Is Copper a Good Investment in 2026? Top 10 Indian Alternatives to Invest

India has NO pure copper ETFs—yet copper could rival gold in 2026! Why are smart investors piling into secret metal ETFs and multibagger stocks like Hindustan Copper (+101%)? Discover the top 10 hidden ways to ride India’s green energy copper boom before prices hit $12,500/tonne.

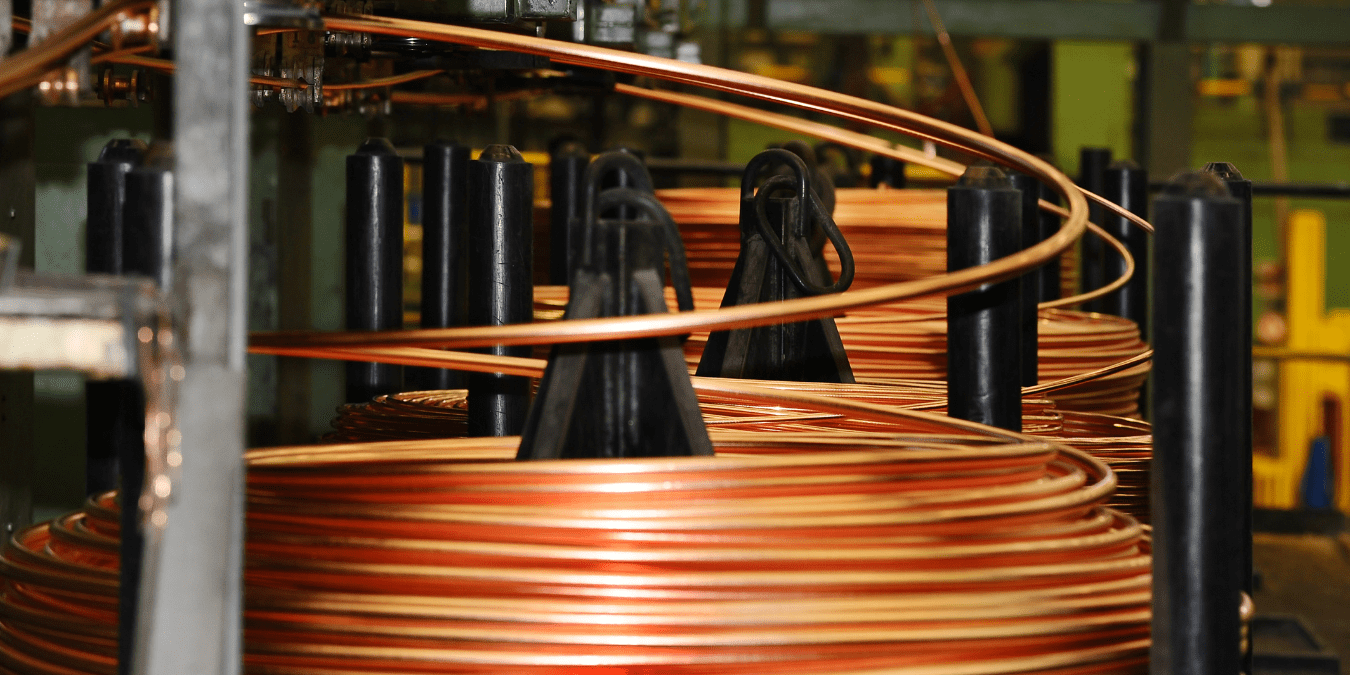

Copper prices have surged over 50% in recent years, hitting record highs above $12,000 per tonne on the London Metal Exchange (LME), fueled by supply disruptions and soaring demand from green energy and electrification. As India pushes toward net-zero emissions with ambitious EV and renewable targets, copper — dubbed “the metal of electrification” — is poised for structural growth. Analysts forecast average prices of $10,500–$12,500 per tonne in 2026, with potential deficits of 330,000 metric tons globally.

