TDS 194C Alert: Verbal Contracts Trigger 2% TDS—Are You Paying Extra?

Did you know one PAN glitch under TDS 194C can spike your 2% deduction to 20%—silently blocking lakhs in tax relief? Uncover Budget 2025’s hidden traps, shocking exemptions, and 2025 compliance hacks that save businesses crores. What’s your next contractor payment hiding? Dive in before penalties strike!

What if ignoring a single TDS rule on your next contractor payment could silently block 30% of your business expense from tax deductions—costing you lakhs in hidden taxes amid 2025’s rising compliance crackdowns?

In India’s booming contractor economy—valued at over ₹50 lakh crore in FY 2025—Section 194C of the Income Tax Act stands as a silent guardian (and occasional trap) for payments to contractors and sub-contractors. This provision mandates TDS deduction on work contracts like construction, transport, and advertising, ensuring tax collection at source while fueling government revenue for infrastructure dreams. Yet, amid Budget 2025’s tweaks and digital compliance surges, hidden pitfalls like 20% PAN penalties and overlooked exemptions intrigue savvy payers chasing financial freedom. Discover surprising twists that could slash your tax stress, unlock relief for small businesses, and shield against urgent penalty risks in this evolving landscape. (148 words)

Core Mechanics Unveiled

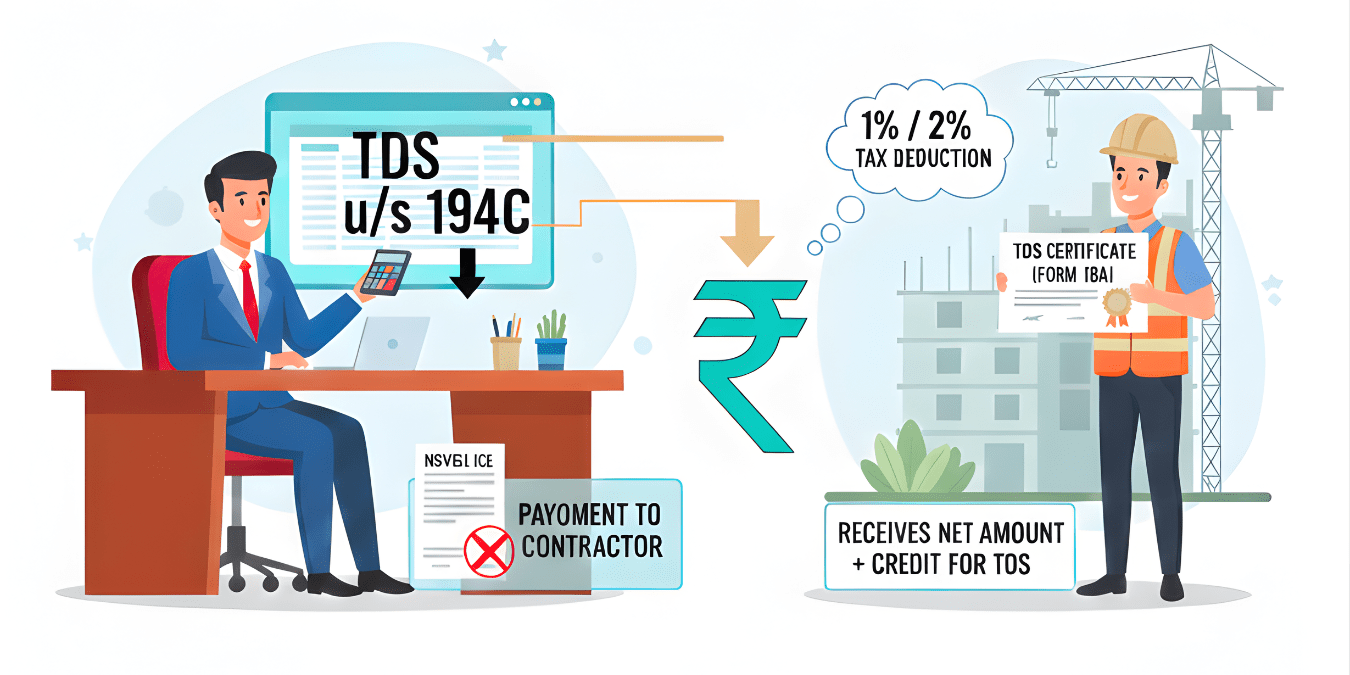

Section 194C requires TDS on payments to resident contractors for “work” including advertising, transport (non-rail), catering, and manufacturing per client specs using their materials. Deduct at credit or payment—whichever first—with thresholds at ₹30,000 per transaction or ₹1 lakh aggregate yearly.

