OPS offers 50% of last pay, NPS bets on equity and annuities, and UPS ensures ₹10,000 monthly with gratuity. The 2025 UPS deadline looms—will you secure your retirement? Explore PFRDA tools and spark a pension revolution.

India’s retirement landscape is a financial crossroads, where the past, present, and future converge in a trio of pension schemes: the Old Pension Scheme (OPS), the New Pension System (NPS), and the newly launched Unified Pension Scheme (UPS), effective April 1, 2025. Each offers a unique promise—OPS delivers rock-solid certainty, NPS fuels market-driven wealth, and UPS blends guarantees with growth. For 23 lakh central government employees and millions more in state services, choosing the right scheme is a high-stakes decision that shapes their post-retirement life. This blog dives into a comprehensive comparison of India’s pension frameworks, weaving historical context, fresh 2025 data, suspenseful twists, and actionable insights to spark curiosity and empower your financial future. Ready to unravel the pension puzzle? Let’s explore.

The Evolution of India’s Pension Framework: A Historical Lens

Pensions in India have evolved dramatically, reflecting economic shifts and fiscal priorities. This evolution sets the stage for a thrilling choice: stability, growth, or both?

- Old Pension Scheme (OPS):

- Launched pre-1947; codified post-independence under CCS (Pension) Rules, 1972.

- Provides defined pensions: 50% of last drawn basic pay at age 60, plus family pension and commutation options.

- Entirely employer-funded, with inflation-indexed dearness relief.

- Discontinued for Central Government recruits after 31 December 2003, yet remains active in many states.

- New Pension System (NPS):

- Introduced January 2004 for Central Government, extended 2009 to private-sector and NRIs.

- Defined-contribution structure: employee contributes 10% of basic + DA; employer matches 14% (central government).

- Corpus invested in equity, government securities, and corporate bonds as per investor choice.

- On retirement at 60, up to 60% lump-sum withdrawal tax-free; 40% must purchase annuity—payout fluctuates with market performance.

- Unified Pension Scheme (UPS):

- Cabinet-approved August 2024; effective 1 April 2025 for Central Government employees covered under NPS.

- Hybrid: guaranteed monthly pension of ₹10,000 minimum; assured pension = 50% of average basic pay over last 12 months (pro-rata for 10–25 years of service); inflation indexation applies.

- Contributions: employee 10% of basic + DA; government matching 10% plus an additional 8.5% to a pool corpus.

- One-time irrevocable choice; retiree NPS subscribers may migrate; option window for existing employees until 30 September 2025.

Old Pension Scheme (OPS): The Golden Standard of Security

The OPS is a nostalgic beacon for retirees, offering a defined-benefit pension equal to 50% of the last drawn basic pay at age 60, adjusted biannually with Dearness Relief (DR) linked to the All India Consumer Price Index for Industrial Workers (AICPI-IW). Fully funded by the government, it requires no employee contributions, making it a zero-risk haven. Upon a retiree’s demise, their family receives 60% of the pension, ensuring generational security. Employees can also commute up to one-third of the pension for a lump sum, with the pension restored after 15 years. However, OPS is limited to those recruited before December 31, 2003, and its fiscal burden—exacerbated by rising life expectancy—prompted its phase-out for new central government hires. States like Himachal Pradesh and Rajasthan have revived OPS, igniting debates about its sustainability. Is this guaranteed comfort worth its hidden costs?

New Pension System (NPS): The Market’s Double-Edged Sword

Introduced on January 1, 2004, the NPS revolutionized India’s pension landscape with a defined-contribution model. Employees contribute 10% of basic pay plus Dearness Allowance (DA), matched by the government’s 14% contribution (for central employees). Extended to private-sector workers and NRIs in 2009, NPS offers flexibility through Active Choice (up to 75% equity allocation) or Auto Choice (lifecycle funds adjusting risk with age). At retirement, 60% of the corpus can be withdrawn tax-free, while 40% must purchase an annuity, yielding a pension subject to market fluctuations. Managed by the Pension Fund Regulatory and Development Authority (PFRDA), NPS empowers wealth creation but exposes retirees to market risks. For the bold, it’s a chance to ride equity waves; for the cautious, it’s a gamble. Can you stomach the uncertainty for potential rewards?