But is copper truly a smart buy for Indian investors in 2026? Yes, for those with a long-term horizon, given India’s copper demand growing at 9.3% annually to 1,878 kT in FY2025 and projections needing 500 kT new smelting capacity every five years. However, volatility from trade tariffs, Chinese demand slowdowns, and mine disruptions warrants caution.

India lacks pure-play copper ETFs tracking spot prices directly, but savvy investors can access exposure via metal ETFs, thematic funds, international options, and stocks.

Why Invest In Copper in 2026

Copper — often called “the metal of the future” — is shining brighter than ever in 2026. As India steps into an era of green energy, electric vehicles (EVs), and rapid infrastructure growth, copper is becoming essential to everything we build and power. From electric wiring and renewable energy to data centers and high-tech manufacturing, copper lies at the heart of modernization.

Yet, despite this growing importance, India still doesn’t have a pure-play Copper ETF that directly tracks copper prices or futures. But that doesn’t mean investors are left behind. Indian investors can still gain copper exposure through Metal ETFs, Thematic Mutual Funds, and International Copper ETFs available via global platforms.

If you’ve been wondering how to invest in copper in 2026, this complete guide covers the top 10 Indian copper ETF alternatives — and how you can smartly participate in the copper boom.

Why Copper is Gaining Popularity

Copper has long been called “Dr. Copper” for its ability to gauge economic health. When industry thrives, copper prices rise — and vice versa. But 2026 is witnessing something more profound: copper is now a strategic commodity driving global sustainability and technological innovation.

Key Drivers of Copper Demand:

- The Green Energy Transition: Electric vehicles use nearly four times the copper of a petrol-powered car. Solar panels and wind turbines are equally copper-heavy.

- Infrastructure Boom in India: Smart cities, metro lines, EV charging stations, and grid expansion all require massive copper inputs.

- Technological Growth: From data centers to robotics, everything digital depends on copper components.

Put simply, copper is the foundation metal of the new-age economy — clean, electric, and connected.

Why Copper Stands Out as a Investment

Copper's role extends beyond wiring — it's vital for EVs (4x more copper than petrol cars), solar systems (2 tonnes per MW), and wind farms, abating massive carbon emissions per tonne used. India's non-fossil capacity hit 217 GW by early 2025, demanding accelerated copper adoption for net-zero goals.

Bullish 2026 Forecasts

- Median LME copper at $10,500/tonne, up 7.2% from prior estimates, per Reuters poll of 30 analysts.

- J.P. Morgan sees $12,075/tonne average, peaking at $12,500/mt in Q2 amid 330 kT deficit.

- Nirmal Bang calls copper "the new gold," targeting $13,000–$13,500/tonne with 25–37% returns.

- Goldman Sachs predicts $10,000–$11,000 range short-term but long-term rise from energy infrastructure.

Hindustan Copper shares jumped 10% in three sessions and turned multibagger (101% in six months) on LME gains, signaling domestic momentum.

India-Specific Tailwinds for Copper

India's copper story accelerates in 2026, fueled by ambitious green targets and infrastructure expansion. Non-fossil capacity reached 217 GW by early 2025, with 30% EV penetration by 2030 demanding 4x copper per vehicle vs. ICE cars — projecting consumption growth at 9.3% annually to 1,878 kT in FY25 and beyond.

Infrastructure boom amplifies needs: metro rail (1.6 tonnes/km electrification), smart cities, EV charging grids, and data centers for AI/digital India. Renewables require 2 tonnes copper per MW installed, aligning with net-zero 2070 while abating 11–14k tonnes CO2 per copper tonne.

Domestic production lags: Hindustan Copper (sole integrated player) ramps up Malanjkhand mine, but 500 kT new smelting capacity every 5 years is critical. Stocks like Hindustan Copper (+101% in 6 months) and ETF holdings (Hindalco/Vedanta) capture this.

Policy tailwinds: PLI schemes for batteries/solar, FAME-III for EVs position copper as India's green metal cornerstone. Investors gain via Nifty Metal ETFs amid global $10.5–12.5K forecasts.

