In today’s fast-paced world, financial needs can arise unexpectedly. Whether it’s for medical emergencies, education, or personal expenses, having access to quick and easy loans can be a lifesaver. In India, several types of loans are designed to be easily accessible, with minimal documentation and quick disbursal times. This blog post will explore the easiest loans to get in India, providing detailed information on each type, including eligibility criteria, interest rates, and application processes.

1. Personal Loans

Overview: Personal loans are unsecured loans that do not require any collateral. They are versatile and can be used for various purposes, such as medical emergencies, weddings, vacations, or debt consolidation.

Key Features:

- Loan Amount: Up to ₹50 lakh

- Interest Rates: 10.50% to 24% per annum

- Tenure: 12 to 84 months

- Processing Time: 24 to 48 hours

Top Providers:

- HDFC Bank: Offers personal loans with minimal documentation and quick disbursal.

- ICICI Bank: Known for its competitive interest rates and flexible repayment options.

- Bajaj Finserv: Provides high loan amounts with quick approval and disbursal.

Eligibility Criteria:

- Minimum age: 21 years

- Maximum age: 60 years

- Minimum income: ₹25,000 per month

- Employment status: Salaried or self-employed

- Fill out the online application form.

- Submit required documents (ID proof, address proof, income proof).

- Wait for verification and approval.

- Receive the loan amount in your bank account.

2. Instant Loan Apps

Overview: Instant loan apps have revolutionized the lending industry by providing quick and easy access to funds. These apps require minimal documentation and offer instant approval and disbursal.

Key Features:

- Loan Amount: ₹1,000 to ₹10 lakh

- Interest Rates: 10% to 36% per annum

- Tenure: 3 to 60 months

- Processing Time: 10 minutes to 24 hours

Top Apps:

- Moneyview: Offers loans up to ₹10 lakh with a quick disbursal process.

- KreditBee: Provides loans up to ₹5 lakh with flexible repayment options.

- Navi: Known for its low-interest rates and high loan amounts.

Eligibility Criteria:

- Minimum age: 18 years

- Minimum income: ₹10,000 per month

- Employment status: Salaried or self-employed

Application Process:

- Download the app from the Play Store or App Store.

- Register and fill out the application form.

- Upload required documents.

- Wait for approval and receive the loan amount instantly.

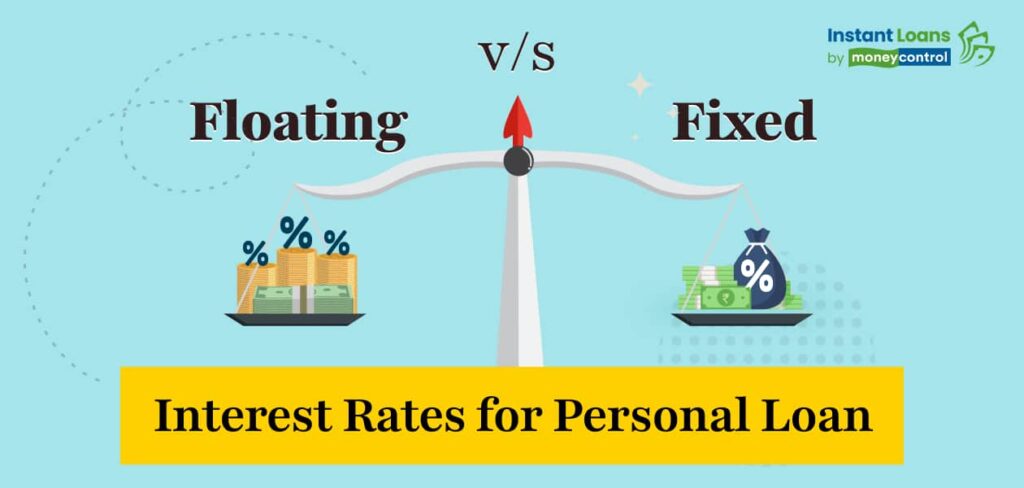

3. Gold Loans

Overview: Gold loans are secured loans where borrowers pledge their gold ornaments as collateral. These loans are easy to obtain and offer quick disbursal.

Key Features:

- Loan Amount: Up to 75% of the gold’s market value

- Interest Rates: 7% to 15% per annum

- Tenure: 3 to 36 months

- Processing Time: 30 minutes to 1 hour

Top Providers:

- Muthoot Finance: Offers high loan amounts with quick processing.

