The 25 bps Rate Cut: Why Your Wallet and the Economy is About to Feel Different

The 5.25% rate cut hides a shocking secret: money is actually tighter than before. While home loans drop, the ‘Real Rate Paradox’ silently erodes liquidity. Are your FDs in danger? Is the ‘Rent vs. Buy’ rule dead? Discover the hidden mechanism in Governor Malhotra’s decision that changes your financial reality for 2026.

Everyone is talking about the 0.25% drop. The headlines are screaming about cheaper home loans. But if you look closer at the fine print of Governor Sanjay Malhotra’s announcement yesterday, you’ll spot a anomaly—a number that doesn’t add up, and it reveals exactly where the Indian economy is heading next.

Most people saw a “relief measure.” The data suggests a “preemptive strike.”

Here is the untold story of the December 2025 repo rate cut, and why it matters more than just saving ₹2,000 on your EMI.

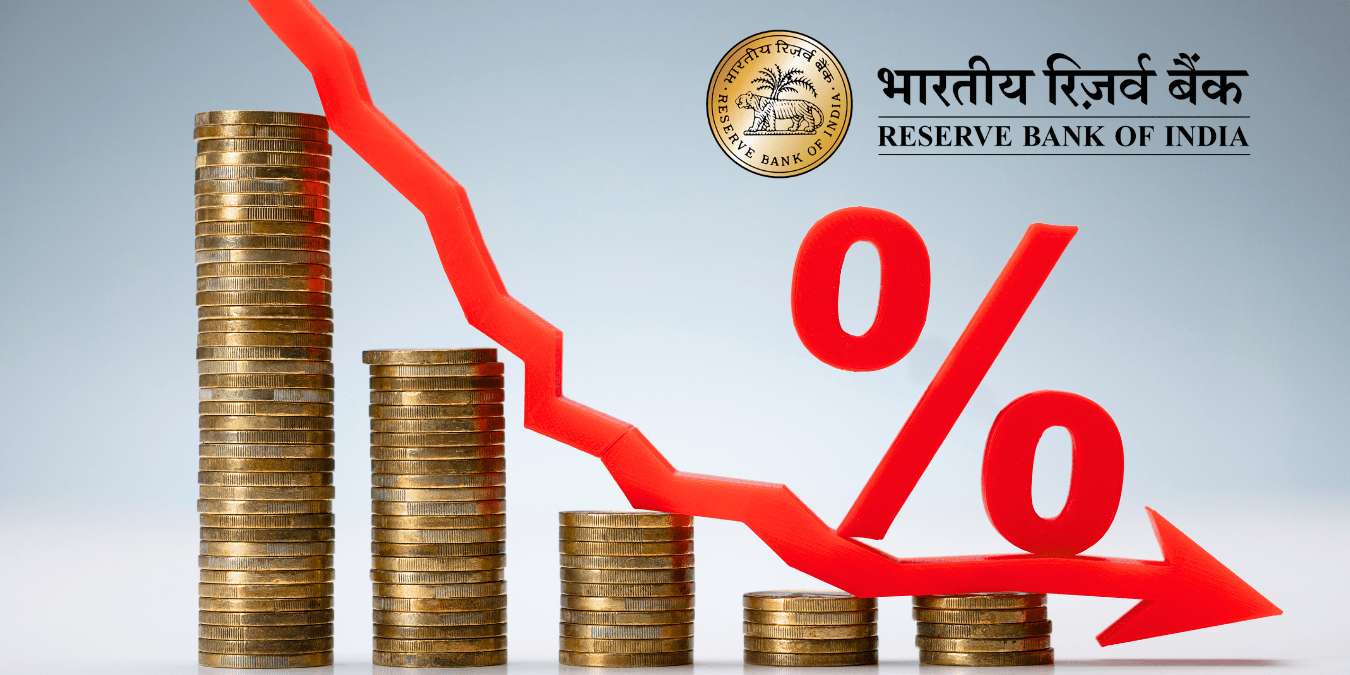

1. The Headline You Know: 5.25% is the New Normal

Let’s get the basics out of the way. As of yesterday, the Reserve Bank of India (RBI) slashed the repo rate by 25 basis points (bps), bringing it down to 5.25%.

