The Robo-Advisor Revolution 2025: The Secret Strategy Helping Indians Beat Traditional Investing—But Will You Miss Out?

What if the investing edge in 2025 isn’t who you know, or even what you know—but a complex code running quietly on millions of smartphones across India? And what if a shockingly simple tweak could double your returns compared to the average saver—yet 90% of investors don’t even know it exists?

Before we reveal the one thing separating India’s ‘new rich’ from the crowd, let’s lift the curtain on the hidden world of robo-advisors—and why this stealthy technology is already reshaping middle-class dreams, startup ambitions, and even regulatory policies in India. Are you ready for what’s coming next?

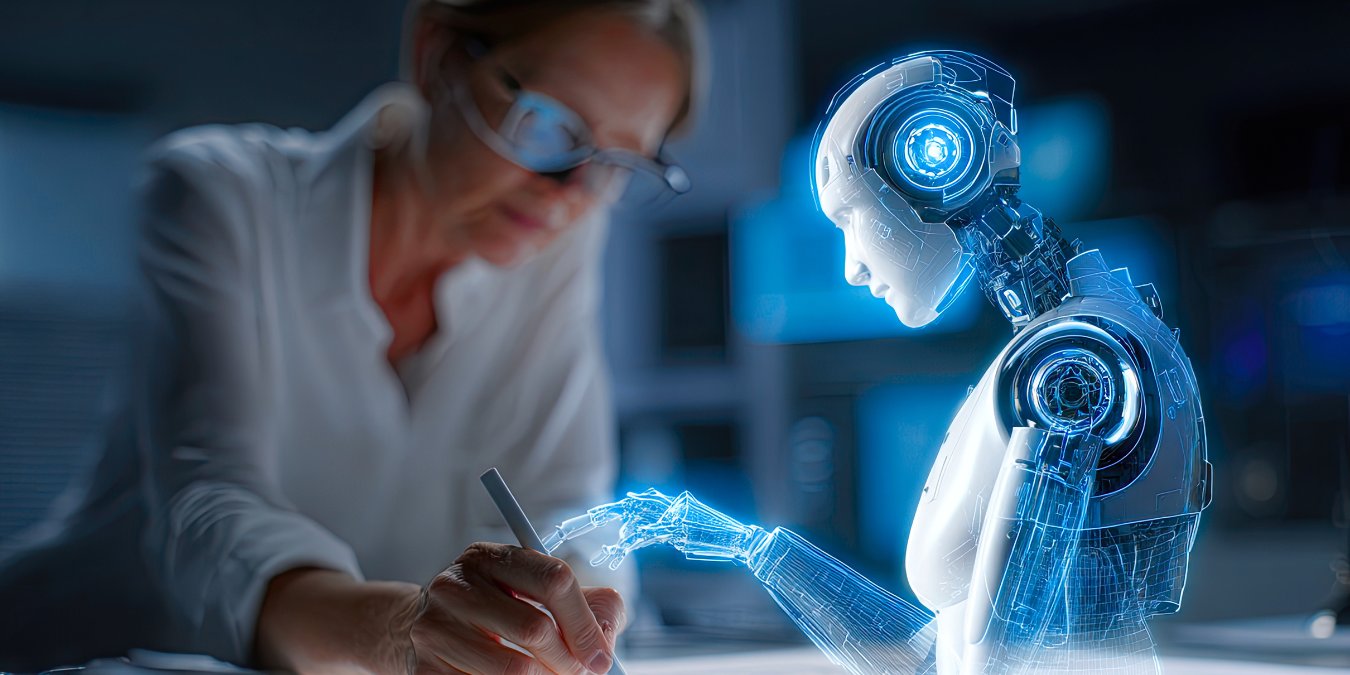

What Are Robo-Advisors, and Why Should You Care Right Now?

Robo-advisors are automated, AI-driven investment platforms that offer financial advice and portfolio management with minimal human intervention. Picture a digital “super-analyst” working 24/7 to grow your money, powered by sophisticated algorithms and the latest in behavioral finance research.

Why this matters for you in 2025:

- India’s wealth-tech user base has skyrocketed, jumping from 4 million in FY20 to a projected 12 million+ by the end of 2025.

- Assets managed by robo-advisors in India are set to reach an unprecedented $22.5 billion in 2025, up over 40% annually!

- Driven by skyrocketing smartphone penetration, rising financial literacy, and fierce competition among robo-advisors, access to investment advice is now more “democratic” than ever—yet surprisingly few are using these tools to their full potential.

Hidden Features Every Indian Investor Is Missing

While most users see robo-advisors as a “set-and-forget” solution for mutual funds or ETFs, the real power lies below the surface:

1. Automatic, “Emotional-Free” Rebalancing

- Robo-advisors don’t panic at headlines. When your portfolio drifts (like stocks becoming too heavy), algorithms calmly restore your balance, locking in gains and minimizing risk—all without emotional bias.

- Actionable takeaway: This feature alone helped Indian investors see steady returns even during 2023–2024’s choppy markets.

2. Tax-Loss Harvesting—The Wealth Accelerator

- Top robo-advisors automatically sell losing investments to offset gains, cutting your tax bill and boosting net returns.

- In the U.S. and now in India (post-2024 Budget move on digital assets), this trick is adding up to 1–2% in after-tax alpha for savvy users.

3. Personalization at Scale (AI-Driven, Not “One-Size-Fits-All”)

- Robo-advisors now use machine learning to tailor portfolios for goals—new home, children’s education, or startup capital.

- Some platforms dynamically adjust allocations if macro conditions (like RBI rate shifts or new fintech policies) change.

