Sensex, Nifty50, and Bank Nifty predictions for July 07, 2025! Uncover top gainers, losers, and stocks to watch with expert trading strategies. Dive into support, resistance levels, and market trends for profitable investments in the Indian stock market. Stay ahead with our SEO-optimized insights!

The Indian stock market is poised for an eventful trading session on Monday, July 07, 2025, as investors navigate a dynamic landscape shaped by global cues, domestic economic indicators, and technical trends. With the Sensex, Nifty50, and Bank Nifty showing resilience amid mixed signals, traders are keenly watching support and resistance levels, top gainers and losers, and stocks with high growth potential. This blog post provides a comprehensive analysis of the Indian stock market, incorporating the latest data, trading strategies, and insights to help you make informed investment decisions.

Market Overview: Sensex, Nifty50, and Bank Nifty

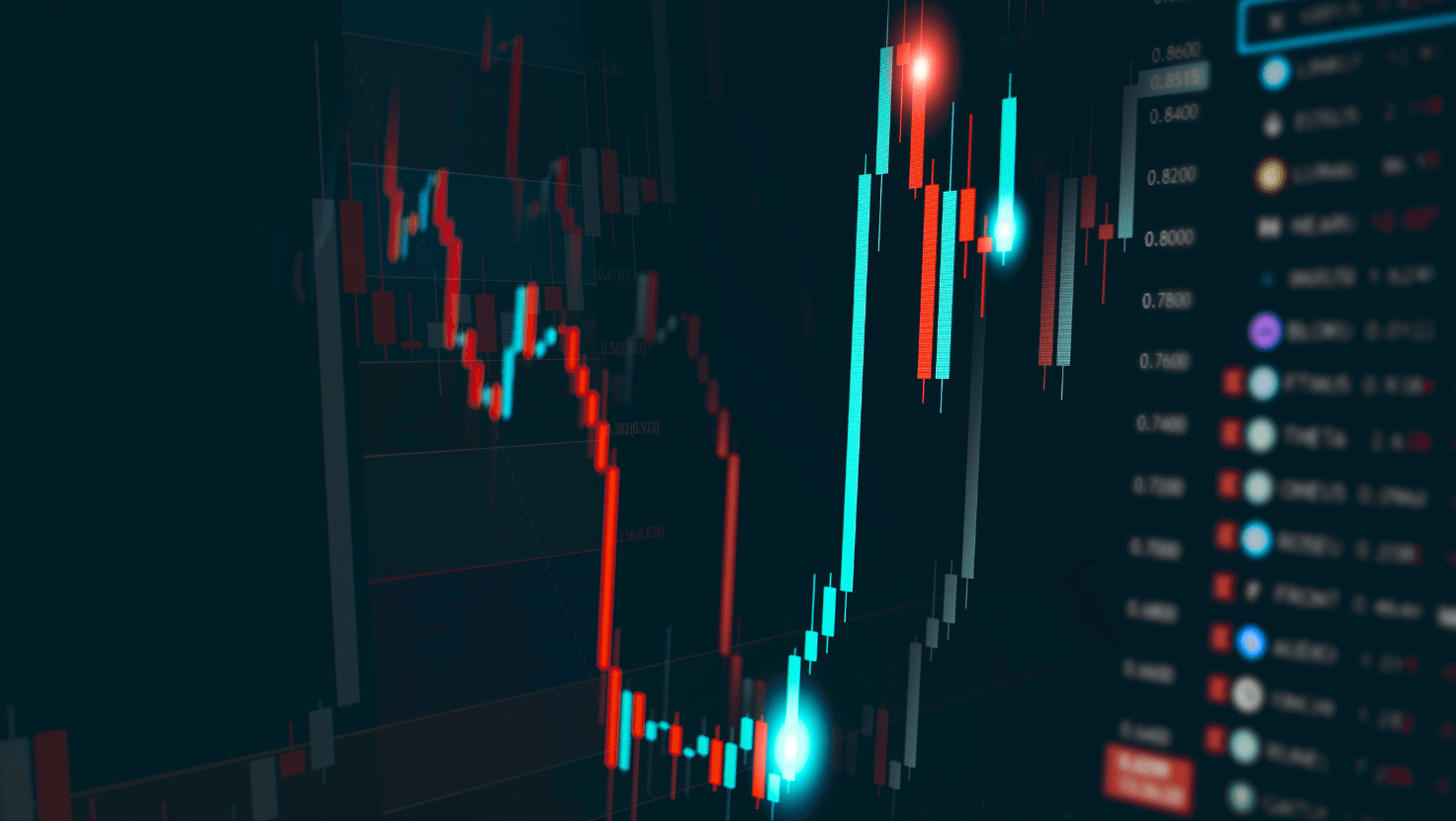

The Indian equity markets have displayed a cautious yet optimistic trend in recent sessions. On July 04, 2025, the Sensex closed at 83,432.89, up by 193.42 points (0.23%), while the Nifty50 ended at 25,461, gaining 55.7 points (0.22%). The Bank Nifty, reflecting strength in the banking sector, closed at 57,032, despite a negative trend noted in some analyses. The bullish sentiment is supported by domestic institutional investor (DII) buying and positive global cues, particularly from U.S. markets hitting record highs. However, volatility persists due to geopolitical tensions and foreign institutional investor (FII) activity.

