Who Qualifies for FAST-DS 2026? Eligibility Rules for Returning NRIs and ESOP Holders with Overseas Accounts

Hidden ₹50 lakh overseas account from student days? Budget 2026’s secret FAST-DS lifeline lets small taxpayers confess foreign assets up to ₹5 crore—for just 60% tax or ₹1 lakh fee—dodging 10-year jail under Black Money Act. But the 6-month clock ticks… Eligible? Your last escape revealed inside!

Budget 2026 brings relief for millions of everyday Indians holding small foreign assets. The Foreign Assets of Small Taxpayers Disclosure Scheme (FAST-DS 2026) offers a six-month window to disclose past oversights without fear of prosecution.

Understanding FAST-DS 2026

FAST-DS 2026 is a voluntary, one-time scheme introduced in the Finance Bill 2026 to help small taxpayers regularize undisclosed foreign income or assets. It targets genuine cases like forgotten ESOPs from overseas jobs or dormant bank accounts from student days abroad, providing immunity from penalties and prosecution under the Black Money Act upon payment of tax or fee. Unlike broad amnesty programs, this is limited to low-value holdings up to ₹1 crore for undeclared income/assets and ₹5 crore for reporting lapses where tax was paid.

From an Indian viewpoint, this scheme acknowledges the realities of a globalized workforce—NRIs returning home, IT professionals on short stints abroad, or students studying overseas—who often miss Schedule FA disclosures in ITRs due to confusion or oversight. The government aims to boost compliance amid rising data from Automatic Exchange of Information (AEOI), without punishing honest mistakes.

Who Qualifies? Key Eligibility Criteria

Eligibility splits into two categories for resident taxpayers (including returning NRIs now deemed residents).

- Category 1 (Never Disclosed Income or Asset): Covers foreign income never taxed in India or assets never reported in ITR Schedule FA, with total value ≤ ₹1 crore.

- Category 2 (Tax Paid but Asset Not Disclosed): Applies if income was declared and taxed but the asset (e.g., foreign brokerage account) was omitted; limit ≤ ₹5 crore.

Students, young professionals, techies with RSUs/ESOPs, and repatriated NRIs with small savings policies fit perfectly. Exclusions include proceeds of crime, ongoing prosecutions, or values exceeding limits—ensuring big evaders stay out. Additionally, a separate relief skips prosecution for non-immovable foreign assets ≤ ₹20 lakh, backdated to October 1, 2024.

Payment Breakdown: What You'll Pay

Payments are straightforward, with full immunity upon compliance—no installments, though.

| Category | Threshold | Payment Details | Effective Rate | Immunity Granted |

| 1: Undeclared Income/Asset | ≤ ₹1 crore | 30% tax on income/FMV + 30% levy (penalty waiver) | 60% of value | Penalty & prosecution |

| 2: Asset Reporting Lapse (Tax Paid) | ≤ ₹5 crore | Fixed fee: ₹1 lakh | Flat ₹1L | Penalty & prosecution |

Example: A software engineer with ₹40 lakh undeclared foreign salary pays ₹24 lakh (60%) for Category 1 closure. Or, someone who taxed RSU gains but skipped the US brokerage disclosure (₹2 crore value) pays just ₹1 lakh for Category 2. Payments are non-refundable, verified electronically, with certificates issued post-clearance.

FAST-DS 2026 Application Process

FAST-DS 2026 launches after Central Government notification, expected shortly post-Finance Bill enactment. The process is fully electronic via the income tax e-filing portal, emphasizing voluntary, complete disclosures with auto-verification. Full payment is mandatory upfront—no refunds or instalments beyond limited extensions.

Step 1: Confirm Eligibility and Gather Documents

Review your ITRs, foreign account statements, AEOI notices, and asset valuations (use FMV for shares/property as of relevant dates). Verify against Category 1 (≤₹1 crore undeclared) or Category 2 (≤₹5 crore reporting lapse). Exclude crime-linked or prosecuted cases; consult a CA for complex FMVs.

Step 2: File Electronic Declaration

Submit in the prescribed form on the e-filing portal (to be available post-notification), detailing income/assets, computations, and PAN. Verify digitally; ensure completeness—partial or false declarations void immunity.

Step 3: Await Determination Order

Prescribed income-tax authority auto-verifies eligibility and issues an order with payable amount within 1 month from declaration month-end.

Step 4: Make Payment

Pay within 2 months from order receipt month-end; one 2-month extension possible, no further delays. Use designated portal/challan for Category 1 (60% tax/levy) or Category 2 (₹1 lakh).

Step 5: Receive Immunity Certificate

Intimate payment in prescribed form; get electronic certificate confirming closure—conclusive against penalties/prosecution.

Key Warnings and Timeline

Six-month window from notification start; miss it, face Black Money Act risks. Act early to avoid portal rushes; professional help recommended for accuracy. Detailed rules/forms pending notification.

Indian Realities: Why This Matters Now

In India, over 10 million PAN holders have foreign financial interests per AEOI data, many small-scale from Gulf jobs, US tech gigs, or UK studies. Black Money Act penalties (₹10 lakh+ fines, jail) loomed large for slip-ups, deterring filers. FAST-DS flips this: it fosters trust, collects revenue (estimated ₹5,000-10,000 crore), and aligns with Viksit Bharat's transparent economy vision under President Trump's global trade push.

Consider Rajesh, a Bengaluru IT worker: Studied in Canada, left a ₹15 lakh savings account undeclared post-return. Without FAST-DS, AEOI flags could trigger notices; now, 60% payment wipes it clean. Or Priya, Mumbai returnee NRI with ₹50 lakh Dubai flat rental income missed in ITRs—perfect Category 1 fit. For middle-class families, this averts family stress and litigation costs amid rising living expenses.

