How to Navigate Complex Legal Hurdles When Claiming Property and EPF After a Loved One’s Death in 2025

Could a simple overlooked document be the key to unlocking a deceased loved one’s assets — or leave your family empty-handed? Discover the hidden truths behind claiming property, EPF, FDs, mutual funds, and lockers in 2025 that every Indian must know before it’s too late.

When a loved one passes away, dealing with financial and legal formalities can be overwhelming and emotionally draining. The process of claiming their assets—whether property, Employee Provident Fund (EPF), fixed deposits (FDs), mutual funds, or bank lockers—is mired in complex rules and paperwork that often confuse families. But amidst the maze of regulations, there are lesser-known facts and strategic moves that can simplify this journey and unlock relief, security, and peace of mind for heirs.

Common Challenges Faced by Heirs During Asset Claims

Common challenges faced by heirs during asset claims in India include:

- Lack of Proper Documentation: Missing important documents like death certificates, wills, nominee details, or succession certificates delays the claim process significantly.

- Disputes Among Heirs: Multiple claimants often lead to legal battles, especially in the absence of a clear Will, complicating the division of inherited assets.

- Complex Legal Procedures: Probate, mutation of property, or court approvals required for transferring ownership make the process lengthy and confusing.

- Difficulty Locating Assets: Unawareness of all financial accounts, investments, lockers, or property owned by the deceased makes claims challenging.

- Nominee vs Legal Heir Conflicts: Nominee designation simplifies claims but can cause disputes if legal heirs contest nominee rights or if no nominee is named.

- Delays in Institutional Processing: Banks, EPFO, mutual fund houses, and courts often have slow processing times, causing emotional and financial strain.

- Digital Access Issues: For online claims (EPF, mutual funds), lack of digital literacy or incomplete KYC hampers smooth settlements.

- Changing Regulations: Frequent updates in inheritance, tax, and financial laws require heirs to stay informed to avoid compliance issues.

- Lockers and Physical Assets Access: Banks have strict protocols to access lockers, especially if keys are lost or multiple heirs are involved.

- Tax and Debt Complications: Outstanding debts of the deceased and inheritance tax liabilities can reduce the asset value benefiting heirs.

Breaking Down the Complex Process Into Clear Steps

Property Claims: The Legal Pathway to Ownership Transfer

- Will and Probate Process: If the deceased left behind a Will, the designated executor takes responsibility for transferring property ownership. This requires the Will to be probated—a court-certified validation that authenticates the document and empowers the executor to act on behalf of the deceased.

- Intestate Succession: Without a Will, succession laws based on religion such as the Hindu Succession Act or Indian Succession Act apply. The property is then distributed among legal heirs defined by these statutes.

- Mutation Procedures: To officially record the change of ownership, heirs must apply for a property mutation with municipal or revenue authorities. This administrative step updates land and tax records, legitimizing new ownership for sale, rental, or further legal use.

- Hidden Pitfall: Incomplete mutation or neglecting this crucial step can trigger legal challenges, disputes, and restrict future transactions related to the property.

EPF (Employees Provident Fund) Claims: Navigating Financial Access

- Account Identification Issues: Many older EPF accounts opened before the introduction of Universal Account Numbers (UAN) lack proper documentation or are forgotten, delaying benefit claims significantly without thorough employment history and UAN records.

- Filing Claims: Nominees or legal heirs can submit claims online via platforms like the UMANG app or physically at regional EPF offices. Claims usually cover the entire provident fund corpus, pension benefits (if eligible), and insurance payouts under the Employees’ Deposit Linked Insurance Scheme (EDLI).

- Complexity in Practice: Sometimes employers maintain separate provident fund trusts apart from the central EPFO, requiring additional claims. Family disagreements can also complicate claims, potentially escalating to litigation.

