From zero-balance accounts to ₹1 crore insurance, women’s savings accounts are shaping India trends 2025. With 200 million women in digital payments, join the financial revolution India 2025 with top bank accounts for women in India 2025.

In a stunning transformation that’s rewriting India’s economic narrative, women are no longer passive participants in the financial ecosystem—they’re becoming the driving force. As of 2025, women own 39.2% of all bank accounts in India, with rural areas witnessing an even more remarkable participation rate of 42.2%. But here’s the twist that nobody saw coming: the most powerful tool in this revolution isn’t just any savings account—it’s the specialized women’s savings accounts that are breaking barriers and creating millionaires

The Million-Rupee Question: Why Traditional Savings Aren’t Enough

Priya from Pune opens a regular savings account, earning a measly 2.5% interest. Meanwhile, her colleague Kavya chooses a women’s savings account and earns up to 7.00% interest while enjoying exclusive benefits worth thousands of rupees annually. The difference? Kavya understood what 83% of women entrepreneurs have discovered—specialized banking products can accelerate wealth creation by 300%.

The numbers don’t lie. Between 2019 and 2024, women seeking credit grew 3X, and 68% of MUDRA loans worth ₹34.11 lakh crore went to women entrepreneurs. This isn’t just financial inclusion—it’s a financial revolution.

This account has revolutionized women’s banking with monthly interest credits instead of quarterly payments, effectively boosting your returns by compounding more frequently. The zero-fee banking philosophy means no charges on most services, while the complimentary air accident cover provides security worth lakhs.

Exclusive Perks:

- Monthly interest crediting maximizes compound growth

- Zero charges on fund transfers, cheque issuance

- Free doctor consultations and discounted medicines

- Enhanced debit card limits for modern lifestyle needs

Standout Features:

- Progressive interest rates up to 7.50%

- Dedicated women’s helpdesk for personalized service

- Premium debit card with enhanced limits

- Relationship manager for high-balance accounts

Technology-Driven Benefits:

- ₹750 monthly cashback on lifestyle spends

- Unlimited free ATM access across all banks

- Auto-sweep facility for optimized returns

- 50% discount on first-year locker rentals

HDFC’s MoneyMaximizer facility automatically sweeps excess funds into higher-yield investments. The EasyShop Woman’s Advantage Debit Card offers up to ₹1 cashback per ₹200 spent, while the ₹10 lakh accidental death cover provides comprehensive protection.

Elite Features:

- ₹10 lakh insurance cover with hospitalization benefits

- MoneyMaximizer auto-sweep facility

- Preferential loan rates across all products

- 90% auto loan financing with 7-year tenure options

Axis Bank’s ARISE account comes with a complimentary Demat account worth ₹3,000, opening doors to stock market investments. The women-expert helpdesk provides investment guidance, while Smallcase offers unlimited investment options in curated stock baskets.

Investment-Focused Advantages:

- Free Demat account with no AMC for first year

- Women-expert investment guidance through dedicated helpdesks

- Unlimited investment options via Smallcase integration

- 15% pharmacy discounts and healthcare benefits

The Hidden Goldmine: Lesser-Known Accounts with Extraordinary Benefits

- Federal Bank Mahila Mitra Plus: The Family Empowerment Account

Special Feature: ₹80.75 Lakh Insurance Cover

Federal Bank offers the highest insurance coverage in the market with their Mahila Mitra Plus account. The 0.60% discount on home loan rates can save lakhs over the loan tenure, while two free zero-balance kids’ accounts promote multi-generational financial planning.

- Bank of India Nari Shakti: The Zero-Balance Wonder

Revolutionary Feature: Absolutely No Minimum Balance

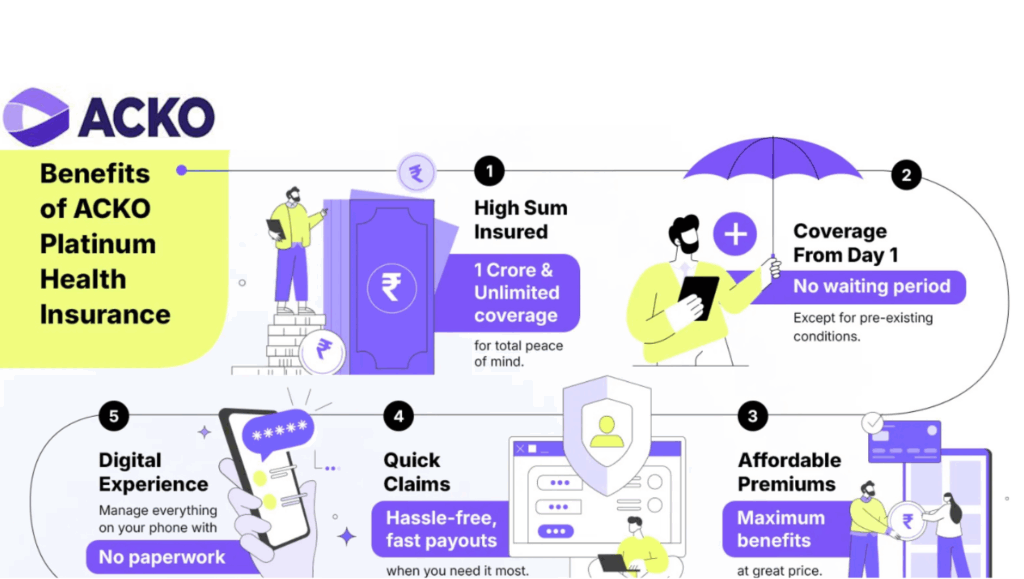

This account breaks the traditional banking mold with zero balance requirements while offering tiered benefits that scale with your relationship value. The ₹1 crore insurance cover at the Platinum tier makes it the most protective account available.