- Manappuram Finance: Known for its competitive interest rates and flexible repayment options.

- HDFC Bank: Provides gold loans with minimal documentation and quick disbursal.

Eligibility Criteria:

- Minimum age: 18 years

- Ownership of gold ornaments

Application Process:

- Visit the lender’s branch with your gold ornaments.

- Fill out the application form and submit required documents.

- Get your gold evaluated.

- Receive the loan amount instantly.

4. Payday Loans

Overview: Payday loans are short-term loans designed to cover immediate financial needs until the next payday. These loans are easy to obtain and require minimal documentation.

Key Features:

- Loan Amount: ₹1,000 to ₹1 lakh

- Interest Rates: 1% to 2.5% per day

- Tenure: 7 to 30 days

- Processing Time: 15 minutes to 1 hour

Top Providers:

- EarlySalary: Offers quick payday loans with minimal documentation.

- mPokket: Provides small loan amounts with instant approval and disbursal.

- CASHe: Known for its flexible repayment options and quick processing.

Eligibility Criteria:

- Minimum age: 18 years

- Minimum income: ₹15,000 per month

- Employment status: Salaried or self-employed

Application Process:

- Download the app or visit the lender’s website.

- Register and fill out the application form.

- Upload required documents.

- Wait for approval and receive the loan amount instantly.

5. Credit Card Loans

Overview: Credit card loans are pre-approved loans offered to credit cardholders based on their credit limit and repayment history. These loans are easy to obtain and offer quick disbursal.

Key Features:

- Loan Amount: Up to the credit limit

- Interest Rates: 12% to 24% per annum

- Tenure: 6 to 48 months

- Processing Time: Instant

Top Providers:

- HDFC Bank: Offers credit card loans with competitive interest rates and flexible repayment options.

- ICICI Bank: Known for its quick approval and disbursal process.

- SBI Card: Provides high loan amounts with minimal documentation.

Eligibility Criteria:

- Must be a credit cardholder

- Good credit score and repayment history

Application Process:

- Log in to your credit card account online.

- Check your eligibility for a loan.

- Apply for the loan and select the desired amount and tenure.

- Receive the loan amount instantly.

6. Two-Wheeler Loans

Overview: Two-wheeler loans are designed to help individuals purchase motorcycles or scooters. These loans are easy to obtain and offer quick disbursal.

Key Features:

- Loan Amount: Up to 100% of the vehicle’s on-road price

- Interest Rates: 9% to 15% per annum

- Tenure: 12 to 48 months

- Processing Time: 24 to 48 hours

Top Providers:

- HDFC Bank: Offers two-wheeler loans with minimal documentation and quick disbursal.

- Bajaj Finserv: Known for its competitive interest rates and flexible repayment options.

- ICICI Bank: Provides high loan amounts with quick approval and disbursal.

Eligibility Criteria:

- Minimum age: 18 years

- Minimum income: ₹10,000 per month

- Employment status: Salaried or self-employed

Application Process:

- Visit the lender’s website or branch.

- Fill out the application form and submit required documents.

- Wait for verification and approval.

- Receive the loan amount in your bank account.

7. Education Loans

Overview: Education loans are designed to help students finance their higher education. These loans are easy to obtain and offer quick disbursal.

Key Features:

- Loan Amount: Up to ₹50 lakh

- Interest Rates: 8% to 15% per annum

- Tenure: 5 to 15 years

- Processing Time: 7 to 15 days

Top Providers:

- State Bank of India: Offers education loans with minimal documentation and quick disbursal.

- HDFC Bank: Known for its competitive interest rates and flexible repayment options.

- ICICI Bank: Provides high loan amounts with quick approval and disbursal.

Eligibility Criteria:

- Admission to a recognized educational institution

- Co-applicant with a stable income

Application Process:

- Visit the lender’s website or branch.

- Fill out the application form and submit required documents.

- Wait for verification and approval.

- Receive the loan amount in your bank account.

8. Agricultural Loans

Overview: Agricultural loans are designed to help farmers finance their agricultural activities. These loans are easy to obtain and offer quick disbursal.

Key Features:

- Loan Amount: Up to ₹50 lakh

- Interest Rates: 7% to 12% per annum

- Tenure: 1 to 7 years

- Processing Time: 7 to 15 days

Top Providers:

- State Bank of India: Offers agricultural loans with minimal documentation and quick disbursal.