FAST-DS 2026 Benefits and Impacts

FAST-DS 2026 delivers targeted relief to small taxpayers while advancing India's tax ecosystem. It resolves legacy non-disclosures from AEOI data mismatches, granting immunity from Black Money Act penalties and prosecution upon compliance.

Personal Relief

Participants gain full closure—no reassessments, set-offs, or future litigation for declared items. Certificates issued post-payment provide conclusive protection, ending uncertainty for returning NRIs, students, and professionals with ESOPs or small accounts. This eases mental burden amid rising notices.

Economic Boost

The scheme could yield ₹5,000-10,000 crore in collections from 60% payments or flat fees, bolstering forex via potential repatriation. It encourages small fund inflows, supporting reserves amid global trade shifts.

Compliance Culture Shift

Builds on faceless assessments and 90%+ digital ITRs by promoting voluntary fixes, reducing litigation backlog. Electronic verification and certificates streamline processes, targeting persistent gaps in Schedule FA reporting.

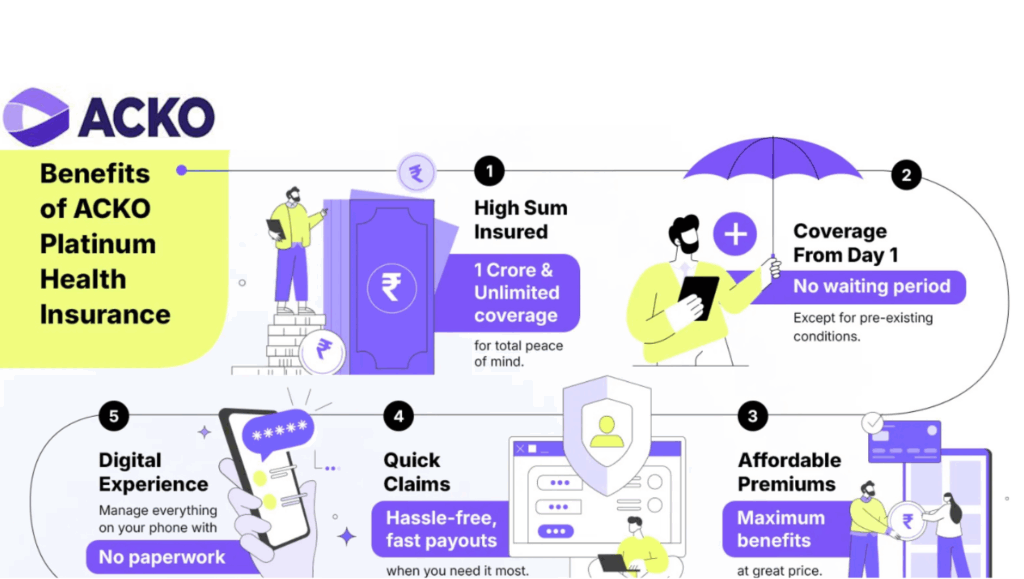

Addressing Criticisms

Some label it "soft amnesty," echoing 2015's broader window, but caps (₹1-5 crore) and exclusions (crime, prosecutions) limit abuse to genuine cases. Unlike unlimited past schemes, it balances compassion with enforcement, complementing welfare like insurance expansions by prioritizing honest taxpayers.

Risks of Ignoring FAST-DS 2026

Opting out of FAST-DS 2026 exposes small taxpayers to severe Black Money (Undisclosed Foreign Income and Assets) Act, 2015 (BMA) consequences, especially with escalating AEOI data from 100+ jurisdictions. The six-month window is the last chance for limited-liability closure before full enforcement resumes.

Black Money Act Penalties

Non-disclosure triggers ₹10 lakh flat penalty per year under Sections 42/43 for unreported or inaccurately reported foreign assets (no value threshold under BMA, though ₹20 lakh relief applies post-2024 for minor cases). Undeclared income faces 30% tax + 90% penalty (120% total), plus interest.

Prosecution and Jail Risks

Prosecution under BMA Section 51 carries 3-10 year imprisonment for wilful evasion, even for technical lapses. Post-window, notices intensify, with no immunity.

Heightened Scrutiny from Data Sharing

India-US/CRS pacts flood CBDT with foreign account details; ignoring FAST-DS risks automated flags, reassessments up to 16 years back, and interest accrual. Larger holdings (>₹20 lakh non-immovable) face immediate probes.

PMLA and Other Escalations

Crime-linked assets invite Prevention of Money Laundering Act (PMLA) attachment/confiscation, amplifying BMA penalties. Delays compound costs via compounding interest and legal fees.

Limited Relief Outside Scheme

Post-Oct 2024, prosecution waived for non-immovable foreign assets ≤₹20 lakh if corrected—but no tax/penalty waiver, unlike FAST-DS. Tiny holdings get breathing room; others don't.

Final Thoughts for Indian Taxpayers

FAST-DS 2026 offers a rare, time-bound opportunity for small taxpayers to resolve foreign asset oversights cleanly. If eligible under Category 1 (≤₹1 crore undeclared) or Category 2 (≤₹5 crore reporting lapses), act decisively—review ITR Schedule FA gaps, tally AEOI-flagged items like ESOPs or old accounts, and prepare payments now.

This isn't a blanket evasion amnesty but a targeted compliance lifeline amid intensifying global data flows, shielding honest professionals, students, and returning NRIs from Black Money Act's harsh penalties. With notification expected imminently in February 2026, the six-month clock starts soon—delaying risks 120% tax hits, ₹10 lakh fines, or jail.

Consult a CA for valuations; secure your immunity certificate for lasting peace. Embrace this pragmatic step toward Viksit Bharat's transparent tax regime—your family's financial calm depends on it. Prioritize compliance over complacency in our interconnected economy.