” The latest updates on UPI payment fees in 2025! Learn why UPI transactions may no longer be free, how it impacts users and merchants, and what it means for India’s digital payments ecosystem. Stay informed about RBI and NPCI’s new fee structure. Read now to save on UPI costs! “

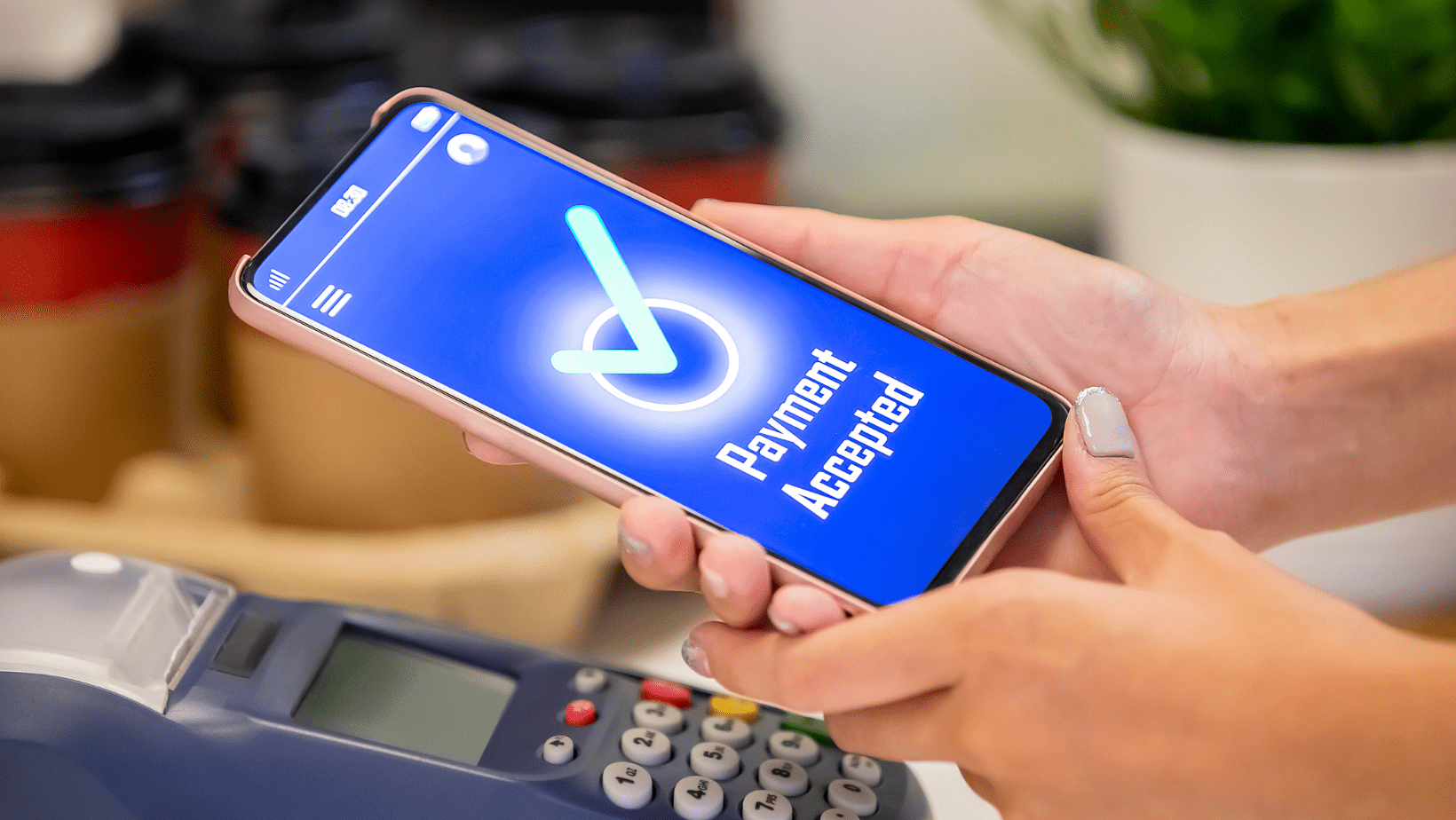

Unified Payments Interface (UPI) has revolutionized the way Indians transact money. Since its inception in 2016, UPI has become the go-to payment method for millions, offering a seamless, instant, and cost-effective way to transfer funds. However, recent developments suggest that UPI payments, which were largely free for users, may soon come with a fee. This blog post delves into the latest updates on UPI payment fees, why these changes are happening, and what it means for you as a consumer. We’ll also explore how this shift could impact the digital payments landscape in India.

What is UPI and Why Has It Been So Popular?

Unified Payments Interface (UPI) is a real-time payment system developed by the National Payments Corporation of India (NPCI). It facilitates inter-bank transactions by instantly transferring funds between two bank accounts on a mobile platform. Since its inception, UPI has seen exponential growth, with millions of transactions being processed daily.

