The New Pension Scheme (NPS) is a voluntary pension scheme that was launched by the government of India in 2004 to provide retirement income to all citizens. NPS allows subscribers to choose their own fund manager and asset allocation among four asset classes: equity, corporate debt, government securities, and alternative investment funds. NPS also offers tax benefits, flexibility, and a regular pension after retirement. Subscribers can withdraw up to 60% of the NPS amount as lump sum and invest the remaining 40% in an annuity plan to get a monthly pension. NPS is different from the Old Pension Scheme (OPS), which is a defined benefit scheme that provides a guaranteed pension based on the last drawn salary and years of service of the government employees. Some states have recently reverted to OPS from NPS, citing fiscal and social reasons. However, this move has been criticised by some experts as fiscally unsustainable and regressive.

How to Decide the Optimal Amount of Investment in NPS for Your Retirement Goals

To decide the optimal amount of investment in NPS, you need to consider the following factors:

- Your current age and expected retirement age: This will determine how many years you have to save and invest for your retirement. The earlier you start, the more time you have to accumulate a larger corpus and benefit from the power of compounding.

- Your risk appetite and return expectations: NPS offers two options for choosing your asset allocation: Active Choice and Auto Choice. Active Choice allows you to decide how much to invest in four asset classes: Equity (E), Corporate Debt ©, Government Securities (G), and Alternative Investment Funds (A). Auto Choice automatically adjusts your asset allocation based on your age and risk profile. There are three options within Auto Choice: Aggressive, Moderate, and Conservative.

- Your retirement income goals: You need to estimate how much monthly pension you would need after retirement to maintain your desired standard of living. This will depend on various factors such as inflation, life expectancy, health care costs, etc. You can use online calculators to get an idea of how much corpus you need to generate a certain amount of pension.

- Your contribution amount and frequency: Based on your income and expenses, you need to decide how much you can afford to contribute to NPS every month or year. You also need to decide whether you want to make a lump sum contribution or a regular contribution. The minimum annual contribution for NPS is Rs 1,000.

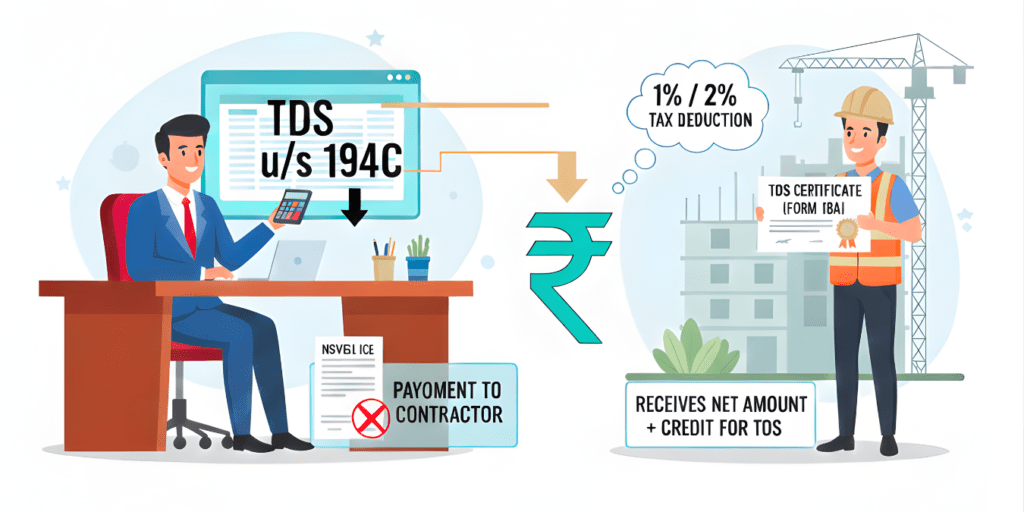

- Your tax implications: NPS offers tax benefits under Section 80C, Section 80CCD(1B), and Section 10(12A) of the Income Tax Act. You can claim a deduction of up to Rs 1.5 lakh under Section 80C for your NPS contributions. You can also claim an additional deduction of up toRs 50,000 under Section 80CCD(1B) for your voluntary contributions. Moreover, you can enjoy tax-free withdrawal of up to 60% of the corpus at maturity under Section 10(12A).

By considering these factors, you can decide the optimal amount of investment in NPS for your retirement goals. However, you should also review your NPS portfolio periodically and make necessary changes as per your changing needs and market conditions.

