“RBI’s Monetary Policy Committee cuts repo rate by 25 bps to 6% amid market uncertainty, tariff turmoil. Shifts to accommodative stance to boost economic growth. Get the latest insights on what this means for India’s economy and your finances.”

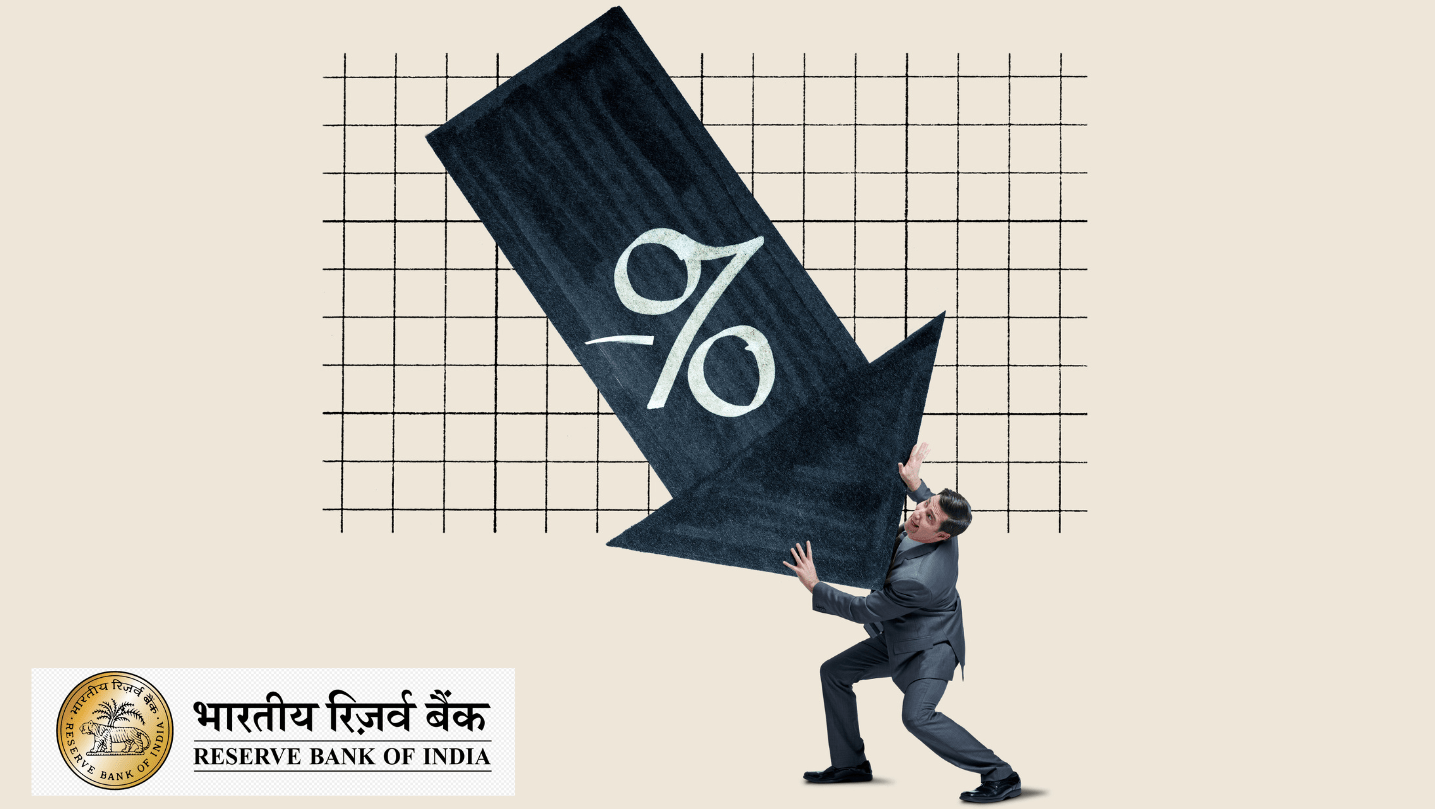

On April 9, 2025, the Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) announced a significant decision to cut the repo rate by 25 basis points (bps), bringing it down to 6% from 6.25%. This move, accompanied by a shift in policy stance from “neutral” to “accommodative,” reflects the central bank’s proactive approach to bolster economic growth amid rising global uncertainties, particularly driven by tariff turmoil. Led by RBI Governor Sanjay Malhotra, the MPC’s decision comes at a critical juncture as India navigates external pressures like U.S.-imposed tariffs and domestic economic challenges. In this blog post, we’ll dive deep into the implications of this repo rate cut, the shift to an accommodative stance, and how it ties into the broader economic landscape in 2025, while incorporating the latest data.

