Axis Bank AMAZE Zero Balance Savings Account— No minimum balance, ₹11,000 in rewards, free Amazon Prime, Swiggy benefits, and 2,000 EDGE points monthly await.

A bank account that lets you save without the stress of maintaining a minimum balance, offers rewards worth thousands, and makes banking as easy as a few clicks on your smartphone. Sounds too good to be true? Welcome to the Axis Bank AMAZE Zero Balance Savings Account, a game-changer in the world of Indian banking. This account is redefining how millions manage their finances, combining convenience, rewards, and accessibility like never before. Curious? Let’s dive into why the AMAZE account is creating waves and how it can transform your banking experience.

What is the Axis Bank AMAZE Zero Balance Savings Account?

The AMAZE Zero Balance Savings Account by Axis Bank is designed for those who crave stress-free banking without the burden of maintaining a minimum balance. Unlike traditional savings accounts that penalize you for dipping below a certain amount, AMAZE lets you bank freely while offering premium benefits typically reserved for high-balance accounts. For a nominal fee of ₹200/month or ₹2,200/year, you unlock a world of rewards, seamless digital banking, and access to over 250+ banking services. But what makes this account stand out in the crowded banking landscape? Let’s explore.

Why Choose a Zero Balance Savings Account?

In a country like India, where financial inclusivity is a priority, zero balance accounts are a lifeline for students, young professionals, and low-income individuals. The AMAZE account takes this concept to the next level by blending affordability with premium perks. No more worrying about penalties for low balances or scrambling to meet minimum requirements. With AMAZE, you get the freedom to use your money as you please, whether it’s for emergencies, investments, or daily expenses.

The Numbers Speak: Why It’s a Smart Choice

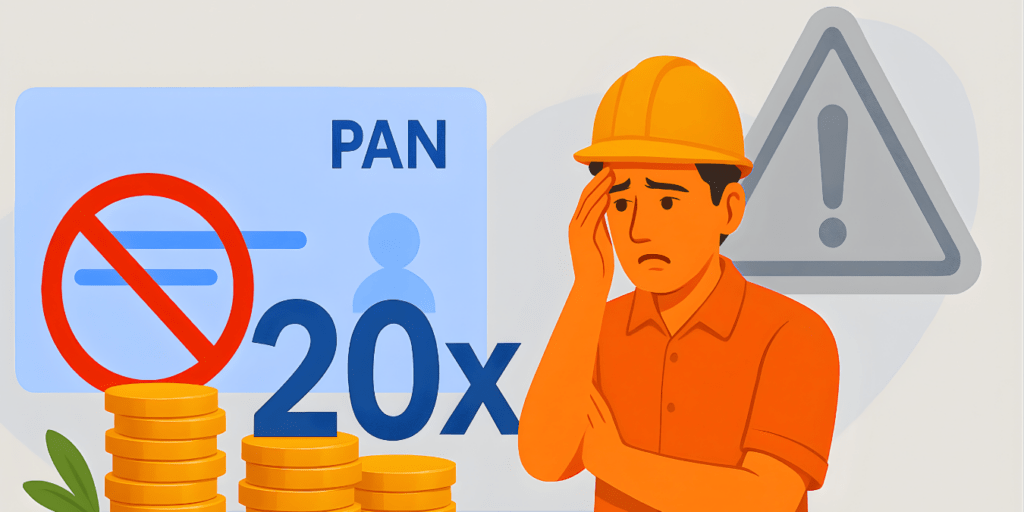

Consider this: a traditional savings account might require a minimum balance of ₹5,000–₹12,000, depending on your location. Falling below this can result in penalties of ₹100–₹600 per month. With AMAZE, you eliminate these fees entirely, saving you potentially ₹1,200–₹7,200 annually. Plus, the initial funding of ₹10,000 (which you can withdraw after activation) makes it accessible to almost everyone. Curious about the perks? They’re even more exciting.

Unpacking the Benefits of AMAZE Zero Balance Savings Account

The AMAZE account isn’t just about skipping minimum balance fees—it’s packed with rewards that make every transaction feel like a win. Here’s what you get:

1. No Minimum Balance, No Stress

- Maintain zero balance without penalties.

- Pay a small subscription fee: ₹200/month or ₹2,200/year (a ₹200 discount for annual payment).

- Ideal for students, freelancers, or anyone seeking hassle-free banking.

