” Starting next financial year, income tax officers can access your email and social media accounts under specific circumstances. Learn about the new provisions, their implications, and how to protect your digital privacy. Stay informed with the latest updates and expert advice on tax compliance and data security. “

Starting April 1, 2026, the Income Tax Department in India will have the authority to access your email and social media accounts under certain circumstances. This new provision, part of the proposed Income Tax Bill, aims to curb tax evasion and bring tax investigations in line with the digital age. In this blog post, we will explore the implications of this new law, the specific cases in which your digital accounts can be accessed, and the potential impact on privacy and compliance.

The digital age has transformed the way we communicate, conduct business, and manage our finances. With the increasing use of digital platforms, the Income Tax Department has recognized the need to adapt its investigative methods to effectively combat tax evasion. Starting next financial year, income tax officers will have the legal authority to access your email and social media accounts if they suspect tax evasion or undeclared assets. This blog post provides an in-depth analysis of this new provision, its implications, and how you can ensure compliance.

Background and Rationale

The proposed Income Tax Bill, set to take effect on April 1, 2026, includes provisions that allow income tax officers to access digital accounts such as emails and social media profiles. This move is part of a broader effort to modernize tax investigations and prevent financial fraud. The rationale behind this provision is to leverage digital forensics to uncover hidden income and assets that may not be disclosed through traditional means.

Legal Framework

Under the existing Income Tax Act, 1961, income tax officers have the authority to conduct searches and seizures if they have credible information that an individual is concealing income or assets. The new provision extends this authority to the digital realm, allowing officers to access computer systems, online accounts, and digital storage if they suspect tax evasion. This includes the power to override access codes and break into virtual spaces where undisclosed assets or financial records may be hidden.

Cases Where Access is Permitted

Income tax officers can access your email and social media accounts in the following cases:

- Suspected Tax Evasion: If there is credible information suggesting that you have evaded taxes, officers can investigate your digital accounts to uncover hidden income or assets.

- Undeclared Assets: If you possess undeclared assets such as cash, gold, jewelry, or property, officers can access your digital accounts to gather evidence.

- Financial Fraud: In cases of suspected financial fraud, officers can investigate your online activities to trace fraudulent transactions and identify involved parties.

- Suspicious Spending Patterns: If your spending patterns do not match your declared income, officers can access your digital accounts to verify the source of funds.

Privacy Concerns and Safeguards

The new provision has raised significant privacy concerns, as it grants income tax officers extensive access to personal digital accounts. To address these concerns, the following safeguards have been proposed:

- Judicial Oversight: Access to digital accounts will require prior approval from a judicial authority to ensure that the investigation is justified and necessary.

- Procedural Safeguards: Clear guidelines will be established to regulate the process of accessing digital accounts, including the scope and duration of access.

- Data Protection: Measures will be implemented to protect the confidentiality and integrity of the accessed data, preventing misuse or unauthorized disclosure.

Compliance Tips for Individuals and Businesses

To ensure compliance with the new provision and avoid potential legal issues, individuals and businesses should consider the following tips:

- Accurate Tax Filing: Ensure that your tax returns accurately reflect your income and assets. Disclose all sources of income and provide supporting documentation.

- Maintain Records: Keep detailed records of your financial transactions, including digital transactions, to provide evidence in case of an investigation.

- Consult a Tax Expert: Seek advice from a tax professional to understand your obligations and ensure compliance with the new law.

- Monitor Digital Activities: Be mindful of your online activities and ensure that they align with your declared income and assets. Avoid engaging in transactions that may raise suspicion.

Why This Change?

The government’s decision to allow access to digital communications is driven by the need to combat tax evasion, which is estimated to cost the Indian economy billions annually. With the rise of digital transactions and online businesses, traditional methods of tax investigation are no longer sufficient.

Latest Data:

- According to a report by the Global Financial Integrity (GFI), India loses approximately $83 billion annually due to illicit financial flows, including tax evasion.

