“Learn how late payments can ruin your credit score and financial reputation. Discover the long-term consequences, tips to mitigate damage, and strategies to rebuild your credit. Protect your financial future with expert advice on managing debt and improving your creditworthiness. Read now!”

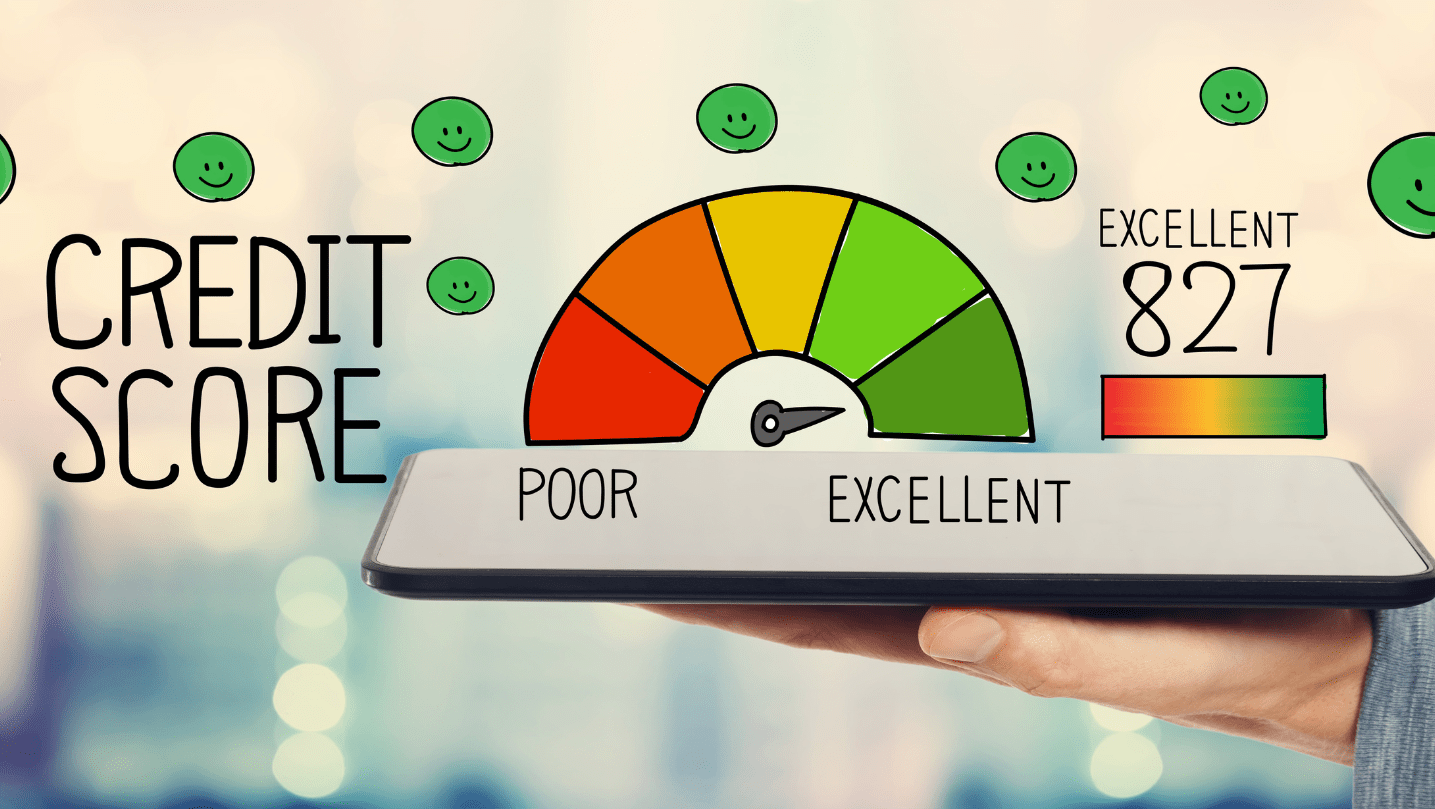

Your credit score is more than just a number—it’s a reflection of your financial health and reputation. Whether you’re applying for a mortgage, a car loan, or even a new credit card, your credit score plays a pivotal role in determining your eligibility and the terms you’ll receive. One of the most significant factors that can negatively impact your credit score is late payments. In this comprehensive guide, we’ll explore how late payments can ruin your financial reputation, the long-term consequences, and what you can do to mitigate the damage.

Understanding Credit Scores: The Basics

Before diving into the impact of late payments, it’s essential to understand what a credit score is and how it’s calculated. A credit score is a three-digit number, typically ranging from 300 to 850, that lenders use to assess your creditworthiness. The higher your score, the more likely you are to be approved for credit and receive favorable terms.

Key Factors That Influence Your Credit Score:

- Payment History (35%): This is the most significant factor and includes whether you’ve made payments on time, the number of late payments, and how late those payments were.

- Credit Utilization (30%): This refers to the amount of credit you’re using compared to your total available credit limit.

- Length of Credit History (15%): The longer your credit history, the better, as it provides more data for lenders to assess your creditworthiness.

- Types of Credit (10%): A mix of different types of credit (e.g., credit cards, mortgages, auto loans) can positively impact your score.

- New Credit Inquiries (10%): Applying for new credit can result in a hard inquiry, which may temporarily lower your score.

The Impact of Late Payments on Your Credit Score

Late payments can have a devastating effect on your credit score, and the severity of the impact depends on several factors, including how late the payment is, how frequently you’ve been late, and the type of credit account.

