In today’s digital age, online banking has become a staple for managing finances. However, with the convenience of online banking comes the risk of cyber threats. This is where Virtual Private Networks (VPNs) come into play. In this comprehensive guide, we will explore how VPNs enhance banking security, the best practices for using VPNs, and the top VPNs recommended for secure online banking.

“How VPNs enhance banking security by encrypting your data and protecting your privacy. Learn about different types of VPNs, best practices for secure online banking, and top VPN recommendations like NordVPN, ExpressVPN, and CyberGhost. Ensure your financial transactions are safe with our comprehensive guide to choosing the best VPN for banking.”

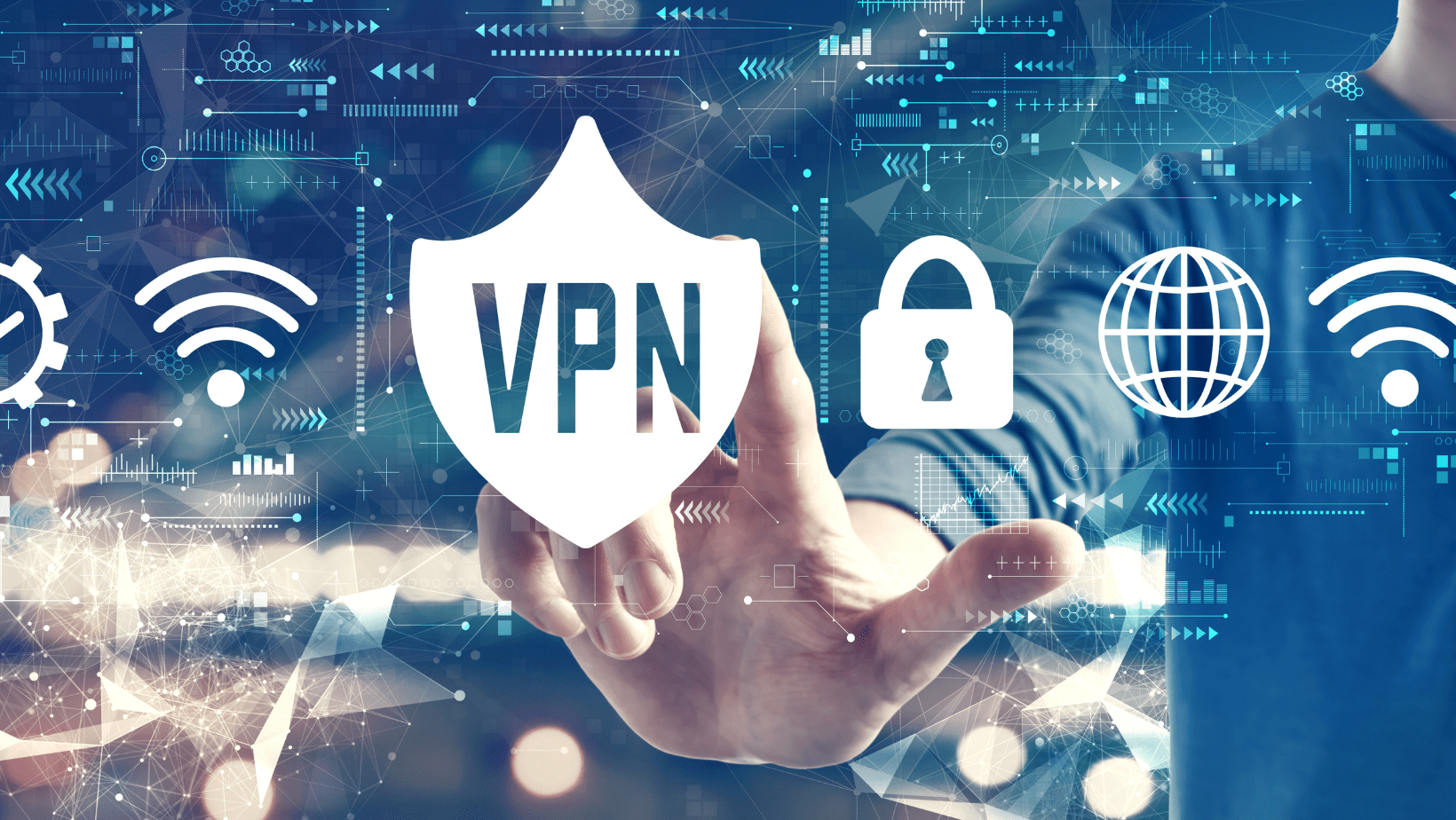

What is a VPN?