- HDFC Bank: Known for its competitive interest rates and flexible repayment options.

- ICICI Bank: Provides high loan amounts with quick approval and disbursal.

Eligibility Criteria:

- Minimum age: 18 years

- Ownership of agricultural land

Application Process:

- Visit the lender’s website or branch.

- Fill out the application form and submit required documents.

- Wait for verification and approval.

- Receive the loan amount in your bank account.

Minimum Credit Score Required For Loan Approval

The minimum credit score required for loan approval can vary depending on the type of loan and the lender’s policies. However, here are some general guidelines:

1. Personal Loans

- Minimum Credit Score: Typically around 650-700

- Note: Some lenders may approve loans for scores as low as 600, but the interest rates might be higher.

2. Home Loans

- Minimum Credit Score: Generally 700 and above

- Note: A score of 750 or higher can help you secure better interest rates and terms.

3. Auto Loans

- Minimum Credit Score: Around 600-650

- Note: Higher scores can lead to better interest rates and loan terms.

4. Credit Card Loans

- Minimum Credit Score: Usually 650 and above

- Note: Premium credit cards may require a score of 750 or higher.

5. Gold Loans

- Minimum Credit Score: Not typically required

- Note: Since gold loans are secured by collateral, credit scores are less critical.

6. Education Loans

- Minimum Credit Score: Around 650-700

- Note: Having a co-applicant with a good credit score can improve approval chances.

7. Instant Loan Apps

- Minimum Credit Score: Varies widely, often around 600-650

- Note: Some apps may approve loans for lower scores but with higher interest rates.

8. Payday Loans

- Minimum Credit Score: Not typically required

- Note: These loans focus more on your current income and employment status.

Tips to Improve Your Credit Score:

- Pay bills on time: Timely payments can significantly boost your score.

- Reduce debt: Keep your credit card balances low.

- Check your credit report: Regularly review your credit report for errors and get them corrected.

- Limit new credit inquiries: Too many inquiries can negatively impact your score.

How to Improve Chances of Loan Approval

Improving your chances of loan approval involves several key steps. Here are some practical tips to help you secure a loan more easily:

1. Maintain a Good Credit Score

Your credit score is one of the most critical factors lenders consider. A higher credit score indicates that you are a responsible borrower.

- Pay bills on time: Ensure all your bills, including credit card payments, are paid on time.

- Reduce debt: Keep your credit card balances low and pay off any outstanding debts.

- Check your credit report: Regularly review your credit report for any errors and get them corrected.

2. Provide Accurate and Complete Information

Ensure that all the information you provide in your loan application is accurate and complete.

- Double-check details: Verify all personal and financial details before submitting your application.

- Submit all required documents: Make sure you provide all necessary documents, such as ID proof, address proof, and income proof.

3. Choose the Right Loan Product

Select a loan product that matches your financial situation and needs.

- Compare options: Look at different lenders and loan products to find the best fit for you.

- Understand terms: Be clear about the loan terms, including interest rates, tenure, and repayment options.

4. Show Stable Income and Employment

Lenders prefer borrowers with a stable income and employment history.

- Provide proof of income: Submit salary slips, bank statements, or income tax returns as proof of income.

- Highlight job stability: If you have been with your current employer for a long time, it can positively impact your application.

5. Reduce Existing Debt

Having too much existing debt can negatively affect your loan approval chances.

- Pay off debts: Try to pay off existing loans or credit card balances before applying for a new loan.

- Avoid new debt: Refrain from taking on new debt just before applying for a loan.

6. Apply for a Reasonable Loan Amount

Requesting a loan amount that is too high compared to your income can lead to rejection.

- Calculate affordability: Use loan calculators to determine how much you can afford to borrow and repay comfortably.

- Be realistic: Apply for a loan amount that aligns with your financial situation.

7. Consider a Co-Applicant

Having a co-applicant with a good credit score and stable income can improve your chances of approval.

- Choose wisely: Select a co-applicant who has a strong financial profile.

- Share responsibility: Ensure both parties understand their responsibilities and obligations.

8. Build a Relationship with the Lender

Having an existing relationship with the lender can be beneficial.

- Maintain accounts: Keep savings or fixed deposit accounts with the lender.

- Use services: Utilize other banking services offered by the lender to build a positive relationship.

9. Prepare a Strong Application

A well-prepared application can make a significant difference.