Key Factors Influencing the Market on July 07, 2025

- Global Cues: U.S. markets continue to perform strongly, with the S&P 500 and Dow Jones showing resilience despite political uncertainties. However, tensions in the Middle East and U.S.-China trade developments could introduce volatility.

- Domestic Economic Indicators: The Reserve Bank of India’s (RBI) recent 50 bps repo rate cut to 5.5% and a reduction in the Cash Reserve Ratio (CRR) have boosted rate-sensitive sectors like banking, real estate, and auto. The RBI’s growth forecast for FY25 remains steady at 6.5%, with inflation projected at 3.7%.

- FII and DII Activity: DIIs have been net buyers, countering FII selling pressure, which has supported market stability.

- Technical Trends: The Nifty50 is trading in a range of 25,000–25,600, with support at 25,338 and resistance at 25,690–25,760. Bank Nifty’s support lies at 56,524–56,209, with resistance at 57,540–57,854.

Nifty50 and Bank Nifty Predictions for July 07, 2025

The Nifty50 is expected to open flat to slightly positive, with GIFT Nifty indicating a marginal gain of 10–20 points. The index is in a positive trend, with a daily closing stop-loss at 25,338. A sustained move above 25,600 could push the index toward 25,760–25,800, signaling strong bullish momentum. Conversely, a close below 25,338 may trigger a short-term correction toward 25,000.

- Bullish Case: Buy on dips near 25,400, targeting 25,600–25,760 with a stop-loss below 25,338.

- Bearish Case: Short below 25,338, targeting 25,100–25,000 with a stop-loss above 25,600.

Bank Nifty has shown resilience, breaching its near-term EMA trend line and forming a bullish hammer, indicating a potential short-term reversal. The index is expected to trade between 56,650–57,480, with support at 56,524 and resistance at 57,540. A close above 57,388 could signal a fresh bullish move toward 58,000.

Trading Strategy:

- Bullish Case: Buy near 56,650–56,800, targeting 57,480–58,000 with a stop-loss below 56,524.

- Bearish Case: Short below 56,524, targeting 56,209–55,900 with a stop-loss above 57,388.

| Index | Support Levels | Resistance Levels |

| Sensex | 83,050 / 82,000 | 83,697 / 84,000 |

| Nifty50 | 25,338 / 25,000 | 25,690 / 25,760 |

| Bank Nifty | 56,524 / 56,209 | 57,540 / 57,854 |

Top 10 Gainers and Losers (Based on Recent Data)

The following table highlights the top 10 gainers and losers from the Nifty50 and Sensex constituents, based on performance in recent sessions.

| Top Gainers | Gain (%) | Top Losers | Loss (%) |

| Bajaj Finance | 2.50 | Trent | -1.50 |

| Infosys | 2.20 | Tata Steel | -1.20 |

| Dr Reddy’s Labs | 1.80 | Eicher Motors | -1.10 |

| ICICI Bank | 1.19 | Tech Mahindra | -1.00 |

| Hindustan Unilever (HUL) | 1.10 | IndusInd Bank | -0.96 |

| Kotak Mahindra Bank | 0.90 | Titan Company | -0.90 |

| Axis Bank | 0.61 | M&M | -0.85 |

| Bharat Electronics | 0.60 | Adani Ports | -0.80 |

| Reliance Industries | 0.55 | Sun Pharma | -0.77 |

| Asian Paints | 0.50 | Bank of Baroda | -0.64 |

Note: Percentages are indicative and based on recent session data. Actual performance on July 07 may vary.

Top Stocks to Watch on July 07, 2025

1. Bajaj Finance

- Sector: NBFC

- Why to Watch: Bajaj Finance has been a top performer, gaining 2.50% in recent sessions, driven by strong quarterly earnings, robust loan growth, and positive RBI policy cues. The stock’s technical indicators show strength, with RSI above 60, indicating sustained bullish momentum.

- Trading Levels: Support at ₹2,200, resistance at ₹2,403. Buy on dips near ₹2,250, targeting ₹2,400 with a stop-loss below ₹2,200.

- Key Catalysts: Lower borrowing costs and increased credit demand due to RBI’s rate cut.

2. Infosys

- Sector: IT

- Why to Watch: Infosys surged 2.20% recently, supported by strong domestic flows and optimism in the IT sector. The stock benefits from a weaker rupee and global demand for IT services.

- Trading Levels: Support at ₹1,900, resistance at ₹2,100. Buy near ₹1,950, targeting ₹2,050 with a stop-loss below ₹1,900.