No Pure Copper ETF? Here Are Proven Alternatives

Without domestic copper futures liquidity, Indian investors pivot to proxies. Metal ETFs track Nifty Metal Index (heavy on Hindalco, Vedanta); thematic funds add active picks like Hindustan Copper; international ETFs via LRS (up to $250K/year) offer direct access through INDmoney or Vested; stocks provide purity.

Top 10 Indian Copper Investment Alternatives

Copper exposure in India relies on proxies like Nifty Metal ETFs (tracking index with Hindalco/Vedanta weight), thematic mutual funds (active copper holdings), international ETFs via LRS platforms (e.g., INDmoney), and direct stocks, as no pure copper ETF exists. Here's a comprehensive table with key metrics, pros/cons, and suitability as of early 2026.

1. Mirae Asset Nifty Metal ETF

| Attribute | Details |

| NAV (Jan 2026) | ₹11.42 |

| AUM | ₹157 Cr |

| Expense Ratio | 0.30% |

| Tracking Error | 0.07% |

| Top Copper Holds | Hindalco (18.65%), Vedanta (16.08%) |

| 1-Yr Return | +34.50% |

| Pros | Low error, high liquidity |

| Cons | Sector volatility |

| Best For | Passive copper proxy |

2. ICICI Prudential Nifty Metal ETF

| Attribute | Details |

| NAV (Jan 2026) | ₹22.50 (est. from index) |

| AUM | ₹500+ Cr (high) |

| Expense Ratio | 0.40% |

| Tracking Error | <0.20% |

| Top Copper Holds | Vedanta, Hindalco (mirrors Nifty Metal) |

| 1-Yr Return | 35% (index-aligned) |

| Pros | Trusted AMC, excellent liquidity |

| Cons | Slightly higher expense |

| Best For | Beginners/high-volume traders |

3. Groww Nifty Metal ETF

| Attribute | Details |

| NAV (Jan 2026) | ₹15.20 (est.) |

| AUM | ₹100+ Cr (growing) |

| Expense Ratio | 0.25% (lowest) |

| Tracking Error | 0.15% |

| Top Copper Holds | Nifty Metal basket (Hindalco/Vedanta heavy) |

| 1-Yr Return | 33% |

| Pros | Ultra-low cost, app SIPs |

| Cons | Newer, lower liquidity |

| Best For | Digital millennials/SIPs |

4. Nippon India ETF Nifty Metal

| Attribute | Details |

| NAV (Jan 2026) | ₹18.75 |

| AUM | ₹300+ Cr |

| Expense Ratio | 0.35% |

| Tracking Error | 0.10% |

| Top Copper Holds | Vedanta, Hindalco, miners |

| 1-Yr Return | 34% |

| Pros | Established Nippon brand |

| Cons | Moderate liquidity |

| Best For | Long-term mining exposure |

5. ICICI Prudential Commodities Fund

| Attribute | Details |

| NAV (Jan 2026) | ₹150+ (est.) |

| AUM | ₹2,500+ Cr |

| Expense Ratio | 1.8% (MF) |

| Top Copper Holds | Vedanta (7.5%), Hindalco (3.9%) |

| 1-Yr Return | 18–22% |

| Pros | Active commodity cycle play |

| Cons | Higher fees |

| Best For | Supercycle investors |

6. SBI Comma Fund

| Attribute | Details |

| NAV (Jan 2026) | ₹120 (est.) |

| AUM | ₹1,800 Cr |

| Expense Ratio | 1.9% |

| Top Copper Holds | Hindustan Copper (1.6%), Vedanta |

| 1-Yr Return | 16–20% |

| Pros | Direct copper producer exposure |

| Cons | Thematic risk |

| Best For | Hindustan Copper bulls |

7. DSP Natural Resources & New Energy Fund

| Attribute | Details |

| NAV (Jan 2026) | ₹180+ |

| AUM | ₹1,200 Cr |

| Expense Ratio | 2.0% |

| Top Copper Holds | Copper + green metals (lithium) |

| 1-Yr Return | 20% (+3% index alpha) |

| Pros | ESG/green transition |

| Cons | Broader resources dilution |

| Best For | Renewables enthusiasts |

