Introduction

The HSBC Cashback Credit Card is a credit card that offers you cashback rewards on various categories of spending. Whether you are dining out, ordering food, buying groceries, or shopping online, you can earn cashback on your purchases with this card. You can also enjoy complimentary lounge access, partner offers, and contactless payments with this card. Here are some of the key features and benefits of the HSBC Cashback Credit Card:

- 10% cashback on all dining, food delivery and grocery spends, capped up to INR 1,000 per billing cycle.

- 1.5% unlimited cashback on all other spends, except for online wallet uploads and fuel purchases.

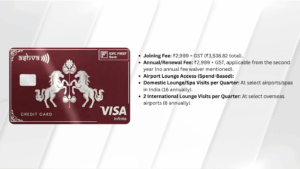

- 4 complimentary domestic lounge visits per year, one per quarter.

- Zero joining fee and INR 999 annual fee, which will be reversed if your total annual spend exceeds INR 200,000 .

- Various partner offers from BookMyShow, Tata CLiQ, Amazon, EazyDiner, Blinkit and PharmEasy .

- Visa Paywave technology for contactless payments.

- EMI facility for purchases with flexible tenure and interest rates.

- Complimentary 3-month PharmEasy Plus membership.

If you are looking for a credit card that gives you cashback on your everyday spending, the HSBC Cashback Credit Card might be the one for you. You can check your eligibility and apply online at HSBC website. You can also win an Amazon e-gift voucher worth INR 250 if you apply online and complete the video KYC process.

OTHER AMAZING OFFERS

Make transactions of minimum Rs 10,000 within first 30 days to get Amazon vouchers worth Rs 1000

5% discount on Amazon spendings of Rs 1,000 or above

Exclusive monthly offers on Amazon, Amazon pay, Blinkit, Easydinner, Pharmeasy etc.

Zero liability for lost cards

Emergency card replacement

HSBC Cashback Credit Card eligibility

According to the web search results, the eligibility criteria for HSBC Cashback Credit Card are:

- You must be aged between 18 to 65 years123.

- Your annual income must be at least INR 400,000 per annum (for salaried individuals).

- You must be an Indian resident.

- You must reside in any of the following cities: Bangalore, Chennai, Gurgaon, Hyderabad, Mumbai, New Delhi, Noida, and Pune.

HSBC Cashback Credit Card documents

The required documents for HSBC Cashback Credit Card are:

- A proof of your identity and address, such as Aadhar card, Voter card, etc.

- Your PAN card or Form 60.

- A copy of the front of your existing credit card and your latest credit card statement, if you have any.

- A copy of your latest salary slip and your last 3 months of bank statements showing salary credits, if you are a salaried employee in a private limited company.

Please note that this list is for reference purposes only. Additional documents may be requested from you during the process of credit card application.

HSBC Cashback Credit Card fees and charges

The fees and charges for HSBC Cashback Credit Card are as follows:

- Joining fee: Zero

- Annual fee: INR 999, which will be reversed if your total annual spend exceeds INR 200,000.

- Interest rate: 3.3% per month or 39.6% per annum.

- Cash advance fee: 2.5% of the transaction amount or INR 300, whichever is higher.

- Late payment fee: INR 400 for statement balance up to INR 500, INR 500 for statement balance between INR 500.01 and INR 5,000, INR 750 for statement balance between INR 5,000.01 and INR 20,000, and INR 950 for statement balance above INR 20,000.

- Overlimit fee: INR 500 per month.

- Cheque bounce fee: INR 350 per cheque.

- Card replacement fee: INR 100 per card.

- Foreign currency transaction fee: 3.5% of the transaction amount.

These are some of the main fees and charges for HSBC Cashback Credit Card. You can find more details on the HSBC website.

HSBC Cashback Credit Card rewards redemption

The HSBC Cashback Credit Card offers cashback rewards on various categories of spending. You can redeem your cashback rewards in the following ways:

- You can use your cashback rewards to pay your annual credit card renewal fees for your primary or additional HSBC credit card.

- You can redeem your cashback rewards for gift vouchers, gifts, charities, and airline miles from the HSBC Rewards Portal2. You need to login with your registered id and password, and filter out the categories as per your choice. You can also download and complete the redemption form, or call the phone banking numbers to redeem your rewards.

- You can also redeem your cashback rewards for Club Vistara points, InterMiles, British Airways Avios miles, or Etihad Airways miles by downloading and completing the redemption form, or by calling the phone banking numbers.

Please note that the redemption of any product or service is subject to the HSBC Terms and Conditions governing the Rewards Programme.

