or invoice data signaling potential evasion.

- Failure to Commence Business: Voluntarily registered taxpayers not starting operations within six months.

- Pending Cancellation Requests: Suspension during voluntary cancellation processing until resolution.

Non-payment of taxes despite filing returns, fraudulent ITC claims from fake invoices or cancelled supplier GSTINs, and ignoring departmental notices accelerate suspensions. Recent 2025 updates mandate Aadhaar authentication under Rule 10A and bank detail verification within 30 days, with non-compliance causing auto-suspensions. Operating from undeclared premises or e-way bill mismatches further invite scrutiny.

Immediate Business Impacts

Suspension halts taxable supplies, preventing GST invoice issuance and e-way bill generation, crippling goods movement across states. Buyers lose ITC eligibility on your supplies, prompting them to switch suppliers and hit your revenue hard—often lakhs daily for mid-sized traders.

Banks flag suspended GSTINs as high-risk, delaying loans and credit lines vital for Diwali inventory or expansion plans. Suppliers tighten terms, refusing credit amid compliance fears, while reputational damage lingers as portals publicly show “Suspended” status. During suspension, Section 39 return filing exemptions apply, but unresolved issues risk full cancellation.

Step-by-Step Revival Process

Log into the GST portal using your GSTIN credentials and check the dashboard for suspension notices under Services > User Services > View Additional Notices or Orders. Identify the trigger—often pending GSTR-3B returns or REG-31 discrepancies—and file all overdue returns immediately, paying dues plus 18% interest via the electronic cash ledger.

For post-December 2022 suspensions due to non-filing, auto-restoration happens within 15 minutes of compliance; otherwise, click "Initiate Drop Proceedings" under the notice to auto-drop proceedings. Respond to REG-31 within 7-15 days with explanations, reconciled data, and proofs like bank statements or supplier GSTR-1 extracts. Submit via the portal's reply function, retaining ARN copies.

- Check Suspension Status on GST Portal: Log in to the GST portal using your GSTIN credentials, navigate to Services > User Services > View Additional Notices or Orders (or My Profile for status). Identify the specific notice (e.g., Form GST REG-31) and suspension reason like non-filing or discrepancies.

- File All Pending Returns Immediately: Submit overdue GSTR-1, GSTR-3B, or GSTR-9 returns with accurate data. For non-filing suspensions post-December 2022, filing triggers auto-restoration within 15 minutes.

- Pay Outstanding Dues and Interest: Clear tax liabilities from electronic cash ledger, including 18% interest on delays. Confirm payment reflects in the ledger before proceeding.

- Respond to Show Cause Notice (REG-31): Within 7-15 days, reply via the portal under the notice section with explanations, reconciled GSTR-1/3B data, bank statements, supplier proofs, or error rectifications. Upload supporting documents and retain ARN.

- Initiate Drop Proceedings (If Applicable): For suspensions due to non-filing or minor issues, use the "Initiate Drop Proceedings" button under the notice on the dashboard. This auto-drops proceedings if compliances are met.

- Submit Formal Revocation Application: If auto-drop fails (e.g., pre-2022 cases), file Form GST REG-18 or REG-21 via Services > Registration > Application for Revocation. Attach rectification proofs and approach jurisdictional GST officer if needed.

- Track Application Status: Monitor progress under Services > Registration > Track Application Status using ARN. Expect 7-15 working days for officer review and order issuance.

- Receive Revival Order: Upon approval, download Form GST REG-20/22 confirming revocation. Verify GSTIN status changes to "Active" and test invoice/e-way bill generation.

- Post-Revival Compliance: File next returns on time, reconcile data monthly, and update any pending details like Aadhaar/bank info to prevent recurrence.

If auto-drop fails or pre-2022 cases apply, approach your jurisdictional GST officer with Form GST REG-18, including rectification proofs; expect 7-15 days for review. Track status under Services > Registration > Track Application Status.

