” Latest stock market updates for March 17, 2025, including IndusInd Bank, SAIL, BSE Ltd, Hindustan Copper Ltd, and Manappuram Finance Ltd. Learn why these stocks are on the F&O ban list and explore key financial insights, market trends, and performance analysis. Stay informed and make smart investment decisions.”

The stock market is a dynamic and ever-evolving entity, with daily fluctuations and changes that can significantly impact investors and traders. On March 17, 2025, five stocks, including IndusInd Bank and Steel Authority of India Limited (SAIL), were placed on the Futures and Options (F&O) ban list by the National Stock Exchange (NSE). This blog post will delve into the reasons behind this ban, the implications for investors, and the latest data on these stocks. Additionally, we will incorporate SEO keywords to ensure this post ranks well on Google and reaches a broad audience.

Understanding the F&O Ban List

The F&O ban list is a mechanism used by stock exchanges to regulate the trading of certain stocks that have exceeded 95% of the market-wide position limit (MWPL). When a stock is placed on this list, it means that no new positions can be created in the F&O segment, and traders can only reduce their existing positions. This measure is taken to prevent excessive speculation and maintain market stability.

Stocks in the F&O Ban List on March 17

On March 17, 2025, the NSE placed the following five stocks on the F&O ban list:

- IndusInd Bank

- Steel Authority of India Limited (SAIL)

- BSE Ltd

- Hindustan Copper Ltd

- Manappuram Finance Ltd

Let’s take a closer look at IndusInd Bank and SAIL, two prominent stocks on this list.

IndusInd Bank: Current Performance and Analysis

IndusInd Bank, a leading private sector bank in India, has been in the news recently due to its stock performance and financial health. As of March 17, 2025, IndusInd Bank’s stock price is ₹672.35, reflecting a decline of 1.80%. The bank has faced challenges, including discrepancies in derivatives accounting, which have impacted investor confidence.

Key Data

- Current Price: ₹672.35

- 52-Week High: ₹1576.35

- 52-Week Low: ₹606.00

- Market Cap: ₹523,797.3 Crores

- P/E Ratio: 7.22

- Dividend Yield: 2.45%

Recent Performance

IndusInd Bank has faced significant challenges, including discrepancies in derivatives accounting, which have impacted investor confidence. The stock has seen a substantial decline, hitting a fresh 52-week low. Despite these issues, the bank remains a key player in the Indian banking sector.

Market Trends and Insights

- Financial Irregularities: Recent reports of financial irregularities have raised concerns among investors and depositors.

- Analyst Downgrades: Several brokerages have downgraded the stock due to the accounting gaps.

- Trading Volume: The stock has seen high trading volumes, indicating active investor participation.

Steel Authority of India Limited (SAIL): Current Performance and Analysis

SAIL, one of the largest steel-making companies in India, has also been placed on the F&O ban list. As of March 17, 2025, SAIL’s stock price is ₹105.89, showing a slight decline of 0.72%. The company has been navigating market challenges, including fluctuating steel prices and global economic conditions.

Key Data

- Current Price: ₹105.89

- 52-Week High: ₹175.35

- 52-Week Low: ₹99.15

- Market Cap: ₹437,381.3 Crores

- P/E Ratio: 19.49

- Dividend Yield: 1.89%

Recent Performance

SAIL has faced challenges due to fluctuating steel prices and global economic conditions. The stock has seen a slight decline, but it remains a significant player in the steel industry.

Market Trends and Insights

- Commodity Prices: Fluctuations in global steel prices significantly impact SAIL’s performance.

- Production Levels: The company’s production levels and operational efficiency are critical factors influencing its financial performance.

- Regulatory Environment: Changes in mining regulations and environmental policies can affect the company’s operations and profitability.

BSE Ltd: Current Performance and Analysis

BSE Ltd, one of India’s leading stock exchanges, has been a significant player in the financial markets. As of March 17, 2025, BSE Ltd’s stock price stands at ₹3,926.25, reflecting a decline of 2.20%. This section will provide a detailed analysis of BSE Ltd’s current performance, key financial metrics, and market trends.

