Why Eternal Shares Jumped 6% to ₹307: Q3 Profit Surge and Blinkit Turnaround Explained

Eternal shares skyrocketed 6% to ₹307—a three-month high—but why now, after leadership drama? Blinkit’s shock profit flip and Q3 beats stunned analysts, outpacing Swiggy’s losses. Is this the delivery-tech rebound Indian investors crave, or a trap? Uncover the hidden triggers before FIIs pile in!

Eternal Ltd shares surged over 6% to around ₹307, hitting their highest level in nearly three months and signalling a strong comeback in India’s delivery-tech space. For Indian investors, this move is more than a day’s rally—it reflects a shift in sentiment around food delivery, quick commerce and new-age tech stocks.

What exactly happened with Eternal?

Eternal Ltd, the parent of food delivery platform Zomato and quick-commerce player Blinkit, jumped over 6% in today’s trade to around ₹307–307.45 per share. This level is the highest since late November 2025, effectively making it a near three‑month high for the stock.

The move comes after a period of correction when the stock had fallen sharply from its 52‑week high of about ₹368 hit in October 2025. Despite today’s surge, the stock is still below that peak, which means there may still be room for long‑term investors if fundamentals remain strong.

Why did Eternal rally 6%?

The rally is rooted in fundamentals rather than just hype. Eternal’s December quarter (Q3 FY26) numbers were robust: revenue from operations jumped to about ₹16,315 crore, growing over 200% year‑on‑year, while net profit came in around ₹102 crore, up roughly 57%. EBITDA also improved to around ₹364–368 crore, indicating better operating efficiency and margin expansion.

A major trigger was the turnaround in its newer businesses. Blinkit (quick commerce) and Hyperpure (B2B supplies to restaurants) both turned Adjusted EBITDA positive for the first time, a key milestone for any high‑growth tech business. Quick commerce drove most of the growth, with adjusted revenue surging over 700% year‑on‑year to more than ₹12,000 crore, while the core food delivery business still managed double‑digit revenue growth of over 25%.

Another factor is market positioning. Delivery‑tech stocks as a basket were strong today, with both Eternal and Swiggy rising on heavy volumes; Eternal traded around ₹307.45, while Swiggy was up over 5% near ₹350.95. Block deals and higher trading volumes in Eternal indicate renewed institutional interest, which usually underpins such sharp short‑term rallies.

From panic to confidence: sentiment shift

Interestingly, this rally comes after a period of nervousness in the market. Following Eternal’s Q3 results, there was a sharp correction as investors reacted negatively to founder Deepinder Goyal stepping back from an executive role, even though the numbers were fundamentally strong. Leadership changes in founder‑driven tech companies often trigger knee‑jerk reactions in India, as investors worry about execution risk and vision continuity.

However, as the street digested the results, focus shifted back to growth and profitability. Eternal’s ability to deliver high revenue growth, profitability at the consolidated level, and positive Adjusted EBITDA in Blinkit and Hyperpure reassured many investors. Today’s 6% move reflects that the market is now rewarding operating performance rather than obsessing over management headlines.

Analyst stance also supports this optimism. Out of 33 analysts tracking Eternal, about 30 maintain a “Buy” rating, with only a small minority recommending “Sell”, and some brokerages have set target prices as high as ₹480—well above the current ₹300‑plus levels. This strong institutional and analyst backing adds a layer of confidence for retail investors looking at the stock’s medium‑term potential.

What this means for Indian investors

For Indian investors, Eternal’s surge is a live case study in how new‑age tech stocks are maturing on Dalal Street. Earlier, the biggest criticism around food delivery and quick commerce platforms was that they “burn cash” without clear profitability; now, Eternal is showing that scale plus discipline can lead to profits. The company has managed to balance aggressive growth with improving margins, especially in Blinkit and Hyperpure, which are often seen as capital‑intensive segments.

At the same time, investors need to recognise that the stock is not risk‑free. Even after the recent correction, Eternal has delivered strong gains over the last year, with the stock up nearly 30% over a 12‑month period, and it has already rallied in the past two sessions by roughly 8%. The stock also remains below its 52‑week high of around ₹368, highlighting both upside potential and the possibility of volatility if sentiment turns again.

