Missed an EMI? The "Silent" Rule That Could Save or Sink Your 2025 Financial Life

That ₹400 BNPL order could be blocking your ₹50 Lakh home loan. In 2025, a silent “SMA” timer marks you “high-risk” the moment midnight strikes—long before your score drops. Uncover the hidden credit trap 90% of Indians ignore and the crucial RBI protection you need right now.

What if I told you that the dreaded “CIBIL drop” after a missed EMI is no longer instant? There is a new, little-known 30-day “shield” that the RBI has quietly activated, yet millions of Indians are still panic-paying late fees they might not even owe. But here’s the catch: relying on this shield without knowing the one critical condition attached to it could red-flag your profile for a completely different reason—one that blocks you from your next job, not just your next loan.

The New Rules of Reputation

In 2025, your financial reputation is no longer just a number stored in a server; it is a digital passport that unlocks everything from your dream home to your next promotion. For years, the fear of a missed Equated Monthly Installment (EMI) has been the stuff of nightmares for the Indian middle class—a single slip-up crashing a hard-earned 750+ score overnight. But the landscape has shifted. The Reserve Bank of India (RBI) has rewritten the playbook with consumer-centric updates that every borrower must know.

However, this relief comes with hidden complexities. As digital lending explodes and AI-driven background checks become the norm in corporate India, the consequences of a “minor” default have mutated. It’s not just about a bank rejecting your loan anymore; it’s about a hiring manager pausing your offer letter or a “settled” status haunting your profile for seven years. This post uncovers the surprising, hidden realities of missed EMIs in 2025 and hands you the strategy to protect your financial future.

The 30-Day "Safety Shield": RBI’s Game-Changing Update

The biggest panic for any borrower is the immediate nosedive of their CIBIL score the moment an auto-debit bounces. In 2025, that fear is largely outdated thanks to the RBI's "30-Day Notice" regulation.

The "No Immediate Reporting" Rule

Previously, banks could report a default to credit bureaus instantly. Now, under the new borrower protection guidelines, lenders are mandated to follow a strict protocol before damaging your credit history. They must identify the bounce, send you a formal notification (via SMS/email), and—crucially—provide a 30-day grace period to clear the dues.

Why This Matters

- Technical Glitches: If your salary was delayed by a day or the server failed, you are no longer instantly penalized.

- The Critical Window: If you pay within this 30-day window, the "default" is generally not reported to CIBIL as a negative event impacting your score, though you may still owe internal late fees to the bank.

The Trap: Do not confuse "not reported" with "no consequence." If you ignore the formal notice and cross the 30-day line, the impact is severe. The late payment is then tagged, and because you ignored a formal regulatory notice, the damage to your score can be steeper—often dropping it by 50-70 points in one go.

The Silent Career Killer: Background Verification (BGV)

Most Indians assume their CIBIL report is private, visible only to them and banks. This is the most dangerous myth of 2025.

The Rise of Credit-Linked Hiring

While not mandatory for all jobs, employment credit checks have become standard practice in high-trust sectors. If you are applying for a role in BFSI (Banking, Financial Services, Insurance), regulatory compliance, or senior leadership in top MNCs, your credit report is fair game.

What Employers Look For

Employers aren't looking for a perfect 900 score. They are looking for integrity signals.

- Financial Stress: A candidate with multiple missed EMIs or high outstanding debt is viewed as a fraud risk, especially in roles handling company money or sensitive data.

- Behavioral Red Flags: A history of "willful default" (having money but not paying) suggests a lack of discipline that recruiters fear will translate into poor workplace performance.

Reality Check: You could ace the interview and have the perfect resume, but a messy repayment history could silently move your application to the "rejected" pile without you ever knowing why.