- Key Catalysts: Strong earnings outlook and potential U.S. market growth.

3. ICICI Bank

- Sector: Banking

- Why to Watch: ICICI Bank gained 1.19%, reflecting strength in the banking sector. The RBI’s rate cut and improved credit growth prospects make it a strong contender.

- Trading Levels: Support at ₹1,200, resistance at ₹1,300. Buy near ₹1,220, targeting ₹1,280 with a stop-loss below ₹1,200.

- Key Catalysts: Favourable monetary policy and robust asset quality.

4. Reliance Industries

- Sector: Conglomerate

- Why to Watch: Reliance Industries rose 1.84% after positive analyst reactions to its solar manufacturing facility launch. The stock remains a market leader with diversified revenue streams.

- Trading Levels: Support at ₹1,400, resistance at ₹1,500. Buy near ₹1,420, targeting ₹1,480 with a stop-loss below ₹1,400.

- Key Catalysts: Expansion in renewable energy and telecom sectors.

5. Asian Paints

- Sector: Consumer Goods

- Why to Watch: Asian Paints gainedಮ

- Trading Levels: Support at ₹2,200, resistance at ₹2,300. Buy near ₹2,250, targeting ₹2,300 with a stop-loss below ₹2,200.

- Key Catalysts: Rising rural demand and stable raw material prices.

6. Tata Steel

- Sector: Metal

- Why to Watch: Despite a 1.20% decline, Tata Steel remains a key stock to watch due to potential recovery in global steel prices and domestic infrastructure demand.

- Trading Levels: Support at ₹150, resistance at ₹170. Buy near ₹155, targeting ₹165 with a stop-loss below ₹150.

- Key Catalysts: Government infrastructure spending and global commodity trends.

7. HDFC Bank

- Sector: Banking

- Why to Watch: HDFC Bank gained 0.11% and is expected to benefit from RBI’s rate cut and strong DII support.

- Trading Levels: Support at ₹1,600, resistance at ₹1,700. Buy near ₹1,620, targeting ₹1,680 with a stop-loss below ₹1,600.

- Key Catalysts: Improved credit growth and stable asset quality.

8. Shriram Finance

- Sector: NBFC

- Why to Watch: Shriram Finance rallied due to strong quarterly earnings and optimism around loan growth.

- Trading Levels: Support at ₹2,800, resistance at ₹3,000. Buy near ₹2,850, targeting ₹2,950 with a stop-loss below ₹2,800.

- Key Catalysts: RBI’s monetary easing and NBFC sector growth.

9. Bharat Electronics

- Sector: Defense

- Why to Watch: Bharat Electronics surged 2.51% after securing ₹528 crore in orders, making it a strong pick in the defense sector.

- Trading Levels: Support at ₹300, resistance at ₹330. Buy near ₹310, targeting ₹325 with a stop-loss below ₹300.

- Key Catalysts: Government focus on defense modernization.

10. Hindustan Unilever (HUL)

- Sector: FMCG

- Why to Watch: HUL gained 1.10% amid stable rural demand and positive consumer sentiment.

- Trading Levels: Support at ₹2,500, resistance at ₹2,600. Buy near ₹2,520, targeting ₹2,580 with a stop-loss below ₹2,500.

- Key Catalysts: Strong brand portfolio and rural market recovery.

Sectoral Trends to Watch

- Banking and NBFC: The RBI’s rate cut has boosted banking and NBFC stocks, with ICICI Bank, HDFC Bank, and Bajaj Finance leading the rally. Expect continued strength in rate-sensitive sectors.

- IT: IT stocks like Infosys and TCS are gaining traction due to global demand and a weaker rupee.

- Realty: Lower borrowing costs are driving realty stocks, with potential for further gains.

- Metal: Metal stocks like Tata Steel may face volatility due to global commodity price fluctuations.

- Pharma: Pharma stocks are under pressure but could recover with positive earnings.

Trading Tips for July 07, 2025

- Focus on Technicals: Monitor support and resistance levels closely, as the market is in a range-bound phase. Use RSI and EMA indicators to time entries and exits.

- Risk Management: Set strict stop-losses to protect against sudden volatility driven by global events.

- Sector Rotation: Rotate investments toward rate-sensitive sectors like banking and realty, while maintaining exposure to IT and defense.

- Stay Updated: Keep an eye on FII/DII activity and global market trends for directional cues.

Final Thought

The Indian stock market on July 07, 2025, is expected to remain range-bound with a bullish bias, driven by positive domestic and global cues. The Nifty50 and Bank Nifty are poised for potential breakouts if they sustain above key resistance levels. Investors should focus on top performers like Bajaj Finance, ICICI Bank, and Infosys, while keeping an eye on support and resistance levels for strategic trading. With the right strategy, traders can capitalize on short-term opportunities while managing risks in a volatile market.

Disclaimer: Investments in securities are subject to market risks. Always conduct thorough research or consult a financial advisor before investing.