Delivery‑tech is also a highly competitive space in India, with players like Swiggy, ONDC‑linked platforms and hyperlocal players intensifying the battle for market share. Still, Eternal’s strong analyst coverage, rising foreign interest as headroom for overseas investors has opened up, and its diversified business model across food delivery, quick commerce, and B2B supplies provide multiple growth levers.

Practical takeaways for a retail investor

If you are tracking Eternal as an Indian retail investor, here are some points to consider (not as investment advice, but as a framework for thinking):

- Check whether the rally is supported by earnings: In Eternal’s case, the 6% surge is backed by strong Q3 numbers and improving profitability, not just speculation.

- Look at business segments separately: Food delivery, quick commerce and B2B supplies have different risk-return profiles; Blinkit’s high growth and new profitability are especially important for the valuation.

- Watch leadership and governance: The recent reaction to founder role changes shows how sensitive the market is to governance; clarity and stability here will matter for long‑term valuations.

- Respect volatility: The stock has already run up from its recent lows and still trades below its peak, which means both corrections and fresh rallies are possible.

An experienced investor in India would typically track quarterly results, analyst revisions, and volume patterns before making a call on such a stock, especially after a sharp move like a 6% single‑day surge.

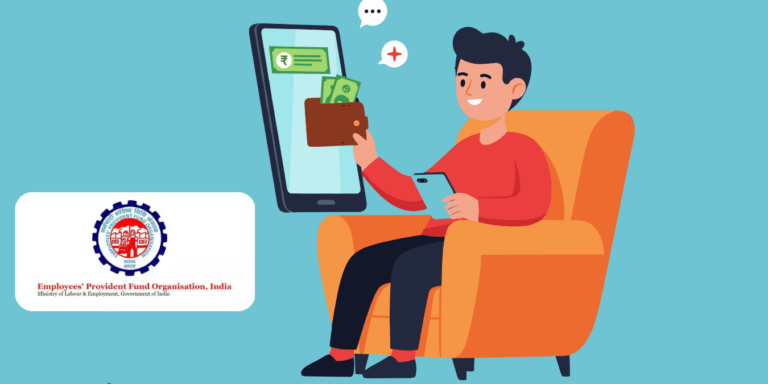

Eternal vs delivery‑tech peers: quick comparison

Eternal Ltd and its peers in India's delivery-tech sector, like Swiggy, are showing strength amid robust Q3 FY26 results and quick commerce growth. Here's a detailed comparison table expanding on market performance, financials, and key metrics as of February 10, 2026.

Detailed Comparison Table

| Metric | Eternal Ltd | Swiggy Ltd |

| Today's Price & Move | ₹307–307.45, up over 6% to near three-month high (highest since late Nov 2025) | ₹354–355.75, up 4–5% to near one-month high |

| Market Cap | ₹2,78,000–2,94,000 Cr | ₹92,000–92,100 Cr |

| P/E Ratio (TTM) | 528–1,260x (high due to low but positive EPS ₹0.55–0.58) | Negative (-19 to -21x, reflecting ongoing losses) |

| Q3 FY26 Revenue | ₹16,315 Cr (up 202% YoY, 20% QoQ); driven by quick commerce ₹12,000 Cr (700% YoY) | ₹6,148 Cr (up 54% YoY); strong in quick commerce/supply chain |

| Q3 FY26 Net Profit | ₹102 Cr (up 73% YoY, 57% QoQ) | Net loss ₹1,065 Cr (widened); EBITDA loss ₹782 Cr |

| EBITDA/Profitability | Adjusted EBITDA ₹364 Cr positive; Blinkit & Hyperpure now Adjusted EBITDA positive | EBITDA loss widened to ₹782 Cr (margin -12.72%); food delivery profitable but overall pressured |

| Key Growth Drivers | Blinkit/Hyperpure turnaround, food delivery +25% YoY; sentiment recovery post-leadership change | Revenue surge from quick commerce/Instamart; expansion investments but profitability lags |

| Market Share (Quick Commerce) | Blinkit 40% (leads with 639+ dark stores) | Instamart 32% (trailing but expanding) |

| Analyst Outlook | 30/33 "Buy" ratings; targets up to ₹480 | Divided; focus on path to EBITDA positivity by Q3 FY26 but losses persist |

Eternal edges ahead in scale, profitability, and market leadership, especially via Blinkit, while Swiggy shows solid revenue momentum but trails on margins. Investors should monitor quick commerce expansion and competition intensity for both.