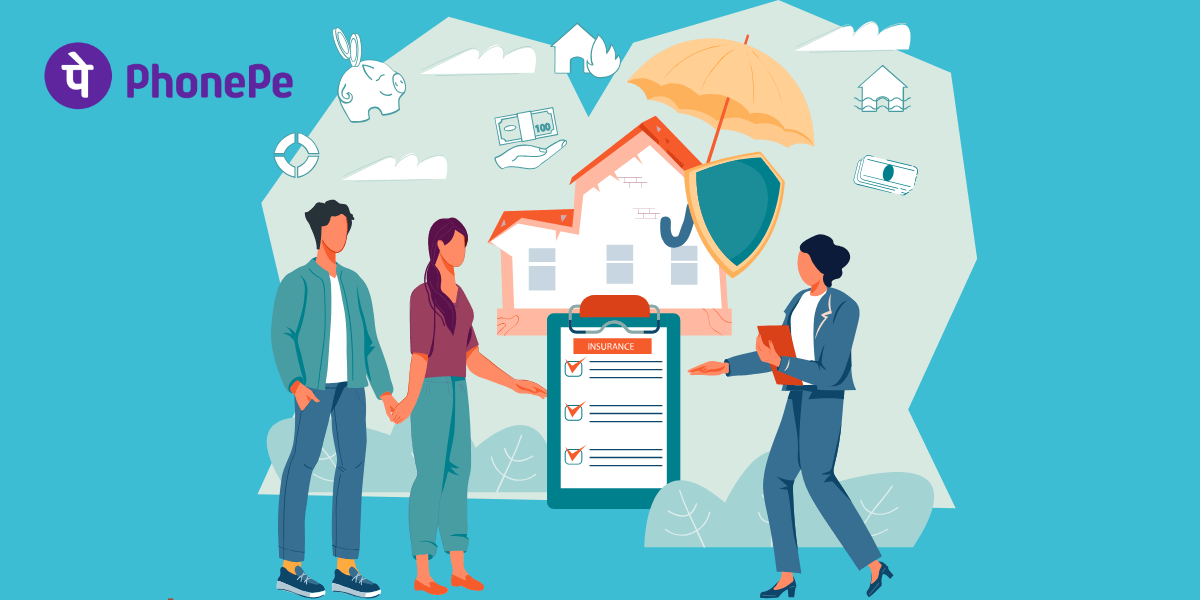

What’s Covered in PhonePe’s ₹181 Home Insurance? 20+ Risks You Didn’t Expect!

Ever wondered how to protect your dream home from floods, theft, or earthquakes in just five minutes? In 2025, PhonePe’s revolutionary home insurance—starting at ₹181/year—offers instant, app-based coverage for urban Indian homeowners. From ₹10 lakh flats to ₹12.5 crore villas, it shields against 20+ risks with no paperwork. Curious how this digital-first solution is transforming lives?

India’s urban landscape is thriving, with millions of new homeowners—young professionals, growing families, and savvy investors—building their futures in bustling cities like Bengaluru, Mumbai, and Hyderabad. Yet, 2025 has brought heightened challenges: unpredictable monsoons flooding apartments, rising urban thefts, and seismic tremors rattling North and North-East India. On August 25, 2025, PhonePe unveiled its revolutionary home insurance product, offering premiums as low as ₹181, a seamless app-based experience, and coverage tailored to the needs of India’s digital-first generation.

Key Takeaways

- Affordable Premiums: PhonePe Home Insurance starts at ₹181/year, making robust coverage accessible.

- Fully Digital: Buy, manage, and claim via the PhonePe app—no paperwork or inspections.

- Comprehensive Protection: Covers structure and contents against 20+ risks, including fire, flood, earthquake, and theft.

- Flexible Options: Sum insured from ₹10 lakh to ₹12.5 crore, customizable for apartments or luxury villas.

- Loan-Friendly: Policy certificates are bank-accepted, ideal for home loan compliance.

