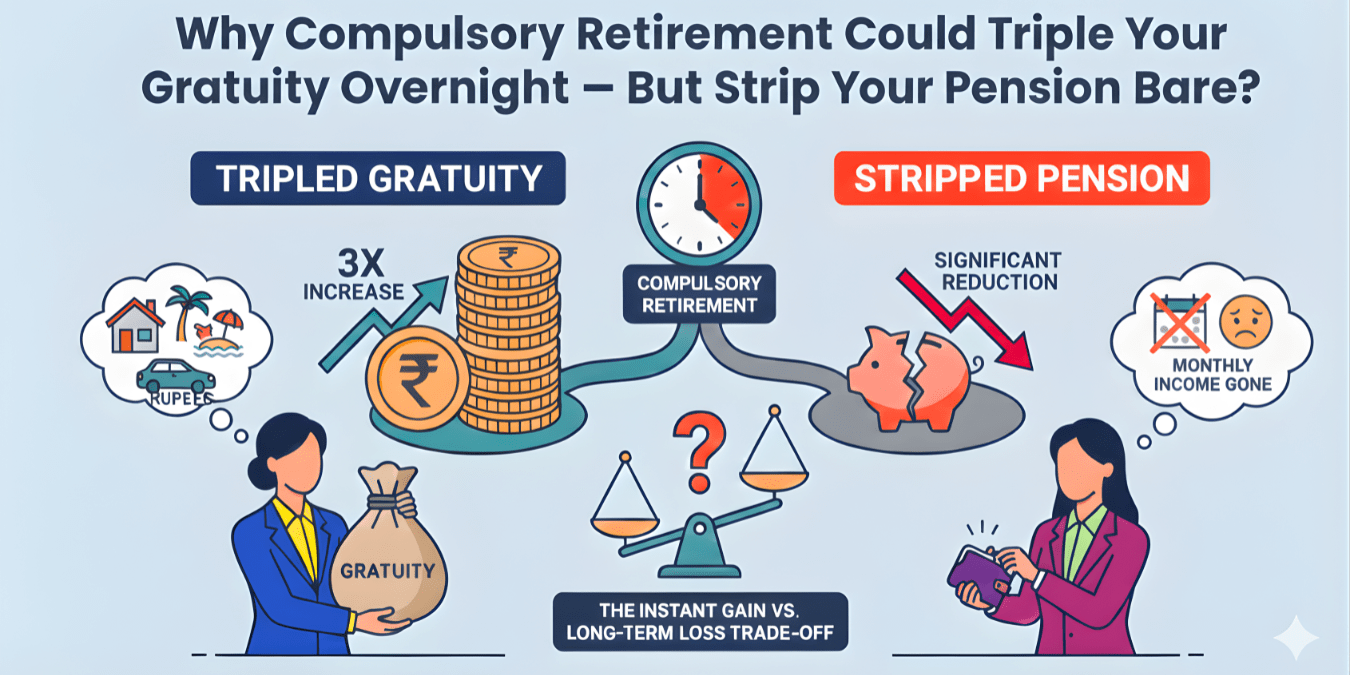

Why Compulsory Retirement Could Triple Your Gratuity Overnight – But Strip Your Pension Bare?

Shocking 2025 twist: Compulsory retirement could slash your pension to ⅔—yet explode gratuity 42% via secret 50% wage hack! Fixed-term workers snag payouts after JUST 1 year. UPS lifeline or trap? Unmask hidden rules saving (or sinking) millions before deadlines hit. Click for your financial escape!

Clocking 25 loyal years at a government job, only to face compulsory retirement at 50, expecting a cushy pension windfall. What if one hidden rule slashes it to two-thirds, while a 2025 Labour Code bombshell secretly boosts your gratuity by 42% through a “50% wage trick” most HR heads ignore? This isn’t fiction—it’s the under-the-radar reality hitting millions of Indian workers in 2025, amid UPS frenzy and RBI pension tweaks. Uncover the surprises that could make or break your financial freedom before the next policy shift blindsides you.

