“Wondering when young professionals should start contributing to family expenses in India? Learn ideal contribution percentages, balancing personal finance & family needs, tax benefits, and real-life case studies. Expert tips for smart budgeting & long-term wealth.”

Young professionals in India are navigating a unique blend of modern career aspirations and traditional family values. One question that often arises is: When should young professionals start contributing to family expenses? This decision is influenced by a mix of financial independence, cultural expectations, and personal circumstances. With India’s evolving economic landscape and shifting societal norms, this topic is more relevant than ever in 2025. In this blog post, we’ll explore the ideal time for young professionals to start contributing to family expenses, backed by the latest data, practical insights, and actionable advice.

The Indian Context: Balancing Tradition and Modernity

India is a land where family ties run deep. According to a 2023 Pew Research survey, 85% of Indians believe that supporting family financially is a moral obligation, a value deeply rooted in the joint family system. However, the rise of nuclear families and urban lifestyles has shifted this dynamic. The Economic Survey of India 2024-25 highlights that 63% of Indian households now live in nuclear setups, compared to 52% a decade ago. This shift means young professionals often face dual pressures: achieving financial independence while contributing to family expenses.

For many, the question isn’t just if they should contribute, but when. Should it be right after landing their first job? Or should they wait until they’ve built some savings? Let’s dive into the factors that can guide this decision.

Key Factors Influencing When to Start Contributing

1. Age and Career Stage

The age at which young professionals start earning in India varies widely. A 2024 report by LinkedIn India shows that the average age for securing a first job is 23-25 for graduates, while it’s 21-23 for those entering the workforce via vocational training or freelancing. For instance:

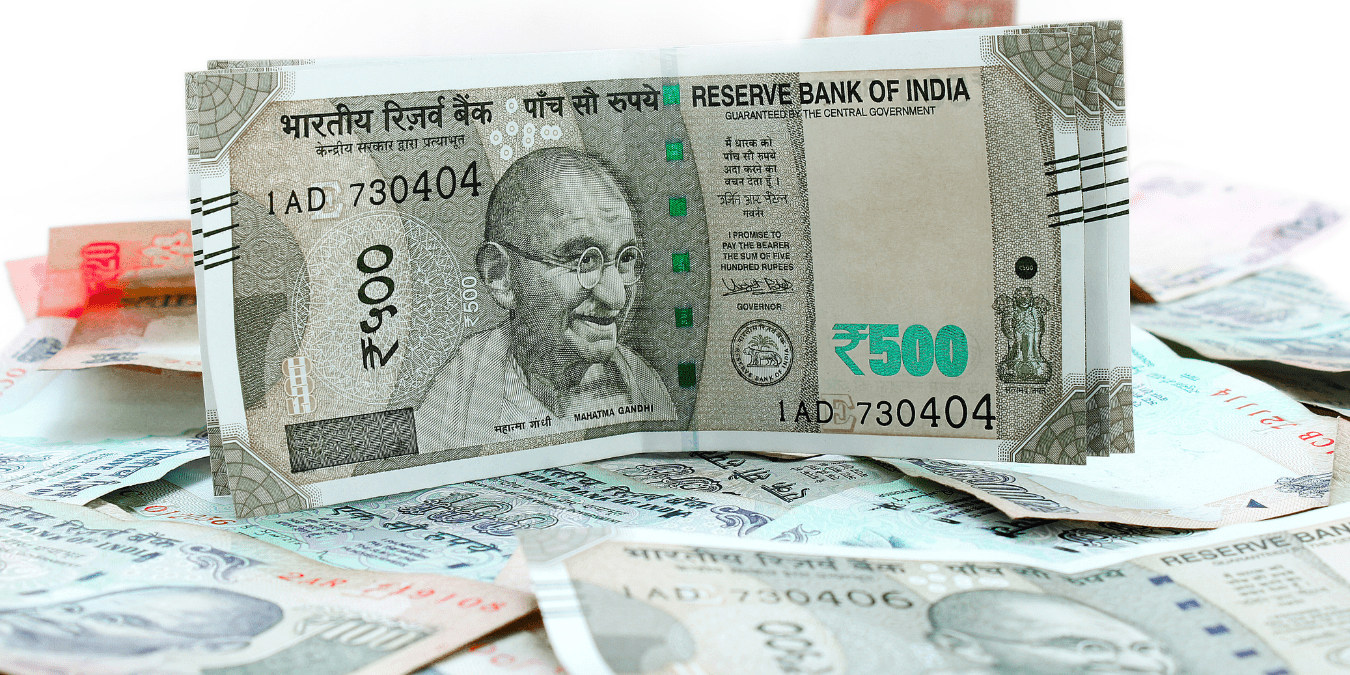

- Entry-Level Professionals (0-2 Years Experience): Earning an average salary of ₹3-6 lakhs per annum (NASSCOM 2024), they often struggle to balance rent, student loans, and personal expenses in metro cities like Mumbai or Bengaluru.

- Mid-Level Professionals (3-5 Years Experience): With salaries ranging from ₹8-15 lakhs, they’re better positioned to contribute after stabilizing their finances.

Insight: Most financial advisors suggest waiting until at least 6-12 months into your first job to assess your income stability before contributing to family expenses.