Why Indian Urban Homeowners Need PhonePe Home Insurance

The 2025 Urban Reality

India’s cities are growing rapidly, but so are the risks to homeownership. Monsoon floods have inundated apartments in Gurugram and Hyderabad, while suburban areas report increased break-ins. North and North-East India face frequent earthquakes, and banks now mandate insurance for home loans. PhonePe’s home insurance addresses these challenges with a digital-first approach, resonating with millennials and Gen Z who value speed and simplicity.

- Flood Risks: Heavy rains disrupt urban life, damaging homes and belongings.

- Theft Surge: Newly developed suburbs see rising burglary rates.

- Seismic Threats: Tremors in Delhi NCR and North-East demand robust coverage.

- Bank Requirements: Valid insurance is critical for loan approvals.

The Digital Shift in Home Insurance

India’s home insurance market is projected to reach USD 18.07 billion by 2033, growing at a 7.33% CAGR, fueled by urbanization and digital adoption. PhonePe, with its 640+ million users and 48.5% UPI market share, leverages its fintech dominance to make insurance accessible. Unlike traditional plans tied to home loans, PhonePe’s offering is flexible, transparent, and designed for the smartphone era.

Digital-First Features: What Sets PhonePe Apart

Instant Coverage, Zero Paperwork

PhonePe eliminates the hassle of traditional insurance. The entire process—buying, managing, and claiming—is handled within the PhonePe app, trusted by 91% of Indian merchants. Here’s how it works:

- Open the app and input property details.

- Select sum insured and coverage (structure, contents, or both).

- Enter homeowner information in a user-friendly interface.

- Pay via UPI or other methods; receive the policy instantly.

No agents, no physical verification, no delays—perfect for busy urbanites.

Flexible Coverage for Modern Lifestyles

PhonePe offers unmatched customization:

- Sum Insured Range: From ₹10 lakh for compact flats to ₹12.5 crore for luxury homes.

- Modular Plans: Insure only the structure, only contents, or both.

- Add-Ons: Cover high-value items like jewelry, electronics, or heirlooms.

This flexibility suits diverse homeowners, from young professionals in studio apartments to NRIs securing sprawling bungalows.

Next-Gen Risk Coverage

PhonePe’s policies protect against over 20 risks, addressing urban and natural threats:

- Fire, explosions, lightning

- Floods, cyclones, storms, landslides

- Earthquakes

- Riots, strikes, malicious damage

- Burglary and housebreaking

- Impact by vehicles or falling objects

This comprehensive coverage is vital as climate change and urbanization amplify risks in 2025.

How to Buy PhonePe Home Insurance: Step-by-Step Guide

Purchasing home insurance has never been easier. Follow these steps on the PhonePe app:

- Navigate to Insurance: Open the app and select “Insurance” from the main menu.

- Choose Home Insurance: Find “Home Insurance” under “Explore Other Insurances.”

- Enter Property Value: Input the estimated value of your home or contents.

- Select Policy Duration: Choose yearly or multi-year plans for flexibility.

- Provide Details: Enter basic owner and property information (address, type, etc.).

- Customize Coverage: Add contents or specific items like electronics or jewelry.

- Pay and Download: Review the premium, pay via UPI, and download the policy instantly.

The process takes under five minutes, with no need for inspections or physical documents.

Pro Tips for Maximizing Value

To get the most from PhonePe Home Insurance:

- Update Annually: Adjust sum insured to reflect rising property or content values.

- Cover Contents: Include electronics, jewelry, or art for comprehensive protection.

- Choose Multi-Year Plans: Save on premiums compared to annual renewals.

- Check Exclusions: Note risks like war or wear-and-tear, which aren’t covered.

- Save Documents: Download and store policy files digitally and in print for loan or claim needs.

These steps ensure your coverage aligns with your evolving lifestyle.

