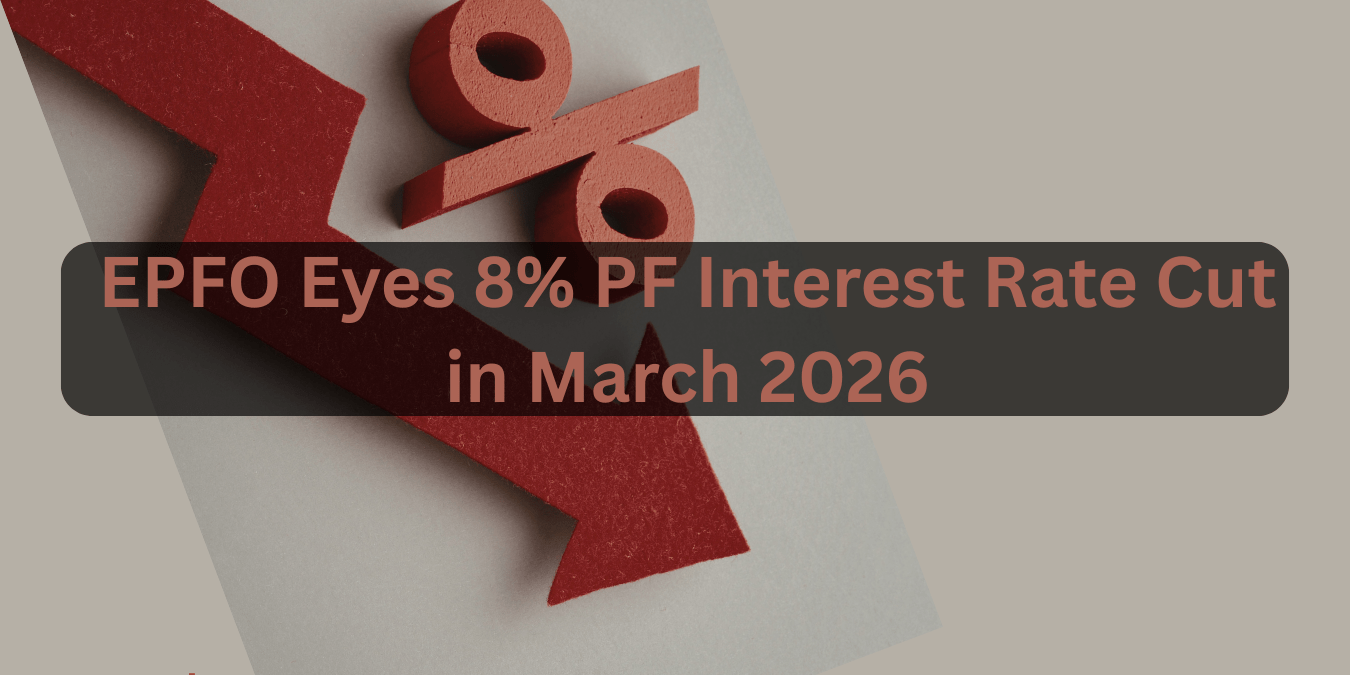

EPFO Eyes 8% PF Interest Rate Cut in March 2026: Will India's EPF Rate Drop Below 8.25% This FY?

EPFO’s March shock: Your PF interest rate faces a stealth cut to 8%—slashing lakhs from retirement dreams? Discover insider strategies salaried Indians are using to fight back, from VPF hacks to SIP surges. What if one move now saves your future? Uncover the suspenseful truth before it’s too late!

India’s EPFO is considering a modest cut in the Employees’ Provident Fund (EPF) interest rate for FY 2025-26, potentially dropping it to 8-8.2% from the current 8.25%. This decision looms ahead of the Central Board of Trustees (CBT) meeting in early March 2026, sparking concerns among millions of salaried workers who rely on EPF for retirement security.

Why a Rate Cut is on the Table

The EPFO’s Finance, Investment and Audit Committee (FIAC) will convene in late February 2026 to review investment returns and recommend the rate to the CBT. With surging memberships under schemes like Pradhan Mantri Viksit Bharat Rozgar Yojana, payouts to more subscribers could strain the corpus, prompting a buffer-building trim. Political factors, such as upcoming state elections in West Bengal, Tamil Nadu, Assam, Kerala, and Puducherry, might however push for maintaining the status quo for a third straight year.

From an Indian worker’s viewpoint, this reflects broader economic realities. Inflation hovers around 4-5%, while fixed deposit rates from banks like SBI stand at 6.5-7.5% for similar tenures. EPF’s government-backed investments in bonds and equities have yielded steady but pressured returns amid global volatility. A cut ensures long-term sustainability for over 7 crore subscribers, prioritizing corpus health over short-term gains.

Historical Context of EPF Rates

EPF rates have trended downward from double digits in the 1990s, stabilizing above 8% since 1977-78. Here's a snapshot of recent years:

| Financial Year | Interest Rate (%) |

| 2024-25 | 8.25 |

| 2023-24 | 8.25 |

| 2022-23 | 8.15 |

| 2021-22 | 8.10 |

| 2020-21 | 8.50 |

This stability beats many small savings schemes, but a dip to 8% would mark the lowest in nearly five decades, eroding real returns post-inflation. As someone tracking personal finance for over a decade—managing EPF contributions across job switches in IT and consulting—I've seen how these tweaks compound over 30 years, turning lakhs into crores.