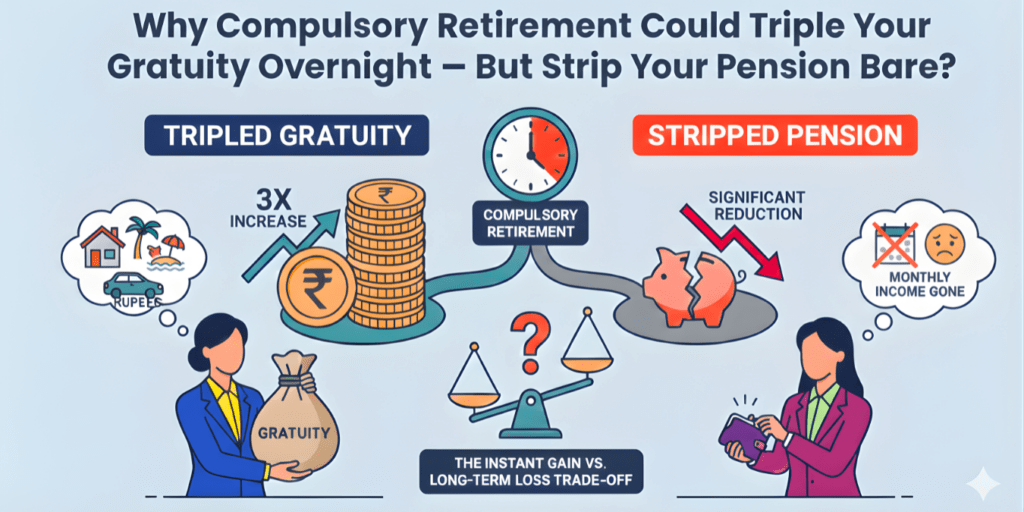

Unified Pension Scheme (UPS): The Game-Changing Hybrid

Approved by the Union Cabinet on August 24, 2024, and effective from April 1, 2025, the UPS is a bold response to employee demands for predictability. It guarantees an assured pension of 50% of the average basic pay over the last 12 months for those with 25 years of service, with pro-rata benefits for 10–24 years. A minimum pension of ₹10,000 per month kicks in after 10 years of service, and 60% family pension ensures survivor support. Like NPS, employees contribute 10% of basic pay plus DA, but the government’s contribution rises to 18.5% (10% to individual accounts, 8.5% to a pool corpus). Inflation indexation via Dearness Relief aligns payouts with rising costs. A lump-sum gratuity—1/10th of monthly emoluments per six months of service—sweetens the deal without reducing the pension. NPS subscribers can switch to UPS by September 30, 2025, but it’s a one-time, irrevocable choice. Will you seize this hybrid promise or stick with market-driven NPS?

No Credit History? How PaySense Personal Loans Empower Millions Across India!

SBI Education Loan: Your Path to Academic Excellence

How India’s Courts Now Freeze Assets in Cheque Bounce Cases — The New 2025 Update

Don’t Let Fraudsters Steal Your Financial Freedom: How to Safeguard Your Credit Score

Eligibility and Enrolment: Who Qualifies, and When?

| Criterion | OPS | NPS | UPS |

| Eligible Employees | Recruited ≤31 Dec 2003 (Central Govt.) | All recruits ≥1 Jan 2004; private, self-employed, NRIs | Central Govt. employees under NPS as on 01 Apr 2025; new recruits ≥01 Apr 2025; retirees before 31 Mar 2025 with ≥10 years’ service |

| Enrolment Window | Automatic for qualifying recruits | Mandatory on joining | One-time election: existing by 30 Sep 2025; new within 30 days of joining |

| Minimum Service for Pension | 10 years | None; vesting at 10 years | 10 years for minimum ₹10,000; 25 years for full assured pension |

The suspense lies in the deadline: miss September 30, 2025, and NPS subscribers are locked into market uncertainty. Are you ready to make this life-altering choice?

Contribution Structures: Who Pays, and How?

- OPS: Fully government-funded, with no employee contributions. The pension is drawn from the exchequer, placing the entire investment risk on the state.

- NPS: Employees contribute 10% of basic pay plus DA; the government adds 14% (central employees). Funds are invested in equity, government securities, or corporate bonds, with options like Active Choice (custom allocation) or Auto Choice (lifecycle-based). Tier II accounts allow voluntary savings with withdrawal flexibility.

- UPS: Employees contribute 10% of basic pay plus DA, with the government matching 10% to individual accounts and adding 8.5% to a pool corpus for assured payouts. Investment options mirror NPS but prioritize 100% G-Secs or Lifecycle Funds for stability.

The twist? UPS’s higher government contribution (18.5%) signals a commitment to security, but the pool corpus’s management remains a mystery. Will it deliver the promised stability?

Pension Calculation and Payouts: What’s in Your Wallet?

- OPS:

- Pension: 50% of last drawn basic pay, inflation-indexed via Dearness Relief.

- Family Pension: 60% of the employee’s pension upon death.

