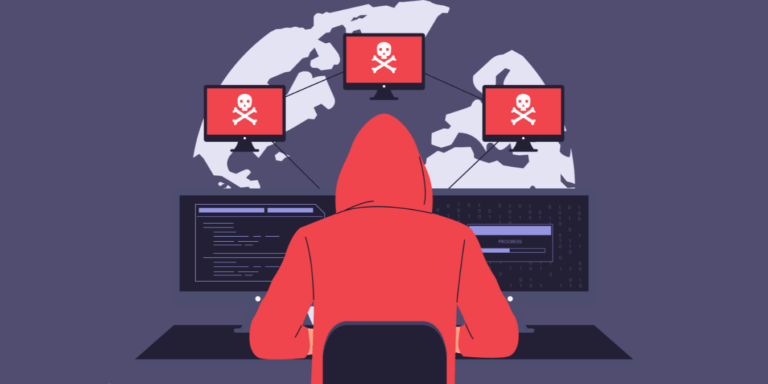

The Secret Promise That Fooled 100+ Investors in Sambhal — and Dragged Javed Habib Into Legal Chaos

A glamorous promise, a vanished company, and 32 FIRs shaking Uttar Pradesh! In 2025, a crypto scheme linked to celebrity hairstylist Javed Habib leaves investors shattered. Who truly ran the “smart returns” trap? The untold truth behind India’s most unexpected fraud will leave you questioning every glittering guarantee.

In Uttar Pradesh’s Sambhal district, a story is unfolding that sounds straight out of a thriller — a mix of celebrity branding, high-return promises, and shattered dreams. Nearly a hundred people have lost their hard-earned money, and at the center of this storm is none other than India’s celebrated hairstylist, Javed Habib — a man once synonymous with success and style, now caught in a web of shocking allegations of financial fraud.

The Shocking Turn: From Hair to Cryptocurrency

For decades, Javed Habib represented aspiration. His salons dotted every major Indian city — a mark of modern grooming and an urban dream. But in 2025, his brand name became part of an unexpected scandal. Reports from Sambhal police indicate that over 32 FIRs have been registered against Habib, his son Anos Habib, and an associate Saifullah, for allegedly duping hundreds of investors in a multi-crore cryptocurrency fraud.

Police estimate the fraud at around ₹5–7 crore, with victims investing between ₹5 lakh and ₹7 lakh each. The accused reportedly used the name Follicle Global Company (FLC) to promote a supposed Bitcoin-based investment offering returns up to 70%. The irony? The glamour of celebrity branding made even cautious investors drop their guard.

How the “Smart” Scam Operated

At the heart of the fraud lies a formula that’s become all too familiar in small towns — faith in celebrity names mixed with promises of “smart, quick money.”

- The Setup: FLC organized so-called “seminars” across Sambhal, including one at the Royal Palace Venkat Hall in 2023. Locals were showcased glossy presentations and social media clips linking Javed Habib’s image with the company.

- The Pitch: Attendees were told they could multiply their money through Bitcoin and Binance Coin investments, with projected monthly returns of ₹35,000 and full repayment in three months.

- The Trap: Dozens fell for the bait. Young professionals, small business owners, and even women saving for weddings invested — hoping to ride India’s crypto wave.

- The Crash: Two and a half years later, no one received a single rupee of return. Complaints snowballed into police reports, and soon, 32 FIRs were filed.

Why Javed Habib’s Name Matters

Celebrities often lend credibility — intentionally or unintentionally — to financial ventures. In this case, what started as alleged branding support turned into chaos when investors believed Habib’s presence equaled safety. Some attendees even recounted that the hairstylist himself was present at the events, while others suggest his brand was merely “used” by organizers.

Media reports confirm that Habib’s lawyer, Pawan Kumar, has denied any direct link between his client and FLC. He contends that Habib had “no operational role” in the company and that his name was exploited without consent.

32 FIRs and a Hunt Across States

The Sambhal Police, under Superintendent Krishan Bishnoi, has taken strong action. Lookout notices have been issued for Javed Habib, his son, and other associates to prevent them from leaving India. When officers visited his Delhi residence on October 15, 2025, Habib was not present.

Authorities are also scrutinizing bank accounts and properties linked to the accused. With over 150 confirmed victims and claims that the scam could cross ₹10 crore, this has become one of Uttar Pradesh’s most high-profile white-collar cases in recent years.

Victims Speak: Broken Trust, Lost Dreams

Several victims have come forward, narrating stories of financial desperation and emotional betrayal.

