Travel insurance is an essential part of planning any trip, whether it’s a short weekend getaway or a long international adventure. It provides peace of mind and financial protection against unexpected events that could disrupt your travel plans. In this guide, we’ll explore the key components that should be included in a travel insurance policy, ensuring you have the coverage you need for a worry-free journey.

1. Trip Cancellation and Interruption Coverage

Why It’s Important

Trip cancellation and interruption coverage reimburses you for non-refundable expenses if you need to cancel or cut short your trip due to unforeseen circumstances. This can include illness, injury, and death of a family member, natural disasters, or other emergencies.

What It Covers

- Trip Cancellation: Reimbursement for prepaid, non-refundable expenses if you cancel your trip before departure.

- Trip Interruption: Reimbursement for unused portions of your trip and additional expenses to return home if your trip is cut short.

Latest Data

According to a recent survey, 40% of travelers have had to cancel or interrupt their trips due to unforeseen events.

2. Medical and Emergency Assistance

Why It’s Important

Medical emergencies can happen anywhere, and healthcare costs can be exorbitant, especially abroad. Travel insurance with medical coverage ensures you receive necessary medical treatment without bearing the financial burden.

What It Covers

- Emergency Medical Expenses: Coverage for medical treatment, hospital stays, and ambulance services.

- Emergency Evacuation and Repatriation: Transportation to the nearest medical facility or back home in case of severe illness or injury.

- 24/7 Assistance Services: Access to a helpline for medical advice, referrals, and assistance in emergencies.

Latest Data

The average cost of a medical evacuation can range from Rs.2, 00,000 to Rs.25, 00,000 (approx.) depending on the location and severity of the condition2.

3. Baggage and Personal Belongings Coverage

Why It’s Important

Lost, stolen, or damaged baggage can ruin a trip. Baggage coverage compensates you for the loss or damage of your personal belongings during your travels.

What It Covers

- Lost or Stolen Baggage: Reimbursement for the value of lost or stolen items.

- Delayed Baggage: Compensation for essential items if your baggage is delayed for a specified period.

- Personal Belongings: Coverage for personal items such as electronics, clothing, and travel documents.

Latest Data

Airlines mishandled approximately 4.57 bags per 1,000 passengers in 2023, highlighting the importance of baggage coverage.

4. Travel Delay Coverage

Why It’s Important

Travel delays can lead to additional expenses for accommodation, meals, and transportation. Travel delay coverage reimburses you for these unexpected costs.

What It Covers

- Accommodation and Meals: Reimbursement for additional expenses incurred due to travel delays.

- Transportation: Coverage for alternative transportation arrangements if your original plans are disrupted.

Latest Data

In 2023, 20% of flights were delayed, with an average delay time of 55 minutes.

5. Personal Liability Coverage

Why It’s Important

Personal liability coverage protects you if you accidentally cause injury to someone or damage their property while traveling. This can prevent significant financial loss from legal claims.

What It Covers

- Bodily Injury: Coverage for legal expenses and compensation if you injure someone.

- Property Damage: Coverage for legal expenses and compensation if you damage someone else’s property.

Latest Data

Personal liability claims can range from a few thousand dollars to millions, depending on the severity of the incident.

6. Accidental Death and Dismemberment (AD&D) Coverage

Why It’s Important

AD&D coverage provides financial compensation to you or your beneficiaries if you suffer a severe injury or death during your trip. This can help cover medical expenses, funeral costs, and provide financial support to your family.

What It Covers

- Accidental Death: Lump-sum payment to your beneficiaries in case of accidental death.

- Dismemberment: Lump-sum payment for the loss of limbs, sight, or other severe injuries.

Latest Data

Accidental injuries are a leading cause of death for travelers, making AD&D coverage a crucial component of travel insurance.

7. Coverage for Pre-Existing Medical Conditions

Why It’s Important

If you have a pre-existing medical condition, it’s essential to ensure your travel insurance covers any related medical expenses. Some policies offer coverage for pre-existing conditions, while others may exclude them.

What It Covers

- Medical Treatment: Coverage for medical expenses related to your pre-existing condition.

- Emergency Evacuation: Coverage for emergency evacuation if your condition worsens during your trip.

Latest Data

Approximately 15% of travelers have a pre-existing medical condition that requires special coverage.

8. Adventure and Sports Coverage

Why It’s Important

If you plan to participate in adventure sports or activities, ensure your travel insurance covers any potential injuries or accidents. Standard policies may exclude high-risk activities, so you may need to purchase additional coverage.

What It Covers

- Medical Expenses: Coverage for injuries sustained during adventure sports.

