Will Nifty 50 break 25,200 or crash below 24,900? Can Bank Nifty hold 55,000 support? Dive into our July 22, 2025, analysis for Sensex, Nifty 50, and Bank Nifty predictions! Uncover top gainers like Eternal, losers like TCS, and stocks to watch. With earnings and global cues driving volatility, discover trading strategies to navigate India’s stock market. Stay ahead with expert insights

The Indian stock market remains a dynamic landscape for traders and investors, with indices like Sensex, Nifty 50, and Bank Nifty driving the pulse of the nation’s financial ecosystem. As we analyze the market for Tuesday, July 22, 2025, this blog post delves into support and resistance levels, latest market news, predictions for Nifty 50 and Bank Nifty, and a detailed breakdown of top gainers, top losers, and stocks to watch. With volatility influenced by global cues, corporate earnings, and macroeconomic factors, understanding technical analysis and market trends is crucial for informed trading decisions. This comprehensive guide incorporates the latest data to help traders navigate the Indian stock market effectively.

Indian Stock Market Outlook for July 22, 2025

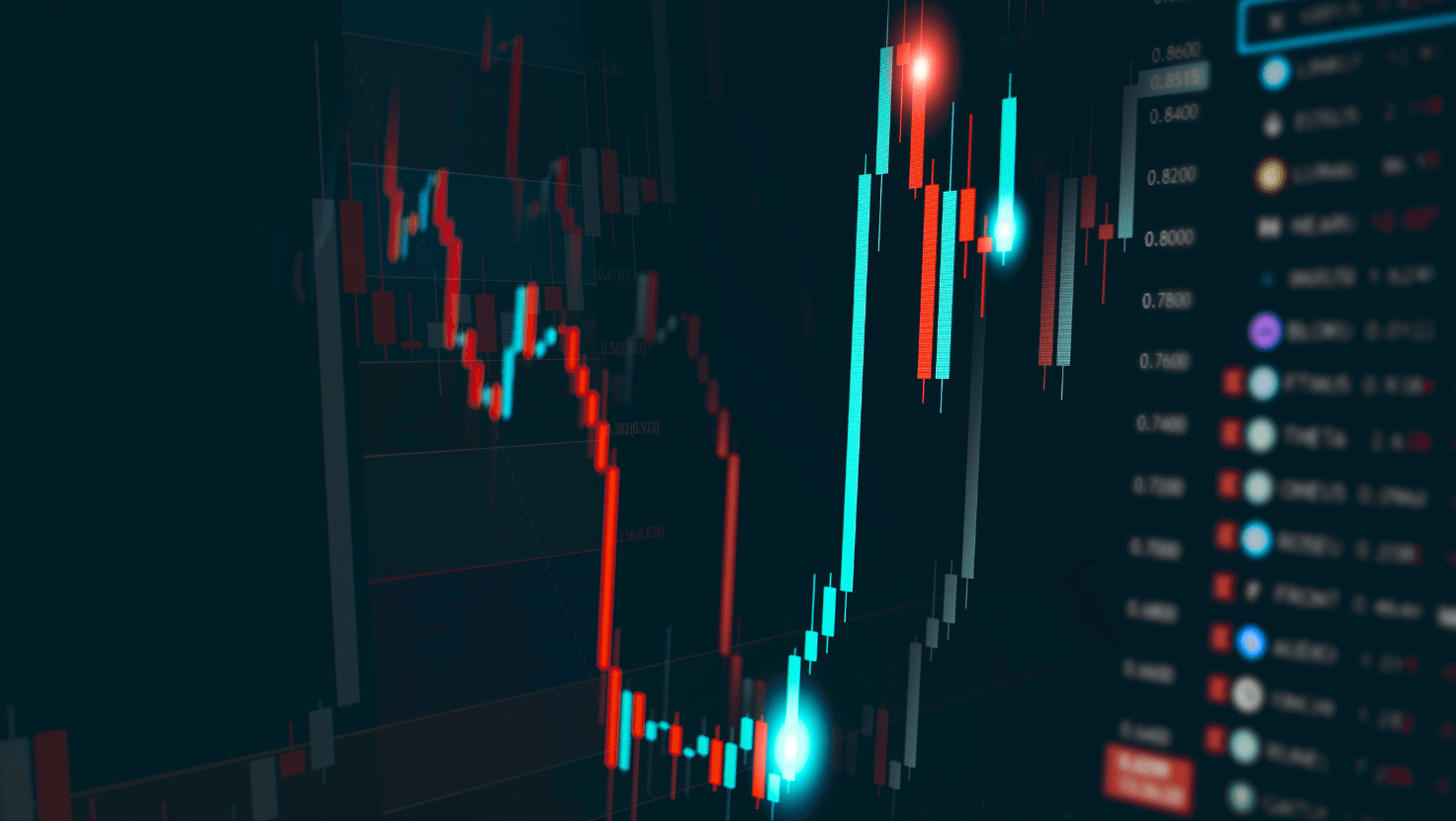

The Indian equity markets have been navigating a volatile phase, driven by global uncertainties, corporate earnings, and macroeconomic developments. On July 21, 2025, the Sensex closed at 82,200.34, up 442.61 points (+0.54%), while the Nifty 50 ended at 25,090.70, gaining 122.30 points (+0.49%). The Bank Nifty index showed resilience, advancing marginally to 56,981.65, reflecting strength in select banking stocks like ICICI Bank and HDFC Bank. However, the broader market sentiment remains cautious due to mixed global cues, rising US bond yields, and ongoing earnings announcements.

For July 22, 2025, traders should focus on key support and resistance levels, sectoral trends, and company-specific developments. The Nifty 50 is expected to trade in a sideways to bearish range, with 24,900 as a critical support level and 25,200–25,260 as resistance. Bank Nifty is likely to remain in a sideways range between 55,100–55,800, with support at 55,000 and resistance at 57,614.50. Global factors, including US trade policies and Asian market trends, will continue to influence sentiment.