- Mohd Hilal, an AC mechanic, invested ₹4.59 lakh, believing he’d doubled his return within months. Instead, Saifullah, one of the promoters, vanished.

- Albina, a young woman saving for her wedding, told the BBC that she had invested her life savings in the scheme — “because it had Javed Habib’s name attached”.

- Some investors were even encouraged to mortgage jewellery, convinced by local agents that “a celebrity-backed crypto” was the safest future.

A Hair Icon’s Fall From Grace

The case has stunned India’s business and fashion circles. Javed Habib’s name has long been associated with entrepreneurship and style education. His multiple franchises, training academies, and motivational brand image made him a household name.

But as the October storm unfolds, he finds himself under legal siege, fighting to defend his legacy. His lawyer maintains that Habib’s health and his father’s recent death have delayed his cooperation with the police, but insists “he will appear soon”.

The Crypto Hype Trap

This scandal exposes a deeper issue — India’s ongoing “crypto craze” and how it’s being cleverly exploited in tier-2 and tier-3 cities. The mix of crypto buzzwords, celebrity faces, and unrealistic returns forms a potent lure.

Many investors were told that FLC had “tie-ups” with major blockchain firms, making it seem authentic. India’s lack of widespread crypto literacy in rural areas turned curiosity into vulnerability. The Sambhal fraud is a mirror to how small-town investors are getting trapped in fake digital dreams.

How Police Pieced It Together

Investigators claim that the fraud’s digital paper trail has been difficult to trace due to the use of crypto wallets and peer-to-peer transfers. However, they were able to link money trails, transaction screenshots, and witness statements, leading to multiple arrests and expanding the case’s reach beyond Uttar Pradesh.

The police have stated that the scam followed an MLM-style structure, where early “investors” were paid small returns using the funds of newer entrants — until the cycle collapsed.

The Hidden Lesson: Don’t Chase “Guaranteed” Returns

While the numbers are shocking, the underlying psychology is not new. Financial experts say scams like these thrive on one factor — trust disguised as opportunity.

Here’s what the Sambhal case teaches every Indian investor:

- No celebrity guarantee: A famous face does not equal financial safety.

- Avoid “fixed” high-returns in crypto: Bitcoin and Binance are volatile markets, not profit machines.

- Do due diligence: Always check SEBI or RBI registration before investing.

- Don’t invest emotionally: Emotional trust is the scammer’s most powerful tool.

Current Status (as of October 2025)

- Total FIRs: 32 across Sambhal district

- Names Mentioned: Javed Habib, his son Anos Habib, associate Saifullah

- Company Involved: Follicle Global Company (FLC)

- Estimated Fraud: ₹5–7 crore

- Victims identified: 150+ and rising

- Legal Proceedings: Lookout notice issued; non-appearance recorded; further investigation underway.

Interestingly, some reports suggest that Habib’s team has now begun returning partial amounts to a few investors, possibly in a bid to settle and de-escalate the legal tangle.

Bollywood, Branding, and Blind Faith

The incident raises a broader social question — are Indian audiences too quick to equate fame with trust?

From crypto influencers to stock advisors, many have learned to leverage fame as financial credibility. Habib’s case isn’t just a “scam story”; it’s a commentary on India’s cultural shift, where social proof trumps substance.

The “celebrity guarantee” mindset needs rethinking — because not every famous face knows what your money deserves.

What Comes Next?

Sambhal police say more names could surface as the probe widens. Investigations into property purchases, foreign transfers, and crypto wallets associated with the company are ongoing.

Legal experts predict that if proven, this could become a landmark cybercrime case for India’s crypto regulation framework — one that may push for stronger investor protections in 2026.

Key Takeaways

- Trust no scheme promising guaranteed returns above 15–20%.

- Always verify financial entities with SEBI, RBI, or MCA databases.

- Crypto investments should be done only through licensed, KYC-compliant exchanges.

- Beware of influencers or celebrities promising “hidden” or “quick” wealth.

Final Thought

What happens when fame meets finance without filters? The Javed Habib case is a chilling reminder that India’s celebrity culture, digital dreams, and rising middle-class ambitions can create the perfect storm for scams. In Sambhal, hope turned to heartbreak — proving that even a familiar face can become a stranger when money is involved. As police tighten their grip and more victims step forward, the story is far from over. Whether Habib is proven guilty or victimized by misused branding, one truth stands out: in the “smart investment” era, the biggest risk isn’t losing money — it’s losing the ability to question glittering promises. And that’s a lesson the rest of India needs to learn, fast.