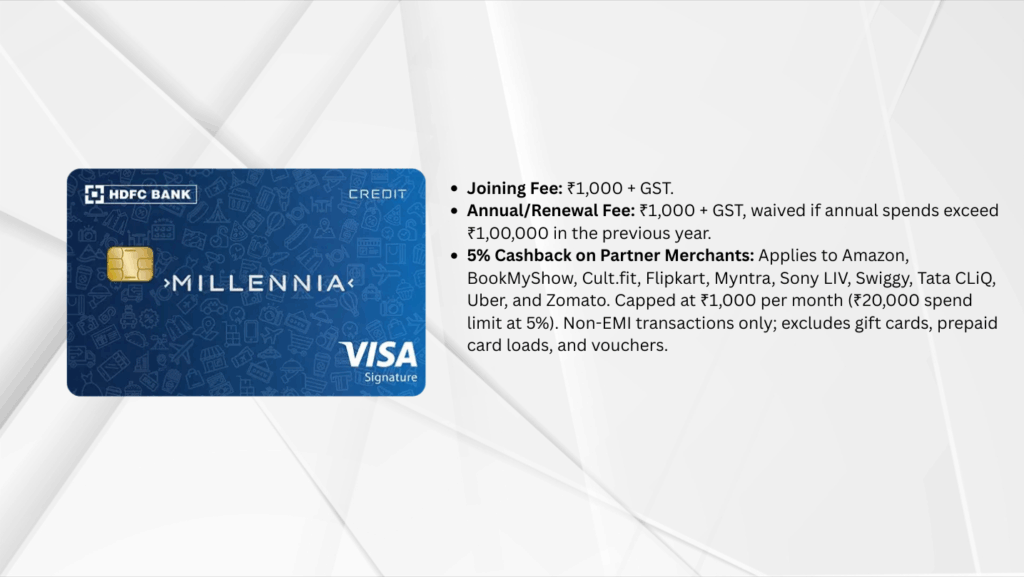

Fixed Deposits (FDs): Claiming Liquid Assets

- Nominee Claims: Typically, an FD gets transferred directly to the nominee upon furnishing the death certificate and claim forms, ensuring a relatively swift payout.

- Legal Heir Certification: If no nominee exists, heirs must procure a succession certificate or a legal heir certificate to gain access, a process that often involves court or revenue office procedures, making it more time-consuming.

- Locker Linkage: Since FD certificates may be stored inside bank lockers, withdrawing FDs might be intertwined with locker access protocols.

Mutual Funds: Transmission of Investment Ownership

- Claims by Nominees or Heirs: The transmission process requires submitting the death certificate and necessary claim forms to redeem or transmit mutual fund units held by the deceased.

- Without Nominee: When no nominee is appointed, the process becomes complex, demanding affidavits, indemnity bonds, and often probate court intervention.

- Inheritance Distribution: In the absence of a Will, units get divided according to succession laws, which may cause disputes that could require mediation or legal resolution.

Lockers: Securing Physical Assets

- Access Requirements: Relatives need to submit the death certificate, KYC profiles, claim forms, legal heir certificates, and potentially court orders to gain access to a locker.

- Lost Key Scenarios: If locker keys are missing, banks may open the locker in the presence of witnesses, inventory contents, and then release assets.

- Distinct Legal Framework: Locker claims do not mirror bank account claims; they follow separate contractual obligations involving service charges and stringent protocols designed to protect security.

Why These Surprising Details Matter in 2025

These surprising details about claiming property, EPF, FDs, mutual funds, and lockers after the death of near ones matter more than ever in 2025 because:

- Rising Inflation and Costs: With inflation impacting daily life and financial stability, timely access to inherited assets provides critical financial relief and security to heirs navigating increased expenses.

- Evolving RBI and Regulatory Landscape: Changes in banking, EPF, and investment regulations in 2025 require heirs to be well-informed to claim assets efficiently and avoid procedural pitfalls or losses.

- Digitization and Ease of Access: The push towards digital processes (like online EPF claims via the UMANG app) offers convenience but demands awareness of tech tools, digital KYC, and documentation habits.

- Unclaimed Assets Growth: Many assets remain unclaimed due to legal complexities or lack of awareness, leading to financial losses or prolonged family disputes—being informed can prevent this.

- Legal Reforms and Nominee Empowerment: Recent legal updates strengthen nominee rights and simplify claims, making it urgent for families to update nominee designations and follow correct procedures.

- Emotional and Financial Urgency: Deaths create emotional upheaval; knowing the clear process and surprising lesser-known facts can reduce stress, speed up settlements, and safeguard heirs’ financial futures.

Actionable Takeaways for Indian Families in 2025

- Maintain Records: Keep detailed employment, financial, and nominee information accessible.

- Nominee Designation: Update nominees regularly on all financial instruments to simplify claims.

- File Promptly: Don’t delay claims to avoid legal complications and asset freezes.

- Seek Legal Advice: For complex cases involving no Wills, multiple heirs, or ancestral properties.

- Use Technology: Leverage digital government portals and apps for submitting claims efficiently.

The Bigger Picture: What’s Next for Inheritance Claims in India?

India’s legal and financial ecosystems are evolving fast, with digitization and new succession laws aiming to make inheritance claims more transparent and less contentious. Upcoming reforms may introduce streamlined processes for lockers and mutual funds and enforce stricter nominee regulations—potentially transforming how Indians secure their loved ones’ financial legacies.