Explore the ACKO Platinum Health Plan: affordable ₹1 crore coverage with zero waiting period, no co-payment, and unlimited restore benefits. Compare pros, cons, and peers to discover why it’s a top choice for comprehensive health insurance in 2025. Unlock tax benefits and AYUSH coverage today!

The ACKO Platinum Health Plan, offered by ACKO General Insurance Limited, is a comprehensive health insurance policy designed to provide extensive coverage for individuals and families. It stands out for its zero waiting period for most conditions, high sum insured options (up to ₹1 crore), and a range of built-in benefits tailored to modern healthcare needs. The plan covers inpatient hospitalization, pre- and post-hospitalization expenses, daycare treatments, and alternative treatments like AYUSH, with no co-payment or room rent restrictions. It is marketed as an affordable, digitally accessible plan with a seamless claim process and cashless treatment at over 7,100 network hospitals.

Review

The ACKO Platinum Health Plan has gained popularity for its competitive features and affordability, particularly for young families and individuals seeking comprehensive coverage without complex restrictions. Positive feedback highlights its no-waiting-period feature, coverage for consumables, and user-friendly digital interface via the ACKO app. Customers appreciate the hassle-free claim process, with some reporting claim approvals within hours. However, concerns exist about ACKO’s relatively new presence in the health insurance market, which raises questions about long-term reliability and claim settlement consistency as the company scales. Some users have noted issues with app interface bugs during registration and occasional delays in medical appointment coordination in certain cities.