How to use HSBC Cashback Credit Card

You can use the HSBC Cashback Credit Card to make purchases in a cashless manner and earn cashback rewards on various categories of spending. Here are some of the ways you can use this card:

- You can use this card to pay for your dining, food delivery and grocery expenses and get 10% cashback on these transactions, capped up to INR 1,000 per billing cycle.

- You can also use this card to pay for your other online and offline purchases, except for online wallet uploads and fuel purchases, and get 1.5% unlimited cashback on these transactions.

- You can redeem your cashback rewards for gift vouchers, gifts, charities, airline miles, or annual credit card renewal fees from the HSBC Rewards Portal3. You can also redeem your cashback rewards for Club Vistara points, InterMiles, British Airways Avios miles, or Etihad Airways miles by downloading and completing the redemption form, or by calling the phone banking numbers.

- You can enjoy 4 complimentary domestic lounge visits per year, one per quarter, with this card12. You can also access various partner offers from BookMyShow, Tata CLiQ, Amazon, EazyDiner, Blinkit and PharmEasy.

- You can use the Visa Paywave technology to make contactless payments with your card. You can also convert your purchases into EMIs with flexible tenure and interest rates.

- You can pay a joining fee of INR 999 and an annual fee of INR 999, which will be reversed if your total annual spend exceeds INR 200,000.

These are some of the ways you can use the HSBC Cashback Credit Card to save money and enjoy benefits. If you want to apply for this card, you can check your eligibility and apply online at HSBC website.

What are the other benefits of the HSBC Cashback Credit Card?

The other benefits of the HSBC Cashback Credit Card are:

- You can enjoy 4 complimentary domestic lounge visits per year, one per quarter, with this card.

- You can access various partner offers from BookMyShow, Tata CLiQ, Amazon, EazyDiner, Blinkit and PharmEasy.

- You can use the Visa Paywave technology to make contactless payments with your card.

- You can convert your purchases into EMIs with flexible tenure and interest rates.

- You can get a complimentary 3-month PharmEasy Plus membership that gives you free delivery, extra cashback and discounts on medicines

HSBC Cashback Credit Card cashback limit

Yes, there is a limitation of cashback for the HSBC Cashback Credit Card. According to the web search results, you can get:

- 10% cashback on all dining, food delivery and grocery spends, capped up to INR 1,000 per billing cycle.

- 1.5% unlimited cashback on all other spends, except for online wallet uploads and fuel purchases.

This means that you can earn a maximum of INR 1,000 as cashback from the 10% category in a billing cycle, and there is no limit to the cashback amount that you can earn from the 1.5% category in a given month3. The cashback amount will be credited to your card account within 60 days from the end of the respective month.

HSBC Cashback Credit Card Charges form international Uses

The charges for international use of credit card depend on the type of transaction and the currency involved. According to the web search results, some of the charges that may apply are:

- Foreign currency conversion fee: This is a fee charged by the credit card issuer for converting the foreign currency transaction amount to Indian rupees. For HSBC Cashback Credit Card, this fee is 3.5% of the transaction amount.

- Dynamic currency conversion fee: This is a fee charged by the overseas merchant for converting the foreign currency transaction amount to Indian rupees at the point of sale. This fee may vary depending on the merchant and may be higher than the foreign currency conversion fee charged by the credit card issuer. It is advisable to choose to pay in the local currency instead of Indian rupees to avoid this fee.

- Cash advance fee: This is a fee charged by the credit card issuer for withdrawing cash from an ATM using your credit card. For HSBC Cashback Credit Card, this fee is 2.5% of the cash advance amount.

- ATM access fee: This is a fee charged by some other banks for using their ATMs abroad. This fee is over and above the cash advance fee charged by the credit card issuer. For HSBC Cashback Credit Card, this fee is INR 120 for non-HSBC ATMs.

- Interest charges: These are charges that apply to your credit card balance if you do not pay it in full by the due date. For HSBC Cashback Credit Card, the interest rate is 3.3% per month or 39.6% per annum.

Conclusion

The HSBC Cashback Credit Card is a credit card that offers you cashback rewards on various categories of spending. It is a card that can help you save money and enjoy benefits on your everyday expenses. Whether you are dining out, ordering food, buying groceries, or shopping online, you can earn cashback on your purchases with this card. You can also enjoy complimentary lounge access, partner offers, and contactless payments with this card. You can redeem your cashback rewards for gift vouchers, gifts, charities, airline miles, or annual credit card renewal fees from the HSBC Rewards Portal. You can also redeem your cashback rewards for Club Vistara points, InterMiles, British Airways Avios miles, or Etihad Airways miles by downloading and completing the redemption form, or by calling the phone banking numbers. You can pay a joining fee of INR 999 and an annual fee of INR 999, which will be reversed if your total annual spends, exceeds INR 200,000.