2. Exclusive Debit Card Rewards

- 3 months of Amazon Prime Membership (worth ₹599) on your first debit card transaction within 30 days.

- 10 complimentary movie tickets (worth ₹4,000) valid for 5 months via BookMyShow.

- 3 months of Swiggy One membership (worth ₹400) plus a ₹500 Swiggy Dineout voucher.

- ₹500 discounted Uber ride package after your first debit card transaction.

3. Earn 2,000 EDGE Reward Points Monthly

- Spend ₹20,000/month via Online Rewards Debit Card or UPI Merchant Payments (Axis Pay or Mobile Banking App).

- Redeem points for shopping, travel, or gift vouchers, adding up to ₹4,800 in annual rewards.

4. Insurance Benefits

- Personal Accident Cover: ₹5,00,000.

- Air Accident Cover: ₹1 crore.

- Purchase Protection Cover: ₹50,000.

- Loss/Delayed Baggage Cover: Up to USD 500.

5. No Charges on Domestic Transactions

- Free ATM withdrawals at Axis Bank ATMs.

- No fees on domestic banking transactions, including NEFT, RTGS, and IMPS.

- Complimentary debit card and chequebook.

6. Access to 250+ Banking Services

- Seamless mobile and internet banking via Axis Bank’s top-rated app.

- Pay bills, recharge, book FDs, or apply for loans directly from your phone.

- Monitor spending, track rewards, and manage EMIs effortlessly.

7. Welcome Kit

- Virtual Debit Card for instant online transactions.

- Physical Debit Card and chequebook for traditional banking needs.

- Mobile & Internet Banking Credentials for 24/7 access.

These benefits, worth over ₹11,000 annually, make AMAZE a premium account disguised as a zero-balance option. But how do you get started? The process is simpler than you think.

How to Open an AMAZE Zero Balance Savings Account

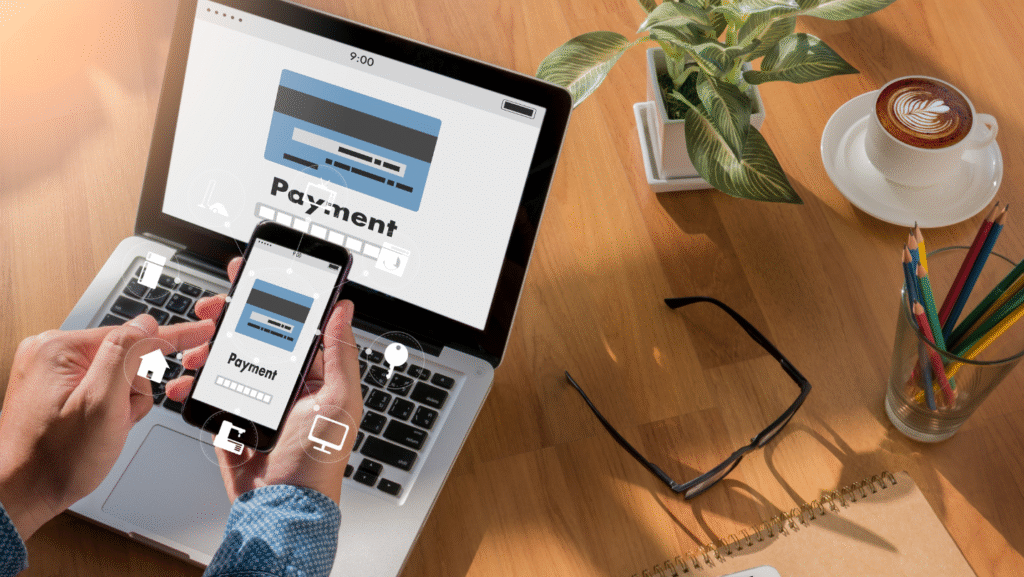

Opening an AMAZE account is as easy as ordering food online. Axis Bank’s digital-first approach ensures you can start banking in just four steps:

- Visit the Official Website: Head to Axis Bank’s AMAZE Zero Balance Savings Account page.

- Complete the Application: Enter your personal details, PAN, Aadhaar, and mobile number. Agree to the terms and conditions.

- Video KYC: Verify your identity via a quick video call with an Axis Bank representative.

- Initial Funding: Deposit ₹10,000 (withdrawable after activation) via debit card, UPI, or internet banking (credit cards not allowed).