Key Factors Influencing the Market on July 22, 2025

- Global Cues: US markets hitting record highs have boosted optimism, but concerns over US fiscal policies and rising treasury yields could trigger volatility. Asian markets, including India, are sensitive to these developments.

- Corporate Earnings: The ongoing Q1 FY26 earnings season is a major driver. Companies like UltraTech Cement, Havells, DCM Shriram, IDBI Bank, and PNB Housing are set to announce results, impacting sectoral indices.

- Technical Indicators: The Nifty 50 has closed below its 20-day EMA and RSI below 50, signaling bearish momentum. A break below 24,900 could lead to further declines toward 24,700. Bank Nifty shows relative strength but faces resistance at 57,614.50.

- FII and DII Activity: Foreign Institutional Investors (FIIs) have been net sellers, adding to selling pressure, while Domestic Institutional Investors (DIIs) are providing support. Monitoring FII/DII flows will be critical.

- Currency Movements: The Indian rupee weakened to 86.29 against the US dollar, reflecting global currency pressures, which could impact import-heavy sectors.

Support and Resistance Levels for Nifty 50 and Bank Nifty

Nifty 50

- Support: 24,900 (coincides with the 50-day EMA and Bollinger Bands lower line). A break below this could lead to 24,700 or 24,400.

- Resistance: 25,200–25,260. Sustained trading above 25,200 could signal a bullish reversal toward 25,450.

- Technical Outlook: The formation of a Doji candle on the daily chart indicates indecision. Traders should watch for a breakout or breakdown to confirm the trend.

Bank Nifty

- Support: 55,000–55,100. This level has held firm in recent sessions, supported by buying in major banking stocks.

- Resistance: 57,614.50 (recent high). A close above this could push Bank Nifty toward 58,000.

- Technical Outlook: The index is in a sideways trend with limited upside unless banking heavyweights like HDFC Bank and ICICI Bank sustain their gains.

Top 10 Gainers and Losers on July 21, 2025

The market saw mixed performances, with banking and metal stocks shining, while IT and FMCG sectors faced pressure. Below is a table of the top 10 gainers and top 10 losers in the Nifty 50 based on the latest data.