This is the third act in a play that started back in February. We began 2025 with a repo rate of 6.5%. After cuts in February and June, and now December, we have seen a massive 125 bps reduction in a single calendar year.

Why now?

Official reason: Inflation has collapsed. The RBI projects CPI inflation for FY26 at a staggering 2.0%—the lowest we've seen in decades—thanks to a crash in food prices and GST rationalization.

The Real Impact:

- Home Loans: Rates could hit a historic low of 7.1%.

- Car Loans: Expect offers to sweeten immediately as inventory piles up.

- Fixed Deposits: The golden era of 8% returns is officially dead.

But you didn't click for the basics. You clicked for what’s hidden.

2. The "Real Rate" Paradox: Why Money is Actually Tight

Here is the shocking fact almost no one is discussing: Money is tighter today than it was when rates were 6.5%.

How? It’s simple math called the "Real Interest Rate."

- Nominal Rate (Repo): 5.25%

- Projected Inflation: 2.0%

- Real Rate: 3.25%

A real interest rate of 3.25% is incredibly high for a developing economy. Usually, central banks target a real rate of around 1-1.5% to stimulate growth. By keeping the real cost of capital this high, Governor Malhotra isn’t just fighting inflation; he is building a fortress.

The Hidden Agenda:

The RBI is terrified of "imported volatility." With global trade wars escalating and tariffs shifting supply chains, the RBI is keeping India’s rates relatively attractive to foreign investors to prevent a capital flight. They are cutting rates just enough to help you buy a house, but keeping them high enough to keep foreign dollars in Mumbai.

3. The "Renter’s Regret" Trigger

If you are still renting in December 2025, the window to switch sides is closing.

With home loan interest rates potentially dropping to 7.1%, the math of "Rent vs. Buy" has flipped violently.

- The Aspiration: Owning a home is no longer a wealth-killer.

- The Urgency: Real estate prices in top 7 cities have already risen 10% in 2025.

- The Trigger: If you wait for rates to drop to 5%, property prices might rise another 15%, erasing your savings.

Expert Insight: Anuj Puri of ANAROCK Group calls this a "sweetener" that will likely trigger a sales velocity surge in Q1 2026. The market is about to get crowded.

4. The Saver’s Crisis: The 2% Trap

This is the painful part. For senior citizens and conservative savers, this news is a siren.

With inflation at 2%, the RBI has little incentive to keep liquidity tight. Banks are flush with cash. This means Fixed Deposit (FD) rates will plummet faster than loan rates.

- The Risk: If your FD renews in January 2026, you might be shocked to see offers of 5.5% - 6.0% instead of the 7.5% you were used to.

- The Pivot: Money will likely flow into Debt Mutual Funds or Hybrid Funds as savers chase the "inflation-beating" returns that FDs no longer guarantee.

5. The "Green" Connection: Why EVs Win Big

One "little-known" aspect of this cut is its disproportionate impact on the Green Energy sector.

Electric Vehicles (EVs) and solar installations are capital-intensive. They are bought on loans. A 125 bps drop in 2025 acts like a direct subsidy to the EV industry.

- Prediction: Watch for zero-down-payment, low-interest financing schemes for EVs in January 2026. The lower cost of funds allows lenders to take risks on "new technology" assets they previously avoided.

What Sectors Benefit Most from a 25 bps Rate Cut

With the repo rate now at 5.25% (following the 25 bps cut in December 2025), the cost of capital has dropped significantly, creating immediate winners in interest-sensitive industries.

Below are the key sectors that benefit most, ranked by the immediacy and magnitude of the impact.

1. Real Estate (Primary Beneficiary)

This sector is the biggest winner. High property prices in 2025 had started to dampen demand, but this cut acts as a massive stimulus.