What It Means for Salaried Indians

For a typical mid-level employee in Mumbai or Bengaluru earning ₹10 lakh annually (basic + DA around ₹50,000/month), monthly EPF contribution totals ₹12,000 (12% each from employee and employer, minus EPS slice). At 8.25%, a ₹5 lakh balance earns about ₹41,250 yearly; a drop to 8% shaves off ₹1,250—modest yearly, but over 20 years with 5% salary hikes, it could mean ₹5-7 lakh less corpus.

Lower-income workers in manufacturing or services feel it hardest. With wage ceilings stuck at ₹15,000 since 2014 despite inflation, many opt out, but the CBT may hike it to ₹25,000 per Supreme Court directive, pulling more into the net. Families planning kids' education or home loans view EPF as a safety net; a rate cut nudges diversification, especially with rising living costs in tier-1 cities.

Real returns matter most. Post-5% CPI, 8.25% nets 3.25%; at 8%, it's 3%—still positive but trailing equity mutual funds' 12-15% long-term averages (with risks). During my career, I've advised peers: EPF is bedrock, but not the whole portfolio.

Process: From Deliberation to Your Account

FIAC assesses returns first, then CBT votes in March. Finance Ministry ratifies, Labour Ministry notifies, and credits hit accounts by mid-2026—often earlier now, with 96% done by July last year. Interest compounds monthly on closing balances, tax-free up to ₹2.5 lakh annual accrual (₹5 lakh for govt employees).

Track via UMANG app or EPFO portal: Log in with UAN, activate KYC. Delays in transfers during job hops cost interest—I've lost months' worth pre-2019 reforms.

Indian Strategies to Offset a Potential Cut

Don't panic—withdrawals hurt compounding. Instead:

- Max voluntary contributions: Up to 100% salary via VPF for same rate, tax-deductible u/s 80C.

- Diversify: Allocate 60-70% EPF/NPS, 20-30% equity funds via SIPs. NPS offers 9-12% historically, with annuity choice.

- PPF or SCSS: PPF at 7.1% (15-year lock), sovereign guarantee; SCSS 8.2% for seniors.

- Job-hop smartly: Transfer PF promptly to retain rate continuity.

Example: ₹30,000 basic salary, 30-year horizon, 5% annual rise. At 8.25%, corpus hits ₹1.91 crore by 60; at 8.1%, ₹1.8 crore—a 6% hit, recoverable via 10% extra SIPs.

Broader Economic Ties

This mirrors RBI's cautious repo rate stance amid 7% GDP growth. EPFO's ₹20 lakh crore+ corpus influences bond markets; sustainable rates prevent shortfalls like 2015-16 arrears. Budget 2026 skipped big EPF tweaks, focusing EPFO 3.0 for UPI withdrawals, signaling digitization.

For gig workers under new yojanas, inclusion rises, but education on alternatives is key. Women, with lower averages (₹2-3 lakh balances), need advocacy for equity access.

Personal Lessons from Two Decades in Workforce

Starting my career in 2005 when EPF rates hovered around 8.5%, I've steadily grown my corpus to over ₹25 lakh by sticking to the mandatory 12% contributions plus voluntary provident fund (VPF) top-ups whenever possible. During rate dips, like the drop to 8.1% in 2021-22, I countered by boosting systematic investment plans (SIPs) in Nifty 50 index funds, which have delivered an average of 14% annualized returns over the long haul.

The core strategy remains straightforward: Prioritize an emergency fund covering 6 months of expenses in a liquid savings account, max out EPF contributions for tax-free compounding, and then layer in growth-oriented assets like equity mutual funds.

Essential Tools for Tracking Progress

EPFO's passbook app simplifies monitoring—log in monthly via your Universal Account Number (UAN) to view real-time balances, interest credits, and transaction history. This hands-on tracking helped me spot and fix transfer delays during job switches, preserving every rupee of interest.

EPF's Enduring Value in India

Even with potential cuts, EPF stands out as a retirement pillar, evolving from its modest 3% origins in 1952 to today's reliable 8%+ yields. It offers unmatched risk-free growth compared to fixed deposits at 6-7%, which face tax on interest—making EPF a cornerstone for salaried Indians balancing security and inflation.

Looking Ahead: What Workers Should Do Now

Keep a close watch on the official EPFO website for updates from the Finance, Investment and Audit Committee (FIAC) meeting, expected after February 25, 2026—their recommendations will shape the March Central Board decision.

Engage through employee unions or online forums to advocate for raising the EPF wage ceiling from ₹15,000, aligning with inflation and Supreme Court guidance, which could boost contributions for more workers.

In our nation's aspirational economy, where gig jobs and formal employment surge, EPF continues to adapt via reforms like EPFO 3.0 for faster withdrawals. A potential rate trim signals the need for diversified, holistic wealth-building—blending EPF's stability with market-linked options. Stay proactive and informed; the disciplined choices you make today will secure your future self at 60.