Once verified, your account is activated, and you receive a virtual debit card for immediate use. No branch visits, no paperwork—just pure convenience.

Eligibility and Documents Required

Wondering if you qualify? The eligibility criteria are straightforward:

- Indian Resident: You must be a resident of India.

- Valid Documents: Original PAN and Aadhaar cards (linked together).

- Smartphone: A device with a working camera for video KYC.

- Location Access: Allow the bank’s representative to access your camera and location during KYC.

- Initial Funding: ₹10,000, which you can withdraw post-activation.

No prior savings account with Axis Bank? Perfect—AMAZE is designed for new customers, but existing customers can apply too (terms apply).

The Fine Print: Charges and Requirements

While AMAZE is a zero-balance account, there are a few things to keep in mind:

- Plan Charges: ₹200/month (minimum 6 months) or ₹2,200/year.

- Debit Card Limits:

- Online Rewards Card: ₹50,000 ATM withdrawal, ₹5,00,000 POS withdrawal.

- E-Debit Card: ₹1,00,000 POS withdrawal (no ATM withdrawal).

- Statement Fees: Free e-statements; physical copies may incur charges.

- Interest Rates: 3%–3.5% on daily balances (credited quarterly, as of July 2023).

These charges are minimal compared to the rewards and savings from avoiding minimum balance penalties.

Why AMAZE Stands Out

In a competitive banking landscape, AMAZE shines for its blend of accessibility and premium benefits. Here’s why it’s a top choice:

- Digital-First Approach: Open your account from anywhere, anytime, with video KYC.

- High Rewards: Up to ₹11,000 in annual benefits, including cashbacks, memberships, and reward points.

- Financial Freedom: No minimum balance means your money is yours to use.

- Trusted Brand: Axis Bank serves over 2.8 crore customers with 11,500+ ATMs and 5,100+ branches across India.

But is it worth the ₹200/month fee? Let’s break it down.

Is the AMAZE Account Worth It?

Some might hesitate at the subscription fee, but consider the value:

- Savings on Penalties: Avoid ₹1,200–₹7,200 in annual minimum balance fees.

- Reward Value: ₹11,000 in benefits (Amazon Prime, Swiggy, BookMyShow, Uber, and EDGE points).

- Convenience: 250+ services, free transactions, and a top-rated mobile app.

For example, spending ₹20,000/month on groceries, bills, or online shopping earns you 2,000 EDGE points (worth ₹400–₹500). Add the ₹5,999 welcome benefits and ₹4,800 annual rewards, and the ₹2,400 annual fee becomes a no-brainer. As one Reddit user put it, “10% cashback on Flipkart and Amazon from a savings account? If it lasts a year, my head will pop off!”

The Suspense: What’s the Catch?

No account is perfect, so let’s address potential downsides:

- Subscription Fee: ₹200/month may feel unnecessary if you don’t use the rewards.

- Limited Offer Duration: Some benefits (e.g., Amazon Prime, Swiggy) are valid for 3–5 months.

- Spending Thresholds: To maximize rewards, you need to spend ₹20,000/month.

However, the ability to withdraw the initial ₹10,000 funding and the absence of domestic transaction fees make it a low-risk option. If you leave the account dormant, the fee may accrue, but Axis Bank typically doesn’t let balances go negative—just ensure you close the account if unused.

Final Thoughts: Is AMAZE Right for You?

If you’re seeking a banking solution that combines convenience, rewards, and financial freedom, the Axis Bank AMAZE Zero Balance Savings Account is a must-consider. Whether you’re a student, a young professional, or someone tired of traditional banking hassles, AMAZE delivers. With a seamless online opening process, premium benefits, and no minimum balance worries, it’s no wonder millions are switching to AMAZE.

Ready to transform your banking experience? Visit Axis Bank’s website and open your AMAZE account today. Curious about how much you could save or earn? Try Axis Bank’s Savings Account Interest Calculator to plan your finances smarter. The future of banking is here—don’t miss out!

Disclaimer: Benefits and terms are subject to change. Check Axis Bank’s official website for the latest details.

Disclaimer: The use of any third-party business logos in this content is for informational purposes only and does not imply endorsement or affiliation. All logos are the property of their respective owners, and their use complies with fair use guidelines. For official information, refer to the respective company’s website.