8. Tata Resources & Energy Fund

| Attribute | Details |

| NAV (Jan 2026) | ₹140 (est.) |

| AUM | ₹900 Cr |

| Expense Ratio | 1.95% |

| Top Copper Holds | Hindalco, Vedanta, energy miners |

| 1-Yr Return | 17–21% |

| Pros | Infra/energy synergy |

| Cons | China sensitivity |

| Best For | Industrial growth |

9. Global X Copper Miners ETF (COPX)

| Attribute | Details |

| NAV/Price (Jan 2026) | $45–50 USD |

| AUM | $2B+ |

| Expense Ratio | 0.65% |

| Top Holds | Freeport-McMoRan, Glencore, Southern Copper |

| 1-Yr Return | 25% (leveraged to copper) |

| Pros | Pure miners, global diversity |

| Cons | Forex risk, LRS ($250K) |

| Best For | Intl copper leverage |

10. US Copper Index Fund (CPER)

| Attribute | Details |

| NAV/Price (Jan 2026) | $28–30 USD |

| AUM | $200M+ |

| Expense Ratio | 1.00% |

| Exposure | Copper futures (direct price) |

| 1-Yr Return | 20–30% (volatile) |

| Pros | Spot tracker |

| Cons | Roll costs, high vol |

| Best For | Price speculators via Vested |

Notes: Returns est. from Nifty Metal/copper trends; domestic = equity tax, intl = debt tax. All benefit from 2026 copper deficits/green demand. Diversify 5–10% allocation.

Bonus: iShares ICOP, Sprott COPP for diversified miners.

| International ETF | Type | Expense | Accessibility for Indians |

| COPX | Miners | 0.65% | LRS via INDmoney/Vested |

| CPER | Futures | 1.0% | High volatility, direct price |

Direct Stock Alternatives for Pure Copper Exposure

For investors seeking maximum copper purity without ETF/MF wrappers, these three NSE-listed stocks offer direct linkage to copper prices, mining, and smelting. Hindustan Copper provides the cleanest play as India's sole integrated producer, while Hindalco and Vedanta add scale via global ops. All surged on 2026 LME rallies (prices $10.5–12.5K/tonne forecasts).

| Sr. No. | Stock Name | Market Cap (₹ Cr, Jan 2026) | Current Price (₹) | 1-Yr Return | P/E Ratio | Key Copper Operations | Dividend Yield | 52-Wk High/Low (₹) |

| 1 | Hindustan Copper Ltd (HINDCOPPER) | ~₹25,000–30,000 | ₹280–300 (up 10% in 3 sessions) | +101% (multibagger in 6 months) | 85–90x (high growth premium) | Vertically integrated: Mining (Malanjkhand), smelting, refining; only pure copper producer in India | 0.2–0.5% | 355/120 |

| 2 | Hindalco Industries Ltd (HINDALCO) | ₹1,50,000+ | ₹680–700 | +25–30% | 14–16x | Copper cathodes/ rods (Birlapur plant); Novelis (global); 18.65% in Mirae Metal ETF | 0.8–1.0% | 780/500 |

| 3 | Vedanta Ltd (VEDL) | ₹3,50,000+ | ₹450–480 | +40–50% | 12–14x | Copper mining/smelt (Sterlite, Tuticorin); Zambia ops; 16% in Mirae Metal ETF | 5–7% (high) | 580/320 |

Performance Snapshot (Jan 2026 Est.)

| Metric | Hindustan Copper | Hindalco | Vedanta |

| YTD Return | +50–60% | +15–20% | +30–35% |

| Beta (vs Nifty) | 1.8 (high vol) | 1.4 | 1.6 |

| Copper Correlation | Very High (direct) | High | High |

| Recent Catalyst | LME surge, multibagger | Infra demand | Dividend payout |

Building a Copper Portfolio: Strategies for Indians

A copper-focused portfolio in 2026 can work well for Indian investors if it is diversified across Indian metal ETFs, thematic funds, international ETFs, and select stocks, and kept within 5–10% of total net worth due to commodity volatility.