Understanding the RBI MPC’s Repo Rate Cut to 6%

The repo rate, the interest rate at which the RBI lends short-term funds to commercial banks, is a critical tool in India’s monetary policy framework. On April 9, 2025, the MPC, in its first bi-monthly meeting of the fiscal year 2025-26, unanimously voted to reduce the repo rate by 25 bps to 6%. This marks the second consecutive rate cut under Governor Sanjay Malhotra’s leadership, following a similar reduction in February 2025, when the rate dropped from 6.5% to 6.25%.

This RBI MPC repo rate cut aligns with market expectations, as a poll by The Economic Times had anticipated this move amid softening inflation and global trade tensions. The decision reflects the RBI’s intent to stimulate economic activity at a time when India’s growth trajectory faces headwinds from external factors, notably the U.S.’s imposition of a 26% tariff on Indian exports. Analysts suggest this tariff could shave off 20-40 bps from India’s projected GDP growth in 2025, prompting the RBI to adopt a more supportive monetary stance.

Key Highlights of the April 9, 2025, MPC Decision

- Repo Rate Reduced to 6%: A 25 bps cut from 6.25%, effective immediately.

- Policy Stance Shifted to Accommodative: Signals openness to further rate cuts to prioritize growth.

- GDP Growth Forecast Revised: FY26 GDP growth lowered to 6.5% from 6.7%.

- Inflation Projection Adjusted: FY26 CPI inflation forecast reduced to 4% from 4.2%.

Why the Repo Rate Cut Amid Market Uncertainty?

The RBI’s decision to lower the repo rate on April 9, 2025, comes against a backdrop of market uncertainty April 2025, fueled by global trade disruptions and domestic economic indicators. Governor Sanjay Malhotra emphasized that the global economic outlook is clouded by “exceptional uncertainty,” largely due to U.S. President Donald Trump’s retaliatory tariffs on major economies, including India. These tariffs, announced earlier in 2025, have heightened fears of a global trade war, impacting export-driven sectors in India.

External Pressures: Tariff Turmoil

The tariff turmoil India narrative gained traction after the U.S. imposed a 26% tariff on Indian exports, expected to cost India’s economy $5.76 billion in 2025, according to industry estimates. Institutions like Goldman Sachs have revised India’s 2025 GDP forecast downward from 6.3% to 6.1%, well below the RBI’s earlier 6.7% projection. This external shock has compelled the RBI to recalibrate its monetary policy to cushion the economy from a potential growth slowdown.

Domestic Factors: Inflation and Growth Dynamics

Domestically, inflation has softened significantly, providing the RBI with room to ease monetary policy. Retail inflation, measured by the Consumer Price Index (CPI), stood at 3.61% in February 2025—below the RBI’s 4% target—driven by a sharp correction in food prices and easing crude oil prices. The MPC noted a “decisively positive” outlook for food inflation, bolstered by robust kharif arrivals and record wheat production forecasts for the rabi season.

However, growth concerns loom large. India’s GDP growth slowed to 6.5% in FY25, the weakest pace since the pandemic, prompting the RBI to prioritize economic stimulus over inflation control. The revised FY26 GDP growth forecast of 6.5% reflects these challenges, with quarterly projections as follows:

- Q1 FY26: 6.5%

- Q2 FY26: 6.7%

- Q3 FY26: 6.6%

- Q4 FY26: 6.3%

Shift to Accommodative Stance: What It Means for India

The RBI’s shift from a neutral stance to an accommodative stance 2025 is a game-changer. A neutral stance offers flexibility to either raise or lower rates based on economic conditions, while an accommodative stance signals a clear intent to ease monetary conditions to support growth. Governor Malhotra clarified that this shift pertains to future rate actions, not liquidity management, dispelling any confusion among market participants.

Implications of the Accommodative Stance

- Lower Borrowing Costs: A repo rate of 6% reduces the cost of funds for banks, which could translate into cheaper loans for consumers and businesses. Home loans, auto loans, and personal loans are expected to see lower EMIs, boosting demand in rate-sensitive sectors.

- Boost to Investment: With borrowing costs declining, businesses may ramp up capital expenditure (capex), particularly in infrastructure and manufacturing, supporting the government’s “Make in India” initiative.

- Support for Consumption: The accommodative stance, combined with tax relief measures from the Union Budget 2025-26, aims to revive urban consumption, which has shown signs of weakening amid global uncertainty.

Analysts predict an additional 50-75 bps of rate cuts in FY26, potentially bringing the repo rate to 5.25%-5.5% by March 2026, contingent on inflation trends and global developments.

Impact on Key Sectors

The RBI MPC repo rate cut and accommodative stance are poised to influence various sectors in India. Here’s a breakdown:

1. Banking and NBFCs

Lower repo rates enhance liquidity in the banking system, enabling banks and non-banking financial companies (NBFCs) to offer competitive lending rates. However, tight liquidity conditions in recent months may delay full transmission to deposit and lending rates, as noted by ICRA’s Chief Economist Aditi Nayar.