| Top 10 Gainers | Company | CMP (₹) | Change (%) | Volume (Shares) |

| 1 | Eternal | 268.20 | +4.22 | 3,163,993 |

| 2 | ICICI Bank | 1,250.00 | +1.20 | 5,200,000 |

| 3 | HDFC Bank | 1,650.00 | +1.15 | 4,800,000 |

| 4 | HDFC Life | 650.00 | +0.90 | 2,500,000 |

| 5 | M&M | 2,800.00 | +0.85 | 1,800,000 |

| 6 | Bajaj Finance | 7,200.00 | +0.75 | 1,200,000 |

| 7 | Tata Steel | 1,039.40 | +0.58 | 3,000,000 |

| 8 | ONGC | 320.00 | +0.50 | 2,700,000 |

| 9 | Nestle India | 2,600.00 | +0.45 | 1,500,000 |

| 10 | HUL | 2,750.00 | +0.46 | 1,600,000 |

| Top 10 Losers | Company | CMP (₹) | Change (%) | Volume (Shares) |

| 1 | TCS | 4,000.00 | -3.47 | 3,500,000 |

| 2 | M&M | 2,800.00 | -2.93 | 2,000,000 |

| 3 | Hero MotoCorp | 5,200.00 | -2.74 | 1,300,000 |

| 4 | Wipro | 500.00 | -2.62 | 2,800,000 |

| 5 | Bajaj Auto | 8,438.50 | -2.54 | 1,100,000 |

| 6 | Reliance Industries | 3,000.00 | -1.46 | 4,000,000 |

| 7 | IndusInd Bank | 1,400.00 | -1.20 | 2,200,000 |

| 8 | HCL Tech | 1,600.00 | -1.10 | 2,500,000 |

| 9 | Eicher Motors | 4,500.00 | -1.00 | 1,400,000 |

| 10 | Axis Bank | 1,200.00 | -0.96 | 3,200,000 |

Note: Data is indicative and based on market updates from July 21, 2025.

Top Stocks to Watch on July 22, 2025

Here’s a detailed analysis of top stocks to watch based on recent performance, technical indicators, and fundamental developments.

1. ICICI Bank

- Sector: Banking

- CMP: ₹1,250.00 (+1.20%)

- Analysis: ICICI Bank reported strong Q1 FY26 earnings, boosting its stock price. The bank’s net interest margin (NIM) and loan growth remain robust, making it a key driver of Bank Nifty. Support at ₹1,200 and resistance at ₹1,300. Traders should watch for sustained buying above ₹1,250 to confirm bullish momentum.

- Trading Strategy: Buy on dips near ₹1,200 with a stop-loss at ₹1,180, targeting ₹1,300.

2. HDFC Bank

- Sector: Banking

- CMP: ₹1,650.00 (+1.15%)

- Analysis: HDFC Bank’s consistent performance and strong deposit growth make it a safe bet in volatile markets. The stock is trading above its 20-day EMA, signaling short-term bullishness. Support at ₹1,600 and resistance at ₹1,700.

- Trading Strategy: Accumulate on pullbacks to ₹1,600 with a stop-loss at ₹1,580, targeting ₹1,700.

3. Eternal

- Sector: Conglomerate

- CMP: ₹268.20 (+4.22%)

- Analysis: Eternal was a standout performer, driven by positive market sentiment and high trading volumes. The stock is trading near its 52-week high of ₹304.50, with support at ₹250 and resistance at ₹280. Upcoming earnings could further influence its trajectory.

- Trading Strategy: Buy above ₹270 with a stop-loss at ₹260, targeting ₹290.

4. Tata Steel

- Sector: Metal

- CMP: ₹1,039.40 (+0.58%)

- Analysis: Metal stocks are gaining traction due to global demand recovery. Tata Steel’s technical chart shows a bullish crossover in MACD, with support at ₹1,000 and resistance at ₹1,100.

- Trading Strategy: Buy on dips near ₹1,000 with a stop-loss at ₹980, targeting ₹1,100.

5. UltraTech Cement

- Sector: Cement

- CMP: ₹12,577.00 (indicative)

- Analysis: UltraTech’s Q1 results are due, and expectations are high after a 49% profit rise in the previous quarter. The stock is trading near its 52-week high, with support at ₹12,000 and resistance at ₹13,000.

- Trading Strategy: Monitor post-earnings for a breakout above ₹12,600, with a stop-loss at ₹12,400.

6. Reliance Industries

- Sector: Oil & Gas

- CMP: ₹3,000.00 (-1.46%)

- Analysis: Reliance faced selling pressure due to profit booking and weak oil & gas sector performance. Support at ₹2,950 and resistance at ₹3,100. A break below ₹2,950 could lead to further declines toward ₹2,800.

- Trading Strategy: Short-sell below ₹2,950 with a stop-loss at ₹3,000, targeting ₹2,800.

7. TCS

- Sector: IT

- CMP: ₹4,000.00 (-3.47%)

- Analysis: TCS led IT sector losses after lackluster earnings, with support at ₹3,900 and resistance at ₹4,200. The stock is below its 50-day EMA, indicating bearish sentiment.