A Virtual Private Network (VPN) is a service that encrypts your internet connection and hides your IP address, making your online actions virtually untraceable. This is particularly important when accessing sensitive information, such as your bank account, over the internet.

There are several types of VPNs, each designed for different purposes and offering various levels of security and functionality. Here are the main types of VPNs:

1. Remote Access VPN

Remote Access VPNs are commonly used by individuals to connect to a private network from a remote location. This type of VPN is particularly useful for employees who need to access their company’s network securely from home or while traveling. It encrypts the user’s internet traffic and routes it through a secure server, ensuring that sensitive data remains protected.

2. Site-to-Site VPN

Site-to-Site VPNs are used to connect entire networks to each other, typically used by businesses with multiple office locations. This type of VPN allows different branches of a company to share resources and communicate securely over the internet. Site-to-Site VPNs can be further divided into:

- Intranet-based VPN: Connects multiple offices of the same company.

- Extranet-based VPN: Connects the company’s network to the network of another organization, such as a partner or supplier.

3. Client-to-Site VPN

Client-to-Site VPNs (also known as Client-Based VPNs) are similar to Remote Access VPNs but are specifically designed for individual users to connect to a specific network. This type of VPN is often used by employees to access their company’s network securely from their personal devices.

4. SSL VPN

SSL VPNs (Secure Sockets Layer VPNs) use the SSL protocol to create a secure and encrypted connection between the user’s device and the VPN server. SSL VPNs are commonly used for remote access and can be accessed through a web browser, making them convenient for users who need to connect to a network without installing additional software.

5. IPSec VPN

IPSec VPNs (Internet Protocol Security VPNs) use the IPSec protocol to secure internet communications across an IP network. IPSec VPNs are often used for site-to-site VPNs and provide robust security features, including data encryption and authentication.

6. Mobile VPN

Mobile VPNs are designed for mobile devices, such as smartphones and tablets. These VPNs provide secure connections even when the device switches between different networks, such as from Wi-Fi to cellular data. Mobile VPNs are essential for users who need to maintain a secure connection while on the move.

7. Cloud VPN

Cloud VPNs (also known as Virtual Private Cloud VPNs) are used to connect a company’s on-premises network to its cloud infrastructure. This type of VPN is essential for businesses that use cloud services and need to ensure secure communication between their local network and cloud resources.

8. Hybrid VPN

Hybrid VPNs combine the features of different types of VPNs to provide a more flexible and comprehensive solution. For example, a company might use a combination of site-to-site and remote access VPNs to meet its specific security and connectivity needs.

9. Peer-to-Peer VPN

Peer-to-Peer VPNs (P2P VPNs) are designed for secure file sharing and communication between peers. This type of VPN is often used for activities like torrenting, where users need to share files directly with each other while maintaining privacy and security.

10. Personal VPN

Personal VPNs are used by individuals to protect their online privacy and security. These VPNs are typically provided by commercial VPN services and are used to encrypt internet traffic, hide the user’s IP address, and bypass geo-restrictions.

Understanding the different types of VPNs can help you choose the right one for your specific needs. Whether you’re an individual looking to secure your online activities or a business needing to connect multiple offices, there’s a VPN solution that can meet your requirements. Always consider the security features, ease of use, and compatibility with your devices when selecting a VPN.

How Does a VPN Work?

A VPN works by creating a secure tunnel between your device and the internet. When you connect to a VPN server, your data is encrypted and routed through the server before reaching its destination. This process ensures that your online activities are hidden from prying eyes, including hackers and even your internet service provider (ISP).

Why Use a VPN for Online Banking?

Enhanced Security

One of the primary reasons to use a VPN for online banking is the enhanced security it provides. VPNs use advanced encryption protocols to protect your data from cybercriminals. This means that even if a hacker intercepts your data, they won’t be able to read it.

Privacy Protection

VPNs also protect your privacy by masking your IP address. This makes it difficult for anyone to track your online activities or determine your physical location. For online banking, this added layer of privacy is crucial in preventing identity theft and fraud.

Safe Public Wi-Fi Usage

Public Wi-Fi networks are notorious for being insecure. Using a VPN on public Wi-Fi ensures that your banking information remains secure, even if the network is compromised. This is particularly useful when you need to access your bank account while traveling or in a public place.

Best Practices for Using a VPN for Banking

Choose a Reputable VPN Provider

Not all VPNs are created equal. It’s essential to choose a reputable VPN provider that offers robust security features, such as AES-256 encryption, a no-logs policy, and a kill switch. Some of the top VPNs for banking include NordVPN, ExpressVPN, and CyberGhost.