The HSBC Cashback Credit Card is a credit card that gives you cashback on your everyday spending. It is a card that can suit your lifestyle and budget. If you are looking for a credit card that offers you cashback rewards on various categories of spending, the HSBC Cashback Credit Card might be the one for you. You can check your eligibility and apply online at [HSBC website] or compare this card with other HSBC credit cards at [HSBC comparison page]. You can also win an Amazon e-gift voucher worth INR 250 if you apply online and complete the video KYC process

Frequently Asked Questions (FAQ)

- What is the HSBC Cashback Credit Card?

The HSBC Cashback Credit Card is a rewards credit card that allows you to earn cashback on your eligible purchases, providing you with a financial benefit for your spending.

- How does the cashback feature work?

You earn cashback on your card transactions, and the percentage or amount of cashback varies depending on the specific terms and conditions of the card. It’s typically a percentage of your eligible purchases.

- What types of purchases are eligible for cashback?

Eligible purchases usually include everyday spending on items like groceries, dining, shopping, and more. Specific details on eligible categories can be found in the card’s terms and conditions.

- Is there an annual fee for the HSBC Cashback Credit Card?

The annual fee for this card, if applicable, will be outlined in the terms and conditions. Some credit cards may have an annual fee, while others may offer fee waivers or promotional offers.

- How can I redeem the cashback I’ve earned?

Typically, you can redeem your cashback through your HSBC online account or by contacting HSBC customer service. The redemption process may vary, so it’s advisable to check the card’s terms and conditions for specific details.

- Can I use the cashback for anything I want?

Cashback earned with the HSBC Cashback Credit Card is generally versatile and can be used to offset your credit card balance or deposited into your bank account, depending on the card’s terms and conditions.

- Are there any restrictions on earning cashback?

Cashback cards usually have terms and conditions, including a maximum cashback limit or restrictions on certain purchases. Be sure to review these terms to understand how cashback is earned and any limitations.

- Is there a grace period for payments on this credit card?

HSBC Cashback Credit Card may offer a grace period during which you can pay your outstanding balance without incurring interest charges. Check your card’s terms for specific details.

- How do I apply for an HSBC Cashback Credit Card?

You can apply for the card online through the HSBC website or by visiting a local HSBC branch. The application process typically includes providing your financial information and meeting specific eligibility criteria.

- What additional benefits come with the HSBC Cashback Credit Card?

The card may offer additional perks, such as travel insurance, airport lounge access, or special discounts. These benefits can vary, so it’s important to review the card’s terms and conditions for a complete list of features.

-

Top 10 Gainers and Losers in Nifty50: Stocks to Watch on Monday, June 30, 2025

Nifty50, Bank Nifty, and Sensex predictions for June 30, 2025! Uncover top gainers, losers, and stocks to watch,

-

Why Car Leasing in India Is the Smart Choice for Tax Savings and Flexibility

Car leasing in India! Learn how to avail affordable lease programs, explore top deals like Hyundai Creta at

-

Top Benefits of HDFC Personal Loan: No Collateral, Up to ₹40 Lakh Funding

HDFC Personal Loan: Get up to ₹40L with 10-second disbursal, 10.50% p.a. rates, and no collateral. Explore features,

-

Kotak Mahindra Bank’s Debit Card Insurance Discontinuation Shocks Cardholders

Kotak Mahindra Bank previously provided complimentary insurance benefits with its debit cards, offered through United India Insurance Co.

-

IDBI Bank Debit Cards: Maximize Rewards and Insurance Protection

IDBI Bank offers a range of debit cards with varying insurance benefits tailored to meet diverse customer needs.

-

HDFC Life Sanchay Plus Review: Is This Savings Plan Worth Your Money?

HDFC Life Sanchay Plus: a savings plan with guaranteed returns, tax-free payouts, and flexible income options. Compare benefits,

-

Mastering Work-Life Balance: Secrets to Establishing Boundaries with Managers from Day One

How to set healthy workplace boundaries with managers from day one in India’s dynamic corporate world. Learn practical,

-

Are You Ready for Home Loan – Some Tips for Choosing the Best Home Loan?

Expert tips to choose the best bank home loan in India for 2025! Compare low interest rates, save

-

Big Spenders Beware: Why Is the Income Tax Department Targeting Credit Card Bills Over ₹1 Lakh

Why the Income Tax Department is eyeing credit card bills over ₹1 lakh in 2025! Learn how to