Current UPI Transaction Statistics

As of February 2025, UPI has over 652 banks live on its platform, processing approximately 16,106.19 million transactions worth ₹21,96,481.69 crore. This growth is a testament to the convenience and efficiency that UPI offers to its users.

The Big News: UPI Payments May No Longer Be Free

The Reserve Bank of India (RBI) and NPCI have been considering the introduction of transaction fees for UPI payments. This move aims to ensure the sustainability of the UPI ecosystem by compensating banks and payment service providers for their services. Here are some key points regarding the potential fees:

- Transaction Charges for Individuals: Currently, personal UPI payments are free of charge. However, there is a possibility that a nominal fee might be introduced for transactions exceeding a certain limit.

- Merchant Transactions: Merchants might be subject to interchange fees on UPI payments made through Prepaid Payment Instruments (PPI) like digital wallets. These fees could vary based on the type of transaction, ranging from 0.5% to 1.1%.

- Sector-Specific Limits: For sectors like capital markets, foreign remittances, and insurance, the UPI transaction limit is set at ₹2 lakh per day. Verified merchants in education and healthcare sectors might have a higher limit of ₹5 lakh per day.

- Cost of Infrastructure: Maintaining the UPI infrastructure is expensive. Banks and payment service providers (PSPs) incur significant costs to process transactions, and these costs have largely been absorbed by the ecosystem so far.

- Sustainability: With UPI transactions growing exponentially, the current model of free transactions is becoming unsustainable. Introducing fees could help cover operational costs and ensure the system’s long-term viability.

- Monetization: Payment apps like PhonePe, Google Pay, and Paytm rely on UPI for their business models. Charging fees could open up new revenue streams for these platforms.

What Kind of Fees Can You Expect?

While the exact fee structure is yet to be finalized, here’s what we know so far:

- Merchant Transactions (P2M): Fees are likely to be imposed on transactions where users pay merchants. This could range from 0.5% to 1% per transaction, depending on the amount.

- Peer-to-Peer (P2P) Transactions: P2P transactions may remain free or have a nominal charge for high-value transactions.

- Interchange Fees: The RBI has proposed an interchange fee of up to 1.1% for transactions above ₹2,000 made through prepaid payment instruments (PPIs) like wallets.

Implications for Users

The introduction of UPI transaction fees could have several implications for users:

- Cost of Transactions: Users might need to factor in the additional cost of transactions, especially for high-value transfers.

- Shift in Payment Preferences: Some users might shift to alternative payment methods that do not incur fees, such as traditional bank transfers or cash payments.

- Impact on Small Transactions: For small transactions, the nominal fee might not be significant, but for frequent users, the cumulative cost could add up.

Implications for Businesses

Businesses, especially small and medium enterprises (SMEs), might also be affected by the introduction of UPI transaction fees:

- Operational Costs: Businesses might need to account for the additional cost of accepting UPI payments, which could impact their pricing strategies.

- Customer Experience: The convenience of UPI payments has been a significant factor in its adoption. Introducing fees might affect customer satisfaction and loyalty.

- Adoption of Alternative Payment Methods: Businesses might explore other payment

What Do Experts Say?

Industry experts believe that while introducing fees may initially deter some users, it is a necessary step for the ecosystem’s growth. According to a report by PwC India, the digital payments market in India is expected to grow to $10 trillion by 2026. To sustain this growth, a balanced fee structure is essential.

How Can You Prepare for UPI Fees?

- Compare Payment Options: Explore other payment methods like NEFT, IMPS, or mobile wallets to see which offers the best value.

- Monitor Updates: Stay informed about the latest developments from NPCI and RBI regarding UPI fees.

- Budget for Fees: If you’re a frequent UPI user, factor in potential transaction costs into your budget.

The Future of UPI Payments

Despite the introduction of fees, UPI is expected to remain a dominant player in India’s digital payments landscape. The government’s focus on financial inclusion and the rise of UPI 2.0 with features like overdraft facilities and invoice payments will continue to drive adoption.

Moreover, the integration of UPI with international payment systems and the launch of UPI Lite for low-value transactions indicate that the ecosystem is evolving to meet diverse user needs.

The potential introduction of UPI transaction fees marks a significant shift in the digital payment landscape in India. While it aims to ensure the sustainability of the UPI ecosystem, it also brings forth several implications for users and businesses. Staying informed about these changes and understanding their impact is crucial for making informed decisions.

As the situation evolves, it is essential to keep an eye on official announcements from the RBI and NPCI.

-

Grab the Apple MacBook Air M4 at Unbeatable Discounts (February 2026)

-

Toxic Sales Culture in Banks? RBI’s Bold Move to Protect Customers & Clean Up Mis-Selling

-

The 6x Income Rule & 35% EMI Cap: How to Calculate Your Home Loan Eligibility Like a Pro in 2026

-

CIBIL Score Myths That Are Silently Killing Your Loan Chances (A Banker Tells All)