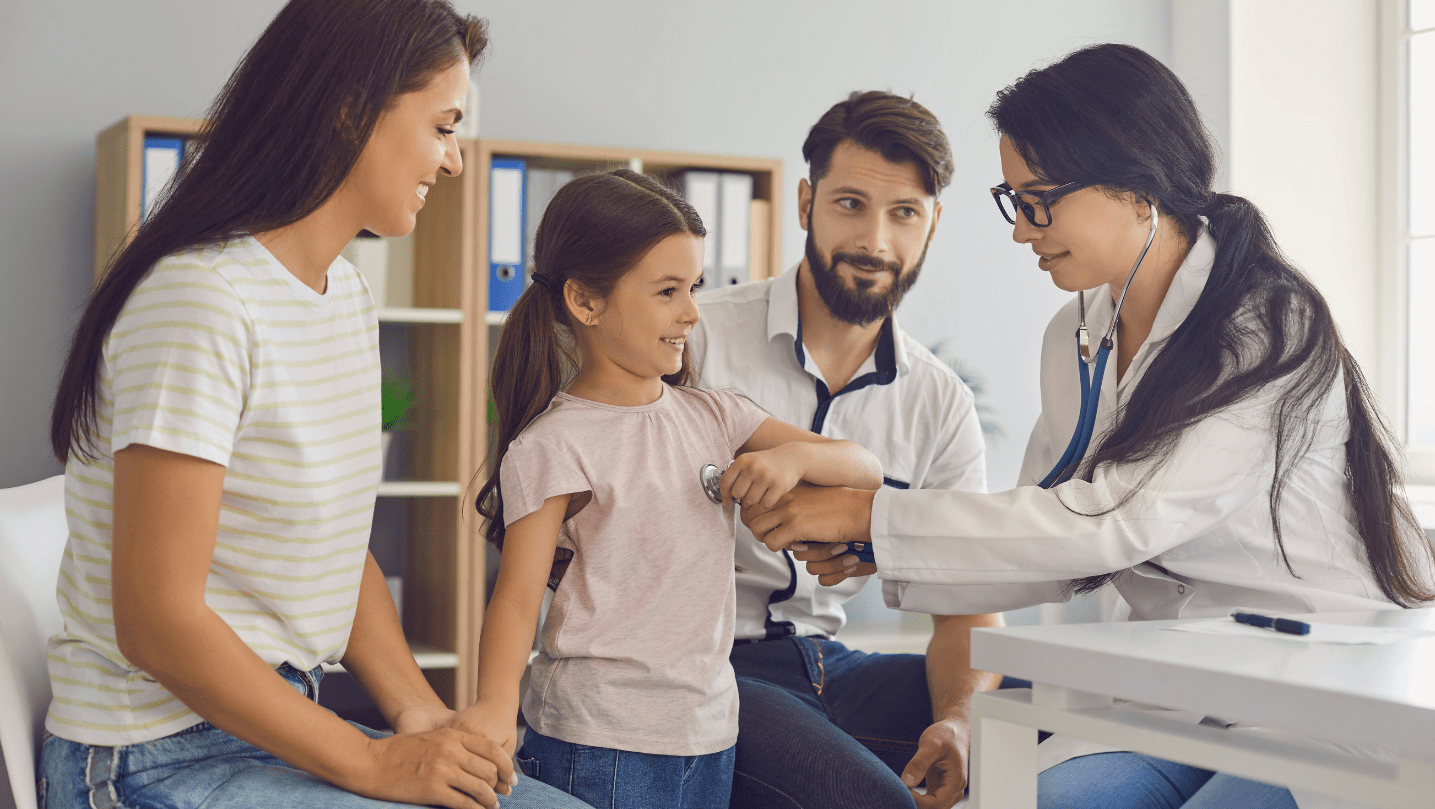

“Wondering when to buy health insurance? Discover the ideal age to get coverage, key factors to consider, and latest trends in India. Learn about premiums, tax benefits, and avoiding common mistakes. Secure your health & finances today! “

In today’s fast-paced world, where medical costs are skyrocketing and lifestyle diseases are on the rise, securing a health insurance policy has become a necessity rather than a luxury. With India witnessing rapid medical inflation- estimated at 14% annually according to a 2024 PwC report- having a robust health insurance plan is critical for financial security and peace of mind. But a question that often lingers in the minds of many is: At what age should you buy health insurance in India, and what factors should you consider?

The benefits of buying early, and the key things to keep in mind while choosing the right plan. Whether you’re a young professional, a middle-aged breadwinner, or a senior citizen, this guide will help you make an informed decision.