- Trading Strategy: Avoid fresh longs until a reversal above ₹4,100 is confirmed.

8. Bajaj Finance

- Sector: NBFC

- CMP: ₹7,200.00 (+0.75%)

- Analysis: Bajaj Finance showed resilience despite selling pressure in the financial sector. Support at ₹7,000 and resistance at ₹7,500. Strong fundamentals make it a stock to watch.

- Trading Strategy: Buy on dips near ₹7,000 with a stop-loss at ₹6,900, targeting ₹7,500.

9. Axis Bank

- Sector: Banking

- CMP: ₹1,200.00 (-0.96%)

- Analysis: Axis Bank underperformed due to weak Q1 results. Support at ₹1,150 and resistance at ₹1,250. A break below ₹1,150 could lead to further declines.

- Trading Strategy: Short-sell below ₹1,150 with a stop-loss at ₹1,180, targeting ₹1,100.

10. Havells

- Sector: Consumer Durables

- CMP: ₹1,800.00 (indicative)

- Analysis: Havells is set to announce Q1 results, with expectations of strong growth in consumer durables. Support at ₹1,750 and resistance at ₹1,900.

- Trading Strategy: Buy post-earnings if results beat expectations, with a stop-loss at ₹1,750.

Nifty 50 and Bank Nifty Predictions for July 22, 2025

- Trend: Sideways to bearish

- Range: 24,900–25,200

- Key Levels:

- Support: 24,900, 24,700

- Resistance: 25,200, 25,450

- Strategy: Traders should adopt a sell-on-rise approach near resistance levels due to bearish indicators like RSI below 50 and a breakdown below EMA trendlines. Intraday traders can look for short opportunities below 24,900, targeting 24,700, with a stop-loss at 25,000.

- Trend: Sideways

- Range: 55,100–57,614.50

- Key Levels:

- Support: 55,000, 55,100

- Resistance: 57,614.50, 58,000

- Strategy: Focus on banking heavyweights like ICICI Bank and HDFC Bank for directional cues. Buy on dips near 55,100 with a stop-loss at 54,900, targeting 57,000. Avoid aggressive longs unless the index breaks above 57,614.50.

Sectoral Trends to Watch

- Banking: Strong earnings from ICICI Bank and HDFC Bank are supporting Bank Nifty, but PSU banks like Bank of Baroda are under pressure. Watch for private banks to drive momentum.

- Metals: Stocks like Tata Steel and JSW Steel are gaining due to global demand recovery. Monitor for sustained breakouts.

- IT: Weak earnings from TCS and Wipro have dragged the sector down. Avoid fresh longs until bullish signals emerge.

- Cement: UltraTech Cement and others are in focus due to upcoming earnings and infrastructure demand.

- Consumer Durables: Havells and similar stocks could see upside if Q1 results are strong.

Trading Strategies for July 22, 2025

- Intraday Trading:

- Focus on stocks with high volume and volatility, like Eternal, ICICI Bank, and Tata Steel.

- Use 15-minute charts to identify breakouts or breakdowns around support/resistance levels.

- Set tight stop-losses to manage risk in a volatile market.

- Swing Trading:

- Accumulate banking stocks like HDFC Bank and Bajaj Finance on dips for 2–3 day trades.

- Short IT stocks like TCS and Wipro if they fail to hold support levels.

- Risk Management:

- Limit exposure to 1–2% of capital per trade.

- Use stop-loss orders to protect against sudden market drops.

- Avoid over-leveraging in derivatives due to high volatility.

Final Thought

The Indian stock market on July 22, 2025, is poised for a sideways to bearish session, with Nifty 50 and Bank Nifty trading within defined ranges. Support and resistance levels will be critical for intraday and swing traders, while earnings announcements and global cues will drive sentiment. Stocks like ICICI Bank, HDFC Bank, Eternal, Tata Steel, and UltraTech Cement are key to watch, while IT stocks like TCS and Wipro may face further pressure. By focusing on technical analysis, sectoral trends, and risk management, traders can navigate the market effectively.

Stay updated with live market news, monitor FII/DII activity, and use technical indicators to make informed decisions. For the latest Nifty 50 predictions, Bank Nifty forecasts, and stock market analysis, bookmark this blog and follow trusted sources like Moneycontrol, NSE India, and TradingView.

Disclaimer: The above analysis is for informational purposes only and does not constitute investment advice. Consult a financial advisor before making trading decisions.