Key Principles for a Copper Portfolio

- Limit copper exposure to 5–10% of your total portfolio to manage sector and commodity risk.

- Use Indian metal ETFs as the core (Nifty Metal exposure) and international ETFs or stocks as satellites.

- Prefer SIP mode to average out volatility in both domestic funds and global ETFs.

Conservative Strategy (Low Risk, 3–5 Year Horizon)

Focus on diversified, India-listed instruments with equity taxation and minimal currency risk.

- 60% – Indian Metal ETFs

- Mirae Asset Nifty Metal ETF (low tracking error, good Hindalco/Vedanta exposure).

- ICICI Pru Nifty Metal ETF (high liquidity; suitable as core holding).

- 40% – Thematic Mutual Funds

- ICICI Pru Commodities Fund (active exposure to Vedanta and Hindalco).

- DSP Natural Resources & New Energy Fund (green metals plus copper theme).

Who it suits:

- First-time commodity investors.

- Those wanting copper exposure without foreign ETFs or high volatility.

Balanced Strategy (Moderate Risk, India + Global Mix)

Combine domestic ETFs/funds with global copper miners and futures for more direct linkage to LME prices.

- 40% – Indian Metal ETFs

- Mirae / Nippon India Nifty Metal ETF as base exposure.

- 30% – Indian Thematic Funds

- SBI Comma Fund (direct Hindustan Copper exposure).

- Tata Resources & Energy Fund (infra + energy + metals).

- 30% – International Copper ETFs

- Global X Copper Miners ETF (COPX: global miners like Freeport, Glencore).

- OR split with US Copper Index Fund (CPER: futures-based price tracker).

Who it suits:

- Investors comfortable with LRS route and USD exposure.

- 5+ year horizon targeting structural copper deficit and green energy build-out.

Aggressive Strategy (High Risk, High Reward)

Lean into direct copper stocks and global ETFs, accepting high volatility for higher potential upside.

- 30% – Indian Metal ETFs

- Mirae Asset Nifty Metal ETF for stability and liquidity.

- 20–30% – Direct Stocks (India)

- Hindustan Copper (pure copper, multibagger behaviour in last 6 months).

- Hindalco and Vedanta for scale and dividends.

- 40–50% – International Copper ETFs

- COPX (miners leveraged to copper price).

- CPER (futures-linked; more volatile, short-to-mid-term tool).

Who it suits:

- Experienced investors who actively track LME, China data, and global mining news.

- Those ready for sharp drawdowns in commodity cycles.

Taxation, Costs, and Practical Steps for Copper Investments

Investing in copper proxies involves different tax treatments (equity vs. debt), varying cost structures, and specific execution steps. Here's a complete breakdown for Indian investors as of January 2026.

Taxation Framework

| Investment Type | Tax Classification | LTCG (>1/3 Years) | STCG (<1/3 Years) | Dividend Tax | Other Notes |

| Domestic ETFs (Mirae/ICICI Nifty Metal, Groww, Nippon) | Equity (≥65% domestic stocks) | 12.5% on gains > ₹1.25 lakh (>1 yr) | 20% | In hands of investor (slab rate) | STT applies; simple for NSE trades |

| Thematic Mutual Funds (ICICI Commodities, SBI Comma, DSP, Tata) | Equity | Same as ETFs | Same as ETFs | Slab rate | Same as ETFs |

| International ETFs (COPX, CPER via LRS) | Debt/Non-Equity | 12.5% with indexation (>2 yrs); 20% (>3 yrs) | Slab rate | TDS + slab | Schedule FA disclosure in ITR; forex gains taxed separately |

| Direct Stocks (Hindustan Copper, Hindalco, Vedanta) | Equity | 12.5% > ₹1.25 lakh (>1 yr) | 20% | DDT abolished; slab rate | STT + simple |

Key 2026 Changes:

- LTCG threshold raised to ₹1.25 lakh across all equity.

