India’s UPI is set for a seismic shift! From September 15, 2025, NPCI unveils ₹5 lakh transaction limits for special merchants, with ₹10 lakh daily caps, revolutionizing tax, investment, and insurance payments. With 12 billion monthly transactions, this fuels India’s $1 trillion digital economy. Will this redefine financial freedom or spark new challenges? Discover how verified merchants and 500 million digital wallet users stand to gain, and why UPI’s bold move could make cheques obsolete in this thrilling leap toward a cashless future!

The Unified Payments Interface (UPI) continues to evolve as a cornerstone of financial transactions. As we approach September 15, 2025, the National Payments Corporation of India (NPCI) is set to roll out enhanced UPI transaction limits for special merchants, boosting per-transaction caps to ₹5 lakh and daily aggregates to ₹10 lakh in key categories. This update isn’t just a technical tweak—it’s a strategic leap forward, addressing the growing demand for seamless high-value payments in a nation where digital adoption is skyrocketing. From bustling Mumbai markets to remote villages in Rajasthan, Indians are increasingly relying on UPI for everything from daily groceries to major investments. In this comprehensive guide, we’ll dive deep into what these changes mean, why they’re happening now, and how they position India as a global leader in fintech innovation.

Understanding UPI and Its Evolution in India

The Rise of UPI: From Launch to Dominance

Launched in 2016 by NPCI, UPI has revolutionized how Indians handle money. This interoperable platform allows instant transfers between bank accounts via mobile apps, operating 24/7 without the need for physical cards or cash. By 2025, UPI processes over 12 billion transactions monthly, according to NPCI’s latest data—a staggering jump from 1 billion in 2019. This growth reflects India’s digital maturity, with over 1.4 billion people now connected to the internet and more than 500 million using digital wallets.

But UPI wasn’t always equipped for big-ticket items. Initial limits were set conservatively at ₹1 lakh per transaction to ensure security and prevent fraud. As India’s economy boomed—GDP growth projected at 7% for 2025 by the IMF—these caps started feeling restrictive. High-value transactions, like paying hefty insurance premiums or investing in mutual funds, often required splitting payments or switching to slower methods like NEFT or RTGS. Enter the 2025 updates: higher UPI transaction limits tailored for special merchants, signaling NPCI’s confidence in the system’s robustness.

Why Special Merchants? Focusing on Verified and Compliant Entities

Not every merchant gets this boost. NPCI’s directive emphasizes “verified merchants” who adhere to strict guidelines, including KYC compliance, fraud monitoring, and integration with secure APIs. This selective approach minimizes risks in India’s vast digital payment ecosystem, where cyber threats are on the rise—2025 cybersecurity reports from Deloitte indicate a 20% increase in payment fraud attempts. By limiting enhancements to categories like tax payments, capital markets, and insurance, NPCI ensures that higher limits benefit sectors with inherent trust and regulatory oversight.

From an Indian perspective, this is crucial. In a country where small vendors in Kolkata’s New Market coexist with global giants like Reliance, verification builds confidence. Imagine a farmer in Punjab using UPI to pay for agricultural insurance without worrying about transaction failures— that’s the inclusive vision driving these changes.

SMBC’s ₹13,483 Crore Yes Bank Deal : How Japan’s SMBC is Redefining India Banking Trends

Education Loan or Education Plan: What’s the Best Choice for Indian Parents?

From TDS to TCS: How Budget 2025 is Making Taxes Easier for Everyone

Electric Car Insurance: Shocking Differences You Need to Know!

Breaking Down the New UPI Transaction Limits for 2025

NPCI's Official Guidelines: What's Changing?

Effective September 15, 2025, NPCI has mandated acquiring banks to implement these elevated limits for person-to-merchant (P2M) transactions. The focus is on easing friction for high-value exchanges while maintaining daily caps to curb misuse. Here's a detailed table summarizing the shifts, based on NPCI's August 2025 circular:

| Category | Previous Per-Transaction Limit | New Per-Transaction Limit | New 24-Hour Aggregate Limit |

| Tax Payments (incl. GeM) | ₹1 lakh | ₹5 lakh | ₹10 lakh |

| Capital Markets (Investments) | ₹2 lakh | ₹5 lakh | ₹10 lakh |

| Insurance Premiums | ₹2 lakh | ₹5 lakh | ₹10 lakh |

| Travel Payments | ₹1 lakh | ₹5 lakh | ₹10 lakh |

| Credit Card Payments | ₹2 lakh | ₹5 lakh | ₹6 lakh |

| Loan and EMI Collections | ₹2 lakh | ₹5 lakh | ₹10 lakh |

| Jewellery Payments | ₹1 lakh | ₹2 lakh | ₹6 lakh |

These updates apply exclusively to verified merchants, ensuring only compliant entities can handle larger sums. P2P limits remain at ₹1 lakh daily, preserving safeguards for everyday peer transfers.