- Equipment Loss or Damage: Coverage for loss or damage to sports equipment.

Latest Data

Adventure sports injuries account for 10% of travel insurance claims.

9. Rental Car Coverage

Why It’s Important

If you plan to rent a car during your trip, rental car coverage protects you against potential damages or theft of the rental vehicle. This can save you from costly repairs or replacement fees.

What It Covers

- Collision Damage Waiver: Coverage for damages to the rental car.

- Theft Protection: Coverage for theft of the rental car.

Latest Data

Rental car damages can cost travelers an average of $500 to $2,000 per incident.

10. COVID-19 Coverage

Why It’s Important

The COVID-19 pandemic has highlighted the need for travel insurance that covers pandemic-related disruptions. Ensure your policy includes coverage for COVID-19-related issues.

What It Covers

- Trip Cancellation: Coverage if you need to cancel your trip due to contracting COVID-19.

- Medical Expenses: Coverage for medical treatment if you contract COVID-19 during your trip.

- Quarantine Costs: Coverage for additional accommodation and meal expenses if you need to quarantine.

Latest Data

COVID-19-related travel insurance claims have increased by 30% since the pandemic began.

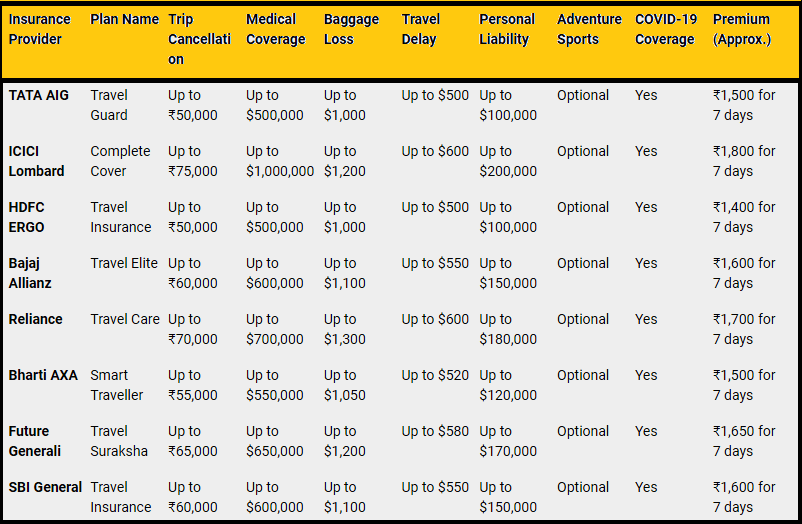

Compare Different Travel Insurance Plans

Here’s a detailed comparison of different travel insurance plans available in India. This table includes key features, coverage limits, and other important details to help you make an informed decision:

Key Considerations

- Trip Cancellation: This covers non-refundable expenses if you need to cancel your trip due to unforeseen circumstances.

- Medical Coverage: This is crucial for covering medical emergencies and hospital expenses while traveling.

- Baggage Loss: Compensation for lost, stolen, or damaged baggage.

- Travel Delay: Reimbursement for additional expenses incurred due to travel delays.

- Personal Liability: Covers legal expenses if you accidentally cause injury or damage to someone else’s property.

- Adventure Sports: Optional coverage for injuries sustained during high-risk activities.

- COVID-19 Coverage: Ensures coverage for medical treatment and trip cancellations related to COVID-19.

Some Common Exclusion to Watch Out For

When reviewing travel insurance policies, it’s crucial to be aware of common exclusions that might limit your coverage. Here is some typical exclusion to watch out for:

1. Pre-Existing Medical Conditions

Many travel insurance policies exclude coverage for pre-existing medical conditions unless you purchase a specific add-on or meet certain criteria.

2. High-Risk Activities

Standard policies often exclude injuries sustained during high-risk activities such as skydiving, scuba diving, bungee jumping, and other adventure sports. You may need to buy additional coverage for these activities.

3. Pandemics and Epidemics

While some policies now include COVID-19 coverage, many still exclude pandemics and epidemics. Always check if your policy covers COVID-19-related issues.

4. Travel to High-Risk Destinations

Travel insurance may not cover trips to destinations with travel advisories or warnings issued by your government. This can include areas with political unrest, war zones, or regions affected by natural disasters.

5. Acts of Terrorism

Some policies exclude coverage for losses resulting from acts of terrorism. If this is a concern, look for a policy that includes terrorism coverage.

6. Self-Inflicted Injuries

Injuries or illnesses resulting from self-harm, suicide attempts, or reckless behavior are typically not covered.

7. Alcohol and Drug Use

Claims arising from incidents where the insured was under the influence of alcohol or drugs are usually excluded.

