Delhi CM Rekha Gupta’s Announcement: Delhi’s Collateral-Free Loans Offer Upto Rs 10 crore !

Delhi CM Rekha Gupta’s Rs 10 crore collateral-free loan scheme shaking up housing finance in 2025! Discover how this hidden gem can transform your home or business loan journey—without the usual collateral hurdles. But what’s the one surprising twist everyone’s talking about? Click to reveal now!

Delhi CM Rekha Gupta’s recent announcement of collateral-free loans up to Rs 10 crore has created a wave of excitement and discussion across India, especially among aspiring homebuyers and entrepreneurs aiming for affordable and accessible housing finance options. This bold move by the Delhi government aims to reshape housing financing by removing traditional barriers like collateral, which often deter middle and lower-income groups from securing large loans. But what makes this scheme truly game-changing? How can it transform the housing finance landscape and empower millions in Delhi and beyond?

The Big Announcement: Collateral-Free Loans Up to Rs 10 Crore

On October 14, 2025, Delhi Chief Minister Rekha Gupta announced a stunning new initiative offering collateral-free loans of up to Rs 10 crore for entrepreneurs, with a special focus on women’s empowerment. Speaking at the Ambedkar International Centre during the launch of a report on enhancing female entrepreneurs, Gupta highlighted the government’s commitment to supporting hardworking entrepreneurs to realize their dreams without the worry of pledged assets. This scheme particularly targets women entrepreneurs in the Micro, Small, and Medium Enterprises (MSME) sector, aiming to unlock their true potential in the workforce. As Gupta pointedly stated, “Half the population cannot stay locked at home if we want true development”.

Why Collateral-Free Loans Are a Hidden Gem for Affordable Housing

Traditionally, securing a home loan or a business loan in India involves providing collateral—property or assets that banks hold as security until the loan is repaid. This can exclude many aspirants who lack sufficient assets, especially women entrepreneurs and young professionals. The “secret” behind collateral-free loans lies in removing this massive hurdle, making financing quicker and smarter.

- No need to mortgage your home or land

- Faster loan approvals with digital verification

- Inclusive approach welcoming underserved groups

For affordable housing seekers in Delhi, this scheme opens a new door. Buyers of discounted flats under schemes like the Delhi Development Authority’s (DDA) Apna Ghar Awaas Yojana can now combine cheaper property prices with easy financing, bridging the gap between income and ownership aspirations.

How This Initiative Fits into Delhi’s Housing Context

Delhi’s urban landscape faces a chronic housing shortage with growing demand fueling prices beyond reach for many. The DDA’s 2025 housing scheme offers 7,500 flats at discounted rates for various income groups, but many still struggle to gather funds despite attractive prices. Collateral-free loans complement this by providing easy credit access:

- Discounts of 15-25% in DDA flats offer affordability

- Collateral-free loans make financing accessible even to first-time buyers

- Enables seamless ownership transition without asset risk

This pairing of government-subsidized housing and easy financing is a future-forward strategy redefining what affordable housing means in India’s capital.