2. Income Levels and Cost of Living

India’s cost of living has surged, especially in urban areas. Per the Mercer Cost of Living Survey 2024, Mumbai ranks as the 52nd most expensive city globally, followed by Delhi at 74th. For a young professional earning ₹30,000 monthly in Mumbai:

- Rent: ₹15,000

- Food and Transport: ₹8,000

- Miscellaneous: ₹5,000

This leaves little room for savings or family support. Conversely, in Tier-2 cities like Jaipur or Coimbatore, where living costs are 30-40% lower (Numbeo 2025), contributions become feasible sooner.

3. Family Financial Situation

The urgency to contribute often depends on your family’s needs. A 2024 Reserve Bank of India (RBI) report notes that 42% of Indian households rely on multiple income sources due to rising inflation (6.1% in 2024). If your family faces:

- Medical emergencies

- Educational expenses for siblings

- Debt repayment

You might need to step in earlier. Conversely, if your family is financially secure, you can delay contributing until you’re on solid ground.

4. Cultural Expectations

In India, filial duty is a powerful motivator. A 2023 YouGov India poll found that 67% of parents expect financial support from children once they start earning. However, this varies by region:

- Northern India: Strong emphasis on supporting parents early.

- Southern India: More focus on children achieving independence first.

Understanding these expectations can help you time your contributions effectively.

The Right Time: A Data-Driven Approach

Based on the latest data and expert opinions, here’s a practical timeline for young professionals in India to start contributing to family expenses:

Phase 1: First 6-12 Months of Employment

- Focus: Build an emergency fund (3-6 months of expenses) and clear high-interest debts like education loans.

- Data Point: A 2024 Groww Survey found that 58% of young professionals save less than 10% of their income in the first year due to high living costs.

- Action: Avoid large family contributions yet—limit support to small, occasional help (e.g., ₹2,000-5,000 monthly).

Phase 2: 1-3 Years into Career

- Focus: Stabilize finances, increase savings (20-30% of income), and start small contributions.

- Data Point: The National Sample Survey Office (NSSO) 2024 reports that professionals aged 25-30 contribute an average of ₹10,000 monthly to family expenses.

- Action: Allocate 10-15% of your income to family support, like covering utility bills or sibling education costs.

Phase 3: 3+ Years into Career

- Focus: Scale up contributions as income grows and personal goals (e.g., buying a house) are met.

- Data Point: A 2025 Indeed India study shows that professionals with 3-5 years of experience earn 40% more than entry-level peers, enabling larger contributions (₹20,000-50,000 monthly).

- Action: Take on significant expenses like parental healthcare or home loan EMIs.

Financial Planning Tips for Young Professionals

Contributing to family expenses doesn’t mean compromising your financial future. Here’s how to strike a balance:

1. Budgeting is Key

Use the 50/30/20 rule:

- 50% for necessities (rent, food)

- 30% for wants (entertainment, travel)

- 20% for savings and family contributions

Apps like Wallet or Moneycontrol can help track expenses in real-time.

2. Build an Emergency Fund First

Financial planner Nithin Sasikumar advises, “Save at least ₹1-2 lakhs before committing to regular family support.” This ensures you’re not stretched thin during unexpected crises.

3. Communicate with Family

A 2024 Times of India survey found that 72% of young professionals feel pressured to contribute more than they can afford. Openly discuss your financial limits with family to set realistic expectations.

4. Leverage Tax Benefits

Contributions to parents’ medical expenses or education can qualify for tax deductions under Section 80D and 80C of the Income Tax Act. Consult a CA to maximize savings.

The Economic Impact of Contributing Early

Young professionals contributing to family expenses have a ripple effect on India’s economy. The RBI 2024 Annual Report estimates that household consumption, bolstered by such contributions, accounts for 60% of India’s GDP. By supporting families early, you’re not just fulfilling a duty—you’re fueling economic growth.

However, starting too soon can strain your finances. A 2025 Mint analysis warns that 35% of professionals under 30 who contribute over 20% of their income delay major milestones like homeownership by 5-7 years.

Expert Opinions

- Dr. Radhika Gupta, CEO, Edelweiss Mutual Fund: “Young professionals should prioritize financial independence first. Contributing to family is noble, but not at the cost of your future.”

- Anand Kulkarni, Financial Advisor: “Start small—5-10% of your income—and scale up as your earnings grow. It’s about sustainability.”

Finding Your Sweet Spot

So, when should young professionals in India start contributing to family expenses? There’s no one-size-fits-all answer, but the sweet spot lies between 1-3 years into your career—after you’ve built a financial cushion and assessed your family’s needs. By planning smartly, communicating openly, and leveraging tools like budgeting apps, you can honor your family responsibilities without derailing your dreams.

-

Senior Citizens Are Getting Up to ₹50,000 Extra Tax Deduction on Savings Interest — Are You Claiming Yours?

-

The Hidden Tier System in Bank Savings Accounts That Rewards Rich Depositors And Hurts Everyone Else

-

DICGC Insurance, Monthly Compounding, and High Interest: The 3 Things You Must Check Before Opening a Savings Account

-

Which Angel Investing Firms Give Indian Startups More Than Just Money — and Why That Matters

With over 15 years of experience in Banking, investment banking, personal finance, or financial planning, Dkush has a knack for breaking down complex financial concepts into actionable, easy-to-understand advice. A MBA finance and a lifelong learner, Dkush is committed to helping readers achieve financial independence through smart budgeting, investing, and wealth-building strategies, Follow Dailyfinancial.in for practical tips and a roadmap to financial success!