Does Checking CIBIL Score Lower It? 50% Indians Believe Yes – The 2025 RBI Truth Inside

Does checking your CIBIL score lower it? Shocking 2025 RBI truth: 50% Indians fall for this myth, risking ₹8.5L higher loans. Discover the hidden soft inquiry hack that protects your 750+ rating forever—without a single point drop. Unlock lower EMIs now!

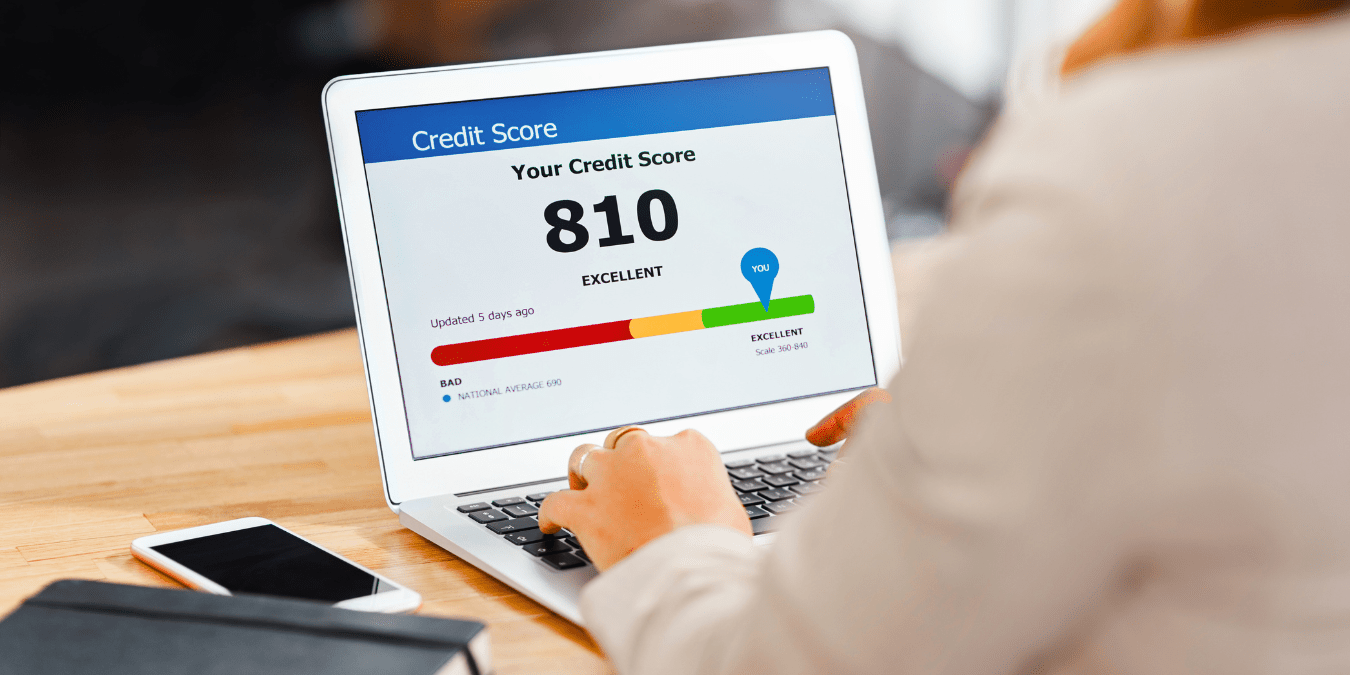

Does checking your credit score lower it? The straightforward truth is no—checking your own credit score, called a soft inquiry, does not reduce it. However, there’s a hidden side involving lenders’ credit checks, known as hard inquiries, which can slightly dip your score. In the evolving Indian credit landscape of 2025, understanding these nuances is crucial for maintaining financial health and leveraging new RBI rules that bring faster credit score updates and control for borrowers.

What Happens When You Check Your Credit Score?

When you check your credit score yourself, it counts as a soft inquiry. Soft inquiries do not impact your score because they are merely informational checks done by you. This means you can monitor your credit regularly without worry. It’s a smart habit for preventing identity theft, spotting errors, and managing your financial profile proactively. On the other hand, when lenders or banks check your credit report to approve loans or credit cards, this triggers a hard inquiry which can cause a slight drop in your score—typically between 0 to 5 points per inquiry. The effect differs based on the rest of your credit profile; a robust score will see negligible impact, while someone with limited credit history might notice more. Persistent multiple hard inquiries within a short period are viewed negatively by lenders, signaling potential financial stress, which cumulatively can lower your creditworthiness.

RBI’s New Credit Score Rules and Their Impact in 2025

A major transformation has come into effect with the Reserve Bank of India’s new credit reporting rules starting January 2025. Now, all lenders must update borrower data twice a month, on the 15th and the last working day, speeding up how quickly your credit activities are reflected in your score. This means repayment, loan closures, or new credit applications show up faster, giving borrowers quicker control and transparency over their financial health. The RBI also mandates alerts for every inquiry and has set stricter timelines on dispute resolution concerning credit reports, enhancing borrower protection and accountability on part of lenders. Early reviews on home loan interest rates are a benefit emerging from these rules, rewarding healthier credit scores with better loan terms sooner than before.

How to Check Credit Score in India without Affecting It

You can check your credit score in India without affecting it by performing a soft inquiry, which is a type of credit check that does not lower your score. Checking your own credit score through authorized credit bureaus like CIBIL, CRIF Highmark, Experian, or Equifax using their official websites or trusted partners results in a soft inquiry. This is completely safe and does not impact your credit rating. You typically need to provide some personal details like your name, PAN card, Aadhaar card, and registered mobile number to verify your identity before accessing the score for free.