1. How Late is Late?

- 30 Days Late: A payment that’s 30 days late can drop your credit score by as much as 100 points, depending on your starting score. This is the first threshold where late payments are reported to credit bureaus.

- 60 Days Late: If you miss two consecutive payments, your credit score will take an even more significant hit. Lenders may start to view you as a higher-risk borrower.

- 90 Days Late: At this point, your account may be classified as delinquent, and the damage to your credit score will be severe. You may also face additional penalties, such as increased interest rates or fees.

- 120+ Days Late: If you’re more than 120 days late, your account may be sent to collections, which will have a long-lasting negative impact on your credit score.

2. Frequency of Late Payments

The more frequently you miss payments, the more your credit score will suffer. Even if you’ve only been late once, if it’s a recent occurrence, it can still have a significant impact. Lenders are particularly wary of borrowers who have a pattern of late payments, as it suggests a lack of financial responsibility.

3. Type of Credit Account

The type of credit account you’re late on can also influence the severity of the impact. For example, being late on a mortgage payment is generally viewed more negatively than being late on a credit card payment. This is because mortgage payments are typically larger and more critical to your overall financial stability.

Long-Term Consequences of Late Payments

The impact of late payments on your credit score isn’t just immediate—it can have long-term consequences that affect your financial reputation for years to come.

1. Higher Interest Rates

If you’re able to secure new credit after a late payment, you’ll likely face higher interest rates. Lenders view borrowers with lower credit scores as higher-risk, and they compensate for this risk by charging higher interest rates. Over time, this can cost you thousands of dollars in additional interest payments.

2. Difficulty Securing New Credit

A lower credit score can make it challenging to secure new credit, whether it’s a credit card, auto loan, or mortgage. Even if you are approved, the terms may be less favorable, with higher interest rates and lower credit limits.

3. Impact on Employment Opportunities

Some employers check credit scores as part of their hiring process, particularly for positions that involve financial responsibility. A low credit score due to late payments could potentially cost you a job opportunity.

4. Higher Insurance Premiums

In some states, insurance companies use credit scores to determine premiums for auto and home insurance. A lower credit score could result in higher insurance premiums, adding to your financial burden.

5. Difficulty Renting a Home

Landlords often check credit scores as part of the rental application process. A low credit score due to late payments could make it difficult to rent an apartment or house, and you may be required to pay a higher security deposit.

How to Mitigate the Damage of Late Payments

If you’ve already missed a payment, don’t panic—there are steps you can take to mitigate the damage and start rebuilding your credit score.

1. Make Payments on Time Going Forward

The most important thing you can do is to make all future payments on time. Payment history is the most significant factor in your credit score, and consistently making on-time payments will help improve your score over time.

2. Contact Your Lender

If you’ve missed a payment, contact your lender as soon as possible. Some lenders may be willing to work with you, especially if you have a good history with them. They may offer a grace period, waive late fees, or even remove the late payment from your credit report.

3. Set Up Payment Reminders

To avoid missing future payments, set up payment reminders or automatic payments. Many banks and credit card companies offer this service, which can help ensure that you never miss a payment again.

4. Pay Down Existing Debt

Reducing your overall debt can help improve your credit utilization ratio, which is another significant factor in your credit score. Aim to keep your credit utilization below 30% of your available credit limit.

5. Consider a Secured Credit Card

If your credit score has taken a significant hit, you may have difficulty getting approved for a traditional credit card. A secured credit card can be a good option for rebuilding your credit. With a secured card, you’ll need to provide a security deposit, which serves as your credit limit. By using the card responsibly and making on-time payments, you can gradually improve your credit score.

6. Monitor Your Credit Report

Regularly monitoring your credit report can help you stay on top of your credit score and identify any errors or inaccuracies. You’re entitled to a free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once a year through AnnualCreditReport.com. If you find any errors, dispute them with the credit bureau to have them corrected.

7. Seek Professional Help

If you’re struggling to manage your debt and improve your credit score, consider seeking help from a credit counseling agency. These organizations can provide you with personalized advice and help you create a debt management plan.

The Importance of Financial Education

One of the best ways to avoid late payments and maintain a healthy credit score is through financial education. Understanding how credit works, the importance of making on-time payments, and how to manage your debt can help you make informed financial decisions.

Resources for Financial Education:

- Online Courses: There are numerous online courses and resources available that can help you learn about credit, budgeting, and debt management.

- Books: There are many books on personal finance that can provide valuable insights and tips for managing your credit.

- Workshops and Seminars: Many community organizations and financial institutions offer free workshops and seminars on financial topics.

Your credit score is a critical component of your financial reputation, and late payments can have a significant negative impact. Understanding how late payments affect your credit score and taking steps to mitigate the damage is essential for maintaining a healthy financial profile. By making on-time payments, reducing your debt, and monitoring your credit report, you can rebuild your credit score and improve your financial reputation over time.

Remember, your credit score is not just a number—it’s a reflection of your financial responsibility. Taking control of your credit today will pay dividends in the future, opening doors to better financial opportunities and a more secure financial future.

-

From Kotak Mahindra Founder to GIFT City Helm: How Uday Kotak’s Expertise Will Boost Gujarat’s Global Finance Hub Status

-

Google Launches ‘Safety Charter’ to Protect Indians from Online Frauds

-

My Father Secretly Gifted Our Ancestral House to My Elder Brother — Can I Still Claim My Share in 2026?

-

How Salaried Employees Can Save Up to Rs 1.05 Lakh Tax-Free Every Year Using Employer Meal Cards Under Draft Tax Rules 2026