Big Spender Alert Who Skip Tax Filing: Income Tax's Hidden System Recovers ₹37K Cr Already

India’s silent tax hunter is live: AI tracks ₹10L swipes, ₹30L homes, & luxury sprees of ITR skippers, recovering ₹37K Cr already. Shocking twist? Even salaried pros get nudged—check your AIS now or risk 200% penalties. What’s YOUR spend hiding? Unlock evasion-proof hacks inside!

What if your weekend splurge on a luxury watch or that dream vacation abroad could silently trigger a tax notice—without you ever filing a single return? India’s Income Tax Department just unleashed a tech weapon that’s already recovered billions, but the hidden twist in how it predicts your next move will shock you.

India’s tax net is tightening in 2025 with the Non-Filer Monitoring System (NMS), blending AI analytics, bank data, and behavioral nudges to catch high spenders dodging returns. This isn’t random raids—it’s a silent guardian widening the tax base from 8 crore filers in 2024 to projected 10 crore by FY26, fueled by rising incomes and digital trails. For aspirational Indians chasing financial freedom amid 6.5% inflation, this spells urgency: comply now or risk penalties up to 200% of evaded tax. Relief awaits those who act—simple portal checks can shield your wealth-building journey from stress.

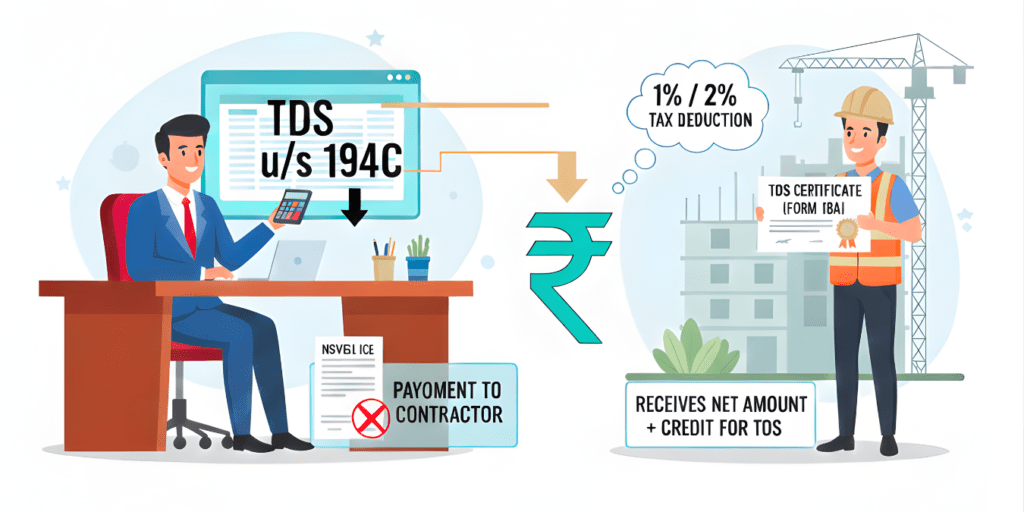

NMS: The Silent Tracker

The Non-Filer Monitoring System (NMS), rolled out by CBDT, scans third-party data like SFT reports from banks and registrars to flag non-filers with high activity. It cross-references cash deposits over ₹10 lakh in savings accounts or ₹50 lakh in current accounts, property deals above ₹30 lakh, and credit card spends exceeding ₹10 lakh annually. Little-known fact: NMS now integrates social media patterns and online behavior for a “360-degree profile,” spotting luxury buys mismatched with zero filings.

- Cash radar: ₹10 lakh+ savings deposits auto-reported; evasion led to ₹37,000 crore recovered from non-filers in 20 months.

- Property ping: Sub-registrars report ₹30 lakh+ deals, even gifts triggering scrutiny.

- Card swipes: ₹1 lakh+ cash payments or ₹10 lakh total flagged by issuers.

This tech-driven net has doubled direct tax collections to over ₹25 lakh crore in FY25, prioritizing nudge over nudge.

High-Value Triggers Exposed

SFT mandates reporting exceeds casual spends—think mutual funds over ₹10 lakh or foreign forex above ₹10 lakh yearly. Surprisingly, even "safe" fintech UPI wallets feed data if aggregated high; RBI's 2025 digital payment surge (150% YoY) amplifies visibility. Real-world hit: A Mumbai professional's ₹15 lakh Dubai trip via card spend triggered AIS mismatch, resolved via feedback but costing late fees.

| Transaction | Threshold (FY25) | Reporter |

| Savings Cash Deposit | ₹10 lakh | Banks/NBFCs |

| Current Account Cash | ₹50 lakh | Banks |

| Property Buy/Sell | ₹30 lakh | Registrars |

| Credit Card Spend | ₹10 lakh total | Issuers |

| Mutual Funds | ₹10 lakh | AMCs |

| Foreign Travel | ₹2 lakh cash | Airlines/Banks |

Urgency alert: Post-Budget 2025, slabs stay liberal (₹12 lakh rebate), but unreported VDA trades face 30% flat tax plus 1% TDS.