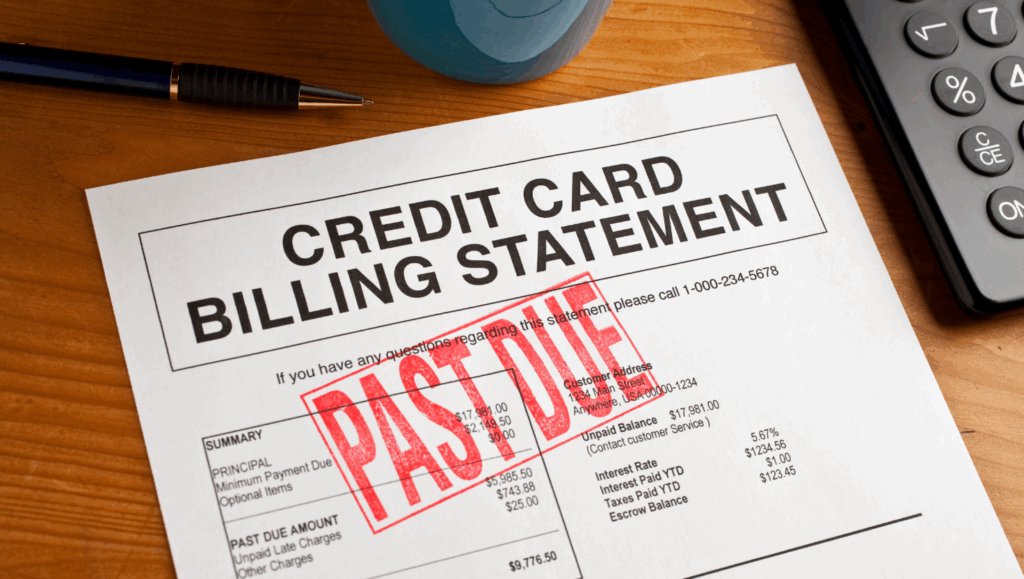

The "Settlement" Trap: Why Paying Less Costs More

When you miss multiple EMIs and unpaid interest piles up, recovery agents might offer you a "sweetheart deal": Pay 60% of what you owe, and we will close the loan. This is known as a One-Time Settlement (OTS).

The "Settled" vs. "Closed" Disaster

Accepting this offer is often a financial suicide mission for your creditworthiness.

- Closed Status: You paid every rupee owed. The account is marked "Closed." This is positive.

- Settled Status: You paid less than the total. The bank marks the account as "Settled." This flag acts as a warning beacon to all future lenders that you are a high-risk borrower who caused the bank a loss.

The Long-Term Damage

A "Settled" tag stays on your CIBIL report for 7 years. During this time, almost no Tier-1 bank will give you a home loan or car loan, regardless of how much your income grows. You are effectively blacklisted from the formal credit market for nearly a decade.

Your Right to Compensation: The ₹100/Day Rule

Here is a powerful right that few Indians exercise. If you clear your dues or spot an error (like a wrong late payment entry), the bank and credit bureau have a fixed timeline to update your records.

The Accountability Clock

- 15-Day Updates: Credit bureaus now process updates bi-monthly (every 15 days) rather than monthly, meaning corrections should happen faster.

- The Penalty: If you lodge a complaint regarding a discrepancy and it is not resolved within 30 days, the institution is liable to pay you compensation of ₹100 per day for every day of delay.

This rule, reinforced in recent RBI circulars, turns the table. You are no longer helpless; you are a consumer with enforceable rights to data accuracy.

Actionable Takeaways: Your Recovery Playbook

If you have missed an EMI or fear you might, execute this plan immediately:

- The "Grace Period" Sprint: If you miss the due date, check your SMS immediately. You likely have a 30-day window before it hits CIBIL. Pay it now, even if you have to borrow from a friend. The late fee (₹500-₹1000) is cheap compared to a score drop.

- Avoid "Settlement" at All Costs: If you are drowning in debt, ask for loan restructuring (extending tenure to lower EMI) rather than "settlement." Restructuring hurts your score less and for a shorter time than a "Settled" tag.

- Check Your "Employment Readiness": Before applying for jobs in finance or MNCs, download your free CIBIL report. If there are errors, file a dispute immediately. If there are valid defaults, be ready to explain them honestly during HR background checks.

- Use the "Goodwill" Approach: If you have a solid history and missed just one payment due to an emergency (medical/technical), write a "Goodwill Letter" to the bank. Ask them to remove the late entry as a courtesy. It works more often than you think.

Final Thought: The Currency of Trust

As we move deeper into 2025, the definition of "wealth" is evolving. It is no longer just about your bank balance or portfolio size; it is about your reliability index. With the inevitable integration of the Unified Lending Interface (ULI)—the successor to UPI for credit—lenders will soon have 360-degree visibility into your financial behaviour in real-time, not just monthly. The "30-day shield" gives you breathing room today, but the future belongs to those who treat their credit score with the same protectiveness as their reputation. The question isn't just "Can you afford the EMI?"; it's "Can you afford the digital footprint of missing it?" The choice, and the change, starts with your next notification.

With over 15 years of experience in Banking, investment banking, personal finance, or financial planning, Dkush has a knack for breaking down complex financial concepts into actionable, easy-to-understand advice. A MBA finance and a lifelong learner, Dkush is committed to helping readers achieve financial independence through smart budgeting, investing, and wealth-building strategies, Follow Dailyfinancial.in for practical tips and a roadmap to financial success!