Benefits

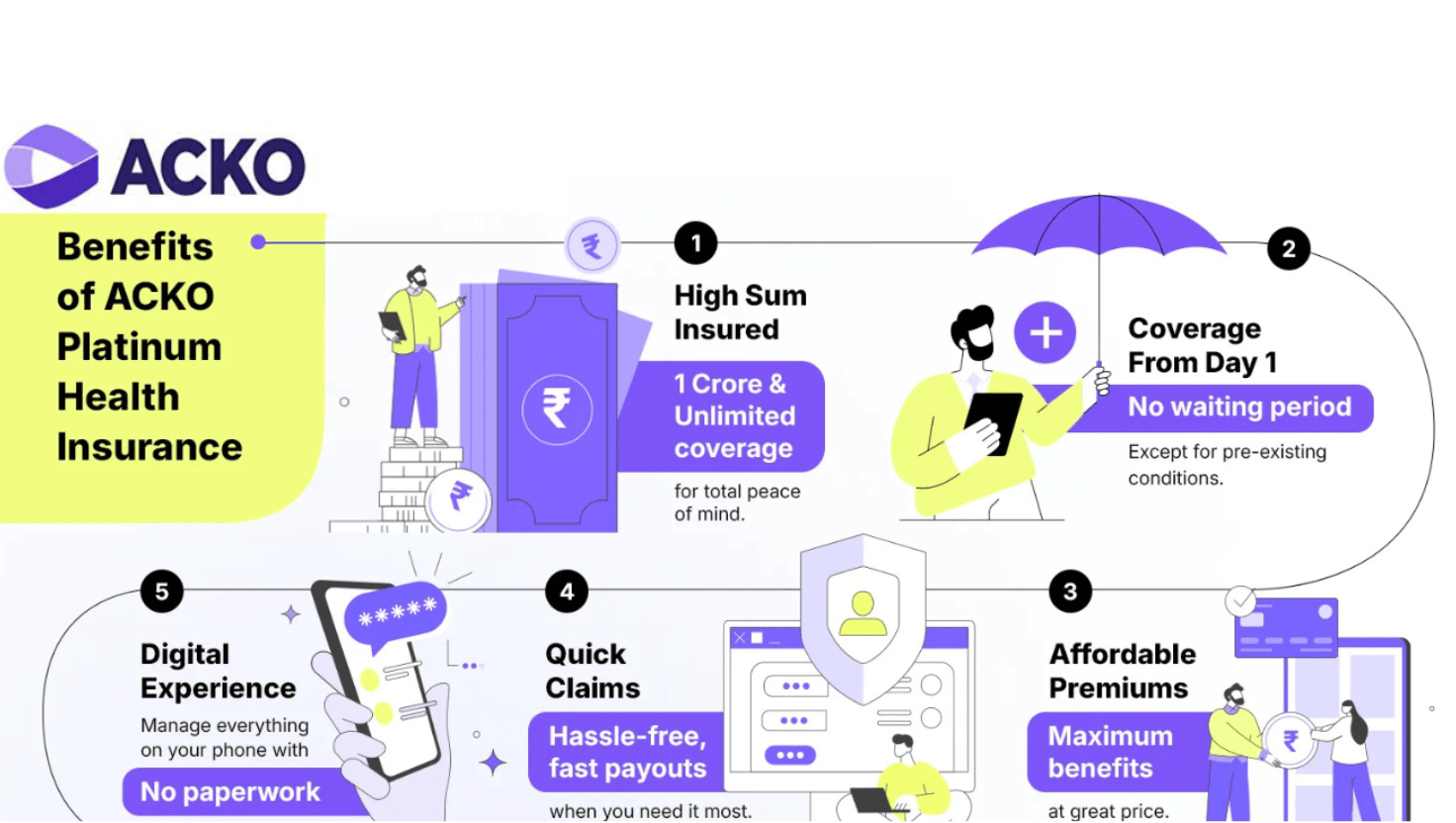

The ACKO Platinum Health Plan offers a robust set of benefits:

- Zero Waiting Period: Covers most conditions from day one, except for pre-existing diseases (0–3 years based on medical evaluation).

- High Sum Insured: Options up to ₹1 crore, suitable for families and individuals with high coverage needs.

- No Co-Payment or Sub-Limits: Full coverage of eligible expenses without policyholder contributions or disease-specific caps.

- Pre- and Post-Hospitalization: Covers expenses 60 days before and 120 days after hospitalization.

- Daycare Treatments: All procedures requiring less than 24 hours of hospitalization are covered.

- AYUSH Coverage: Includes alternative treatments like Ayurveda, Unani, Siddha, and Homeopathy.

- Restore Sum Insured: 100% restoration of the sum insured for subsequent claims within the same policy year.

- Non-Medical Expenses: Covers consumables like gloves, oxygen masks, and nebulization kits.

- Tele-Consultations: Access to doctors via the ACKO app for convenient medical advice.

- Ambulance Charges: Covers emergency ambulance costs up to the sum insured.

- Tax Benefits: Premiums qualify for deductions under Section 80D of the Income Tax Act, 1961.

Bonus

- No Claim Bonus (NCB): A 10% increase in the sum insured for each claim-free year, up to a maximum of 100% of the base sum insured. Unlike traditional NCBs, this applies even if claims are made in previous years, though it caps at 100%.

- Wellness Benefits: Includes free annual health check-ups and discounts on online consultations or medicine orders.

Premium and Charges

Premiums for the ACKO Platinum Health Plan vary based on age, family size, sum insured, and health status. For a family of two adults (30 years old) and one child (1 year old) in Zone 1 with a ₹25 lakh cover, the premium was assessed as of February 2024. For a 25-year-old individual with no pre-existing conditions and a ₹1 crore cover, the plan is noted as one of the most affordable in the market. However, premiums may increase after pre-policy medical check-ups (PPMC) for conditions like hypertension, and an 18% GST applies. Exact premium figures are not publicly disclosed, but ACKO emphasizes lower costs due to its digital-first model, which eliminates agent commissions.

Pros

- Affordable Premiums: Competitive pricing, especially for high coverage like ₹1 crore.

- Zero Waiting Period: Immediate coverage for most conditions, a rare feature.

- Comprehensive Coverage: Includes consumables, AYUSH, and unlimited sum insured restoration.

- No Co-Payment or Room Rent Limits: Reduces out-of-pocket expenses.

- Digital Convenience: Easy purchase, renewal, and claim filing via the ACKO app with no paperwork.

- Tax Benefits: Eligible for deductions under Section 80D.

- Wide Network: Over 7,100 cashless hospitals.