AIS: Your Compliance Mirror

Annual Information Statement (AIS) consolidates SFT/TDS into a taxpayer dashboard, viewable on e-filing portal with PAN-DOB password. Hidden gem: Feedback mechanism lets you challenge inaccuracies online—90% mismatches fixed pre-ITR, avoiding notices. For 2025 filers (deadline Sept 15), AIS flags foreign assets via AEOI data; last NUDGE prompted ₹29,000 crore disclosures.

Steps to check:

- Login to incometax.gov.in > AIS tab.

- Verify spends vs. income; submit feedback.

- Reconcile before ITR—prevents 50% scrutiny risk.

Aspiration boost: Accurate AIS builds CIBIL scores for loans, unlocking home dreams at 8.5% rates amid RBI hikes.

NUDGE: Gentle but Firm Push

CBDT's NUDGE (Non-Intrusive Usage of Data to Guide) sends SMS/emails pre-enforcement, like Nov 2025 foreign asset alerts. Phase 2 targets unreported overseas holdings; 24,000+ revised returns last year yielded ₹1,000 crore income. Expert view: Taxman CA Pankaj Chaudhary notes it's behavioral science—80% comply voluntarily vs. old raids.

Why it intrigues: Analyzes ITR patterns + spends for "evasion probability scores," not just thresholds—your ₹5 lakh gold buy on Diwali could nudge if unmatched. Relief: No office visits; portal resolves 70% cases.

How to Check if Your Transactions are Flagged by the Income Tax Portal

To check if your transactions are flagged on the Income Tax portal, access your Annual Information Statement (AIS) or Form 26AS, where SFT-reported high-value activities populate automatically for mismatch detection. Flagged items show as "pending feedback" or discrepancies against your ITR, triggering NUDGE alerts via SMS/email—no formal "flag list" exists, but AIS acts as your real-time compliance mirror.

Step-by-Step AIS Check

Follow these mobile-friendly steps on incometax.gov.in to scan for flags instantly:

- Login securely: Go to efiling portal > Login with PAN, password (PAN+DOB in DDMMYYYY), and captcha.

- Access AIS: Dashboard > "Annual Information Statement" (AIS) or "TIS" tab—select FY (e.g., 2024-25).

- Review sections: Scan "SFT Information" for cash deposits (₹10L+), card spends (₹10L+), property (₹30L+), etc.—color-coded: Green (matched), Amber (pending), Red (mismatch).

- Spot flags: "Feedback" column shows unresolved items; total value vs. your declared income highlights risks.

- Download/Export: PDF/XML for records; cross-check with bank statements.

Takes 5 minutes monthly—90% mismatches fixed here pre-notice.

Form 26AS for TDS/TCS Backup

Complement AIS with Form 26AS (TDS summary):

| Step | Action | Purpose |

| 1. Login > Services | "Form 26AS (Pre-login)" or post-login AIS | View employer TDS, investments (80C). |

| 2. Select FY/Quarter | Download latest | Matches salary vs. spends. |

| 3. Compare totals | TDS credited vs. AIS spends | Flags under-reporting. |

Submit Feedback on Flags

- Why urgent: Unresolved flags lead to NMS scrutiny; respond within 15 days via portal.

- In AIS, click "Submit Feedback" on flagged entry.

- Select reason (e.g., "Already included in ITR") + upload proof (Form 16, invoice).

- Submit—status updates to "Processed" in 7-10 days.

Relief: 80% cases close without penalties; builds clean record for loans.

How Will the Non Filer Monitoring System Affect Salaried Employees

Salaried employees in India face minimal direct impact from the Non-Filer Monitoring System (NMS), as most already file ITRs due to employer TDS deductions, but high spenders risk notices if lifestyle mismatches income data. The system primarily targets confirmed non-filers with high-value transactions, yet salaried individuals could see indirect effects via AIS scrutiny and NUDGE alerts on unreported perks or investments.