Preventive Strategies for Indian SMEs

Automate reminders for GSTR-1 (11th/13th), GSTR-3B (20th), and annual GSTR-9 deadlines using GST portal alerts or apps. Reconcile monthly: match GSTR-1 sales with 3B, purchases with GSTR-2B, and verify supplier GSTIN status weekly to block risky ITC.

Pay taxes alongside filings, confirming ledger credits instantly; maintain 2-3 days' buffer funds. Update business details—Aadhaar, bank accounts, addresses—promptly under Rule 10A. Respond to all REG-31 notices within days, archiving submissions.

Adopt software for AI-driven reconciliation and one-click filings, slashing errors by 90% for under ₹3,000 yearly—cheaper than one suspension's losses.

| Prevention Step | Manual Risk | Automated Benefit |

| Return Filing | Miss deadlines (60% suspensions) | Scheduled auto-filing, zero misses |

| Reconciliation | Mismatches (30% cases) | Real-time GSTR-1/2B/3B checks |

| Supplier Verification | Fake ITC traps | Auto-GSTIN status alerts |

| Notice Response | Ignored (20% escalations) | Instant notifications |

| Payment Tracking | Overdue dues | Ledger auto-recon with banks |

2025 Updates and Compliance Traps

Budget 2025 introduced AI-powered real-time discrepancy detection, shrinking investigation timelines from months to days under enhanced Rule 21A analytics. Aadhaar authentication became mandatory for all new and renewals under Rule 10A, with extensions granted only in exceptional cases via officer approval. December 2025 GSTN advisory mandates auto-suspension for missing or invalid bank details beyond 30 days, targeting verification gaps.

From July 2025, GSTR-3B revisions route exclusively through new GSTR-1A, eliminating direct portal edits to curb ITC manipulations. Quarterly filers face suspension after two consecutive non-filings, while composition scheme taxpayers trigger after three periods.

Key Compliance Traps

Filing GSTR-3B without simultaneous tax payment flags immediate suspension, even if returns appear compliant. Overlooking minor GSTR-1/3B mismatches—under ₹5,000 or 1% variance—escalates via REG-31 notices.

Manual spreadsheets breed errors in high-volume businesses; switch to automated tools for 99% accuracy. Deadline-day rushes amplify portal glitches, especially 20th evenings; file 2-3 days early. Suppliers on cancelled GSTINs trap ITC claims, leading to 30% of fraud suspensions.

Monthly Checklist

- Days 1-7: Reconcile prior month's sales/purchases against GSTR-2B, draft GSTR-1 with HSN codes.

- Days 8-14: File GSTR-1 by 11th/13th, review GSTR-2B inputs, resolve supplier mismatches via emails.

- Days 15-21: Calculate GSTR-3B liability including reverse charge, confirm cash ledger funds.

- Days 22-30: File and pay GSTR-3B by 20th/22nd, verify ledger credits, update Aadhaar/bank details.

- Ongoing: Check notices daily under User Services, verify GSTIN status of top 5 suppliers weekly.

Technology as GST Shield

GST-compliant software automates compliance workflows, slashing suspension risks by detecting issues before they escalate. Tools extract invoice data via OCR, perform real-time GSTR-1/2B/3B reconciliations, and send WhatsApp/SMS alerts for deadlines or notices, preventing 95% of common suspensions.

Recommended Tools

- hisabkitab: Automates invoice extraction from PDFs/emails, continuous reconciliation with AI flagging mismatches, and one-click filings; ideal for SMEs with ₹3,000/year plans.

- ClearTax: Offers portal-synced e-invoicing, bank API integrations for instant payment proofs, and predictive suspension alerts based on Rule 21A patterns.

- Vyapar/Tally: Mobile-first for Lucknow traders; handles HSN coding, e-way bills, and chaotic market invoicing with offline sync and supplier GSTIN verification.

- Free Alternatives: GST portal apps for basic reminders; upgrade for AI-driven features like auto-REG-31 drafting.

