Introduction

Buying a car is a significant milestone for many, and securing the right car loan can make this dream more affordable. In India, numerous banks and financial institutions offer car loans with competitive interest rates and flexible terms. This blog post will explore the top 10 best and low-interest car loan providers in India, helping you make an informed decision.

1. State Bank of India (SBI)

Interest Rate: Starting from 9.05% p.a.

Processing Fee: Rs.1,000 onwards

Features:

- Financing up to 90% of the car’s on-road price.

- Optional life insurance cover.

- Various loan schemes tailored to different needs, including the SBI Green Car Loan for electric vehicles.

Why Choose SBI?

SBI is known for its extensive network and customer-friendly services. The bank offers multiple car loan schemes, ensuring that there is something for everyone, whether you are looking for a new car, a used car, or an electric vehicle.

Interest Rate: Starting from 9.00% p.a.

Processing Fee: 0.50% of the loan amount (minimum Rs.2,500 plus GST and maximum Rs.10,000 plus GST)

Features:

- No penalty on pre-closure of car loans.

- Lower interest rates for individuals with a high credit score.

- Financing for passenger cars, SUVs, and MUVs.

Why Choose Bank of Baroda?

Bank of Baroda offers competitive interest rates and flexible repayment options. The bank’s policy of no pre-closure penalty makes it an attractive option for those who might want to repay their loan early.

Interest Rate: Starting from 8.70% p.a.

Processing Fee: Contact the bank for details

Features:

- Competitive interest rates.

- Flexible repayment options.

- Financing for new and used cars.

Why Choose Union Bank of India?

Union Bank of India provides one of the lowest interest rates in the market, making it a cost-effective choice for car buyers. The bank also offers flexible repayment options, which can be tailored to suit your financial situation.

4. HDFC Bank

Interest Rate: Starting from 9.40% p.a.

Processing Fee: 0.50% of loan amount (min. Rs.3,500; max. Rs.8,000)

Features:

- Quick loan processing.

- Pre-approved loans for existing customers.

- Attractive interest rates for salaried and self-employed individuals.

Why Choose HDFC Bank?

HDFC Bank is known for its quick loan processing and excellent customer service. The bank offers pre-approved loans for existing customers, making the process of buying a car even more convenient.

5. Federal Bank

Interest Rate: Starting from 8.85% p.a.

Processing Fee: Contact the bank for details

Features:

- Financing up to 100% of the car’s on-road price.

- Flexible repayment tenure.

- Special schemes for electric vehicles.

Why Choose Federal Bank?

Federal Bank offers up to 100% financing on the car’s on-road price, which can be a significant advantage for buyers. The bank also has special schemes for electric vehicles, promoting eco-friendly transportation.

6. Axis Bank

Interest Rate: 8.55% – 13.05% p.a. for new cars

Processing Fee: Rs.3,500 to Rs.5,000 for new cars

Features:

- Up to 100% financing on the on-road price of new and green cars.

- Pre-approved car loans for existing customers.

- Balance transfer and top-up loans available.

Why Choose Axis Bank?

Axis Bank offers a wide range of car loan options, including loans for new, used, and green cars. The bank’s pre-approved car loans for existing customers and balance transfer options make it a flexible choice.

7. Canara Bank

Interest Rate: Starting from 8.70% p.a.

Processing Fee: 0.25% of loan amount (min. Rs.1,000; max. Rs.5,000)

Features:

- Competitive interest rates.

- Financing for new and used cars.

- Flexible repayment options.

Why Choose Canara Bank?

Canara Bank offers competitive interest rates and flexible repayment options, making it a good choice for both new and used car buyers. The bank’s low processing fee is an added advantage.

8. IDBI Bank

Interest Rate: 8.85% p.a. onwards (floating)

Processing Fee: Contact the bank for details

Features:

- Financing up to 100% of the car’s on-road price.

- Special schemes for salaried and self-employed individuals.

- Flexible repayment tenure.

Why Choose IDBI Bank?

IDBI Bank provides up to 100% financing on the car’s on-road price, which can be very beneficial for buyers. The bank also offers special schemes for different customer segments, ensuring a tailored approach.

9. Punjab National Bank (PNB)

Interest Rate: Starting from 8.75% p.a.

Processing Fee: Nil

Features:

- No processing fee.

- Competitive interest rates.

- Financing for new and used cars.

Why Choose PNB?

PNB stands out with its no processing fee policy, making it a cost-effective option for car buyers. The bank also offers competitive interest rates and flexible financing options.

10. Karnataka Bank

Interest Rate: Starting from 8.88% p.a.

Processing Fee: Contact the bank for details

Features:

- Financing up to 85% of the car’s on-road price.

- Flexible repayment options.

- Special schemes for salaried and self-employed individuals.

Why Choose Karnataka Bank?