Enable Multi-Factor Authentication

Multi-factor authentication (MFA) adds an extra layer of security to your online banking. Even if someone gains access to your VPN, they would still need to pass the MFA to access your bank account.

Regularly Update Your VPN Software

Ensure that your VPN software is always up to date. VPN providers regularly release updates to fix security vulnerabilities and improve performance. Keeping your software updated ensures that you have the latest security features.

Avoid Free VPNs

While free VPNs might seem tempting, they often come with significant drawbacks, such as limited bandwidth, slower speeds, and weaker security features. Investing in a paid VPN service is a small price to pay for the security of your financial information.

How to choose the best VPN for banking?

Choosing the best VPN for banking involves considering several key factors to ensure your online transactions are secure and your personal information is protected. Here are some important criteria to help you make an informed decision:

1. Strong Security Features

Look for a VPN that offers robust security features, such as:

- AES-256 Encryption: This is the industry standard for data encryption and ensures your information is secure.

- Kill Switch: This feature automatically disconnects your internet if the VPN connection drops, preventing any data leaks.

- No-Logs Policy: Ensure the VPN provider does not keep logs of your online activities, which protects your privacy.

2. High-Speed Connections

Banking transactions require a stable and fast internet connection. Choose a VPN that offers high-speed servers to avoid delays and interruptions.

3. Wide Server Network

A VPN with a large network of servers in multiple countries can provide better connectivity and more options for secure connections. This is especially useful if you travel frequently and need to access your bank account from different locations.

4. User-Friendly Interface

A VPN should be easy to use, even for those who are not tech-savvy. Look for a VPN with a simple and intuitive interface that allows you to connect to a secure server with just a few clicks.

5. Compatibility

Ensure the VPN is compatible with all your devices, including smartphones, tablets, and computers. This allows you to secure your banking transactions across all your devices.

6. Customer Support

Good customer support is essential in case you encounter any issues with the VPN. Look for providers that offer 24/7 customer support through various channels, such as live chat, email, or phone.

7. Reputation and Reviews

Research the VPN provider’s reputation and read user reviews to get an idea of their reliability and performance. Trusted sources and expert reviews can provide valuable insights into the VPN’s effectiveness for banking security.

Top VPNs for Banking Security

Based on these criteria, here are some of the top VPNs recommended for secure online banking:

1. NordVPN

- Security: Offers AES-256 encryption, a kill switch, and a strict no-logs policy.

- Speed: Known for its high-speed servers.

- Server Network: Over 5,400 servers in 59 countries.

- User-Friendly: Easy-to-use interface and apps for various devices.

2. ExpressVPN

- Security: Provides strong encryption, a kill switch, and a no-logs policy.

- Speed: High-speed connections suitable for banking transactions.

- Server Network: More than 3,000 servers in 94 countries.

- User-Friendly: Simple and intuitive apps for all devices.

3. CyberGhost

- Security: Features AES-256 encryption, a kill switch, and a no-logs policy.

- Speed: Reliable and fast servers.

- Server Network: Over 7,000 servers in 90 countries.

- User-Friendly: User-friendly interface with dedicated servers for online banking.

4. Surfshark

- Security: Offers strong encryption, a kill switch, and a no-logs policy.

- Speed: Good speeds for secure banking.

- Server Network: More than 3,200 servers in 65 countries.

- User-Friendly: Easy-to-use apps and affordable pricing.

5. Private Internet Access (PIA)

- Security: Provides robust encryption, a kill switch, and a no-logs policy.

- Speed: Fast and reliable connections.

- Server Network: Over 35,000 servers in 78 countries.

- User-Friendly: Simple interface and good customer support.

Choosing the best VPN for banking involves prioritizing security, speed, and ease of use. By considering the factors mentioned above and selecting a reputable VPN provider, you can ensure that your online banking transactions are secure and your personal information is protected. Always stay informed about the latest security features and updates to maintain the highest level of protection.

Using a VPN for online banking is a smart move to enhance your security and protect your privacy. By encrypting your data and masking your IP address, a VPN ensures that your financial information remains secure, even on public Wi-Fi networks. Remember to choose a reputable VPN provider, enable multi-factor authentication, and keep your software updated to maximize your online banking security.

-

IBM is the Latest AI Casualty: Shares Tank 13% on Anthropic’s COBOL Modernization Threat

On Monday, February 23, 2026, Wall Street witnessed a shocking sight: IBM — one of the most storied

-

Gold & Silver Rate Today 24 February 2026

If you are planning to buy gold jewellery, invest in silver, or simply track the precious metals market,