Cons

- Limited Track Record: ACKO is a relatively new player, raising concerns about long-term claim settlement reliability.

- Pre-Existing Disease Waiting Period: Despite zero waiting for most conditions, pre-existing conditions may have a 0–3-year waiting period based on medical tests.

- App/Website Issues: Some users report bugs during registration or delays in appointment coordination.

- Exclusions: Does not cover maternity expenses (except ectopic pregnancy), worldwide hospitalization, or certain treatments like cosmetic surgeries and sleep disorders.

- Premium Loading: Post-medical check-up, premiums may increase for conditions like hypertension.

Comparison with Peers (June 2025)

The following table compares the ACKO Platinum Health Plan with other leading health insurance plans based on key features, benefits, and premiums for a family of two adults (30 years old) and one child (1 year old) in Zone 1, with a sum insured of ₹10 lakh, as of February 2024 data.

| Feature | ACKO Platinum | ICICI Lombard Health AdvantEdge | Care Health Insurance | Niva Bupa Senior First (Platinum) |

| Sum Insured | Up to ₹1 crore | Up to ₹1 crore | Up to ₹1 crore | Up to ₹25 lakh |

| Waiting Period | 0–3 years (pre-existing diseases, based on medical evaluation) | 2–4 years (pre-existing diseases) | 2–4 years (pre-existing diseases) | 2–3 years (pre-existing diseases) |

| No Claim Bonus | 10% increase, up to 100% of sum insured | Cumulative bonus, up to 50% | Up to 50% increase | Up to 50% increase |

| Co-Payment | None | Optional co-pay (10–20%) | Optional co-pay (10–20%) | 20% for ages 61+ |

| Room Rent Limit | None | None | None | Capped at ₹10,000/day |

| Pre/Post-Hospitalization | 60/120 days | 60/120 days | 60/120 days | 30/60 days |

| Daycare Treatments | All covered | All covered | All covered | All covered |

| AYUSH Coverage | Yes | Yes | Yes | Limited |

| Restore Benefit | 100% unlimited restoration | 100% restoration (once per year) | 100% restoration (once per year) | Not available |

| Non-Medical Expenses | Covered | Limited | Limited | Not covered |

| Ambulance Charges | Covered up to sum insured | Up to ₹5,000 per claim | Up to ₹3,000 per claim | Up to ₹2,000 per claim |

| Maternity Coverage | Not covered (except ectopic pregnancy) | Covered after 2 years | Covered after 2 years | Covered after 2 years |

| Claim Settlement Ratio | Not specified (new player, limited data) | 98.5% (Q LOL) | 100% (last 3 years) | 97.8% |

| Premium (Approx.) | Competitive (exact figures not disclosed) | Moderate | Moderate | Higher (for seniors) |

| Network Hospitals | 7,100+ | 7,500+ | 8,000+ | 6,000+ |

Notes on Comparison

- ACKO Platinum: Stands out for zero waiting period (except for pre-existing conditions), unlimited restoration, and no co-payment or room rent limits. Its affordability is a key advantage, but its newer market presence raises reliability concerns.

- ICICI Lombard Health AdvantEdge: Offers robust coverage with restoration benefits and domestic air ambulance cover but has longer waiting periods and optional co-pay.

- Care Health Insurance: Known for a 100% claim settlement ratio over three years, it offers comprehensive coverage but includes co-pay options and limited non-medical expense coverage.

- Niva Bupa Senior First (Platinum): Tailored for seniors (61+), it has higher premiums and a 20% co-pay for older policyholders, with more restrictive room rent limits.

Final Thought

The ACKO Platinum Health Plan is a compelling choice for those seeking affordable, comprehensive coverage with minimal restrictions and immediate benefits. Its zero waiting period, no co-payment, and unlimited restoration make it highly competitive, especially for younger families. However, its limited track record and potential waiting periods for pre-existing conditions are notable drawbacks. Compared to peers, it offers superior flexibility and affordability but lacks maternity coverage and worldwide hospitalization. For detailed policy terms, refer to ACKO’s official website or consult an insurance advisor.