Key Integrations

E-invoicing integration pushes IRN instantly to the portal, ensuring GSTR-1 auto-population and zero mismatches. Bank APIs (e.g., ICICI/HDFC) link ledgers for real-time payment tracking and interest calculations, blocking non-payment traps.

Benefits for Indian Businesses

| Feature | Manual Risk | Tech Benefit |

| Reconciliation | 30% mismatch suspensions | Real-time alerts, 99% accuracy |

| Alerts | Missed deadlines (60% cases) | WhatsApp/push notifications |

| E-Invoicing | Delayed sync errors | Instant IRN generation |

| Supplier Check | Fake ITC claims | Auto-GSTIN status scans |

Lucknow's street vendors to Delhi exporters save lakhs yearly; mobile apps thrive in low-connectivity markets with offline HSN libraries. Start with free trials to shield against 2025 AI enforcements.

Long-Term Compliance Mindset

View GST compliance as essential cash flow oxygen that sustains business operations, rather than mere administrative paperwork. Quarterly audits by Chartered Accountants identify compliance drifts early, preventing minor issues from snowballing into suspensions.

Train staff on GST portal navigation, including dashboard checks, return filing, and notice responses, through hands-on workshops or free GSTN tutorials. Network with local GST Suvidha Kendras for jurisdiction-specific tips, like Lucknow's unique quarterly filing nuances amid Uttar Pradesh's high enforcement zones.

Strategic Advantages in 2025

Under President Trump's 2025 trade policies favoring compliant exporters, Indian firms with pristine GST records secure easier US market access and reduced tariffs. Zero-suspension histories boost bank ratings, unlocking low-interest export credits essential for global competition.

Prevention vs Revival Costs

| Aspect | Revival Cost | Prevention Cost |

| Time | 7-30 days downtime | Daily 15-min checks |

| Finances | ₹50k-5L (penalties + interest) | ₹2-3k/year software |

| Revenue | Lakhs in lost sales | Zero interruptions |

| Reputation | Supplier/buyer distrust | Trusted partner status |

Reviving a suspended GSTIN requires lightning speed and precise documentation, but prevention demands mere pennies compared to lakhs in daily losses. Check your GST portal dashboard immediately—your business survival hinges on proactive compliance.

Useful Recommendation

- Automate Compliance Workflows: Adopt tools like ClearTax or hisabkitab for real-time GSTR-1/3B reconciliation and WhatsApp alerts, cutting suspension risks by 95%.

- File Early, Pay Fully: Submit GSTR-3B 2-3 days before the 20th with simultaneous tax payments to avoid non-payment traps and portal rushes.

- Daily Dashboard Checks: Log into GST portal every morning under Services > User Services for notices; respond to REG-31 within 24 hours.

- Monthly Supplier Audits: Verify GSTIN status of top 5 suppliers weekly via portal search to block fake ITC claims.

- Update Core Details Promptly: Refresh Aadhaar, bank accounts, and addresses within 15 days of changes per 2025 Rule 10A mandates.

- Quarterly CA Reviews: Schedule professional audits every 90 days to catch discrepancies before AI flags them.

- Build Cash Ledger Buffer: Maintain 1.5x average monthly liability for instant payments and interest avoidance.

- Train Staff Weekly: Conduct 30-minute sessions on portal navigation, HSN coding, and e-invoicing using GSTN's free videos.

- Visit GST Suvidha Kendra: Get jurisdiction-specific tips monthly, especially for Lucknow's high-enforcement zones.

- Test E-Invoicing Daily: Generate sample IRNs to ensure seamless GSTR-1 population and zero mismatch suspensions.

- Backup All Records: Store 3 years of returns, ledgers, and ARNs in cloud for instant REG-31 replies.

- Initiate Drop Proceedings Fast: Use dashboard button immediately after filing overdue returns for 15-minute auto-revivals.