“Tax planning tips for first-time home buyers in India! Learn about Section 24, 80EEA deductions, joint home loan benefits, and more to save ₹5 lakh+ on taxes. Maximize your savings with expert advice on home loan interest, stamp duty, and affordable housing tax benefits. Start your homeownership journey wisely!”

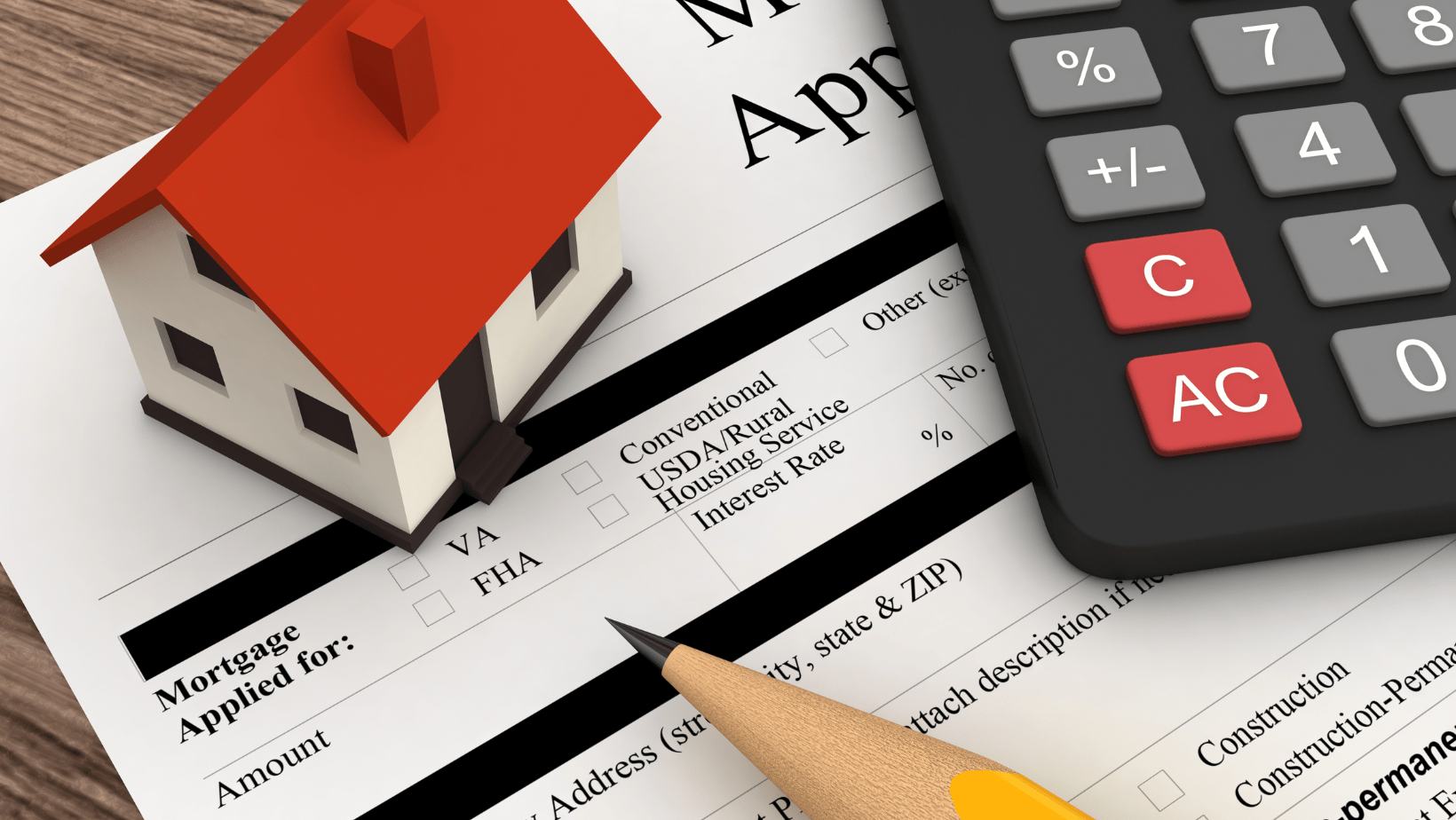

Buying your first home is a monumental milestone, but it also comes with significant financial responsibilities. One of the most overlooked yet crucial aspects of homeownership is tax planning. For first-time home buyers, understanding the tax benefits and strategies available can lead to substantial savings and a smoother financial journey.

In this comprehensive guide, we’ll explore the latest tax-saving opportunities, deductions, and exemptions available to first-time home buyers. Whether you’re a salaried professional, a business owner, or a self-employed individual, this blog will provide actionable insights to help you maximize your savings and make the most of your home purchase.

Why Tax Planning is Essential for First-Time Home Buyers

The real estate market is expected to see continued growth, with rising property prices and fluctuating interest rates. According to a 2024 report by Knight Frank India, first-time home buyers account for over 60% of residential property purchases. With the increasing cost of homeownership, effective tax planning is more important than ever to reduce your tax liability and maximize savings.

Tax benefits such as deductions on home loan interest, principal repayment, and additional exemptions can save you lakhs of rupees. By leveraging these opportunities, you can make your dream of homeownership more affordable and financially sustainable.