The Hidden Trigger Behind Compulsory Retirement

Compulsory retirement strikes without warning, often at age 50 or after 20-30 years under rules like FR 56(j) or CCS Pension Rule 40, framed as “public interest” not punishment. No stigma attaches, yet it triggers emotional whiplash—relief from job stress clashes with fears of slashed retirement cash. In 2025, DoPPW clarifications reveal a twist: for penalty cases, competent authorities decide pension/gratuity at ⅔ to full superannuation levels, consulting UPSC if below full. This discretion creates uncertainty, with pensions capped at ₹1.25 lakh monthly and floored at ₹9,000.

Surprisingly, non-penal compulsory retirement (e.g., efficiency reviews) preserves full superannuation benefits if 10+ years served, but penalty versions invoke Rule 44’s reductions. Real-world example: A 2025 Allahabad High Court case upheld retirement at 50 after 12 years, stressing subjective authority without natural justice appeals. For private sector, Labour Code 2020 (effective Nov 21, 2025) mandates gratuity regardless, igniting aspiration for contract workers.

Urgency alert: With UPS opt-in deadlines looming (extended to Nov 30, 2025), missing this could lock you into NPS market risks over assured payouts.

Pension Perils: The 10-Year Cliff and UPS Game-Changer

Cross 10 qualifying years? Secure compulsory retirement pension at 50% of last emoluments (or average), but penalty drops it to authority-decided fractions. Below 10 years? No pension—only service gratuity proportional to superannuation levels. CCS Rule 44(4)(b) ensures this one-time payout, yet many miss it amid shock.

Enter 2025's Unified Pension Scheme (UPS): Opt from NPS for guaranteed 50% average basic+DA (last 12 months) after 25 years, or ₹10,000 minimum post-10 years—with family pension at 60%. Compulsory retirement under UPS? Assured payout slashed to ⅔-full, but gratuity intact under NPS rules. Government ups contribution to 18.5%, battling inflation via Dearness Relief.

Pension Breakdown Table

| Service Years | Standard Superannuation | Compulsory (Penalty) | UPS Twist (2025) |

| <10 | Service Gratuity | Proportional Gratuity | Gratuity only, min ₹10k pension ineligible |

| 10-25 | 50% emoluments | ⅔ to full | 50% assured if opted, reduced on penalty |

| 25+ | Full 50% | ⅔ to full | Guaranteed 50% + lump sum (1/10th pay/6 months) |

Expert insight: DoPPW's Oct 30 OM stresses uniformity, yet private firms lag, risking disputes. Emotional relief: UPS shields against NPS volatility, vital as inflation hits 6%+.

Gratuity Goldmine: 2025's 50% Wage Hack Employers Hide

Gratuity formula stays classic: (15/26) × (Basic+DA) × Years. But Social Security Code 2020 mandates "wages" as min 50% CTC—add back excess allowances! A ₹10L CTC worker (Basic+DA 35%) sees wages jump from ₹29k to ₹42k monthly, gratuity soaring 42% (₹1.69L to ₹2.4L for 10 years). Fixed-term employees? Eligible post-1 year, not 5—huge for IT/contract gigs. Max ₹20L unchanged.

Private sector shock: Applies nationwide from Nov 21, hiking liabilities 25-50%. Example: 1.5-year contract at ₹3L/year yields ₹34k gratuity (rounded up). Tax-free up to ₹20L, but compulsory retirement doesn't forfeit if not misconduct-linked.

Gratuity Impact Table (₹10L CTC, 10 Years)

| Rule | Wages/Month | Payout | Increase |

| Pre-2025 | ₹29,167 | ₹1.69L | - |

| Post-50% Add | ₹41,667 | ₹2.4L | +42% |

Aspiration boost: Restructuring salary now maximizes this—HR must comply for Ind AS 19 valuations, recognizing past service cost immediately.

What are Gratuity Rights for Fixed Term Employees after 2025 Rule Changes

Fixed-term employees (FTEs) in India gained full gratuity parity with permanent workers under the Code on Social Security 2020, effective nationwide from November 21, 2025, slashing eligibility from 5 years to just 1 continuous year of service. This "one-year revolution" covers contracts in IT, manufacturing, and gig sectors, calculating payouts as (15/26) × average "wages" (basic + DA, now min 50% of CTC) × completed years, rounded up for partial years, capped at ₹20 lakh tax-free.