NPS Investment Calculator: Find Out How Much You Need to Invest Monthly to Get a Desired Pension

The returns from NPS are variable and depend on the performance of the investments you choose. You can also select the allocation limits for each asset class according to your risk tolerance and preference.

To use an online NPS calculator, you need to enter some details such as:

- Your current age

- Your monthly investment amount

- Your expected return on investment

- The percentage of annuity you want to purchase at retirement

- The expected return on annuity

The online NPS calculator will then compute the lump sum amount and the monthly pension you can expect at retirement based on these inputs. The lump sum amount is the part of the corpus that you can withdraw at retirement, while the monthly pension is the amount you will receive every month from the annuity service provider. The annuity is a contract that guarantees a fixed income for life or a certain period.

NPS vs Other Tax-Saving Investments: How Much Should You Allocate to NPS for Maximum Returns and Tax Benefits

NPS investments qualify for a tax exemption of Rs 1,50,000 under Section 80C of the Income Tax Act, as well as an additional Rs 50,000 deduction under Section 80CCD (1B).

Other tax-saving investments include ELSS, PPF, and ULIPs. ELSS stands for Equity Linked Savings Scheme, which is a type of mutual fund that invests in equity and has a lock-in period of 3 years. PPF stands for Public Provident Fund, which is a long-term savings scheme backed by the government and has a lock-in period of 15 years. ULIPs stands for Unit Linked Insurance Policies, which are insurance policies that also offer an investment option with varying asset allocation.

The choice of tax-saving investment depends on your risk appetite, return expectation, liquidity requirement, and investment horizon. NPS is suitable for those who want to save for retirement and get tax benefits on both contribution and withdrawal. ELSS is suitable for those who want to invest in equity and get higher returns in the long run. PPF is suitable for those who want to save for long-term goals and get guaranteed returns. ULIPs are suitable for those who want to combine insurance and investment and get tax benefits on both premium and maturity.

The amount of allocation to NPS depends on your income level, tax bracket, and retirement goal. Generally, it is advisable to invest at least 10% of your salary in NPS to get the maximum tax benefit under Section 80CCD (2), which allows your employer to contribute to your NPS account and claim it as a deduction from your taxable income. You can also invest an additional Rs 50,000 in NPS to get the benefit under Section 80CCD (1B), which is over and above the limit of Rs 1,50,000 under Section 80C.

However, you should also consider other factors such as your age, risk profile, and asset allocation before investing in NPS. NPS has different schemes that invest in different proportions of equity, corporate debt, and government securities. You can choose the scheme that suits your risk tolerance and return expectation. You can also switch between schemes once a year. You should also diversify your portfolio by investing in other tax-saving instruments such as ELSS, PPF, or ULIPs to balance your risk-reward ratio.

How to Invest in NPS Online: A Step-by-Step Guide for Beginners

There are two types of NPS accounts that you can invest in: Tier I and Tier II.

- Tier I is the mandatory retirement account, where you can get tax benefits on your contributions under Section 80CCD of the Income Tax Act. You need to invest at least INR 500 to open a Tier I account and at least INR 1,000 every year to keep it active. You can withdraw 60% of the accumulated corpus as lump sum when you turn 60, and use the remaining 40% to buy an annuity plan that will pay you a monthly pension.

- Tier II is the voluntary savings account, where you can invest any amount that you wish to. You can withdraw your money anytime from this account, but there are no tax benefits on your contributions or returns. You can only open a Tier II account if you already have a Tier I account.

To open an NPS account online, you will need a mobile number, an email ID, a PAN card, an Aadhaar card, and a bank account with net banking facility. Here are the steps to follow:

- Visit the official eNPS website.

- Click on ‘Registration’ and choose ‘Individual’.

- Enter your Aadhaar number or Virtual ID number and generate an OTP.

- Enter the OTP you receive on your registered mobile number and click on ‘Continue’.

- Choose your preferred account type: Tier I only or Tier I and Tier II.

- Fill up all the mandatory details online and submit to generate an acknowledgement number.

- Choose a pension fund manager and an investment option: auto mode or active mode.

- In auto mode, your equity allocation will change with your age. In active mode, you can decide the mix of equity, corporate debt, and government bonds.

- Upload your photograph and signature. Your photograph will be the same as in your Aadhaar card.

- Click on the ‘e-signature’ option and enter another OTP to verify your signature.

- Make the initial payment for your NPS account through net banking or debit card.

- Once the payment is successful, your Permanent Retirement Account Number (PRAN) will be allotted.

