” How RBI’s new gold loan rules impact borrowers. Learn about reduced LTV ratios, stricter KYC norms, and capped interest rates. Find tips to navigate these changes and secure a gold loan in 2023. Stay informed about the latest trends and regulations in India’s gold loan market.”

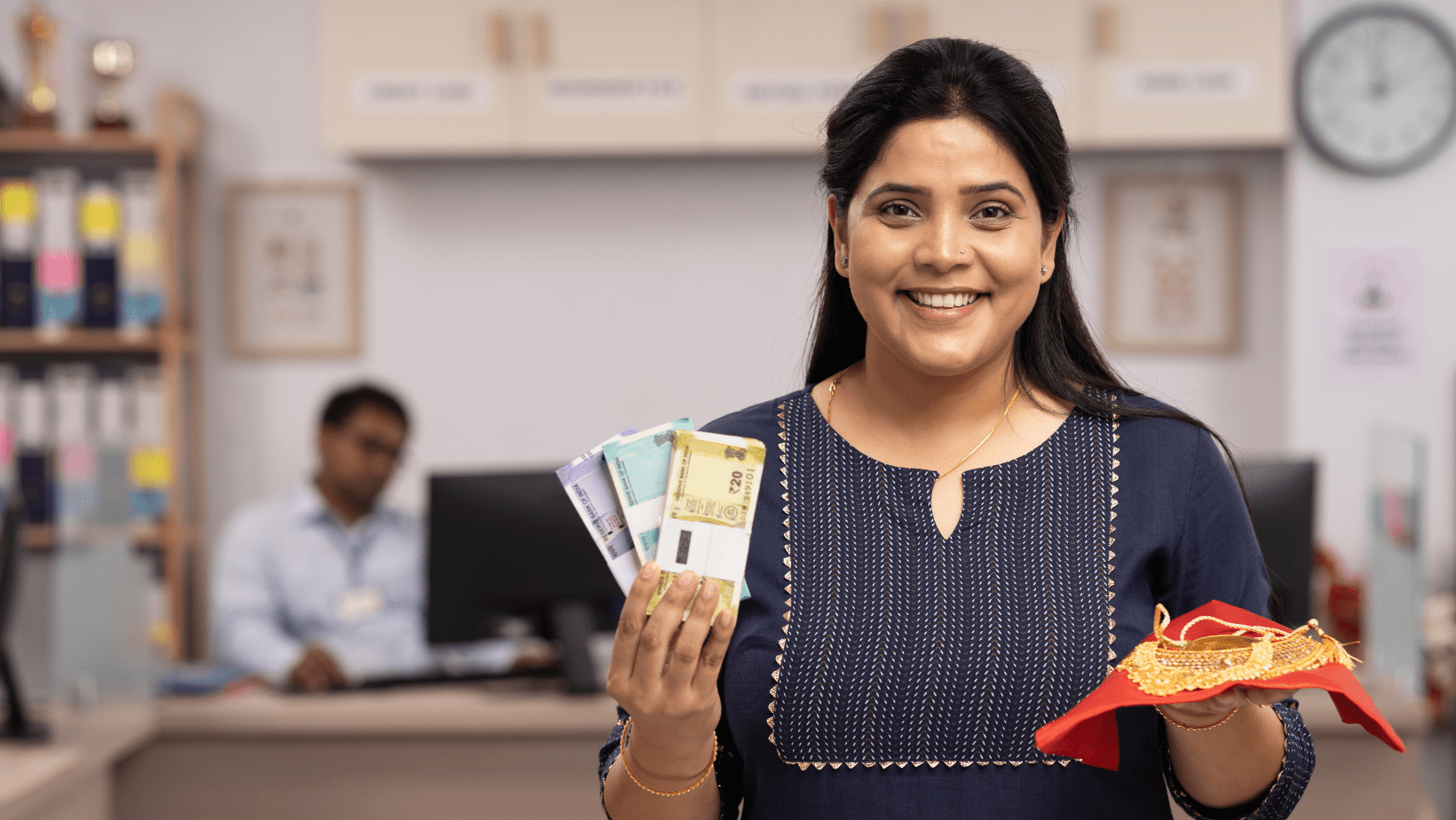

Gold loans have long been a popular financial product in India, offering a quick and easy way for individuals to access funds by pledging their gold ornaments as collateral. However, recent regulatory changes by the Reserve Bank of India (RBI) are set to make obtaining a gold loan more challenging. In this blog post, we will explore the reasons behind the RBI’s decision, the new rules, and their potential impact on borrowers and lenders.

What Are Gold Loans and Why Are They Popular?

Gold loans are secured loans where borrowers pledge their gold jewelry or ornaments as collateral to obtain funds from banks or non-banking financial companies (NBFCs). These loans are popular due to their quick processing, minimal documentation, and flexible repayment options. Borrowers can use the funds for various purposes, such as education, medical emergencies, business expansion, or personal expenses. According to a report by the World Gold Council, Indian households hold over 25,000 tonnes of gold, making it one of the largest gold markets globally.

The popularity of gold loans stems from their ease of access, minimal documentation, and quick disbursal. Unlike personal loans or credit cards, gold loans do not require a high credit score, making them an attractive option for individuals with limited credit history or low income. Additionally, gold loans typically come with lower interest rates compared to unsecured loans, as the lender’s risk is mitigated by the collateral.

Why the RBI is Tightening Gold Loan Rules

The RBI’s decision to tighten gold loan rules stems from several concerns identified during recent reviews and audits. These concerns include irregular practices in loan sourcing, appraisal, and valuation of gold, as well as inadequate due diligence and monitoring of loan usage. The central bank aims to ensure financial stability, curb unethical practices, and protect borrowers’ interests by implementing stricter regulations.