8. Non-Medically Necessary Treatments

Elective or non-emergency medical treatments, such as cosmetic surgery, are generally not covered.

9. Unapproved Medical Treatments

Medical treatments that are not approved or recommended by a licensed physician or that are experimental in nature may be excluded.

10. Pregnancy and Childbirth

Routine pregnancy and childbirth are often excluded, although complications arising from pregnancy may be covered under certain conditions.

11. Losses Due to Illegal Activities

Any losses incurred while engaging in illegal activities or violating local laws are typically not covered.

12. Unattended Baggage

Claims for lost or stolen baggage may be denied if the baggage was left unattended in a public place.

13. Mental Health Issues

Coverage for mental health issues, including anxiety and depression, is often limited or excluded.

14. Natural Disasters

Some policies exclude coverage for natural disasters unless you purchase additional coverage.

15. Missed Connections

Standard policies may not cover missed connections unless they are due to reasons specified in the policy, such as severe weather or airline strikes.

Tips for Avoiding Exclusions

- Read the Fine Print: Carefully review the policy documents to understand all exclusions.

- Ask Questions: If you’re unsure about any aspect of the coverage, ask the insurer for clarification.

- Consider Add-Ons: Purchase additional coverage for high-risk activities, pre-existing conditions, or other specific needs.

- Stay Informed: Keep up-to-date with travel advisories and ensure your destination is covered.

By being aware of these common exclusions, you can choose a travel insurance policy that provides the comprehensive coverage you need for a worry-free trip.

How to find a Policy that Covers Pre-existing Medical Conditions

Finding a travel insurance policy that covers pre-existing medical conditions can be a bit more challenging, but it’s definitely possible. Here are some steps to help you find the right coverage:

1. Research Specialized Providers

Some insurance companies specialize in offering coverage for travelers with pre-existing medical conditions. These providers often have tailored policies that can accommodate a wide range of health issues. Examples include:

- Staysure

- InsureCancer

- AllClear Insurance

- Travel Insurance 4 Medical

2. Compare Policies Online

Use comparison websites to compare different travel insurance policies. These platforms allow you to filter results based on your specific needs, including coverage for pre-existing conditions. Websites like Money Supermarket and Compare the Market are good places to start.

3. Check for Medical Screening

Many insurers require a medical screening to assess your condition before offering coverage. Be prepared to provide detailed information about your medical history. This helps the insurer determine the level of risk and the appropriate premium.

4. Look for Exclusion Waivers

Some policies offer a pre-existing medical condition exclusion waiver. This waiver lifts the exclusion for pre-existing conditions, meaning the policy will cover medical expenses related to those conditions if you need treatment during your trip.

5. Read the Fine Print

Carefully review the policy documents to understand what is covered and what is excluded. Make sure the policy explicitly states that it covers your specific medical condition.

6. Consult with an Insurance Broker

If you’re having trouble finding a suitable policy, consider consulting with an insurance broker. Brokers have access to a wide range of policies and can help you find one that meets your needs.

7. Be Honest About Your Condition

Always disclose your medical condition accurately when applying for travel insurance. Failing to do so can result in your claims being denied.

8. Consider the Cost

Policies that cover pre-existing conditions may be more expensive, but the peace of mind and financial protection they offer are worth the investment.

Example Providers and Policies

| Provider | Policy Name | Coverage for Pre-Existing Conditions | Medical Screening Required | Exclusion Waiver | Premium (Approx.) |

|---|---|---|---|---|---|

| Staysure | Comprehensive Travel Cover | Yes | Yes | Yes | ₹2,000 for 7 days |

| All Clear Insurance | Gold Travel Insurance | Yes | Yes | Yes | ₹2,200 for 7 days |

| Insure Cancer | Cancer Travel Insurance | Yes | Yes | Yes | ₹2,500 for 7 days |

| Travel Insurance 4 Medical | Medical Travel Cover | Yes | Yes | Yes | ₹2,100 for 7 days |

Additional Tips

- Start Early: Begin your search for travel insurance as soon as you start planning your trip.

- Ask for Recommendations: If you know others with similar conditions, ask them which insurers they use.

- Review Customer Feedback: Look for reviews and testimonials from other travellers with pre-existing conditions to gauge the reliability of the insurer.

Conclusion

Travel insurance is a vital component of any travel plan, providing financial protection and peace of mind against a wide range of potential issues. When choosing a travel insurance policy, ensure it includes coverage for trip cancellation, medical emergencies, baggage loss, travel delays, personal liability, and more. By understanding what should be included in your travel insurance, you can travel with confidence, knowing you’re protected against the unexpected.