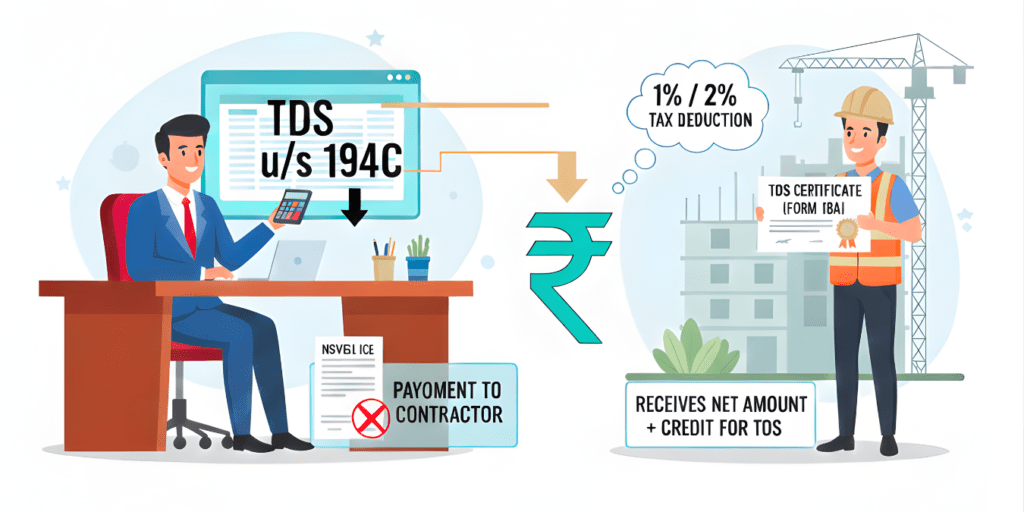

Which Banks or NBFCs will Implement the Collateral-Free Scheme

The collateral-free loan scheme announced by Delhi CM Rekha Gupta will be implemented through a collaborative partnership between the Delhi government and the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE). CGTMSE, established by the Ministry of MSME and SIDBI, acts as a risk guarantor, enabling banks and NBFCs to lend without requiring collateral by providing guarantee coverage of up to 95% on loans.

Key details on the implementing lenders and structure:

- CGTMSE works with 276 member lending institutions, including major banks and NBFCs across India.

- These member banks and NBFCs will be the frontline agencies disbursing collateral-free loans under this scheme in Delhi.

- The Delhi government has allocated ₹5 crore in FY 2025-26 as a start, with a phased funding contribution planned up to ₹50 crore to support guarantee coverage.

- Guarantee coverage is split between CGTMSE and Delhi government to mitigate lender risk:

- Small enterprises loans up to ₹10 crore get 75% CGTMSE + 20% Delhi government coverage.

- Women entrepreneurs and Agniveer-promoted MSMEs get 90% CGTMSE + 5% Delhi government coverage.

- Micro enterprises loans up to ₹5 lakh get 85% CGTMSE + 10% Delhi government coverage.

- The scheme covers sectors such as manufacturing, services, retail, and education.

How Does this Compare with Central Government Housing Loan Schemes

Delhi CM Rekha Gupta’s collateral-free loan scheme and central government housing loan schemes like Pradhan Mantri Awas Yojana (PMAY) differ significantly in focus, scale, and financing structure but share a common goal of enhancing financial inclusion and affordable housing.

Key Comparison Points

| Aspect | Delhi Collateral-Free Loan Scheme | Central Govt Housing Loan Schemes (e.g., PMAY) |

| Loan Purpose | Primarily MSME business expansion and housing finance including affordable flats | Primarily affordable housing purchase/construction |

| Loan Amount | Up to Rs 10 crore | Home loans typically up to Rs 18 lakh to Rs 25 lakh (varies by category) |

| Collateral Requirement | No collateral required | Usually collateral required, but with interest subsidy and credit-linked subsidy schemes (CLSS) for lower-income groups |

| Credit Guarantee | Backed by CGTMSE and Delhi Govt with up to 95% guarantee coverage reducing lender risk | Interest subsidies on loans through CLSS; some low-income schemes have partial guarantee support |

| Interest Subsidy | No direct subsidy; relies on collateral-free and guarantee coverage for affordability | Interest subsidy up to 6.5% for Economically Weaker Sections (EWS) and Low Income Groups (LIG) on home loans for up to 20 years |

| Target Beneficiaries | MSMEs, women entrepreneurs, startups, affordable housing buyers | Urban poor, low and middle-income groups, slum dwellers, women, and transgender persons |

| Application & Approval | Digitally streamlined with single window, rapid disbursal facilitated by guarantee trust | Application through PMAY portal, with subsidy credited after loan sanction, tends to be lengthier with more documentation |

| Focus on Women Empowerment | Strong emphasis on women entrepreneurs with higher guarantee coverage | Special components for women ownership and subsidy, but within set eligibility slabs |

| Loan Tenure | Flexible, linked with business or housing project need | Typically up to 20 years for home loans under PMAY |

The two approaches serve complementary roles: Delhi’s scheme unlocks collateral-free credit at larger scales primarily to fuel entrepreneurship and housing finance, while central schemes provide targeted interest subsidies and housing affordability support to economically weaker sections and urban poor, making them collectively powerful tools for India’s housing finance future.