Key Data

- Current Price: ₹3,926.25

- 52-Week High: ₹6,133.40

- 52-Week Low: ₹1,941.05

- Market Cap: ₹531,521.4 Crores

- P/E Ratio: 57.45

- Dividend Yield: 0.38%

Recent Performance

BSE Ltd has experienced a notable decline in its stock price, down 16% in March 2025. This decline can be attributed to several factors, including regulatory concerns and target cuts by analysts. Despite this, BSE Ltd remains a crucial entity in the Indian financial markets, providing a platform for trading in equities, derivatives, and other financial instruments.

Market Trends and Insights

- Regulatory Concerns: Recent regulatory changes have impacted BSE Ltd’s operations, leading to increased scrutiny and compliance requirements. These changes have contributed to the stock’s recent decline.

- Target Cuts: Analysts have revised their target prices for BSE Ltd, reflecting concerns over the company’s future growth prospects and market conditions.

- Trading Volume: BSE Ltd has seen a trading volume of 3,770,603 shares, indicating active participation from investors.

Financial Performance

BSE Ltd’s financial performance is a critical factor for investors. The company’s P/E ratio of 57.45 suggests that it is trading at a premium compared to its earnings. Additionally, the dividend yield of 0.38% provides a modest return to shareholders.

Hindustan Copper Ltd: Current Performance and Analysis

Hindustan Copper Ltd, a prominent player in the mining and copper production industry, has seen notable fluctuations in its stock performance. As of March 17, 2025, the stock price stands at ₹215.80, reflecting a decline of 1.63%.

Key Data

- Current Price: ₹215.80

- 52-Week High: ₹415.80

- 52-Week Low: ₹195.40

- Market Cap: ₹208,683.8 Crores

- P/E Ratio: 51.98

- Dividend Yield: 0.43%

Recent Performance

Hindustan Copper Ltd has experienced a decline in its stock price, influenced by market conditions and company-specific factors. The company’s P/E ratio of 51.98 indicates that it is trading at a high multiple relative to its earnings, which may concern some investors. Additionally, the dividend yield of 0.43% provides a modest return to shareholders.

Market Trends and Insights

- Commodity Prices: Fluctuations in global copper prices significantly impact Hindustan Copper Ltd’s performance. Recent declines in copper prices have contributed to the stock’s downward trend.

- Production Levels: The company’s production levels and operational efficiency are critical factors influencing its financial performance and stock price.

- Regulatory Environment: Changes in mining regulations and environmental policies can affect the company’s operations and profitability.

Manappuram Finance Ltd: Current Performance and Analysis

Manappuram Finance Ltd, a leading non-banking financial company (NBFC) in India, specializes in gold loans and other financial services. As of March 17, 2025, the stock price is ₹208.50, reflecting an increase of 1.04%.

Key Data

- Current Price: ₹208.50

- 52-Week High: ₹230.25

- 52-Week Low: ₹138.40

- Market Cap: ₹176,176.9 Crores

- P/E Ratio: 9.00

- Dividend Yield: 1.92%

Recent Performance

Manappuram Finance Ltd has shown resilience in its stock performance, with a recent uptick in its price. The company’s P/E ratio of 9.00 suggests it is trading at a relatively low multiple compared to its earnings, which may attract value investors. The dividend yield of 1.92% offers a decent return to shareholders.

Market Trends and Insights

- Gold Prices: As a major player in the gold loan segment, Manappuram Finance Ltd’s performance is closely tied to gold prices. Recent stability in gold prices has positively impacted the company’s stock.

- Loan Portfolio: The company’s loan portfolio and asset quality are crucial factors influencing its financial health and stock performance.

- Regulatory Changes: Changes in financial regulations and policies can affect the company’s operations and profitability.

Implications of the F&O Ban

The inclusion of these stocks in the F&O ban list has several implications for investors and traders:

- Restricted Trading: Investors cannot create new positions in the F&O segment for these stocks, limiting speculative trading.

- Market Stability: The ban helps maintain market stability by preventing excessive speculation and potential market manipulation.

- Investor Caution: Investors may exercise caution and closely monitor these stocks’ performance and any related news.

Latest Market Trends and Insights

The stock market is influenced by various factors, including economic indicators, corporate earnings, and global events. Here are some of the latest trends and insights:

- Economic Indicators: Key economic indicators such as GDP growth, inflation rates, and employment data play a crucial role in shaping market sentiment.