- You can use this PRAN to log in to your NPS account and make further contributions.

NPS Tier 1 vs Tier 2: Which One Should You Invest More in and Why

The choice between NPS Tier 1 and Tier 2 accounts depends on your financial goals, risk appetite, and tax planning. Here are some factors to consider when choosing between the two:

- If you prioritize greater withdrawal freedom, you can opt for a Tier 2 account, though with decreased tax benefits.

- If you are looking for long-term retirement planning, then NPS Tier 1 is the better choice as it offers tax benefits, annuity options, and a lock-in period to ensure that your retirement corpus is not depleted before you retire.

- The Tier 1 account provides fewer opportunities to meet financial emergencies, unlike the Tier 2 account. While the Tier 1 account is rigid, the Tier 2 account is similar to operating a savings bank account.

- You enjoy more significant tax benefits with the Tier 1 account than the Tier 2 account at the investment and maturity phases.

How to Choose the Best Fund Manager and Asset Allocation for Your NPS Investment

Choosing the best fund manager and asset allocation for your NPS investment is an important decision that can affect your retirement corpus and pension. Here are some tips to help you with this decision:

- First, you need to decide whether you want to opt for Active Choice or Auto Choice in NPS. Active Choice allows you to select your own asset allocation among the four asset classes: Equity (E), Corporate Debt ©, Government Securities (G), and Alternative Investment Funds (A). Auto Choice automatically adjusts your asset allocation based on your age and risk profile. There are three options within Auto Choice: Aggressive, Moderate, and Conservative.

- If you opt for Active Choice, you need to assess your risk appetite, return expectations, investment horizon, and retirement income goals. Based on these factors, you can decide how much to invest in each asset class. Generally, equity investments offer higher returns but also higher risk, while debt investments offer lower returns but also lower risk. Alternative investments offer diversification benefits and potential for unique returns. You can use online calculators to get an idea of how different asset allocations can affect your retirement corpus and pension.

- If you opt for Auto Choice, you need to select one of the three options: Aggressive, Moderate, or Conservative. Aggressive option allocates more funds to equity and less to debt as you age, while Conservative option does the opposite. Moderate option maintains a balance between equity and debt. You can choose the option that suits your risk profile and retirement goals.

- After deciding your asset allocation, you need to choose the best fund manager for each asset class. You can compare the performance of different fund managers based on their returns, risk-adjusted returns, consistency, and portfolio composition. You can also check their ratings and reviews from various sources. You can find some useful information and analysis on the performance of different fund managers in different asset classes in these links: Scheme G, Scheme E, Scheme C.

- You can change your fund manager or asset allocation once a year if you are not satisfied with their performance or if your needs change.

How to Make Partial Withdrawals from NPS and What are the Tax Implications

According to the current NPS withdrawal rules, you can make partial withdrawals from your Tier I account only after completing three years of investment and only for specific purposes such as:

- Higher education or marriage of children

- Purchase or construction of a residential house

- Skill development or self-employment activities

- Medical treatment of self or family members for specified illnesses or disabilities

You can make partial withdrawals up to 25% of your own contributions (excluding employer’s contributions) and only three times during the entire tenure of investment. There should be a gap of at least five years between any two partial withdrawals, except in case of medical emergencies.

Partial withdrawals from NPS are tax-exempt2, but the taxation will be different if you exit your NPS account prematurely (before 60 years of age). In case of premature exit, you can withdraw up to 20% of the corpus as a lump sum and the remaining 80% will have to be used to purchase an annuity. The lump sum withdrawal will be taxable as per your income tax slab, while the annuity income will be taxable as per your income tax slab in the year of receipt.

To apply for a partial withdrawal from NPS, you need to log in to your NPS account online and submit a withdrawal request form along with the required documents. You can also visit your nearest Point of Presence (POP) or Nodal Office and submit the physical form and documents. The withdrawal amount will be credited to your bank account within a few days after verification.

How to Change Your Nominee, Fund Manager, or Asset Allocation in NPS Online

- To change your nominee, you need to log in to your NPS account at eNPS portal using your PRAN number and password. Then, you need to click on the ‘Update Details’ tab and select the ‘Update Nomination Details’ option. You can add, modify, or delete your nominees online by entering their details and uploading their scanned photographs. You also need to enter an OTP sent to your registered mobile number and email ID to confirm the changes.

- To change your fund manager, you need to log in to your NPS account at eNPS portal using your PRAN number and password. Then, you need to click on the ‘Transact Online’ tab and select the ‘Change PFM’ option. You can choose the desired pension fund manager from the available options and submit the request. You can change your fund manager once in a financial year.