Category-Specific Insights: Who Benefits Most?

Tax Payments and Government e-Market Place (GeM)

India's tax landscape is digitizing rapidly. In 2025, GST collections hit ₹2 trillion monthly, per CBIC data, with many businesses opting for UPI due to its speed. The jump from ₹1 lakh to ₹5 lakh per transaction simplifies corporate tax filings and GeM procurements—government's online marketplace for goods and services. For a medium-sized enterprise in Chennai paying quarterly GST, this means one seamless transaction instead of five, saving hours and reducing errors.

Narrative spotlight: Meet Rajesh, a textile exporter from Surat. Previously, his ₹4 lakh tax payment required multiple UPI transfers, each with OTP verifications. Post-September 15, he completes it in one go, freeing time for business expansion amid India's export boom to $1 trillion by 2030.

Capital Markets and Investments

With India's stock market capitalization surpassing $5 trillion in 2025 (BSE data), investors are pouring funds into equities and mutual funds. The new ₹5 lakh limit doubles the previous cap, enabling lump-sum investments without fragmentation. SEBI's push for digital demat accounts aligns perfectly, making UPI a preferred channel over cheques.

Story time: Anjali, a young professional in Hyderabad, recalls splitting her ₹3 lakh SIP investment last year. Now, with higher limits, she invests effortlessly via apps like Groww or Zerodha, boosting her portfolio in a market where retail participation has grown 30% YoY.

Insurance Premiums: Securing Futures Digitally

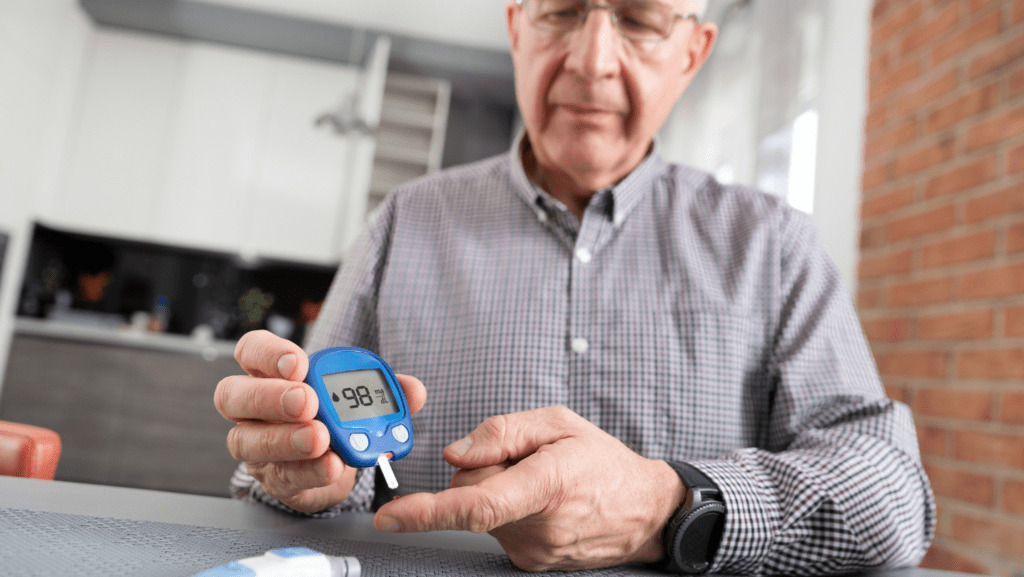

Insurance penetration in India reached 5% in 2025 (IRDAI stats), up from 3.7% in 2020, driven by health and life policies post-pandemic. The ₹5 lakh cap supports premium payments for family floater plans or high-value term insurance, reducing reliance on bank drafts.

Personal anecdote: In rural Maharashtra, farmer Vijay used to travel to banks for his crop insurance renewal. UPI's enhanced limits mean he pays from home, aligning with PM Fasal Bima Yojana's digital goals.