- The Income Tax Department has identified over 1.5 lakh high-risk cases in the last fiscal year, many of which involve digital transactions.

Implications for Taxpayers

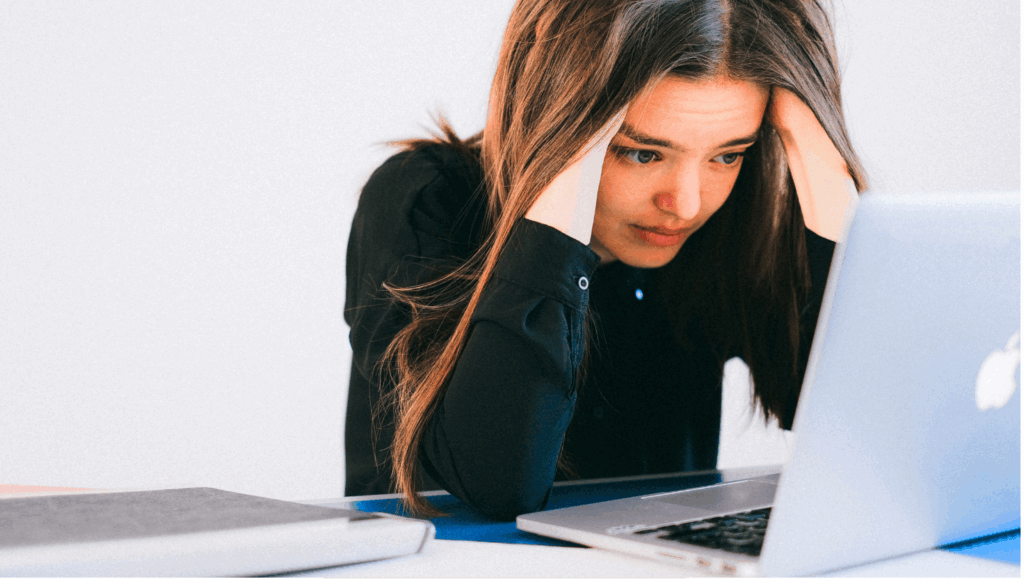

While the new provisions aim to enhance tax compliance, they also raise several concerns:

- Privacy Concerns: Access to personal emails and social media accounts can be seen as an invasion of privacy. Taxpayers are worried about the misuse of sensitive information.

- Data Security: There are concerns about how the accessed data will be stored and protected. Unauthorized access or data breaches could lead to significant harm.

- Legal Recourse: Taxpayers have the right to challenge the access if they believe it is unjustified. Legal experts suggest that the courts will play a crucial role in balancing privacy rights with tax enforcement.

How to Protect Your Digital Privacy

Given the new provisions, it’s essential to take steps to protect your digital privacy:

- Use Encrypted Communication: Opt for encrypted email services and messaging apps that offer end-to-end encryption.

- Regularly Update Passwords: Ensure that your passwords are strong and updated regularly. Use two-factor authentication for added security.

- Be Cautious with Sharing Information: Avoid sharing sensitive financial information over emails or social media.

- Consult Legal Experts: If you receive a notice from the Income Tax Department, consult a legal expert to understand your rights and obligations.

The new provision allowing income tax officers to access email and social media accounts marks a significant shift in tax investigations. While it aims to curb tax evasion and financial fraud, it also raises important privacy concerns. By understanding the legal framework, the specific cases where access is permitted, and the safeguards in place, individuals and businesses can take proactive steps to ensure compliance and protect their privacy.

-

The Supabase India Ban Explained: Who’s Affected, Why It Happened, and What Comes Next

-

Geopolitical Shock: Bitcoin Tumbles Under $64K Following US-Israel Military Strike on Iran

-

New EPFO Rule 2026: You Can Now Withdraw 100% of Your PF Balance Without Resigning — Here’s How

-

Is Your Money Safe in Fino Payments Bank After CEO Rishi Gupta’s Shocking Arrest?