Don’t Fly Without Knowing This: Is Your Credit or Debit Card Providing Free Air Accident Cover?

Credit and debit cards are more than just tools for cashless transactions. They come with a range of hidden benefits, including complimentary insurance covers that many cardholders in India are unaware of. One such benefit is the free air accident cover, a financial safety net that could provide significant support in the unfortunate event of an air travel mishap. This blog explores the intricacies of air accident insurance offered by credit and debit card providers in India, why it matters, how to check your eligibility, and the steps to claim it. Packed with the latest data and insights, this guide aims to uncover this lesser-known perk and help you make the most of it.

What is Air Accident Cover?

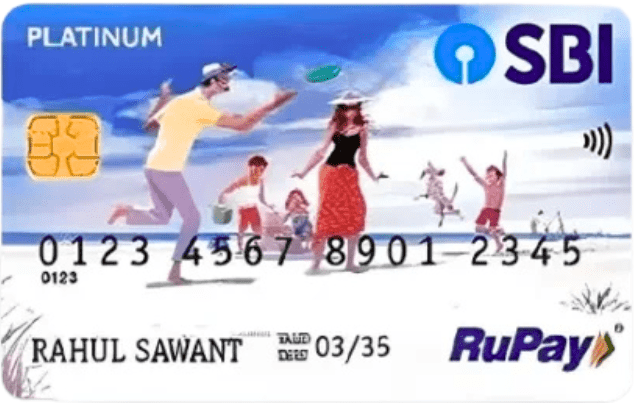

Air accident cover is a complimentary insurance benefit provided by many banks and card issuers in India, designed to offer financial protection in the event of accidental death or disability caused by an air travel incident. This coverage is typically embedded in the terms of premium credit and debit cards, particularly those linked to networks like Visa, Mastercard, RuPay, and Amex. Unlike traditional insurance policies, this cover comes at no additional cost to the cardholder, with premiums often included in the card’s annual fee.

The coverage amount can vary significantly, ranging from ₹50,000 to as high as ₹3 crore, depending on the card type, issuer, and specific terms. For instance, premium cards like the HDFC Infinia Credit Card or ICICI Bank Emeralde Private Metal Credit Card offer substantial air accident coverage, while entry-level cards may provide more modest sums.

Why it matters: With air travel becoming increasingly common in India—over 153 million passengers flew domestically in 2024, a 13% increase from 2023 (DGCA data)—the risk of accidents, though rare, cannot be ignored. This free cover acts as an additional layer of financial security for you and your family.

Why Aren’t Cardholders Aware of This Benefit?

Despite its value, many Indians remain unaware of the air accident cover tied to their cards. A 2024 survey by BankBazaar revealed that 68% of cardholders in urban India were unaware of the complimentary insurance benefits linked to their debit or credit cards. This lack of awareness stems from several factors:

- Fine Print Overload: Banks often bury these benefits in lengthy terms and conditions, making it easy for cardholders to overlook them.

- Lack of Communication: As noted by consumer activist T. Sadagopan in a 2021 article by The Hindu, banks rarely proactively inform customers about these perks, leaving it to cardholders to discover them independently.

- Assumption of Complexity: Many assume that claiming such insurance is a cumbersome process, deterring them from exploring it further.

Raising awareness about these benefits is crucial, especially since they can provide significant financial relief in emergencies. Let’s dive into the specifics of how this cover works and which cards offer it.

How Does Air Accident Cover Work?

Air accident cover typically applies to accidental death or permanent total disability caused by an air travel incident. However, eligibility comes with specific conditions:

- Active Card Usage: Most banks, such as SBI, HDFC, and ICICI, require the card to be “active,” meaning it must have been used for at least one financial transaction (e.g., at an ATM, POS, or e-commerce platform) within 30 to 90 days before the incident.

- Ticket Purchase Requirement: For air accident cover, the flight ticket must often be purchased using the specific card offering the coverage. This ensures the insurance is linked to the cardholder’s travel.

- Coverage Limits: The coverage amount depends on the card variant. For example:

- Exclusions: Coverage is limited to accidental deaths and does not include natural deaths or incidents involving pilots, aircrew, or military personnel unless they are off-duty.

Key Insight: This cover is not a substitute for a comprehensive term insurance plan but serves as a valuable add-on for frequent travellers.

Which Cards Offer Air Accident Cover in India?

The extent of air accident cover varies across banks and card networks. Below is a snapshot of some popular cards offering this benefit, based on the latest data from 2024–2025:

- Air accident cover: Up to ₹3 crore (international flights).

- Additional benefits: Emergency overseas hospitalization (₹50 lakh), baggage delay coverage (₹55,000).

- Air accident cover: ₹3 crore.

- Additional benefits: Purchase protection (₹1.4 lakh), credit shield (₹1 lakh).

- Air accident cover: ₹2.5 crore.

- Additional benefits: Loss of travel documents ($300), baggage delay ($300).

- Air accident cover: ₹1 crore.

- Additional benefits: Emergency hospitalization cover (₹15 lakh).

- Air accident cover: ₹10 lakh.

- Additional benefits: Non-air accident cover (₹5 lakh), purchase protection (₹50,000).

- Air accident cover: ₹1 crore (international travel).