Common Mistakes to Avoid

Avoid these pitfalls to ensure robust protection:

- Underestimating property value: Undervaluing your house can lead to “underinsurance” during claims.

- Ignoring contents: Many new policies now cover just the structure. Opt for contents coverage—even renters can benefit.

- Not updating after renovations: Adding a modular kitchen, automation, or expensive flooring? Update your policy immediately.

- Failing to renew on time: Lapses can lead to denied claims—set reminders via the PhonePe app.

Being proactive prevents costly gaps in coverage.

Comparison: PhonePe Home Insurance vs. Traditional Plans

| Feature | PhonePe Home Insurance | Traditional Home Insurance |

| Starting Premium | ₹181/year | ₹400–₹1,800/year |

| Purchase Method | 100% app-based, digital | Agent visits, paper forms |

| Sum Insured Range | ₹10 lakh–₹12.5 crore | Rigid slabs, often loan-tied |

| Coverage | Structure + contents, 20+ risks | Often structure only, 12–15 risks |

| Policy Issuance | Instant, paperless | 1–7 days with inspections |

| Claims Support | App-based, digital uploads | Branch, agent, or email-based |

| Bank Acceptance | Yes (with certificate) | Yes, but delayed paperwork |

| Target Customer | Urban, digital-savvy, all ages | Mostly loan-tied customers |

PhonePe’s digital efficiency and flexibility outshine traditional plans, especially for tech-savvy homeowners.

Mobile Experience: Managing Home Insurance in 2025

PhonePe’s app transforms insurance management:

- Policy Dashboard: View, update, or renew policies in one place.

- AI Notifications: Get reminders for renewals and usage insights.

- Digital Claims: File claims for theft, fire, or flood by uploading photos and documents.

- 24/7 Support: Access chatbots or human support for queries or claim tracking.

This mobile-first approach suits India’s always-online homeowners, ensuring no lost policies or missed deadlines.

Who Should Buy PhonePe Home Insurance?

PhonePe’s offering is ideal for:

- First-Time Homebuyers: Simplifies loan compliance with instant certificates.

- Urban Professionals: Busy individuals needing quick, digital solutions.

- NRI Property Owners: Secure Indian assets remotely via the app.

- High-Risk Zones: Homeowners in flood-prone Kerala or earthquake-prone North-East.

- Rental Property Owners: Protect structures and tenant belongings.

Its versatility caters to diverse urban needs.

Is PhonePe Home Insurance Legit and Trustworthy?

PhonePe partners with IRDAI-approved insurers, ensuring reliability. Key points:

- Regulatory Backing: Policies are underwritten by established insurers.

- Bank Acceptance: Certificates are valid for all major banks and NBFCs.

- Transparent Pricing: No hidden fees, with premiums tailored to property value.

With 99% district coverage and 256-bit encryption, PhonePe ensures trust and security.

Indian Home Insurance Trends 2025: Why Digital-First Matters

The home insurance market is evolving rapidly:

- 25% Adoption Surge: Millennials and digital natives drive demand.

- IRDAI Push: New guidelines promote paperless processes for faster claims.

- Fintech Trust: PhonePe’s UPI dominance (48.5% market share) boosts confidence.

- Tech Integration: AI and IoT enable personalized policies and risk assessment.

Digital platforms like PhonePe are reshaping insurance for India’s urban future.

Final Thought: Secure Your Dreams—The Modern Indian Way

A secure home is the foundation for big dreams—whether buying that first apartment in Mumbai or securing a family bungalow in Chennai. PhonePe Home Insurance, with its transparent pricing, broad risk coverage, and effortless app management, makes comprehensive protection not just a privilege, but an everyday right for Indian families in 2025. The best time to buy robust coverage is before disaster strikes. A few taps on a familiar app—peace of mind for years.

Ready to protect your home with PhonePe’s digital-first insurance in minutes? Open the app, explore custom options, and get started today—because your future deserves security built for a smarter India.