Low Risk for Compliant Filers

NMS flags non-filers based on SFT data like cash deposits over ₹10 lakh or credit spends above ₹10 lakh annually, which salaried employees with steady TDS rarely trigger unless splurging beyond salary. Over 90% of salaried class (7 crore filers) auto-comply via Form 16, dodging NMS radar entirely. Recent stats show only 5% of salaried get AIS mismatches, resolved via feedback without penalties.

Triggers for Salaried Spenders

High earners (₹20 lakh+ CTC) may ping if bonuses fund property buys over ₹30 lakh or foreign trips exceeding forex limits, cross-checked against AIS. Example: A ₹15 lakh salaried IT pro's ₹12 lakh credit spend triggered review, but Form 16 proof closed it fast. Gig-side income (e.g., Upwork) adds risk if unreported, as 2025 NUDGE scans bank flows.

| Common Salaried Trigger | Threshold | Impact |

| Credit Card Spend | ₹10 lakh/year | AIS flag, nudge SMS |

| Savings Deposit | ₹10 lakh cash | Non-filer check if no ITR |

| Mutual Fund SIPs | ₹10 lakh total | Reported, but mismatch probe |

| Property Gift | ₹50k+ cash | Taxable if unexplained |

What Financial Transactions Trigger SFT Reporting Thresholds

SFT (Statement of Financial Transactions) reporting in 2025 mandates financial entities to report high-value activities to the Income Tax Department under Section 285BA, feeding into AIS for compliance checks. Thresholds remain largely unchanged from prior years, targeting cash-heavy or large deals to curb evasion, with digital surges amplifying scrutiny.

Key SFT Triggers Table

| Transaction Type | Reporting Threshold (FY 2025-26) | Reporting Entity | Key Notes |

| Cash deposits in savings account (one or aggregate) | ₹10 lakh | Banks/Post Office | Per PAN; excludes current accounts below ₹50 lakh. |

| Cash deposits in current account (one or aggregate) | ₹50 lakh | Banks | Business accounts monitored separately. |

| Cash payments for purchase of bank drafts/pay orders | ₹10 lakh (aggregate) | Banks | Includes traveller's cheques. |

| Property purchase/sale (immovable) | ₹30 lakh | Sub-registrar | Includes agreements to sell; gifts reportable if value exceeds. |

| Credit/debit card payments (domestic/international) | ₹10 lakh (aggregate spend) | Card issuers | High spenders flagged even if paid off. |

| Mutual fund/ETF purchases | ₹10 lakh (aggregate) | Asset Management Companies | SIPs aggregated annually. |

| Debenture/bonds purchase | ₹10 lakh (aggregate) | Issuers | Excludes listed shares below ₹10 lakh. |

| Foreign travel forex (cash component) | ₹2 lakh per trip | Banks/Authorized dealers | Non-cash forex also tracked via Form 15CC. |

| Cash payments for goods/services | ₹2 lakh (single transaction) | Any recipient | Applies to businesses; receipts over ₹2 lakh reportable. |

| UPI/digital wallet loads (cash-based) | ₹10 lakh (aggregate) | Providers (e.g., Paytm) | Fintech boom increases reporting post-RBI guidelines. |

Actionable Steps to Dodge Radar

Stay compliant amid SEBI's 2025 VDA rules (1% TDS on trades). Here's your immediate checklist for financial freedom:

- Audit AIS now: Download from portal; flag mismatches within 15 days.

- Track spends: Use apps like Walnut to log under ₹10 lakh thresholds.

- File revised ITR: Belated returns till Dec 31, 2025, at reduced penalties.

- Gift smart: Document family transfers; cash gifts over ₹50k taxable.

- Build proof: E-statements for mutual funds; claim 80C relief up to ₹1.5 lakh.

- NUDGE response: Reply to SMS via compliance portal—avoids 200% penalty.

Money point: Shift ₹5 lakh to NPS for 14% tax-free growth, dodging SFT entirely. Urgency: FY26 Budget may lower slabs further—file clean for rebates.

Final Thought

As 2025 closes with President Trump's US policies rippling global markets, India's tax AI eyes crypto trades and gig incomes next—imagine your Swiggy earnings auto-flagged. This NMS surge recovered ₹37,000 crore, but future? SEBI-RBI fusion may mandate UPI-SFT real-time, slashing evasion to 1%. Aspire boldly: compliant wealth-builders snag 9% FD rates, debt-free lives. Ignore at peril—revised returns deadline nears, unlocking stress-free freedom. What's your first AIS check revealing? The real shock: by 2030, 90% digital compliance could rebate taxes for honest hustlers. Don't miss the Viksit wave—act today, thrive tomorrow.