Eligibility Breakthrough

Pre-2025, FTEs needed 5 years or contract renewal to qualify; post-change, any FTE with 240+ days in a year gets gratuity on termination, resignation, or expiry—huge relief for 1.5-year IT contracts amid layoffs. No forfeiture for voluntary exit after 1 year, unlike misconduct cases. Labour Ministry notifications confirm nationwide enforcement, with states aligning by Q1 2026.

Private firms must fund via trusts or self-insure, hiking liabilities 25-40%; public sector follows CCS norms. Example: A 2.5-year ₹6L CTC FTE (wages ₹25k/month post-50% rule) nets ₹36,538 gratuity.

Calculation with 2025 Wage Hack

"Wages" now include 50%+ CTC as basic/DA, boosting payouts 30-50%. Formula remains standard, but max service for computation caps at 26 days/month.

Gratuity for FTEs Table (₹10L CTC, Sample Terms)

| Tenure | Pre-2025 (5-yr Rule) | Post-2025 (1-yr Rule) | Boost from 50% Wages |

| 1.5 Years | ₹0 (ineligible) | ₹1.15L | +38% vs old wages |

| 3 Years | ₹0 (if no renewal) | ₹2.31L | +42% |

| 5 Years | ₹3.46L | ₹4.63L | +34% |

Tax-exempt up to ₹20L; claim within 30 days via employer Form-I.

Claim Process and Pitfalls

- Submit Form F/I to employer within 30 days of exit.

- Employer pays within 30 days; delay attracts 10% simple interest.

- Dispute? Approach Controlling Authority under Sec 45C(1).

- Fintech alert: Use ClearTax/Bajaj calculators for simulations; EPFO integrates for auto-credits by mid-2026.

Urgency: Restructuring CTC now maximizes benefits before audits; non-compliance risks ESIC penalties amid rising gig economy scams.

Tax Traps and RBI/SEBI Relief in 2025

Gratuity: Exempt up to ₹20L under Income Tax Act; excess taxed as income. Pension: Fully taxable, but UPS lump sums may qualify deductions. Compulsory retirement adds urgency—claim Form 10E for relief on premature exit.

RBI's 2025 Master Circular streamlines: Banks pay Dearness Relief sans delays via emails/websites, easing digital life certificates for seniors. SEBI NPS tweaks allow AIS officers OPS switch on disability. Emotional relief: No more bank queues amid rising scams.

Actionable Steps: Secure Your Payout Today

- Step 1: Check service years via EPFO/employer portal—demand Rule 44 audit if nearing 10.

- Step 2: Opt UPS by Nov 30 via NPS portal; simulate pension at proteantech.in.

- Step 3: Request salary restructure (50%+ wages) for gratuity max—use Bajaj/ClearTax calculators.

- Step 4: File life certificate digitally; claim gratuity within 30 days post-exit.

- Money Move: Shift 10% NPS to debt funds for stability; track DR hikes quarterly.

Implement now—inflation erodes 6% yearly, scams spike 30%.

Final Thought

Compulsory retirement unveils a dual-edged sword: pension risks demand vigilance, yet 2025 gratuity reforms and UPS promise unprecedented security for India's 70L+ pensioners. As RBI eyes faster payouts and states roll Labour Codes unevenly, savvy workers restructuring salaries today unlock wealth-building edges. But whisper networks buzz of 2026 NPS-OPS hybrid pilots and AI-driven efficiency retirements—will your portfolio survive the next shock? Don't wait; future-proof now or regret forever.

With over 15 years of experience in Banking, investment banking, personal finance, or financial planning, Dkush has a knack for breaking down complex financial concepts into actionable, easy-to-understand advice. A MBA finance and a lifelong learner, Dkush is committed to helping readers achieve financial independence through smart budgeting, investing, and wealth-building strategies, Follow Dailyfinancial.in for practical tips and a roadmap to financial success!