2. Real Estate

The real estate sector, a key beneficiary of lower interest rates, is expected to see a revival in demand. NAREDCO President G Hari Babu hailed the decision as a “timely and positive step,” predicting improved affordability for homebuyers and a push for developers to launch new projects.

3. Automotive Industry

With vehicle loan rates likely to decline, the automotive sector could witness a pickup in sales, especially in the two-wheeler and passenger vehicle segments, which have faced moderation in demand.

4. Exports and Manufacturing

While the repo rate cut supports domestic manufacturing, the tariff turmoil India poses a challenge for export-oriented industries. The RBI aims to offset this by ensuring ample liquidity and encouraging domestic demand to compensate for export losses.

Market Reactions and Investor Sentiment

Despite the RBI MPC repo rate cut being widely anticipated, Indian stock markets displayed a muted response on April 9, 2025. The Nifty Bank index fell nearly 1%, with PSU banks like SBI and Bank of Baroda declining by 2%. Gold loan NBFCs, such as Muthoot Finance and IIFL Finance, saw sharper drops of up to 9% after the RBI hinted at stricter regulations for gold-backed loans.

Analysts attribute this subdued reaction to market uncertainty April 2025, driven by global equity sell-offs and fears of U.S. tariff impacts. However, experts like Anil Rego of Right Horizons remain optimistic, suggesting that the accommodative stance and rural demand revival could support rate-sensitive and domestic-focused stocks in the medium term.

RBI’s Broader Strategy: Liquidity and Forex Management

Beyond the repo rate cut, the RBI has injected over $80 billion into the banking system in the past two months through measures like bond purchases, forex swaps, and variable rate repo auctions. Governor Malhotra reiterated the central bank’s commitment to maintaining “sufficient” reserves and intervening in the forex market only during excessive rupee volatility, rather than targeting a specific exchange rate. As of January 31, 2025, India’s foreign exchange reserves stood at $630.6 billion, providing a robust import cover of over 10 months.

What Lies Ahead for India’s Economy?

The RBI’s April 9, 2025, policy reflects a delicate balancing act between fostering growth and managing inflation risks. With CPI inflation projected at 4% for FY26—within the RBI’s 2-6% target range—the central bank has room to prioritize growth. Quarterly inflation forecasts are:

- Q1 FY26: 3.6%

- Q2 FY26: 3.9%

- Q3 FY26: 3.8%

- Q4 FY26: 4.4%

However, uncertainties remain high. The tariff turmoil India and potential weather-related supply shocks could disrupt this trajectory. The next MPC meeting, scheduled for June 4-6, 2025, will be crucial in gauging the monsoon’s impact and refining the rate cut cycle.

Expert Opinions

- Madan Sabnavis, Chief Economist, Bank of Baroda: “The RBI’s confidence in cutting rates amid tariff turmoil is commendable. We may see the repo rate drop to 5.5% by March 2026 if inflation remains benign.”

- Sonal Varma, Nomura: “With inflation at target, the MPC’s focus is squarely on supporting growth against U.S. tariff risks.”

A Proactive Step Toward Economic Resilience

The RBI MPC’s decision to cut the repo rate by 25 bps to 6% on April 9, 2025, and shift to an accommodative stance 2025 underscores its commitment to safeguarding India’s economic growth amid market uncertainty April 2025. While the tariff turmoil India poses challenges, the central bank’s proactive measures—rate cuts, liquidity infusion, and a growth-focused stance—signal a robust response to global and domestic headwinds. For businesses, consumers, and investors, this move offers hope of lower borrowing costs and renewed economic momentum, though its full impact will depend on how effectively banks transmit these benefits.

Frequently Asked Questions

Q: What is the new repo rate?

A: The new repo rate is 6%.

Q: Why did the RBI cut the repo rate?

A: The RBI cut the repo rate to address market uncertainty, support economic growth, and boost liquidity.

Q: What does the shift to an accommodative stance mean?

A: The shift to an accommodative stance indicates the RBI’s willingness to support economic growth through monetary policy measures.

Q: How will the rate cut impact the economy?

A: The rate cut is expected to boost economic growth, increase credit demand, and improve liquidity in the system.

Q: Will the RBI consider further rate cuts?

A: The RBI’s accommodative stance suggests that it may consider further rate cuts or other measures to support economic growth.

-

NCC Shares Crash 10% After NHAI Bans Firm from Tenders for Two Years

-

Hungary and Slovakia Halt Diesel Exports to Ukraine Amid Oil Transit Dispute: What It Means for Europe’s Energy Future

-

Arrest Of Britain’s Ex-Prince Andrew Sparks Global Outrage: What Really Happened and Why It Matters

-

Newgen Software Share Price Surges 18% After Q3 FY26 Results