- Lower Loan-to-Value (LTV) Ratio:

The RBI has reduced the maximum Loan-to-Value (LTV) ratio for gold loans from 75% to 60%. This means borrowers can now only avail up to 60% of the gold’s market value as a loan, down from the previous 75%. For example, if your gold is valued at ₹1 lakh, you can now borrow only ₹60,000 instead of ₹75,000. - Stricter KYC Norms:

The RBI has mandated stricter Know Your Customer (KYC) requirements for gold loan applicants. Borrowers must now provide additional documentation, such as proof of income and address, to verify their identity and financial stability. - Increased Scrutiny of Gold Loan NBFCs:

Non-Banking Financial Companies (NBFCs) that specialize in gold loans are now subject to tighter regulatory oversight. The RBI has introduced stricter capital adequacy norms and reporting requirements to ensure these lenders maintain sufficient liquidity and manage risks effectively. - Capping Interest Rates:

To protect borrowers from exorbitant interest rates, the RBI has imposed a cap on the maximum interest rate that gold loan providers can charge. This move is expected to make gold loans more affordable for borrowers but may squeeze the profit margins of lenders.

How Will the RBI’s Move Impact Gold Loan Borrowers?

While the RBI’s tighter regulations are intended to create a more robust and transparent gold loan ecosystem, they may pose challenges for borrowers. Here’s how:

- Reduced Loan Amounts:

The lower LTV ratio means borrowers will receive smaller loan amounts for the same quantity of gold. This could be a significant drawback for individuals who rely on gold loans for large expenses, such as medical emergencies or business investments. - Increased Documentation:

Stricter KYC norms may make the loan application process more cumbersome, especially for individuals who lack proper documentation or have irregular income sources. - Limited Access for Low-Income Borrowers:

The new regulations could make it harder for low-income borrowers to access gold loans, as lenders may become more cautious about extending credit to high-risk individuals. - Potential Increase in Processing Time:

With increased scrutiny and regulatory compliance, the time taken to process gold loan applications may increase, delaying access to funds for borrowers in urgent need.

Impact on Lenders

Lenders, including banks and NBFCs, will need to invest in improving their due diligence processes, valuation procedures, and monitoring mechanisms to comply with the new regulations. This may involve additional costs and resources, but it will ultimately lead to a more robust and transparent gold loan industry.

Lenders will also need to ensure that their third-party service providers adhere to the new guidelines and maintain adequate controls over outsourced activities. This will help prevent irregularities and ensure compliance with regulatory requirements.

Why Is the RBI Tightening Gold Loan Rules?

The RBI’s decision to tighten gold loan regulations is driven by several factors:

- Rising Demand for Gold Loans:

The COVID-19 pandemic and subsequent economic challenges have led to a surge in demand for gold loans. According to a 2023 report by CRISIL, the gold loan portfolio of NBFCs grew by 30% in the last two years. This rapid growth has raised concerns about the potential risks associated with excessive lending. - Protecting Borrowers:

The RBI aims to safeguard borrowers from over-leveraging and falling into debt traps. By reducing the LTV ratio, the central bank ensures that borrowers do not borrow beyond their repayment capacity. - Ensuring Financial Stability:

Gold loans are a significant part of India’s financial ecosystem, with outstanding gold loan balances exceeding ₹6 lakh crore in 2023. The RBI’s stricter norms are designed to prevent systemic risks and ensure the stability of the financial sector. - Curbing Malpractices:

There have been instances of unethical practices by some gold loan providers, such as charging hidden fees or misrepresenting loan terms. The RBI’s new guidelines aim to promote transparency and fairness in the gold loan market.

Navigating the New Gold Loan Landscape

For borrowers looking to obtain a gold loan in the current regulatory environment, here are some tips to navigate the changes effectively:

- Choose Reputable Lenders: Opt for well-established banks or NBFCs with a strong track record in the gold loan industry. Reputable lenders are more likely to adhere to the new regulations and provide fair valuation and transparent loan processes.

- Prepare Documentation: Ensure that you have all the necessary documentation to verify the ownership of your gold. This may include purchase receipts, invoices, or other proof of ownership.

- Understand the Valuation Process: Familiarize yourself with the gold valuation process and ensure that it is conducted in your presence. This will help you understand the basis of the loan amount and ensure that you receive a fair valuation for your gold.

- Monitor Loan Usage: Be prepared to provide details about the intended use of the loan funds and ensure that they are used for legitimate purposes. This will help you comply with the new regulations and avoid any issues during the loan tenure.

- Stay Informed: Keep yourself updated on the latest RBI guidelines and changes in the gold loan industry. This will help you make informed decisions and navigate the regulatory landscape effectively.

The Future of Gold Loans in India

Despite the RBI’s tighter regulations, gold loans are expected to remain a popular financing option in India. The cultural affinity for gold, coupled with the need for quick liquidity, ensures that demand for gold loans will continue to grow. However, lenders and borrowers alike will need to adapt to the new regulatory landscape.

Industry experts predict that gold loan providers will focus on improving operational efficiency, leveraging technology, and offering value-added services to attract customers. For borrowers, staying informed about the latest regulations and making informed decisions will be key to maximizing the benefits of gold loans.

-

Why A Karnataka HC Judgment Could Make Government Officials Think Twice Before Relieving Officers Without A Next Posting

-

PM Kisan 22nd Installment Date 2026: Expected Release, Beneficiary Status & Complete Guide

-

Livspace Fires 1,000 Employees and Cofounder Quits: Inside India’s Most Shocking Startup Shakeup of 2026

-

US Supreme Court Strikes Down Trump’s Global Tariffs as ‘Unlawful’ — The 18% Tariff on India Is Now Illegal