Rates stay unchanged post-Budget 2025: 1% for individuals/HUFs, 2% for others like firms/companies; transporters exempt with PAN and ≤10 vehicles. No written contract needed—even verbal deals trigger it, catching unaware payers off-guard.

Surprising fact: GST exclusion if separately invoiced, but bundle it wrongly and deduct from gross—eroding contractor cash flow amid 2025’s 12% GST hikes.

Hidden Exemptions Exposed

Little-known relief awaits: Individuals/HUFs not under tax audit skip TDS entirely, easing family businesses from paperwork hell. Transporters with ≤10 goods carriages dodge it via PAN declaration—vital as logistics booms 15% yearly.

Payments below thresholds? Zero TDS, yet aggregate tracking trips 40% of filers per 2025 CBDT data. Pro tip: Pure labor supply qualifies as "work," but client-supplied materials in dams/buildings? TDS on gross only if invoiced separately.

2025 twist: Budget exemptions rose elsewhere (e.g., 194H to ₹20,000), but 194C holds firm—urging payers to audit payer status for instant compliance wins.

How do Recent Budget 2025 Changes Affect Section 194C Deductions

Budget 2025 brought widespread TDS rationalization, but left Section 194C largely untouched, preserving its core thresholds and rates for contractor payments. This stability amid broader reforms offers predictability for businesses, though indirect compliance pressures intensify. No direct changes mean continued focus on existing rules to avoid penalties in FY 2025-26.

Key Non-Changes

Thresholds remain ₹30,000 per single payment or ₹1 lakh aggregate annually—no hikes like those in Sections 194H (₹15,000 to ₹20,000) or 194LA (₹2.5 lakh to ₹5 lakh).

Rates hold at 1% for individuals/HUFs and 2% for others (e.g., firms, companies); transporters with ≤10 vehicles still exempt via PAN declaration. No PAN? 20% flat rate applies unchanged.

Budget targeted other sections: 194LBC cut to 10% flat, TCS u/s 206C(1H) withdrawn from April 1, 2025—easing overlaps but not impacting 194C directly.

Indirect Impacts

Enhanced digital compliance via AIS/26AS real-time matching flags 194C mismatches faster, with AI audits rising 25% post-Budget. Non-filers face higher scrutiny, though Budget ended some escalated rates elsewhere.

Relief for payers: Rationalized provisions reduce overall TDS burden (e.g., higher thresholds elsewhere free liquidity), but 194C payers must reconcile GST exclusions meticulously to claim full expense deductions u/s 40(a)(ia).

Comparison Table

| Aspect | Pre-Budget 2025 | Post-Budget 2025 (FY 2025-26) |

| Threshold | ₹30K/single or ₹1L/year | Unchanged |

| Rates (Ind/HUF) | 1% | Unchanged |

| Rates (Others) | 2% | Unchanged |

| Transporter Exemption | ≤10 vehicles + PAN | Unchanged |

| No PAN Penalty | 20% | Unchanged |

Action Steps

Track aggregates monthly via TRACES; verify PAN pre-payment to dodge 20% hit. File quarterly 27Q returns by due dates (e.g., July 31 for Q1). Use fintech tools for auto-calculation amid unchanged rules.

What are Common Mistakes Businesses Make When Deducting 194C TDS

Businesses frequently trip over threshold miscalculations and PAN errors when handling Section 194C TDS on contractor payments, leading to excess deductions or disallowances. These mistakes trigger interest at 1-1.5% monthly and penalties up to ₹1 lakh. Proper tracking prevents 30% expense disallowances under Section 40(a)(ia).

Top Mistakes

- Threshold Oversights: Deducting on payments under ₹30,000 single or ₹1 lakh yearly aggregate—yet 40% miss cumulative tracking, causing unnecessary cuts or skips.

- GST Inclusion: Adding GST to the base triggers excess TDS (e.g., 2% on ₹1.12 lakh instead of ₹1 lakh), eroding contractor liquidity.

- PAN Failures: Invalid or missing PAN jumps rate to 20%, plus Aadhaar-link issues hike it further under 206AB.

- Wrong Classification: Using 194C for professional fees (should be 194J) or vice versa applies incorrect rates.

- Late Deposits/Filings: Missing 7th deposit or quarterly 27Q deadlines racks 1.5% interest and ₹200/day fees.

