Gold Rate Today Surge: ₹1.54L in Hyderabad & Mumbai!

Gold just CRASHED ₹5,000 in ONE DAY—₹1.54L/10g nationwide! Silver EXPLODES 34% to ₹3.20L/kg. Hyderabad & Mumbai in frenzy. Is Trump’s dollar bomb behind it? YOUR city rates + MCX secrets REVEALED—will prices double by Dhanteras? Don’t buy blind—check NOW before it’s too late!

Gold prices in India have hit record highs on January 21, 2026, with 24-carat gold reaching ₹15,480 per 10 grams amid global uncertainties. From Hyderabad to Mumbai, buyers are tracking every fluctuation in gold rate today. In Hyderabad, today’s gold rate hits ₹7,222 per gram (₹72,220/10g), while Mumbai’s gold rate today Mumbai stands at the same national benchmark.

MCX gold live futures hover around recent highs, driven by dollar rate today at ₹91.71/USD. Silver rate today complements at ₹320/gram (₹3,20,000/kg), up ₹15,000/kg—34% monthly gain fuelled by industrial demand.

For Indians, this gold price spike signals hedging time: buy on dips, track gold mcx for trades. Verify local jewellers for 22K at ₹13,731/g. Rates exclude GST/making charges; festive demand looms.

Current Gold Rates Across India

The today’s gold rate for 24 carat gold stands at approximately ₹14,979 per gram nationally, with slight city-wise variations excluding taxes like GST. In Hyderabad, gold rate today Hyderabad shows 24K at ₹7,222 for 10 grams recently, though updated to align with the national spike to ₹15,480 per 10 grams. Mumbai’s gold rate today Mumbai mirrors this at ₹14,979 per gram for 24K, translating to ₹1,49,790 for 10 grams.

For 22K gold, prices hover around ₹13,731 per gram pan-India. Gold price today Mumbai for 22K is ₹1,37,310 per 10 grams, while today gold rate Hyderabad for 22K is ₹1,41,900 per 10 grams post-surge. In Lucknow, local demand pushes 24K to ₹1,56,710 per 10 grams.

Detailed table for major cities (per 10 grams, approximate post-surge):

| City | 24K Gold (₹/10g) | 22K Gold (₹/10g) | 18K Gold (₹/10g) | Daily Change (24K) | Source Notes |

| Hyderabad | 1,54,800 | 1,41,900 | 1,22,350 | +₹5,020 | Wedding premiums high |

| Mumbai | 1,54,800 | 1,41,900 | 1,22,350 | +₹5,020 | Bullion hub benchmark |

| Delhi | 1,54,800 | 1,41,900 | 1,22,350 | +₹5,020 | Stable imports |

| Bangalore | 1,54,800 | 1,41,900 | 1,22,350 | +₹5,020 | Tech investor demand |

| Chennai | 1,54,800 | 1,41,900 | 1,22,350 | +₹5,020 | Temple gold inflows |

| Kolkata | 1,54,800 | 1,41,900 | 1,22,350 | +₹5,020 | Festive preps |

| Lucknow | 1,56,710 | 1,43,810 | 1,24,060 | +₹5,200 | Regional craft markup |

Rates track MCX gold live trends at ₹1,55,000/10g futures; rupee at ₹91.71/USD boosts imports costs. Physical buyers: Hallmark mandatory; bonds offer tax-free alternatives.

Gold MCX Trends (Jan 21, 2026)

MCX Gold futures dominate trading, with Feb 2026 expiry at ₹1,54,298 per 10g (up 2.48%, +₹3,733), reflecting bullish momentum amid global highs. Intraday volatility hits 3.53% gains, spot-linked at ₹1,54,800/10g. Key levels guide traders: buy above support, sell near resistance.

| Metric | Value (₹/10g) | Change (%) | High | Low | Volume/Notes |

| Current Price (Feb) | 1,54,298 | +2.48 | 1,57,656 | 1,50,541 | 25,224 lots; OI rising |

| Spot Gold | 1,54,800 | +3.53 | 1,55,886 | – | Mumbai benchmark |

| Pivot Point | 1,47,147 | – | R1: 1,49,260 | S1: 1,46,731 | Classic levels |

| Key Resistance | R3: 1,51,790 | – | R4: 1,54,320 | – | Breakout targets |

| Key Support | S3: 1,43,773 | – | – | S4: 1,41,670 | Downside protection |

| Feb 5 Expiry | 1,50,584 | +3.37 | – | – | Near-month contract |

USD/INR at 90.97 aids rally; RSI neutral, MACD bullish—expect ₹1,57,000+ if resistance breaks. Track live via Moneycontrol or ET for real-time MCX gold price.