Karnataka Bank offers flexible repayment options and special schemes for different customer segments. The bank’s competitive interest rates make it a viable option for car buyers.

Conclusion

Choosing the right car loan provider can significantly impact your financial health. The banks listed above offer some of the best and low-interest car loans in India, each with unique features and benefits. Be sure to compare these options and choose the one that best suits your needs.

-

Samsung Galaxy S26 vs S26+ vs S26 Ultra: Which Samsung Flagship Gives Better Value for Money

Samsung just dropped the Galaxy S26 Ultra — and the price will surprise you. A 200MP camera, Privacy

-

5 Key Takeaways from Trump’s 2026 State of the Union Address — What It Really Means for You

The longest State of the Union speech in modern presidential history was delivered on the night of February

-

Angel One Fixes February 26 Record Date for 1:10 Split: Share Price Reaction

Angel One shares plunged Tuesday as the 1:10 stock split record date looms on February 26—but why the

-

Inside Anil Ambani’s 17-Storey Pali Hill “Abode”: How a Rs 3,716-Crore Mansion Landed in a Money Laundering Case

A billionaire’s 17-storey Mumbai palace, worth Rs 3,716 crore, suddenly seized by ED in a shocking money laundering

-

The Real Reason Behind Incannex Healthcare’s 1-for-30 Reverse Stock Split — Nasdaq Compliance Crisis Revealed

Incannex Healthcare just collapsed 358 million shares into 11.9 million overnight — but this wasn’t sudden. A secret

-

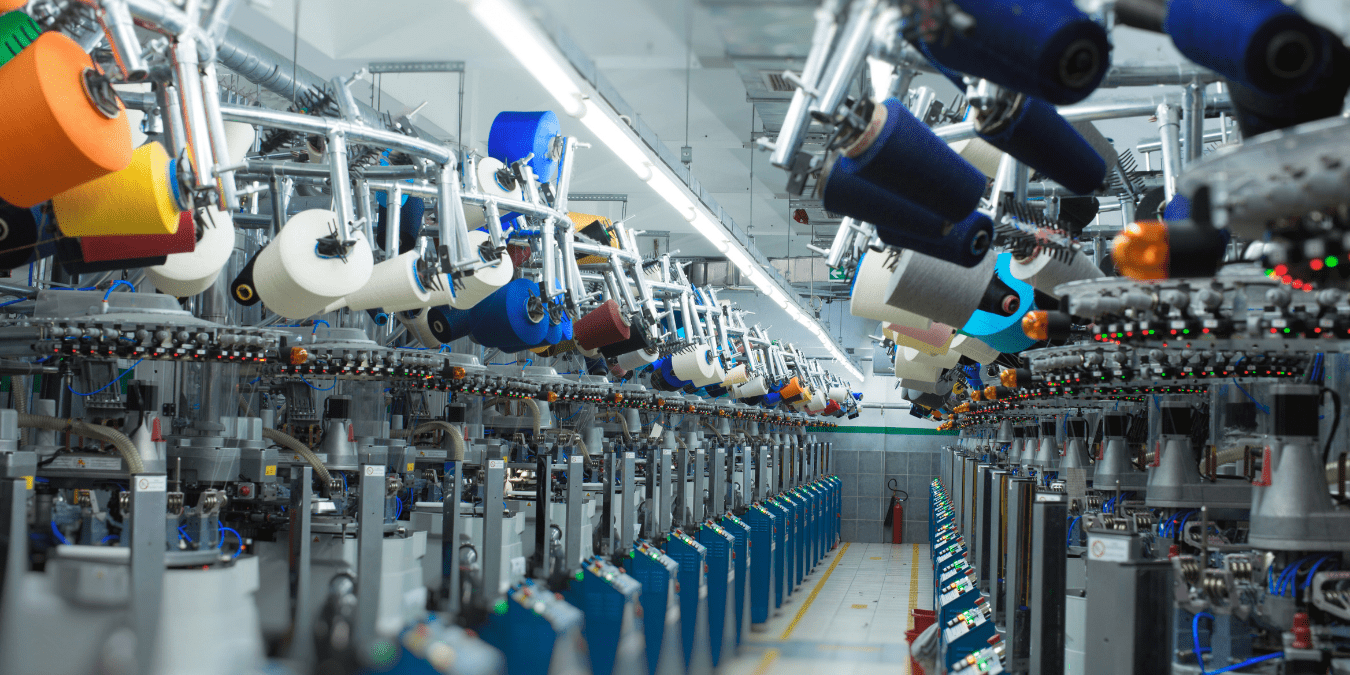

Shree Ram Twistex IPO Oversubscribed 43 Times: Sends a Strong Signal About India’s Textile Sector

Shree Ram Twistex IPO attracted 43x more money than it needed — but the real shock isn’t the