Key Features and Benefits of Delhi’s Collateral-Free Loan Scheme

| Feature | Details |

| Loan Amount | Up to Rs 10 crore |

| Collateral Requirement | None |

| Target Beneficiaries | MSME entrepreneurs, especially women |

| Sector Focus | Business expansion, housing financing |

| Application Process | Simplified, leveraging digital tools |

| Government Support | Credit guarantees mitigate lender risk |

| Expected Impact | Boost women entrepreneurship and affordable housing |

Eligibility Criteria and Documentation Required For Loans

The eligibility criteria and documentation required for collateral-free loans under the Delhi CM Rekha Gupta scheme are designed to be inclusive yet ensure financial credibility. Here are the details:

Eligibility Criteria

- The applicant must be a Micro, Small, or Medium Enterprise (MSME) operating in Delhi.

- Women entrepreneurs and enterprises promoted by Agniveers receive priority with enhanced guarantee coverage.

- Business should be legally registered with valid proof such as GST registration or Udyam registration.

- The enterprise generally needs to have a minimum turnover (e.g., Rs 10 lakh annually) and proven operational history, though exact turnover criteria may vary by lender.

- Borrowers usually must have a credit score of 650+ for smooth approval, though some schemes are relaxed for women entrepreneurs.

- The loan can be availed by new and existing enterprises across manufacturing, services, retail, and education sectors.

- Applicants must be of eligible age (typically between 21-65 years).

Documentation Required

- Identity and Address Proof: PAN card, Aadhaar card, voter ID, or passport.

- Business Registration Proof: GST certificate, Udyam registration certificate, or shop establishment license.

- Financial Documents: Bank statements for the last 6 months, Income Tax Returns (ITR) if available.

- Credit Score Report: For assessment of creditworthiness.

- Business Proof: Trade licenses, partnership deed, or incorporation certificate depending on the business type.

- Additional Documents: May include trade licenses, sales invoices, and contracts to prove business continuity.

- For women entrepreneurs, sometimes relaxed documentation and faster processing are offered.

The application process is intended to be seamless and digital through the banks or NBFCs affiliated with CGTMSE, making documentation submission paperless and quick. The Delhi government and CGTMSE jointly provide guarantee coverage’s up to 95%, minimizing lender risk and easing approval for eligible applicants.

How to Apply and What to Expect

The Delhi government has promised a streamlined process with digital integration and single-window systems to ensure quick approvals. Applicants need to:

- Register online through official portals

- Submit business/housing plans and digital ID proofs

- Await fast-track processing backed by credit guarantees

This ease is crucial to attract the next wave of borrowers who prefer speed and transparency over paperwork-heavy hurdles.

Challenges and Considerations

While the scheme is revolutionary, a few challenges remain:

- Awareness: The government and financial institutions must create massive awareness campaigns.

- Repayment Discipline: Borrowers need financial education to ensure timely repayments.

- Risk Management: Lenders must carefully balance ease with due diligence despite no collateral.

Addressing these aspects smartly will ensure sustainable growth and lower default rates.

What This Means for Delhi Residents

Delhi CM Rekha Gupta’s collateral-free loan scheme is a bold, smart move towards democratizing access to finance. It ignites hope, especially among women entrepreneurs and aspiring homeowners who have long been sidelined by collateral restrictions. By coupling this financing option with ongoing affordable housing efforts, Delhi is crafting a future where owning a home or starting a business is no longer a distant dream but a reachable goal.

Key Takeaways

- Collateral-free loans up to Rs 10 crore announced by Delhi CM Rekha Gupta focus on MSMEs and women entrepreneurs.

- The scheme removes asset pledging barriers, enabling faster, smarter financing.

- It complements government affordable housing schemes like DDA’s Apna Ghar Awaas Yojana.

- Digital and credit guarantee support enhances access and reduces lender risk.

- Challenges include awareness, repayment discipline, and risk management.

- The initiative could spark a “golden era” for financial inclusion in Delhi.

Final Thought

Delhi, where securing a Rs 10 crore loan is as simple as pitching your innovative idea—with no asset required to tie you down. This is no distant fantasy but the emerging reality woven by CM Rekha Gupta’s revolutionary scheme. How will this move reshape the future of affordable housing and entrepreneurship? Will other states follow Delhi’s bold lead? The answers lie just beyond the horizon, promising a smart, inclusive financial future brimming with opportunities.

With over 15 years of experience in Banking, investment banking, personal finance, or financial planning, Dkush has a knack for breaking down complex financial concepts into actionable, easy-to-understand advice. A MBA finance and a lifelong learner, Dkush is committed to helping readers achieve financial independence through smart budgeting, investing, and wealth-building strategies, Follow Dailyfinancial.in for practical tips and a roadmap to financial success!