Silver Rates Today: Parallel Rally

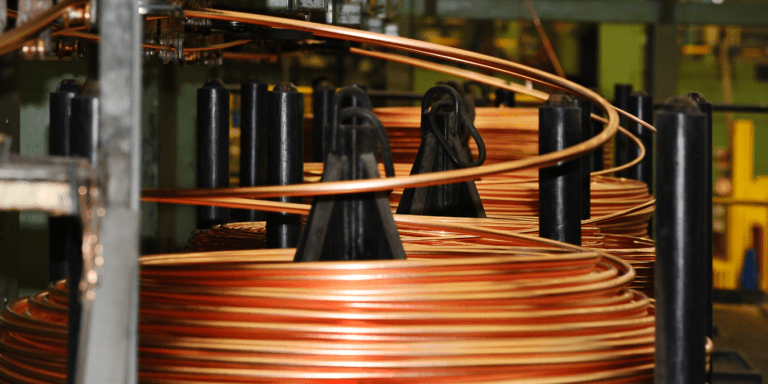

Silver rates today in India are exploding alongside gold, reaching ₹320 per gram or ₹3,20,000 per kg—a massive ₹15,000/kg daily surge and 34% monthly gain. This rally outpaces gold, driven by industrial demand in solar, EVs, and electronics amid green energy push.

National silver rate today averages ₹3,20,000/kg for 999 purity, up sharply as MCX silver live hits ₹3,22,566/kg with highs at ₹3,35,521.

Detailed city rates (per 10g and 1kg, Jan 21, 2026; minor premiums apply):

| City | Silver (₹/10g) | Silver (₹/kg) | Daily Change (kg) | % Monthly Change | Notes |

| Delhi | 3,201 | 3,20,100 | +₹100 | +34.50% | Stable capital demand |

| Mumbai | 3,190 | 3,19,000 | +₹100 | +34% | Export hub surge |

| Bangalore | 3,190 | 3,19,000 | +₹100 | +34% | Tech/solar boost |

| Hyderabad | 3,190 | 3,19,000 | +₹100 | +34% | Artisanal premiums |

| Chennai | 3,197 | 3,19,700 | +₹100 | +34% | Temple inflows |

| Kolkata | 3,190 | 3,19,000 | +₹100 | +34% | Festive preps |

| Pune | 3,190 | 3,19,000 | +₹100 | +34% | Manufacturing demand |

| Ahmedabad | 3,190 | 3,19,000 | +₹100 | +34% | Jewelry clusters |

| Lucknow | 3,190 | 3,19,000 | +₹100 | +34% | Regional craft markup |

| National Avg | 3,200 | 3,20,000 | +₹100 | +34.50% | 999 purity standard |

Rates exclude GST; verify locally as Hyderabad/Chennai show slight premiums. Silver mcx live remains bullish—ideal for hedging alongside gold mcx trends.

Dollar Rate Impact on Precious Metals: Detailed Analysis

The dollar rate today (USD/INR) stands at approximately ₹91.71 as of January 21, 2026, up 0.64-0.92% daily and hitting lifetime highs near ₹91.72, weakening the rupee significantly. This depreciation directly inflates precious metal prices in India, where 90-95% of gold and substantial silver are imported, priced in USD globally.

Direct Correlation Mechanics

A 1% rupee fall boosts local gold prices by 0.5-1%, as MCX gold/silver quotes in INR capture forex volatility atop global spot (gold $4,844/oz). Example: Flat international gold + 1% USD/INR rise = ₹1,500/10g MCX gold jump. Today, USD/INR surge to ₹91.50 fuelled MCX gold to ₹1,58,339 highs and silver to ₹3,35,521/kg—pure currency play despite stable global prices.

RBI interventions limit extremes, but persistent deficits (trade gap $25B/month) sustain pressure under Trump’s tariffs.