- Why: Cheaper home loans (expected to dip near 7.1%) improve affordability for end-users.

- Impact: Lower EMIs revive demand in the affordable and mid-income housing segments, which are highly sensitive to interest rate fluctuations.

- Developer Side: Developers see reduced financing costs for construction, improving their margins and allowing for faster project execution.

2. Automobiles (Volume Driver)

The auto sector, particularly passenger vehicles and two-wheelers, sees a direct correlation with rate cuts.

- Why: Over 75-80% of cars and two-wheelers in India are bought on finance. A 25 bps cut (cumulatively 125 bps in 2025) significantly lowers the monthly outgo for buyers.

- Impact: Expect a surge in sales for entry-level cars and EVs, where buyers are most "EMI-conscious." Commercial vehicle sales also typically rise as fleet operators find it cheaper to expand or upgrade.

3. Banking & NBFCs (Credit Growth)

While banks might see a slight compression in Net Interest Margins (NIMs) as lending rates fall, the overall volume growth compensates for it.

- Why: Lower rates spur credit demand across retail (housing, personal loans) and corporate sectors.

- NBFCs Advantage: Non-Banking Financial Companies (NBFCs) benefit disproportionately because their cost of borrowing (wholesale funds) drops faster than the rates they charge customers, temporarily boosting their margins.

4. Capital Goods & Infrastructure

These are capital-intensive sectors where debt servicing is a major expense.

- Why: Companies heavily burdened with debt (like power, telecom, and road construction firms) see their interest obligations fall, directly boosting their bottom line.

- Impact: With the RBI keeping liquidity flush (via ₹1 lakh crore OMOs), infrastructure projects find it easier to secure cheap long-term funding.

5. Consumer Durables

- Why: Big-ticket items like refrigerators, air conditioners, and premium electronics are increasingly bought on "No-Cost EMI" or consumer finance schemes. Lower rates make these schemes more attractive and viable for lenders to offer.

Summary Table: Who Wins & Why

| Sector | Key Benefit | Top Impact Area |

| Real Estate | Demand Revival | Affordable & Mid-segment Housing |

| Auto | Lower EMIs | Entry-level Cars, EVs, Two-wheelers |

| NBFCs | Cheaper Funds | Wholesale Borrowing Costs Decrease |

| Banks | Volume Growth | Retail Loan Book Expansion |

| Infra | Debt Relief | Lower Interest Expense on Heavy Capex |

Actionable Takeaways for You

| If You Are... | Your Move Now |

| A Homeowner | Refinance immediately. If your loan is linked to an external benchmark (EBLR), the reset happens automatically, but check the spread. If you are on MCLR, switch to a Repo-Linked Lending Rate (RLLR) now. |

| A Saver | Lock in rates. If you have idle cash, book an FD today before banks slash rates next week. Look for 2-3 year tenures to ride out the low-rate cycle. |

| An Investor | Look at Realty & Auto Stocks. These interest-rate sensitive sectors are primed for a Q4 rally as demand unlocks. |

| A Renter | Run the numbers. Use a "Buy vs. Rent" calculator with a 7.1% interest rate input. The break-even point has likely shifted in favor of buying. |

The Final Teaser: What Happens in February 2026?

The MPC kept its stance "neutral," meaning they aren't committed to cutting more. But here is the breadcrumb trail: Governor Malhotra explicitly mentioned that global uncertainty is the only thing holding them back.

If global trade tensions ease by January, experts like those at Kotak Mahindra Bank predict another cut could bring the terminal rate to a flat 5.0%.

Imagine a world with sub-7% home loans and 5% repo rates. We aren't there yet, but we are knocking on the door. The question is: Will you position your portfolio for that world now, or wait until the news is already priced in?

Don't blink. The financial landscape of 2026 is being written today.

Disclaimer: This professional analysis is for informational purposes and reflects the latest publicly available data. Investment decisions should consider individual objectives and may benefit from consultation with a registered financial advisor.