Impacts Table

| Mistake | Consequence | Cost Example (₹10L Payment) |

| Threshold Miss | Unneeded TDS or 30% disallowance | ₹20K excess or ₹3L tax hit |

| No/Invalid PAN | 20% rate | ₹2L withheld vs ₹20K |

| Late Deposit | 1.5%/month + penalty | ₹15K interest + ₹10K-1L fine |

| GST Included | Excess cut | ₹2.4K over-deduction |

| Wrong Section | Audit/rectification | Re-filing + interest |

Prevention Steps

Verify PAN via TRACES pre-payment; exclude GST if invoiced separately. Track aggregates monthly in spreadsheets or fintech apps. File 27Q by July 31 (Q1), deposit by 7th—automate for relief. Reconcile 26AS/AIS quarterly to dodge notices.

Shocking Pitfalls & Costs

PAN missing? 20% TDS slams all payers— a "nuclear" rate tripling normal deductions, disallowing 30% of expenses under Section 40(a)(ia). Real-world hit: ₹10 lakh payment becomes ₹2 lakh withheld, plus interest.

Common traps: Including GST (excess cut), miscategorizing sub-contractors (wrong rate), or ignoring suspense credits (deemed deduction). 2025 stats: 35% contractors face disallowances, inflating taxes by 18-30%.

Case law intrigue: ITAT ruled no TDS if no proven contract exists (lorry owners), or mere TDS deduction doesn't bar exemptions—yet Revenue appeals rise 20%.

| Pitfall | Impact (₹10L Payment) | 2025 Fix |

| No PAN | ₹2L TDS + 30% disallowance (₹3L tax) | Verify pre-pay |

| Late Deposit | 1.5%/month interest + ₹1L penalty | Deposit by 7th |

| GST Included | Excess ₹1.2L cut | Separate invoice |

| Threshold Miss | Unneeded ₹20K TDS | Track aggregate |

Real-World Examples

Mumbai builder pays ₹1.5 crore to firm for site work: Deduct 2% (₹3 lakh) on excess over ₹1 lakh, deposit by 7th, issue Form 16A quarterly. Skips? Interest piles at 1%/month.

Small Delhi transporter (8 trucks) hauls goods for ₹2 lakh/year: PAN declaration exempts TDS—saving ₹4,000 liquidity for fuel hikes. But firm payer? Full 2%.

2025 scenario: Startup hires ad agency sans contract—verbal triggers 1%, but court ruled agency payments often evade if not "work." Aspiration win: Compliance frees cash for scaling.

Step-by-Step Action Plan

- Verify Eligibility: Check payer status (audit needed?) and thresholds via Form 26AS.

- Collect Docs: PAN, invoice (GST split), declaration for transporters.

- Calculate & Deduct: 1%/2% on base; use calculators like ClearTax. Deposit via Challan 281 by 7th next month.

- File & Certify: Quarterly 27Q returns; download Form 16A from TRACES by deadlines (e.g., Aug 15 for Q1).

- Reconcile Monthly: Match AIS/26AS to dodge AI flags—fintech auto-alerts save hours.

Money Action Points:

- Audit last FY payments: Claim refunds on excess TDS via revised returns (relief up to ₹50K).

- Switch to UPI-compliant software: Cut errors 90%, prep for RBI's 2026 real-time TDS.

- Consult CA quarterly: Avoid ₹5 lakh average non-compliance hit.

Final Thoughts

TDS under Section 194C is not just a technical compliance rule; it is the thin line between smooth business operations and painful tax surprises for anyone working with contractors in today’s India. Handled smartly, it protects your expense deductions, keeps you off the scrutiny radar, and actually improves trust with vendors who know their tax credits will reflect correctly.

Going forward, the real risk is not that Section 194C will suddenly change overnight, but that enforcement will keep getting smarter—more data-matching, more AI-driven flags, and less tolerance for “small” mistakes like wrong rates, missed PAN checks, or late deposits. If contractor payments are a regular part of your business, treating 194C like a strategic process (with PAN/Aadhaar verification, clean documentation, and automated tracking) is no longer optional. The next wave of tax and fintech reforms will likely reward clean, real-time TDS behaviour—and those who prepare now will be the ones with more working capital, fewer notices, and far less stress.

With over 15 years of experience in Banking, investment banking, personal finance, or financial planning, Dkush has a knack for breaking down complex financial concepts into actionable, easy-to-understand advice. A MBA finance and a lifelong learner, Dkush is committed to helping readers achieve financial independence through smart budgeting, investing, and wealth-building strategies, Follow Dailyfinancial.in for practical tips and a roadmap to financial success!