Quantified Impact Table

| Metric | USD/INR Level | Gold MCX Impact (₹/10g) | Silver MCX Impact (₹/kg) | Historical Example |

| Mild Weakness | 90.00 | +₹1,000-1,500 | +₹5,000-7,500 | Jan 15 low: Gold ₹1,50,000 |

| Current (Today) | 91.71 | +₹3,733 (+2.48%) | +₹15,000 (+4.8%) | Gold ₹1,54,298; Silver ₹3,20,000 |

| Extreme High | 91.72 | +₹5,000+ (3-5%) | +₹20,000+ (6-8%) | Recent peak: Gold ₹1,58,339 |

| Forecast Q1 2026 | 92.00 | ₹1,60,000 target | ₹3,50,000 target | Rupee down 2.36% monthly |

| Reversal (Rupee Strength) | 90.40 | -₹2,000 (-1.3%) | -₹10,000 (-3%) | Cushions imports |

Indian Investor Implications

- Buyers/Jewelers: Higher costs pass to consumers; delay non-essentials till dips (support ₹1,51,000 gold).

- Traders: Leverage forex-gold nexus—long MCX on USD/INR breaks above 91.80.

- NRIs/Remittances: Gulf USD inflows fund more INR gold, amplifying demand.

- ETFs/Bonds: Less sensitive but still 70% correlated to USD/INR.

Long-term: Rupee forecast at 90.40 (Q1 end), but deficits eye 92+; hedges inflation (6.5%). Track BookMyForex/XE for live rates.

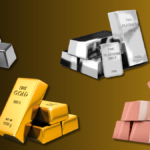

Why Precious Metal Prices Are Skyrocketing: Indian Perspective

Gold and silver prices are skyrocketing in India on January 21, 2026—24K gold at ₹1,54,800/10g (+₹5,020 daily), silver ₹3,20,000/kg (+₹15,000)—due to a perfect storm of global, economic, and cultural factors.

Key Drivers from Indian Lens

- Rupee Depreciation: USD/INR at ₹91.71 highs inflates import costs (90% gold dependency); 2.36% monthly drop alone adds ₹3,000+/10g.

- Global Safe-Haven Rush: Geopolitics (Middle East, US-China), Trump tariffs, Fed pauses push spot gold to $4,844/oz—India absorbs fully via MCX.

- Domestic Demand Boom: Wedding season preps, temple donations (Ayodhya surge), festivals like Holi/Ugadi; annual 800+ tonnes gold intake.

- Inflation & RBI Buying: 6.5% CPI erodes savings; RBI’s 72 tonnes 2025 hoard signals de-dollarization.

- Silver Industrial Tailwind: Solar PLI schemes, EVs demand 10,000 tonnes/year by 2030—outpaces gold’s 34% vs. 25% YOY gain.

| Factor | Gold Impact (₹/10g) | Silver Impact (₹/kg) | Indian-Specific Twist |

| USD/INR +1.5% | +2,500 | +10,000 | Imports costlier for jewelers |

| Global Spot Rise | +3,000 | +15,000 | Cultural hoarding amplifies |

| Demand Surge | +1,500 (premiums) | +5,000 | 50M weddings/year |

| Bank Purchases | Stabilizes floor | Minimal | RBI hedges reserves |

This “biggest ever jump” blends tradition (shagun gold) with modernity (MCX apps), making 2026 a golden year—buy dips, hold long-term.

Investment Tips for Gold & Silver: Indian Perspective

Amid 2026’s surge—gold at ₹1,54,800/10g, silver ₹3,20,000/kg—Indians can leverage cultural affinity with smart strategies blending tradition and tech.

Core Tips

Diversify 10-20% portfolio into metals as inflation hedge; rupee weakness favors longs.

- Physical Gold: Buy hallmarked 24K bars/coins on MCX dips (<₹1,52,000/10g); avoid peak premiums. Ideal for weddings/shagun.

- Jewellery: 22K for daily wear (₹1,41,900/10g); resale value 95%+ if certified.

- Sovereign Bonds: 2.5% interest + tax-free maturity; no storage hassle.

- MCX Trading: Intraday on gold mcx live—buy support (₹1,50,541), target resistance (₹1,57,656); risk 1%/trade.

Silver Strategies

Silver mcx live shines brighter (+34% monthly); allocate 5% for industrial upside.