- To change your asset allocation, you need to log in to your NPS account at eNPS portal using your PRAN number and password. Then, you need to click on the ‘Transact Online’ tab and select the ‘Change Scheme Preference’ option. You can choose the scheme type (active or auto choice) and the percentage of contribution in different asset classes (equity, corporate debt, and government securities). You can also switch between different schemes within the same asset class. You can change your asset allocation twice in a financial year

How to Exit from NPS and What are the Options for Annuity and Lump Sum Withdrawal

To exit from NPS online, you will need your Permanent Retirement Account Number (PRAN) and password. Here are the steps to follow:

- Visit the official eNPS website.

- Log in to your NPS account using your PRAN and password.

- Click on ‘Exit from NPS’ menu and click on ‘Initiate Withdrawal Request’ option.

- Enter the necessary details such as bank account number, IFSC code, annuity service provider, annuity scheme, etc.

- Choose the percentage of corpus that you want to withdraw as lump sum and the percentage that you want to invest in annuity.

- Confirm your withdrawal request and generate a claim ID.

- Print the withdrawal form and submit it along with the required documents to your nodal office within 90 days.

You can also exit from NPS offline by filling up a withdrawal form and submitting it to your nodal office along with the required documents. You can download the withdrawal form from the NSDL website.

How to Transfer Your NPS Account from One Employer to Another or from One POP to Another

Some steps on how to transfer your NPS account from one employer to another or from one POP to another. POP stands for Point of Presence, which is a service provider for NPS subscribers.

- To transfer your NPS account from one employer to another, you need to submit an Inter Sector Shifting (ISS-1) Form to the POP-SP with whom you want to be associated in NPS2.

- If you change jobs and join an organisation registered under NPS, you can continue the PRAN under the new Corporate by submitting the CS-S3 form.

- To transfer your NPS account from one POP to another, you need to submit a request in the prescribed format to the target POP-SP.

- You cannot opt for different POP-SPs for your Tier I and Tier II accounts respectively. You have to shift both your accounts together to any POP-SP.

Conclusion

The New Pension Scheme (NPS) is a voluntary pension scheme that was launched by the government of India in 2004 to provide retirement income to all citizens. NPS allows subscribers to choose their own fund manager and asset allocation among four asset classes: equity, corporate debt, government securities, and alternative investment funds. NPS also offers tax benefits, flexibility, and a regular pension after retirement.

Frequently Asked Questions (FAQ)

1. What is NPS?

- NPS stands for the National Pension System. It's a voluntary, long-term retirement savings scheme initiated by the Indian government.

2. Who can invest in NPS?

- Any Indian citizen between the ages of 18 and 60 can invest in NPS. Non-resident Indians (NRIs) are also eligible.

3. How does NPS work?

- NPS allows individuals to contribute regularly to their retirement account during their working years. The accumulated corpus is then invested in various asset classes, and at retirement, a portion is withdrawn as a lump sum, while the remaining is used to purchase an annuity.

4. What are the tax benefits of NPS?

- NPS offers tax benefits under Section 80C and 80CCD(1B) of the Income Tax Act. Contributions up to Rs. 1.5 lakh in a financial year are deductible, and an additional Rs. 50,000 under Section 80CCD(1B) is eligible for deduction.

5. How can I open an NPS account?

- You can open an NPS account through Point of Presence (PoP) banks, authorized financial institutions, or online through the eNPS portal.

6. Can I change my NPS fund manager and investment choice?

- Yes, NPS allows you to change your fund manager and investment choice (Asset Allocation) twice a year.

7. What are the investment options in NPS?

- NPS offers two investment choices: Active Choice, where you decide the asset allocation, and Auto Choice, where the allocation is automatically adjusted based on your age.

8. When can I withdraw from my NPS account?

- You can make partial withdrawals from your NPS account after completing ten years, but the maximum limit is 25% of your contributions.

9. Can I continue contributing to NPS after the age of 60?

- Yes, you can continue contributing to NPS up to the age of 70. However, there are restrictions on the withdrawal options after 60.

10. What happens to my NPS account if I die before retirement?

- In the event of your demise before retirement, the accumulated NPS corpus will be passed on to your nominee or legal heir as a lump sum or annuity, depending on the option chosen.

11. Is NPS a guaranteed pension plan?

- No, NPS is not guaranteed. Returns depend on the performance of the chosen funds. The risk is borne by the investor.