- IndusInd Bank Indus Diva: The Lifestyle Champion

Signature Benefit: ₹1,000 Welcome Voucher

Indus Diva welcomes new customers with immediate value while providing a Visa Platinum Plus debit card with ₹1.25 lakh withdrawal limit and ₹2 lakh POS limit. The cross-currency markup of just 2% makes it ideal for international travelers.

The Science Behind Smart Account Selection: Decoding the Perfect Match

The Earnings Optimizer Strategy

For Balance Below ₹1 Lakh: Choose accounts with flat high-interest rates like IDFC FIRST Bank (7.00%) or RBL Bank (3.00% base rate).

For Balance ₹1-10 Lakh: Opt for tiered rate structures like RBL Bank (up to 6.00%) or Bandhan Bank Avni (up to 6.00%).

For Balance Above ₹10 Lakh: Select premium relationship accounts with wealth management services and preferential rates.

The Digital Advantage Calculator

Monthly Digital Transactions: ICICI’s ₹750 monthly cashback equals ₹9,000 annually—equivalent to earning 4.5% additional interest on a ₹2 lakh balance.

Insurance Value Maximization: HDFC’s ₹10 lakh accidental cover replaces standalone policies costing ₹3,000-5,000 annually.

The Security and Insurance Shield

Multi-Layer Protection Framework

Tier 1: Basic Protection – All accounts include personal accident coverage ranging from ₹2-10 lakhs.

Tier 2: Enhanced Security – Premium accounts add air travel coverage, hospital cash benefits, and purchase protection.

Tier 3: Comprehensive Coverage – Top-tier accounts like Federal Bank Mahila Mitra Plus provide ₹80.75 lakh comprehensive insurance covering multiple scenarios.

The Global Mobility Features

International Banking Readiness

Multi-currency accounts, forex card integration, and international wire transfer facilities cater to India’s increasingly global female workforce. ICICI’s and HDFC’s international partnerships provide seamless overseas banking.

NRI Family Connection

Family banking features allow overseas family members to contribute to accounts, supporting education funding and property purchases across borders.

The Small Business Ecosystem

MSME Integration Benefits

Banks are offering current account linkages, payment gateway integration, and business loan pre-approvals to women’s savings account holders. With 40% of UDYAM-registered MSMEs being women-owned, this integration is revolutionary.

UPI and Digital Payments Leadership

200 million women are ready to adopt digital payments, and women’s savings accounts are becoming the gateway to digital commerce with QR code generation, payment link creation, and e-commerce integration.

The Community and Network Effect

Financial Literacy Integration

Banks are creating women-only investment clubs, financial planning workshops, and peer learning networks. The community-driven approach is building confidence and investment acumen among female account holders.

Mentorship and Advisory Services

Dedicated relationship managers, women financial advisors, and investment committees provide personalized guidance that goes beyond traditional banking.

The Verdict: Your Action Plan for 2025

Immediate Action Steps:

- Assess Your Current Account: Calculate the opportunity cost of staying with basic savings accounts

- Match Your Profile: Use our comparison framework to identify your ideal account type

- Leverage Transfer Benefits: Most banks offer account transfer bonuses and relationship incentives

- Maximize Initial Benefits: New account opening bonuses can provide immediate returns of ₹1,000-5,000

Long-term Wealth Strategy:

- Automate Wealth Building: Set up auto-sweep facilities and SIP investments

- Insurance Integration: Replace standalone policies with account-linked coverage

- Tax Planning: Coordinate investment products for maximum tax efficiency

- Regular Reviews: Annual account performance reviews ensure optimal benefit utilization

The Revolutionary Impact: Beyond Banking

The women’s savings account revolution extends far beyond interest rates and benefits. It represents a fundamental shift toward financial equality, economic empowerment, and generational wealth creation. As women’s participation in credit origination grows 22% annually and female entrepreneurship surges, these specialized accounts are becoming the foundation of India’s economic transformation.

The choice is clear: In 2025, settling for ordinary banking isn’t just costly—it’s economically irresponsible. The women’s savings account revolution has arrived, offering unprecedented opportunities for wealth creation, lifestyle enhancement, and financial security.

The question isn’t whether you can afford to open a specialized women’s savings account—it’s whether you can afford not to. Your financial future starts with a single decision, and that decision could be worth millions over your lifetime.

Take action today. The financial revolution is waiting, and your economic empowerment begins now.