Key Tax Benefits for First-Time Home Buyers

1. Deduction on Home Loan Interest (Section 24)

Under Section 24 of the Income Tax Act, home buyers can claim a deduction of up to ₹2 lakh per year on the interest paid on a home loan for a self-occupied property. For a let-out or rented property, there is no upper limit on the interest deduction.

- How It Works: If you’ve taken a home loan of ₹40 lakh at an interest rate of 8.5%, your annual interest payment would be approximately ₹3.4 lakh. You can claim a deduction of ₹2 lakh, reducing your taxable income.

- Update: The ₹2 lakh limit applies to self-occupied properties. For joint home loans, each co-owner can claim a deduction of up to ₹2 lakh.

2. Deduction on Principal Repayment (Section 80C)

Under Section 80C, you can claim a deduction of up to ₹1.5 lakh per year on the principal repayment of your home loan. This deduction is part of the overall limit under Section 80C, which includes other investments like PPF, ELSS, and life insurance premiums.

- Tip: Ensure that your home loan is taken from a recognized financial institution to qualify for this deduction.

3. Additional Deduction for First-Time Home Buyers (Section 80EEA)

First-time home buyers can claim an additional deduction of up to ₹1.5 lakh per year on home loan interest under Section 80EEA. To qualify:

- The loan must be sanctioned between April 1, 2019, and March 31, 2025.

- The property value should not exceed ₹45 lakh.

- The loan amount should not exceed ₹35 lakh.

- Update: This benefit is in addition to the ₹2 lakh deduction under Section 24, making it a valuable tax-saving tool for first-time buyers.

4. Stamp Duty and Registration Charges

You can claim a deduction on stamp duty and registration charges under Section 80C, subject to the overall limit of ₹1.5 lakh. These charges are significant expenses when purchasing a home, and this deduction can help reduce your tax liability.

5. Deduction for Joint Home Loans

If you’ve taken a joint home loan with a spouse or family member, both co-owners can claim deductions under Sections 24 and 80C based on their share of the loan.

6. Pradhan Mantri Awas Yojana (PMAY)

The Pradhan Mantri Awas Yojana (PMAY) scheme offers subsidies on home loan interest rates for first-time home buyers. Depending on your income category, you can receive a subsidy of up to ₹2.67 lakh. This scheme aims to make housing more affordable and accessible for all.

Tax-Advantaged Savings for Home Buyers

1. PPF and Other Section 80C Investments

Investments in Public Provident Fund (PPF), Equity-Linked Savings Scheme (ELSS), and other Section 80C instruments can help you save tax while building a corpus for your home purchase.

2. Home Loan Prepayment

Prepaying your home loan can reduce your interest burden and help you save on taxes. However, ensure that you don’t exhaust your emergency funds while doing so.

Tax Planning Strategies for First-Time Home Buyers

1. Opt for a Joint Home Loan

Taking a joint home loan with a spouse or family member allows both borrowers to claim tax benefits, effectively doubling your deductions.

2. Time Your Purchase

Plan your home purchase to maximize tax benefits. For example, closing your home loan before the end of the financial year allows you to claim deductions for that year.

3. Keep Detailed Records

Maintain organized records of all home-related documents, including:

- Home loan statements

- Interest certificates (Form 16A)

- Property registration and stamp duty receipts

- Home improvement bills

These documents are essential for claiming deductions and exemptions.

4. Consult a Tax Advisor

Tax laws in India are complex and subject to frequent changes. A tax advisor can help you navigate the rules and ensure you’re maximizing your savings.

Common Mistakes to Avoid

1. Ignoring Section 80EEA Benefits

Many first-time home buyers are unaware of the additional deduction under Section 80EEA. Ensure you claim this benefit if you qualify.

2. Overlooking Joint Loan Benefits

If you’ve taken a joint home loan, ensure both co-owners claim their share of deductions.

3. Not Planning for Long-Term Tax Implications

Consider the long-term tax implications of your home purchase, such as capital gains tax when selling the property.

The Future of Tax Benefits for Home Buyers

The Indian government has been actively promoting affordable housing through various schemes and tax benefits. In the 2025 Union Budget, the government is expected to introduce new tax incentives to boost the real estate sector. Stay informed about these potential changes to ensure you don’t miss out on future tax savings.

Take Control of Your Tax Planning

Tax planning is a crucial aspect of the home-buying process that can significantly impact your financial well-being. By understanding and leveraging the available tax benefits, first-time home buyers in India can save lakhs of rupees and make homeownership more affordable.

Remember, every buyer’s situation is unique. Consult with a tax professional or financial advisor to create a personalized tax strategy that aligns with your goals. With the right planning, you can maximize your savings and enjoy the benefits of homeownership for years to come.

-

The Supabase India Ban Explained: Who’s Affected, Why It Happened, and What Comes Next

-

Geopolitical Shock: Bitcoin Tumbles Under $64K Following US-Israel Military Strike on Iran

-

New EPFO Rule 2026: You Can Now Withdraw 100% of Your PF Balance Without Resigning — Here’s How

-

Is Your Money Safe in Fino Payments Bank After CEO Rishi Gupta’s Shocking Arrest?