- International holdings must be reported in Schedule FA of ITR (even if no gains).

Cost Structure Comparison

| Investment | Expense Ratio/TER | Brokerage | Other Costs | Total Annual Cost (Est.) |

| Domestic ETFs | 0.25–0.40% | ₹0–20/order (zerodha) | STT 0.001%, GST | 0.3–0.5% |

| Thematic MFs | 1.8–2.2% (Direct Plan) | ₹0–100 (platforms) | Exit load (1% <1yr) | 2–2.5% |

| Intl ETFs | 0.65–1.0% | 0.5–1% (INDmoney) + FX spread (0.5–1%) | LRS compliance, platform fees | 2–3% (incl. currency) |

| Stocks | None | ₹0–20/order | STT 0.1%, DP charges | <0.2% |

Copper's Long-Term India Story

India's copper demand is projected to grow at 9.3% annually, reaching critical mass by 2030 as the nation accelerates its green energy transition and infrastructure boom. EVs require 4x more copper than ICE vehicles, solar/wind projects need 2 tonnes per MW, and data centers powering AI expansion demand high-conductivity wiring — positioning copper as the "metal of electrification".

With non-fossil capacity at 217 GW (early 2025) and 30% EV penetration targeted by 2030, domestic consumption could hit 2.5+ million tonnes annually. New smelting capacity of 500 kT every 5 years becomes essential, benefiting producers like Hindustan Copper.

Supply constraints amplify upside: global deficits of 330 kT in 2026, aging mines in Chile/Peru, and underinvestment create a structural bull case. Each tonne of copper in renewables abates 11,400–14,600T CO2, aligning perfectly with India's net-zero 2070 pledge.

Hindustan Copper's 101% 6-month multibagger performance signals market conviction. For Indian investors, copper offers multi-year growth through ETFs, funds, and stocks — a rare commodity play with domestic tailwinds.

Yes, Copper is a Strong Investment for Indians

Copper stands out as a compelling 2026 opportunity for Indian investors, backed by supply deficits (330 kT projected), LME forecasts of $10,500–$12,500/tonne, and India's green energy acceleration. From EVs needing 4x copper to renewables abating 11K+ tons CO2 per tonne, structural demand aligns perfectly with net-zero 2070 goals and 9.3% domestic consumption growth.

India lacks pure copper ETFs, but the top 10 alternatives deliver accessible exposure:

- Mirae Asset Nifty Metal ETF (top liquidity, 0.30% expense)

- ICICI Pru Nifty Metal ETF (trusted, high volume)

- Groww Nifty Metal ETF (lowest cost SIPs)

- Nippon India ETF Nifty Metal (mining diversity)

- ICICI Pru Commodities Fund (Vedanta 7.5%)

- SBI Comma Fund (Hindustan Copper 1.6%)

- DSP Natural Resources Fund (green metals alpha)

- Tata Resources Fund (infra synergy)

- Global X COPX (pure miners via LRS)

- US Copper CPER (futures price tracker)

Direct stocks like Hindustan Copper (+101% in 6 months) offer aggressive upside. Allocate 5–10% via conservative (ETFs/funds) to aggressive (intl + stocks) strategies. Track LME prices and rebalance annually.

Copper isn't just a commodity — it's the backbone of India's electrification megatrend. Position early, diversify smartly, and consult SEBI advisors. The multi-year bull case is robust.

Disclaimer: The use of any third-party business logos in this content is for informational purposes only and does not imply endorsement or affiliation. All logos are the property of their respective owners, and their use complies with fair use guidelines. For official information, refer to the respective company’s website.