4. Hybrid Models—Human Advice PLUS AI Precision

- New “hybrid” robo-advisors offer optional video chats with human experts—for complex queries or emotional support.

- Surprise: Such platforms are now the most trusted among first-time investors and NRIs sending money home.

Why Are Indians Flocking to Robo-Advisors in 2025? The Real Drivers Explored

1. A Massive Aspirational Push

With a burgeoning middle class, urbanization, and social media–fuelled investing FOMO, more Indians want to “make money work for them,” not just save it.

2. Time Poverty + Tech Convenience

Younger investors (ages 22–40) value convenience, transparency, and “auto-pilot” wealth building over face-to-face advice or paperwork-heavy banks.

3. Trust in Science, Not Rumors

Post-pandemic, and with rising scams/mis-selling in traditional markets, algorithm-driven transparency wins trust—especially with digital natives.

4. Aggressive Price Wars

Some robo-advisors now offer zero account minimums, flat annual fees (as low as 0.10%–0.25%), and free “starter” periods—making them accessible to all, not just HNIs.

| Traditional Advisor | Classic DIY Investing | Robo-Advisor 2025 | |

| Minimum investment | ₹1 lakh+ | Any | As low as ₹100 |

| Annual costs | 1–2.5% | 0–1% | 0.10–0.50% |

| Tax optimization | Manual | Manual | Automatic |

| Emotional bias | Unavoidable | High | Eliminated |

| Goal personalization | Variable | Manual | Full AI-driven |

| 24/7 access | No | Partial | Yes (App/Web) |

| Regulation | High | Med | Improving (RBI/SEBI) |

Unveiling Little-Known Robo-Advisor Features That Can Supercharge Your Portfolio

1. ESG (Ethical Investing) Customization

- The most advanced robo-advisors now offer tailored “ESG” portfolios, letting investors align money with their social values—a hot trend among Gen Z and women investors.

2. Retirement Drawdown Plans

- Not just “accumulation”—robo-advisors can now simulate safest withdrawal rates for retirees, helping prevent outliving your savings.

3. Regulatory Safety Nets

- New RBI and SEBI rules (2024 onwards) require platforms to disclose algorithms transparently, enforce data encryption, and protect investor interests, making robo-investing as secure as major banks.

Compare Robo Advisors with Traditional Financial Advisors

Here’s a clear comparison between robo-advisors and traditional financial advisors, tailored for today’s Indian investors:

| Feature/Aspect | Robo-Advisors | Traditional Financial Advisors |

| Cost/Fees | Lower (0.10%–0.50% of AUM annually) | Higher (~1%–2.5% of AUM, some charge extra) |

| Minimum Investment | Low/None (₹100 or less on some platforms) | Higher (Often ₹1 lakh or above) |

| Accessibility | 24/7 via app or web, instant onboarding | By appointment, limited hours |

| Personalization | Algorithms offer goal-based portfolios | Deeply tailored, considers full life context |

| Human Touch/Support | Minimal, some hybrid offer chat/video advice | Full human interaction, emotional guidance |

| Scope of Services | Primarily investment management, tax features | Investment, tax, insurance, estate, retirement |

| Rebalancing & Automation | Automatic, unemotional, regular | Manual or periodic, sometimes delayed |

| Emotional Bias | Neutral, algorithm-driven | Possible human bias, emotional influence |

| Transparency | Instant reports, easy fee structure | Detailed explanations, may be less transparent |

| Complex Needs | Limited, not ideal for complex situations | Ideal for complex, multi-layered planning |

| Regulatory Status | Improving, RBI/SEBI oversight | Established, regulated |

| Risk/Errors | Tech glitches, algorithmic errors, cyber risk | Human fallibility, mis-selling |

| Best for | Beginners, DIY investors, tech-savvy, cost-sensitive | Wealthy/older individuals, complex needs, human preference |

How to Choose the Best Robo-Advisor in India Right Now (2025 Edition)

To cut through the noise, here’s a step-by-step formula you can use today:

- Define Your Goal: Growth, steady income, or tax-saving?

- Compare Costs: Look for annual fees under 0.25%. Avoid platforms with “hidden” transaction/exit charges.

- Check the Fine Print: Is there an “ad-hoc” human support option? Are there dynamic rebalancing or auto tax-harvesting features?

- Mobile Experience: Top apps provide actionable insights, notifications, and 1-click rebalances—optimized for Indian UX patterns.

- Regulatory Status: Ensure SEBI/RBI compliance. Prefer platforms with full client-data encryption and clear complaint redressal.

Actionable Takeaways (What Should YOU Do Today?)

- Don’t Just “Set and Forget”: Log in quarterly, check for new features, and update your goals as life priorities shift.

- Activate all “auto” features: Turn on tax-loss harvesting, rebalancing, and goal-targeting wherever possible.

- Start with small amounts: Even ₹100 can get you going on most platforms—test the UI, track results, and scale up with confidence.

- Ask for hybrid support: As regulations unlock more “human+AI” models, demand both worlds—AI efficiency and expert backup in one service.

- Watch for policy changes: Budget 2026 and upcoming Fintech Sandbox pilots may unlock even more personalized, low-cost advisory.

What’s Next? The Future Few Are Expecting (But You Should)

Here’s the real teaser: Behind closed doors, India’s largest robo-advisors are now piloting “hyper-personalized” AI—think algorithms that not only track your portfolio, but anticipate your spending habits, nudge you at the right time, and help you optimize taxes based on upcoming life events or new government schemes.

Will you be among the first to ride this new financial wave? Or will another year go by with your money working quietly—for someone else?