- Commutation: Up to one-third convertible to a lump sum, restored after 15 years.

- Example: A retiree with a final basic pay of ₹1,00,000 gets ₹50,000 monthly, adjusted for inflation.

- NPS:

- Corpus Withdrawal: 60% tax-free lump sum; 40% buys an annuity.

- Pension: Varies with market returns and annuity rates (e.g., 6–8% annually).

- Example: A ₹50 lakh corpus yields ₹30 lakh lump sum and ₹10,000–₹14,000 monthly pension, depending on annuity performance.

- UPS:

- Assured Pension: 50% of average basic pay over the last 12 months (₹10,000 minimum for 10+ years’ service).

- Family Pension: 60% of assured pension.

- Gratuity: 1/10th of emoluments per six months of service, alongside full pension.

- Inflation Indexation: Dearness Relief ensures purchasing power.

- Example: An employee with a ₹1,00,000 average basic pay (25 years’ service) gets ₹50,000 monthly, plus gratuity.

The drama unfolds in the payout certainty: OPS and UPS shield retirees from market volatility, while NPS bets on investment savvy. Which aligns with your vision of retirement?

Tax Benefits and Portability: The Fine Print

| Benefit Type | OPS | NPS | UPS |

| Income-Tax Deductions | N/A (fully employer-funded) | Section 80C, 80CCD(1B), 80CCD(2) | All NPS deductions extended to UPS |

| Portability | Not available | Across employers; PAN-based account | Same as NPS—allowed between Central ministries, PSUs; one-time switch for retirees |

The hook? NPS and UPS offer tax savings and mobility, but OPS’s simplicity resonates with those prioritizing ease over flexibility. What’s your financial priority?

Narrative Hooks: Stories That Stir the Soul

- The Secure Haven vs. The Market Adventure: Picture retiring with OPS’s predictable ₹50,000 monthly, sipping chai without a care. Contrast this with NPS’s rollercoaster—your ₹50 lakh corpus could yield ₹20,000 monthly or crash to ₹8,000 in a market dip. UPS offers a middle path: ₹10,000 minimum, with potential for more. Which story feels like yours?

- The Deadline Dilemma: September 30, 2025, looms for NPS subscribers. Stay with market-linked uncertainty or lock into UPS’s guarantees? The clock is ticking, and this one-time choice is irreversible. Will you act in time?

- Inflation’s Silent Thief: OPS and UPS combat rising prices with Dearness Relief, preserving your purchasing power. NPS demands outpacing inflation through savvy investments—a challenge for the risk-averse. Can you outsmart inflation’s erosion?

- The Retiree’s Crossroads: Imagine a 58-year-old NPS subscriber with 20 years of service and a ₹40 lakh corpus. Stick with NPS for a potential lump sum, or switch to UPS for a ₹10,000 minimum pension? The emotional weight of security versus growth tugs at the heart.

Actionable Recommendations

- New Entrants (Post-2004):

- Risk-Averse: Choose UPS within 30 days of joining for guaranteed ₹10,000 monthly (10+ years’ service) and inflation protection.

- Growth-Seekers: Stick with NPS, leveraging up to 75% equity allocation and Tier II for flexibility.

- Existing NPS Subscribers:

- Short Tenure (<25 years): Switch to UPS for the ₹10,000 floor, especially if nearing retirement.

- Long Tenure, High Corpus: Stay with NPS to maximize the 60% tax-free lump sum and potential equity gains.

- State Employees & PSUs:

- Advocate for UPS adoption through unions, as states like Himachal Pradesh explore OPS revival.

- Compare state-specific OPS variants with UPS for tailored transitions.

- Use Tools: Leverage the UPS Calculator launched by the NPS Trust (May 20, 2025) to project payouts. Check PFRDA’s resources or bank portals for simulations.

The Viral Call-to-Action: Secure Your Future Today

India’s pension landscape—spanning OPS’s unwavering stability, NPS’s dynamic growth, and UPS’s balanced promise—demands a choice that aligns with your risk appetite, service tenure, and retirement dreams. Don’t let indecision steal your golden years. Act now:

- Assess personal risk appetite, service tenure, and post-retirement expenses.

- Calculate projected payouts under each scheme using online calculators provided by PFRDA and major banks.

- Decide before deadlines: existing employees by 30 September 2025; new recruits within 30 days.

- Engage in workplace pension seminars and share insights with peers to foster collective financial security.

Empower your retirement with a choice that resonates. Will you embrace OPS’s legacy, NPS’s potential, or UPS’s hybrid promise? Share your thoughts below, and let’s secure India’s future, one pension at a time.