Travel, Credit Cards, Loans, and More

Travel payments soar with India's tourism rebound—domestic trips up 25% in 2025 (Ministry of Tourism). Higher limits facilitate booking flights or hotels without caps hindering. Credit card bills, often ₹3-4 lakh for high-spenders, now settle smoothly. Loan collections benefit fintechs like Paytm or PhonePe, streamlining EMIs in a ₹50 trillion lending market.

Jewellery payments, capped at ₹2 lakh, cater to festive seasons like Diwali, where gold purchases spike.

The Broader Impact: Users, Merchants, and the Economy

Elevating User Experience in Everyday Finances

For millions of Indians, these limits mean goodbye to transaction splitting. Benefits include:

- Time Savings: Complete payments in seconds, not minutes.

- Error Reduction: Fewer entries lower typo risks.

- Convenience Boost: Handle emergencies, like sudden medical insurance top-ups, without hassle.

In a 2025 Nielsen survey, 78% of UPI users cited limits as a pain point; this update directly addresses that, enhancing satisfaction.

Empowering Merchants: From Verification to Volume Growth

Verified merchants gain a competitive edge. Compliance involves API integrations and fraud checks, but rewards include higher transaction volumes. Sectors like insurance see 15% uptake in digital premiums (McKinsey 2025 report), thanks to frictionless payments.

Example: A Mumbai jeweler, post-verification, processes ₹2 lakh gold sales via UPI, attracting tech-savvy buyers over cash.

Fueling India's Digital Payment Adoption

UPI's transaction value crossed ₹200 trillion in FY 2024-25 (RBI data), with high-value segments growing fastest. Higher limits reduce cash dependency, aligning with Digital India initiatives. They also curb black money, as traceable digital trails promote transparency.

Globally, India leads: UPI volumes surpass China's WeChat Pay, per World Bank 2025 fintech index.

How Banks and PSPs Are Preparing for Implementation

Technical and Compliance Roadmaps

By September 15, banks like HDFC and SBI must update systems for real-time limit tracking. This includes:

- Merchant Verification: Automated KYC via Aadhaar and PAN.

- Aggregate Monitoring: AI-driven tools to enforce ₹10 lakh daily caps.

- Fraud Prevention: Enhanced ML models detecting anomalies.

PSPs like Google Pay and BHIM will notify users via apps, with some imposing sub-limits for added security.

Challenges? Integration delays in smaller banks, but NPCI's phased rollout ensures smoothness.

User Notifications and Bank-Specific Variations

Expect push alerts: "Your UPI limit for taxes now ₹5 lakh!" Banks may offer opt-ins for higher limits, tied to account tiers.

Why Now? Timing the 2025 UPI Limit Hike

Responding to Economic and Digital Growth

India's digital economy is projected at $1 trillion by 2028 (NITI Aayog). With inflation at 5% and rising incomes, high-value needs escalate. NPCI's move mirrors this, building on 2024 relaxations for hospitals and education.

Smoothing High-Value Transactions

Past frictions—like reconciling split payments—hindered efficiency. Now, UPI rivals credit cards for large sums, with lower fees.

Prioritizing Security in Verified Ecosystems

Limits tied to verification mitigate risks; 2025 saw a 10% drop in UPI fraud post-similar measures (RBI).

Future Implications for India's Payment Landscape

UPI as the Ultimate Payment Hub

These changes solidify UPI's versatility, from micro-payments to macro-transactions, potentially integrating with CBDC (e-Rupee) pilots.

Synergies with National Initiatives

Aligns with Jan Dhan 2.0, promoting inclusion for 500 million unbanked. Supports Make in India by easing B2B payments.

Opportunities for Innovation

Fintechs innovate: AI chatbots for limit queries, blockchain for verification. Banks gain from premium users, boosting revenues 12% (EY 2025 forecast).

Final Thought

As September 15, 2025, dawns, NPCI's higher UPI transaction limits for special merchants herald a new era in India's digital payments. From ₹5 lakh per transaction to ₹10 lakh daily aggregates, this enhancement empowers users with unparalleled convenience, merchants with robust growth, and the economy with accelerated digitization. In a nation where UPI has become synonymous with financial freedom—from street vendors in Varanasi to corporates in Gurgaon—these changes underscore our commitment to innovation, security, and inclusion. As we embrace this milestone, India's fintech story continues to inspire the world, proving that seamless payments aren't just transactions—they're pathways to prosperity.