- Corporate Earnings: Quarterly earnings reports provide insights into a company’s financial health and future prospects, impacting stock prices.

- Global Events: Geopolitical events, trade policies, and global economic conditions can significantly influence market trends.

The F&O ban list is an essential tool for maintaining market stability and preventing excessive speculation. IndusInd Bank and SAIL, two prominent stocks on the list, have faced challenges that have impacted their stock performance. Investors should stay informed about the latest market trends and exercise caution when trading these stocks.

-

Why A Karnataka HC Judgment Could Make Government Officials Think Twice Before Relieving Officers Without A Next Posting

-

PM Kisan 22nd Installment Date 2026: Expected Release, Beneficiary Status & Complete Guide

-

Livspace Fires 1,000 Employees and Cofounder Quits: Inside India’s Most Shocking Startup Shakeup of 2026

-

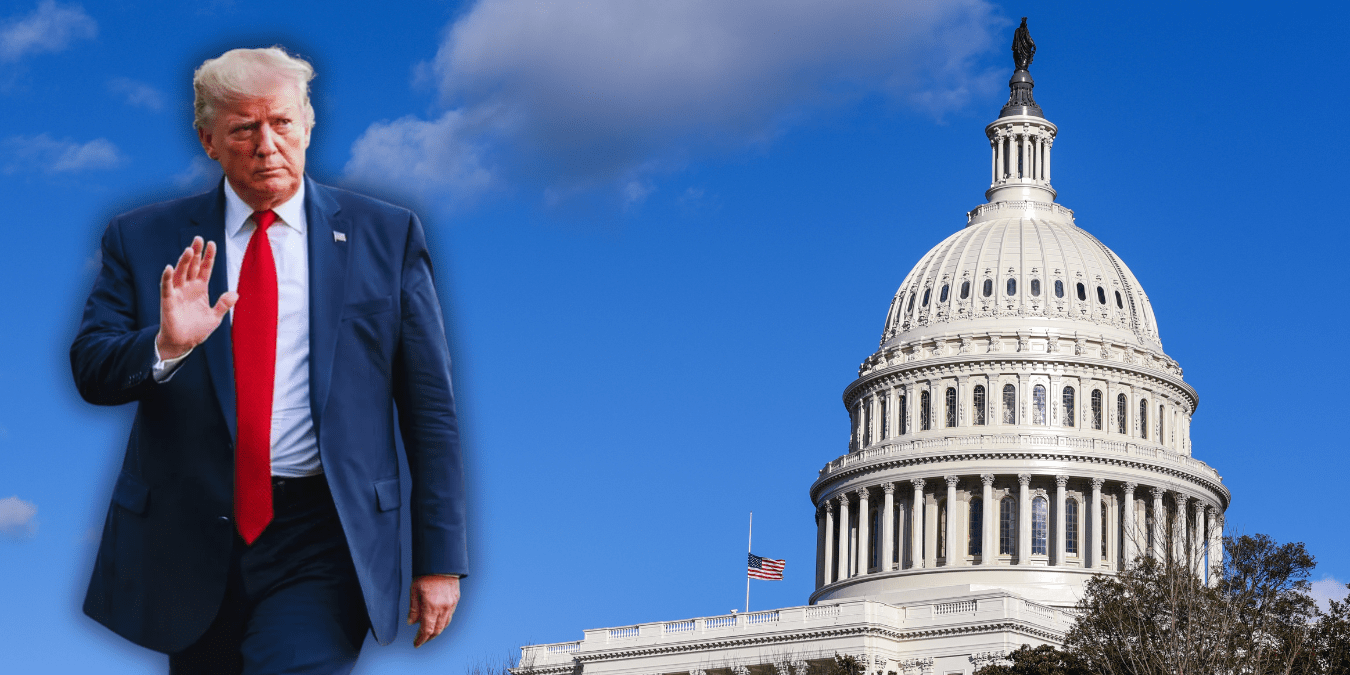

US Supreme Court Strikes Down Trump’s Global Tariffs as ‘Unlawful’ — The 18% Tariff on India Is Now Illegal