Soft inquiries are different from hard inquiries, which happen when a lender checks your credit during loan or credit card applications. Hard inquiries can cause a minor dip in your credit score, but soft inquiries have no such effect and may not even appear on your credit report. You can check your credit score repeatedly as often as you want through these soft inquiry methods without worrying about any negative impact. Many popular platforms and financial institutions, including Bajaj Finserv, Paytm, Airtel Finance, and banks, offer free credit score checks that fall under soft inquiries.

To ensure your credit score remains unaffected, always use official or trusted websites for checking your score, confirm that your request is a soft inquiry, and avoid applying for multiple loans or credit cards in a short time, as those trigger hard inquiries. By regularly checking your credit score via soft inquiries, you can stay informed about your credit health and detect any errors or fraud attempts early without lowering your score.

Difference Between Soft Inquiry and Hard Inquiry in India

In India, a soft inquiry is a credit check that does not affect your credit score and occurs without your explicit consent, while a hard inquiry requires your permission and can temporarily lower your score by 5-10 points.

Key Differences

| Aspect | Soft Inquiry | Hard Inquiry |

| Impact on Score | No effect on credit score | Temporary drop of 5-10 points; multiple can signal risk |

| Consent Required | No, can be done without permission | Yes, only with your approval |

| Visibility to Lenders | Often not visible or shared in credit reports | Visible to all lenders reviewing your report for up to 2 years |

| Duration on Report | Up to 2 years, but minimal impact | Up to 2 years, affects future approvals |

When Soft Inquiries Happen

Soft inquiries arise when you check your own credit score via bureaus like CIBIL or CRIF High Mark, for pre-approved offers, employment background checks, or utility setups. Lenders use them for marketing or account reviews without seeking new credit. These checks provide limited info and stay invisible during loan decisions, making frequent self-checks safe.

When Hard Inquiries Happen

Hard inquiries trigger during formal credit applications, such as new loans (home, personal, auto), credit cards, or credit limit increases. Banks or NBFCs perform them to assess eligibility and terms. Multiple hard pulls in a short span, like shopping multiple lenders quickly, amplify the negative effect, though rate-shopping for mortgages or autos may count as one under some models.

Tips for Managing Inquiries

Limit hard inquiries by comparing pre-approvals first and spacing applications. Regularly use soft inquiries through apps like Bajaj Finserv or Paytm to monitor your score without harm. Review your credit report annually for unauthorized hard pulls and dispute errors promptly.

Common Myths and Surprising Insights for Indians in 2025

Many Indians still harbor the myth that simply checking their own credit score will lower it. This misunderstanding keeps almost half the population from using credit score checks as a financial management tool, which is counterproductive and risky. The reality is that frequent self-checks are friendly to your credit standing. In contrast, the real impact lies in how often and why lenders open hard inquiries on your report. Also, factors like income level or job title do not directly influence the credit score; instead, how you use your credit and repay debts do. Another little-known fact is how multiple loan or credit card applications clustered in a short period can cause a drop in your score—sometimes severely enough to lead to rejections of new credit applications.

Why Timing and Frequency Matter: Strategic Credit Management

The timing of credit inquiries plays a pivotal role. Applying for multiple loans or cards in a brief window causes multiple hard inquiries, which lenders interpret as a red flag. These inquiries can stay on your report and visible to future lenders for up to two years, affecting your ability to get credit at favorable terms. This means that spacing out your credit applications and monitoring your inquiries is essential to maintain a healthy score. Planning large purchases or credit needs well in advance and checking your credit score frequently allows you to strategize and avoid unnecessary dips in creditworthiness. Leveraging the new RBI rule updates, you can now check your scores more frequently with up-to-date info, helping you time credit applications more effectively.

Actionable Takeaways for Indian Borrowers

- Regularly check your credit score yourself; it's a soft inquiry, so no harm done.

- Avoid multiple loan or credit card applications within a short timeframe to minimize hard inquiries.

- Use RBI’s new bi-monthly score updates to monitor real-time changes in your credit profile.

- If you see errors or unexpected inquiries on your credit report, immediately raise a dispute—RBI mandates quicker resolutions.

- Maintain timely repayments and low credit utilization to naturally improve your credit score and access better loan terms.

- Understand that your credit score is now updated faster, meaning your improved financial behavior can be rewarded sooner than before.

The evolution of credit reporting in India in 2025 opens exciting opportunities for better control and smarter financial decisions. But it also requires awareness and discipline to avoid pitfalls like misunderstanding credit inquiries. Stay tuned for upcoming shifts in credit scoring models and lender policies that aim to further empower Indian consumers and redefine how creditworthiness is assessed—insights you'll definitely want to know before your next big financial move.

This new era makes mastering your credit score not just a good practice but an urgent necessity to unlock financial freedom in India’s booming economy

Final Thought

In 2025, your CIBIL score isn't just a number—it's your financial superpower in India's booming economy. With RBI's bi-monthly updates, regular soft inquiries let you spot errors, thwart fraud, and watch repayments boost your rating from 650 to 750+ in months, unlocking loans at 8-9% interest instead of 12-14%—saving ₹2-5 lakh on a ₹50 lakh home loan. Nearly 50% of Indians skip checks due to myths, missing faster approvals, higher limits, and premium cards. Proactive monitoring empowers negotiation power, turning credit health into lasting wealth. Embrace it now: Check weekly, repay on time, and thrive amid rising costs and new fintech shifts. Your future self—and lower EMIs—will thank you.