Why Health Insurance Matters

Before we explore the ideal age to buy health insurance, let’s understand why it’s so crucial in the Indian context. According to the Health Insurance Consumer Pulse Survey 2024 by PwC, only 37% of Indians are covered by private health insurance, leaving a significant portion of the population vulnerable to out-of-pocket medical expenses. With healthcare costs projected to rise further due to advanced treatments and increasing demand for quality care, a medical insurance policy acts as a safety net against financial strain.

The Insurance Regulatory and Development Authority of India (IRDAI) has also made strides to make health insurance more accessible. As of April 1, 2024, there’s no upper age limit for purchasing health insurance, a game-changer for senior citizens. However, starting early still offers unmatched advantages. Let’s break it down.

The Ideal Age to Buy Health Insurance: When Should You Start?

There’s no one-size-fits-all answer to the question of the perfect age to buy a health insurance policy, but experts unanimously agree that the earlier, the better. Here’s why different life stages matter when it comes to purchasing health insurance in India:

1. In Your 20s: The Golden Age to Begin

Your 20s are often considered the best time to invest in a health insurance plan. At this age, you’re typically in good health, free from pre-existing conditions, and have minimal financial responsibilities. Here’s why starting early works:

- Lower Premiums: Younger individuals are seen as low-risk by insurers, resulting in affordable premiums. For instance, a 25-year-old buying a ₹10 lakh health insurance policy might pay ₹6,000–₹8,000 annually, compared to ₹15,000–₹20,000 for the same coverage at age 40.

- No Pre-Existing Conditions: Most people in their 20s don’t have chronic illnesses, meaning no waiting periods or coverage exclusions.

- Cumulative Bonus: Insurers reward claim-free years with a No Claim Bonus (NCB), increasing your sum insured without hiking premiums. Starting early lets you build this bonus over time.

- Future Planning: If you plan to start a family, early investment allows you to serve waiting periods for maternity benefits (typically 9–24 months).

Real-World Example: A quote from Policybazaar shows that a 26-year-old non-smoker in Mumbai can get a ₹15 lakh family floater plan for as low as ₹9,500 annually, covering basic hospitalization and OPD expenses.

2. In Your 30s: Balancing Family and Health Needs

By your 30s, life often gets busier with career growth, marriage, and kids. This is another excellent time to buy a health insurance policy, especially a family floater plan, if you haven’t already. Here’s why:

- Comprehensive Coverage: At this age, you might need coverage for dependents (spouse, children, or parents), making family plans cost-effective.

- Lifestyle Diseases: Sedentary lifestyles and stress can lead to early onset of conditions like diabetes or hypertension. A health insurance plan ensures you’re covered.

- Tax Benefits: Under Section 80D of the Income Tax Act, you can claim deductions up to ₹25,000 (or ₹50,000 for senior citizens) on premiums, a perk that’s more meaningful when you’re earning well.

Stat Alert: According to Forbes Advisor India (2024), 65% of Indians in their 30s are now opting for digital channels to buy health insurance online, reflecting a shift toward convenience and awareness.

3. In Your 40s: A Critical Checkpoint

If you’ve delayed buying health insurance, your 40s are a wake-up call. Health risks increase, and premiums rise, but it’s still not too late. Key reasons to act now:

- Rising Health Risks: Age-related ailments like arthritis or heart issues may begin to surface, making coverage essential.

- Higher Sum Insured: Medical costs in metro cities (e.g., Mumbai, Delhi) can easily exceed ₹10–20 lakh for critical treatments. A higher sum insured becomes vital.

- Pre-Entry Medical Checks: Many insurers require health checkups after age 45, which could lead to premium loading or exclusions if issues are detected.

Tip: Opt for plans with no upper age limit and lifelong renewability, such as Care Health Insurance’s Care Plus, introduced in 2025.

4. In Your 50s and Beyond: Senior Citizen Plans

For those over 50, senior citizen health insurance policies are tailored to address age-specific needs. Thanks to IRDAI’s 2024 ruling, there’s no maximum age limit, so even an 80-year-old can buy a new policy. However:

- Higher Premiums: A ₹10 lakh policy might cost ₹25,000–₹40,000 annually due to higher risk.

- Pre-Existing Diseases: Coverage for conditions like diabetes or hypertension often comes with a 1–3-year waiting period.

- Co-Payment: Some plans require you to bear 10–30% of the claim amount, increasing out-of-pocket costs.

Data Point: The Mordor Intelligence Report 2025 predicts that senior citizen health insurance penetration will rise to 25% by 2030, driven by an aging population and rising awareness.

Things to Keep in Mind When Buying Health Insurance

Choosing the right health insurance policy goes beyond just picking an age. Here are the top factors to consider to ensure you get the best coverage tailored to your needs:

1. Coverage and Sum Insured

- What to Check: Ensure the plan covers hospitalization, pre- and post-hospitalization expenses (60–90 days), daycare procedures, and ambulance costs.