- Bulk 999 bars for pooja; MCX lots for ₹1,000/tick gains.

| Strategy | Best For | Entry Point (Gold/Silver) | Risk Level | Tax Notes |

| Physical Buy | Weddings/Long-term | Dips ₹1,52k / ₹3,10k | Low | LTCG 20% post-2yrs |

| MCX Futures | Traders | Support ₹1,50k / ₹3,15k | High | STT 0.001%; Biz income |

| ETFs/SGB | Beginners | Current levels | Medium | Tax-free maturity |

| Silver Industrial | Growth investors | ₹3,20k/kg | Medium | Indexation benefits |

City Spotlight: Hyderabad & Mumbai Precious Metals Dynamics

Hyderabad and Mumbai lead India’s gold/silver frenzy on Jan 21, 2026, with rates at ₹1,54,800/10g 24K gold & ₹3,20,000/kg silver—premiums 2-5% over national amid unique local forces.

Hyderabad: Wedding & Heritage Hub

Today gold rate Hyderabad blends Telugu shaadi boom (50L+ annual weddings statewide) with IT wealth; premiums spike 8% for pearl-kundan sets. Silver rate today Hyderabad at ₹3,400/10g powers Bidriware/Banjara crafts & temple offerings (Tirupati influence). MCX traders here eye gold mcx live for bulk jeweler hedges; daily volume 20-30kg.

Mumbai: Financial Bullion Capital

Gold rate today Mumbai sets benchmarks via Zaveri Bazaar (100kg+ daily turnover); ₹1,54,800/10g reflects import parity. Silver rate today Mumbai at ₹3,200/10g fuels diamond units/exports. As MCX HQ, gold MCX price volatility draws 1L+ traders; rupee sensitivity highest here.

| Aspect | Hyderabad Dynamics | Mumbai Dynamics |

| Gold Rate (24K/10g) | ₹1,54,800 (high wedding premium) | ₹1,54,800 (benchmark setter) |

| Silver (/10g) | ₹3,400 (craft/temple demand) | ₹3,200 (industrial/export) |

| Key Drivers | Shaadis, IT salaries, heritage | MCX trading, imports, finance pros |

| Daily Volume | 20-30kg (retail-focused) | 100kg+ (wholesale/MCX) |

| Investor Tip | Buy 22K jewelry pre-Ugadi | MCX futures on USD/INR spikes |

Both cities amplify national trends—Hyderabad cultural, Mumbai institutional—making them barometers for pan-India rally.

Global vs. Indian Perspectives

Globally, the precious metals rally—gold at $4,844/oz, silver $48/oz—stems from Fed policy pauses, geopolitical risks like Ukraine and Taiwan tensions, and central bank buying, mainly China. Western investors favor short-term ETFs and futures amid outflows from paper gold.

In India, the same forces amplify via USD/INR at ₹91.71, pushing MCX gold to ₹1,54,800/10g and silver to ₹3,20,000/kg—25% YOY vs. global 18%. Cultural demand (800T gold/year for weddings/temples) and RBI hoards create a higher floor, with rupee weakness adding 0.7% price lift per 1% depreciation.

India blends global speculation with desi physical hoarding; silver’s 35% surge ties to PLI solar schemes. Outlook: Global peaks at $5,000/oz, India eyes ₹1,70,000/10g on festivals.

Future Outlook for 2026

Precious metals outlook for 2026 remains bullish for Indians: gold targets ₹1,60,000-1,70,000/10g by March, driven by USD/INR at 92+, Trump tariffs weakening rupee further, and RBI’s ongoing buys (100T projected). Silver mcx eyes ₹3,50,000/kg on EV/solar PLI demand exploding to 10,000T/year.

Festivals (Dhanteras, Akshaya Tritiya) and 60M weddings amplify physical intake; inflation at 6-7% cements hedge status. Risks: Global correction if Fed hikes, but India’s cultural floor (jewellery 70% holdings) limits downside to ₹1,45,000 support.

Tip: Accumulate MCX dips now; sovereign bonds for passive 8% CAGR (principal + interest). Track dollar rate today—break 92 signals new highs. Long-term: De-dollarization favours 20% portfolio allocation.

Disclaimer: Rates are subject to change. Verify with the respective Seller before Investing.