- Be organized: Gather all necessary documents and information before starting the application process.

- Write a cover letter: If applicable, include a cover letter explaining the purpose of the loan and how you plan to repay it.

10. Seek Professional Advice

If you’re unsure about the process, consider seeking advice from a financial advisor.

- Get expert help: A financial advisor can guide you through the application process and help you improve your financial profile.

Conclusion

In conclusion, obtaining a loan in India has become easier than ever, thanks to the variety of loan options available. Whether you need funds for personal expenses, education, or agricultural activities, there is a loan option that suits your needs. By understanding the key features, eligibility criteria, and application processes of these loans, you can make an informed decision and secure the funds you need quickly and easily.

Frequently Asked Questions (FAQs)

1. What is a credit score, and why is it important for loan approval?

A credit score is a numerical representation of your creditworthiness, based on your credit history. Lenders use it to assess the risk of lending to you. A higher credit score indicates a lower risk, improving your chances of loan approval and better interest rates.

2. What is the minimum credit score required for a personal loan?

The minimum credit score for a personal loan typically ranges from 650 to 700. However, some lenders may approve loans for scores as low as 600, though the interest rates might be higher.

3. How can I check my credit score?

You can check your credit score through credit bureaus like CIBIL, Experian, or Equifax. Many banks and financial institutions also offer free credit score checks through their websites or mobile apps.

4. What factors affect my credit score?

Several factors affect your credit score, including payment history, credit utilization ratio, length of credit history, types of credit accounts, and recent credit inquiries.

5. How can I improve my credit score?

To improve your credit score, pay your bills on time, reduce outstanding debt, avoid applying for multiple loans or credit cards simultaneously, and regularly check your credit report for errors.

6. Can I get a loan if I have a low credit score?

Yes, you can still get a loan with a low credit score, but it may come with higher interest rates and stricter terms. Secured loans, such as gold loans or loans with a co-applicant, can improve your chances of approval.

7. What documents are typically required for a loan application?

Commonly required documents include identity proof (Aadhaar card, PAN card), address proof (utility bills, rental agreement), income proof (salary slips, bank statements), and employment proof (employment letter, business registration).

8. How does my employment status affect my loan approval chances?

Lenders prefer borrowers with stable employment and a steady income. Being employed with a reputable company or having a successful business can positively impact your loan approval chances.

9. What should I do if my loan application is rejected?

If your loan application is rejected, review the reasons provided by the lender. Work on improving your credit score, reducing existing debt, and ensuring all information in your application is accurate before reapplying.

10. Can having a co-applicant improve my chances of loan approval?

Yes, having a co-applicant with a good credit score and stable income can significantly improve your chances of loan approval. The co-applicant shares the responsibility of repaying the loan, reducing the lender’s risk.

-

Nothing Phone 4a and 4a Pro: Snapdragon 7 Gen 4, Gaming Benchmarks, Connectivity Features and 6 Years Android Updates for India

Nothing’s latest Phone 4a and 4a Pro, launched on March 5, 2026, bring fresh vibes to India’s competitive

-

War Premium, Sanctions, and Discounted Crude: Why India’s Rush Back to Russian Oil Is More Complex Than You Think

India had almost ditched Russian oil — until Iran’s war changed everything overnight. Now Washington is quietly handing

-

BoB Raises ₹10,000 Crore for Green Infrastructure — Which Projects Will Get Funded and Who Really Benefits?

BoB’s massive ₹10,000 crore green bond bonanza: First-ever in India! But wait—which secret solar farms, wind giants, or

-

Oracle Shocks the Tech World Again — Is Larry Ellison’s AI Pivot Costing 30,000 Their Jobs?

Oracle is planning to fire up to 30,000 employees — its biggest layoff ever. But here’s the twist:

-

Diesel Prices Surge in India: Hormuz Halt Puts Spotlight on Reserves and Russian Supplies

Key Takeaway Iran’s declaration that the Strait of Hormuz is “closed” has sent global crude prices sharply higher,

With over 15 years of experience in Banking, investment banking, personal finance, or financial planning, Dkush has a knack for breaking down complex financial concepts into actionable, easy-to-understand advice. A MBA finance and a lifelong learner, Dkush is committed to helping readers achieve financial independence through smart budgeting, investing, and wealth-building strategies, Follow Dailyfinancial.in for practical tips and a roadmap to financial success!