- Ideal Sum Insured: In 2025, experts recommend a minimum of ₹10–15 lakh for metro residents and ₹5–10 lakh for non-metro areas, given medical inflation.

- Modern Treatments: Look for coverage of advanced procedures like robotic surgery or stem cell therapy, which are increasingly common.

2. Premium Affordability

- Compare premiums across insurers using platforms like Policybazaar or ACKO. A low premium might mean limited coverage, so balance cost with benefits.

- Pro Tip: Multi-year plans (2–3 years) often offer discounts and protect against premium hikes.

3. Network Hospitals

- Opt for a plan with a wide network of cashless hospitals near your location. As of 2025, top insurers like Niva Bupa and Star Health boast over 20,000 network hospitals across India.

4. Waiting Periods

- Pre-existing diseases (PEDs) typically have a waiting period of 1–3 years. Buying early reduces this burden.

- Maternity benefits or critical illness riders also have waiting periods—plan accordingly.

5. No Claim Bonus (NCB)

- A claim-free year can boost your sum insured by 10–50% without extra cost. Starting young maximizes this benefit over decades.

6. Add-Ons and Riders

- Customize your policy with riders like critical illness cover, maternity benefits, or OPD coverage. Note that these increase premiums but enhance protection.

- Example: A ₹5 lakh policy with a critical illness rider might add ₹2,000–₹3,000 to your annual premium.

7. Claim Settlement Ratio (CSR)

- Choose insurers with a CSR above 90%. In 2024–25, SBI General Insurance reported a CSR of 94%, while Care Health Insurance stood at 92%, per IRDAI data.

8. Co-Payment and Sub-Limits

- Avoid plans with high co-payment clauses (e.g., 20–30%) or sub-limits on room rent, as they increase out-of-pocket expenses.

- Look for “no room rent capping” options for flexibility during hospitalization.

9. Tax Benefits

- Leverage Section 80D deductions: ₹25,000 for self/family (below 60) and ₹50,000 for senior citizens. This reduces your taxable income significantly.

10. Policy Flexibility

- Check for lifelong renewability and portability options to switch insurers without losing benefits.

Latest Trends in Health Insurance

The health insurance landscape in India is evolving rapidly. Here’s what’s new:

- Digital Adoption: Over 65% of policies are now purchased online, per Mordor Intelligence, with AI-driven tools helping customize plans.

- IRDAI Guidelines: From January 2025, insurers must cover genetic disorders, mental health, and age-related conditions, making plans more inclusive.

- Rising Premiums: Medical inflation has pushed premiums up by 8–10% in 2025, reinforcing the need to lock in rates early.

- Telemedicine Coverage: Post-COVID, most plans now include unlimited e-consultations, a boon for remote areas.

Common Myths About Health Insurance Debunked

- “I’m Young and Healthy, I Don’t Need It”: Accidents and sudden illnesses don’t discriminate by age. Early investment saves money long-term.

- “Employer Insurance Is Enough”: Corporate plans lapse when you switch jobs, leaving you uncovered.

- “It’s Too Expensive”: Affordable plans start at ₹20–₹30 per day, as per ACKO’s 2025 offerings.

How to Buy Health Insurance

- Assess Your Needs: Consider age, family size, location, and health history.

- Compare Online: Use platforms like Policybazaar, Coverfox, or insurer websites for quotes.

- Read the Fine Print: Check exclusions, waiting periods, and sub-limits.

- Consult an Advisor: For complex needs, seek expert advice (many platforms offer free consultations).

- Buy and Renew: Opt for a multi-year plan and renew on time to avoid lapses.

Act Now for a Healthier Tomorrow

So, at what age should you buy a health insurance policy? The short answer: as soon as you can. Starting in your 20s offers the best value, but every decade has its merits. With no upper age limit and rising healthcare costs, there’s no excuse to delay. Prioritize comprehensive coverage, affordable premiums, and a trusted insurer to safeguard your health and finances.

Take charge today—compare health insurance plans, evaluate your needs, and secure your future. After all, health is wealth, and a good medical insurance policy ensures you keep both intact.

-

The Supabase India Ban Explained: Who’s Affected, Why It Happened, and What Comes Next

-

Geopolitical Shock: Bitcoin Tumbles Under $64K Following US-Israel Military Strike on Iran

-

New EPFO Rule 2026: You Can Now Withdraw 100% of Your PF Balance Without Resigning — Here’s How

-

Is Your Money Safe in Fino Payments Bank After CEO Rishi Gupta’s Shocking Arrest?