- Additional benefits: Non-air accident cover (₹5 lakh), baggage loss (₹2 lakh).

- Air accident cover: Up to ₹1 crore (commercial flights only).

- Additional benefits: Personal accident cover (₹2 lakh).

- Air accident cover: Up to ₹3 crore (linked to salary account with recent salary credit).

- Additional benefits: Non-air accident cover (₹50 lakh).

Note: Coverage amounts and conditions are subject to change, so always verify with your bank or card issuer’s official website.

How to Check If Your Card Offers Air Accident Cover

To determine if your credit or debit card includes air accident cover, follow these steps:

- Review Card Documentation: Check the welcome kit, services guide, or terms and conditions provided with your card. These documents often detail insurance benefits.

- Visit the Bank’s Website: Most banks, such as SBI, HDFC, ICICI, and Axis, list insurance benefits on their official websites under the card’s features section.

- Contact Customer Care: Call your bank’s customer service or visit a branch to inquire about specific insurance benefits tied to your card.

- Check with Card Network: Networks like RuPay, Visa, or Mastercard often standardize insurance benefits. For instance, RuPay cards under the NPCI scheme offer air accident cover for active users.

- Use Insurance Apps: Platforms like CoverSure allow you to analyze your card type and transaction history to uncover linked insurance benefits.

Pro Tip: Ensure your card is active by making a small transaction (e.g., online purchase or ATM withdrawal) within the stipulated period (30–90 days) to remain eligible.

How to Claim Air Accident Insurance

Claiming air accident insurance requires careful adherence to the bank’s and insurer’s guidelines. Here’s a step-by-step guide based on the latest processes outlined by banks like SBI, HDFC, ICICI, and Axis:

- Notify the Bank Promptly: Inform your bank within 7–90 days of the incident, depending on the issuer’s terms (e.g., IndusInd Bank: 7 days; SBI RuPay: 90 days).

- Submit Required Documents: Common documents include:

- Death certificate (original or certified).

- Post-mortem report.

- FIR or police report.

- Proof of ticket purchase using the card.

- Cardholder’s ID proof (e.g., PAN, Aadhar).

- Nominee’s ID proof and bank details.

- Airline certification (for air accidents).

- File the Claim: Submit the claim form and documents to the bank or the designated insurer (e.g., ICICI Lombard for IndusInd, Royal Sundaram for Standard Chartered).

- Follow Up: Processing times vary (10–60 days), and additional documents may be requested. Check the status via the bank’s portal or customer care.

- Receive Payout: Approved claims are typically paid via direct bank transfer or cheque to the nominee after deducting any outstanding card dues.

Important: Claims must be filed within the stipulated window (30–90 days from the incident), and documents should be in English or notarized if in a vernacular language.

Limitations and Exclusions to Understand

While air accident cover is a valuable perk, it comes with limitations:

- Accidental Death Only: Coverage applies only to deaths caused by accidents, not natural causes.

- Ticket Purchase Condition: The flight ticket must be bought using the card offering the cover.

- Single Card Coverage: If you hold multiple cards, only one card’s insurance is applicable, typically the one with the highest coverage.

- Exclusions: Pilots, aircrew, and military personnel on duty are often excluded. Terrorism may be covered in some policies but not all.

- Discontinuation Risk: Some banks, like SBI, are phasing out certain insurance benefits (e.g., ₹1 crore cover on SBI Card ELITE effective July 15, 2025).

Expert Advice: Mahavir Chopra of Beshak.org emphasizes understanding the scope of coverage, as air accident insurance is narrower than comprehensive accident cover. Always read the fine print to avoid surprises.

Why You Should Care About This Benefit

The free air accident cover is a powerful yet underutilized benefit that can provide financial security for your loved ones. With air travel incidents, though rare, carrying significant financial implications, this cover acts as a safety net. For instance, the DGCA reported 1,200+ air safety incidents in 2024, underscoring the importance of such protections. Additionally, the rise in card fraud (₹1,457 crore in FY24, per RBI) highlights the need to understand all card benefits, including insurance, to maximize protection.

Real-Life Scenario: Imagine a cardholder with an HDFC Millennia Debit Card who frequently travels for work. By using the card to book flights and ensuring one transaction every 90 days, they unlock ₹1 crore in air accident cover—potentially life-changing support for their family in a worst-case scenario.

Tips to Maximize Your Card’s Insurance Benefits

- Stay Active: Make at least one transaction every 30–90 days to keep your card eligible for insurance.

- Update Nominee Details: Ensure your bank has updated nominee information to streamline claims.

- Choose Premium Cards: Opt for cards with higher coverage if you’re a frequent traveler. Compare cards on platforms like BankBazaar or CoverSure.

- Read the Terms: Check the specific conditions (e.g., ticket purchase, claim deadlines) to avoid disqualification.

- Don’t Rely Solely on Card Insurance: Complement this cover with a comprehensive term or travel insurance plan for broader protection.

Unlock the Hidden Value of Your Card

The free air accident cover offered by your credit or debit card is a hidden gem that could provide substantial financial support in times of crisis. With coverage ranging from ₹50,000 to ₹3 crore, this benefit is particularly valuable for frequent travelers. However, its effectiveness depends on your awareness and adherence to eligibility conditions, such as active card usage and ticket purchase requirements.