Frequently Asked Questions

1. What is travel insurance?

Travel insurance is a type of insurance that provides coverage for various risks associated with traveling, such as trip cancellations, medical emergencies, lost luggage, travel delays, and more. It helps protect you financially against unexpected events that could disrupt your travel plans.

2. What does travel insurance typically cover?

Travel insurance typically covers:

- Trip cancellation and interruption

- Medical and emergency assistance

- Baggage loss and delay

- Travel delays

- Personal liability

- Accidental death and dismemberment

- Coverage for pre-existing medical conditions (if specified)

- Adventure sports (if specified)

- Rental car coverage

- COVID-19 related issues

3. How do I choose the right travel insurance plan?

To choose the right travel insurance plan, consider the following:

- Assess your travel needs and risks

- Compare coverage limits and exclusions

- Evaluate the cost and deductibles

- Check the insurer’s reputation and customer reviews

- Look for additional benefits like 24/7 assistance services

4. Are pre-existing medical conditions covered by travel insurance?

Coverage for pre-existing medical conditions varies by policy. Some insurers offer coverage if you meet certain criteria, such as being medically stable for a specified period before purchasing the policy. Always disclose your medical history accurately and check if the policy includes a pre-existing condition exclusion waiver.

5. What are common exclusions in travel insurance policies?

Common exclusions include:

- Pre-existing medical conditions (unless specified)

- High-risk activities (unless specified)

- Pandemics and epidemics (unless specified)

- Travel to high-risk destinations

- Acts of terrorism

- Self-inflicted injuries

- Alcohol and drug-related incidents

- Non-medically necessary treatments

- Routine pregnancy and childbirth

- Losses due to illegal activities

6. How do I file a travel insurance claim?

To file a travel insurance claim:

- Notify your insurer as soon as possible

- Gather necessary documentation (e.g., medical reports, receipts, police reports)

- Complete the claim form provided by the insurer

- Submit the form and documentation to the insurer

- Follow up with the insurer for any additional information or steps required

7. Can I buy travel insurance after booking my trip?

Yes, you can buy travel insurance after booking your trip. However, purchasing it soon after booking can provide additional benefits, such as coverage for pre-existing conditions and trip cancellation due to unforeseen events.

8. Is travel insurance mandatory?

Travel insurance is not mandatory for all destinations, but some countries require it for entry. Even if it’s not mandatory, having travel insurance is highly recommended to protect yourself against unexpected events and financial losses.

9. What should I do if I need medical assistance while traveling?

If you need medical assistance while traveling:

- Contact your travel insurance provider’s emergency assistance hotline

- Follow their instructions for seeking medical treatment

- Keep all medical reports, receipts, and documentation for your claim

- Inform the local authorities if necessary

10. How much does travel insurance cost?

The cost of travel insurance varies based on factors such as:

- The length and destination of your trip

- Your age and health condition

- The coverage limits and benefits included in the policy

- Any additional coverage options (e.g., adventure sports, rental car coverage)

-

Nothing Phone 4a and 4a Pro: Snapdragon 7 Gen 4, Gaming Benchmarks, Connectivity Features and 6 Years Android Updates for India

Nothing’s latest Phone 4a and 4a Pro, launched on March 5, 2026, bring fresh vibes to India’s competitive

-

War Premium, Sanctions, and Discounted Crude: Why India’s Rush Back to Russian Oil Is More Complex Than You Think

India had almost ditched Russian oil — until Iran’s war changed everything overnight. Now Washington is quietly handing

-

BoB Raises ₹10,000 Crore for Green Infrastructure — Which Projects Will Get Funded and Who Really Benefits?

BoB’s massive ₹10,000 crore green bond bonanza: First-ever in India! But wait—which secret solar farms, wind giants, or

-

Oracle Shocks the Tech World Again — Is Larry Ellison’s AI Pivot Costing 30,000 Their Jobs?

Oracle is planning to fire up to 30,000 employees — its biggest layoff ever. But here’s the twist:

-

Diesel Prices Surge in India: Hormuz Halt Puts Spotlight on Reserves and Russian Supplies

Key Takeaway Iran’s declaration that the Strait of Hormuz is “closed” has sent global crude prices sharply higher,

With over 15 years of experience in Banking, investment banking, personal finance, or financial planning, Dkush has a knack for breaking down complex financial concepts into actionable, easy-to-understand advice. A MBA finance and a lifelong learner, Dkush is committed to helping readers achieve financial independence through smart budgeting, investing, and wealth-building strategies, Follow Dailyfinancial.in for practical tips and a roadmap to financial success!