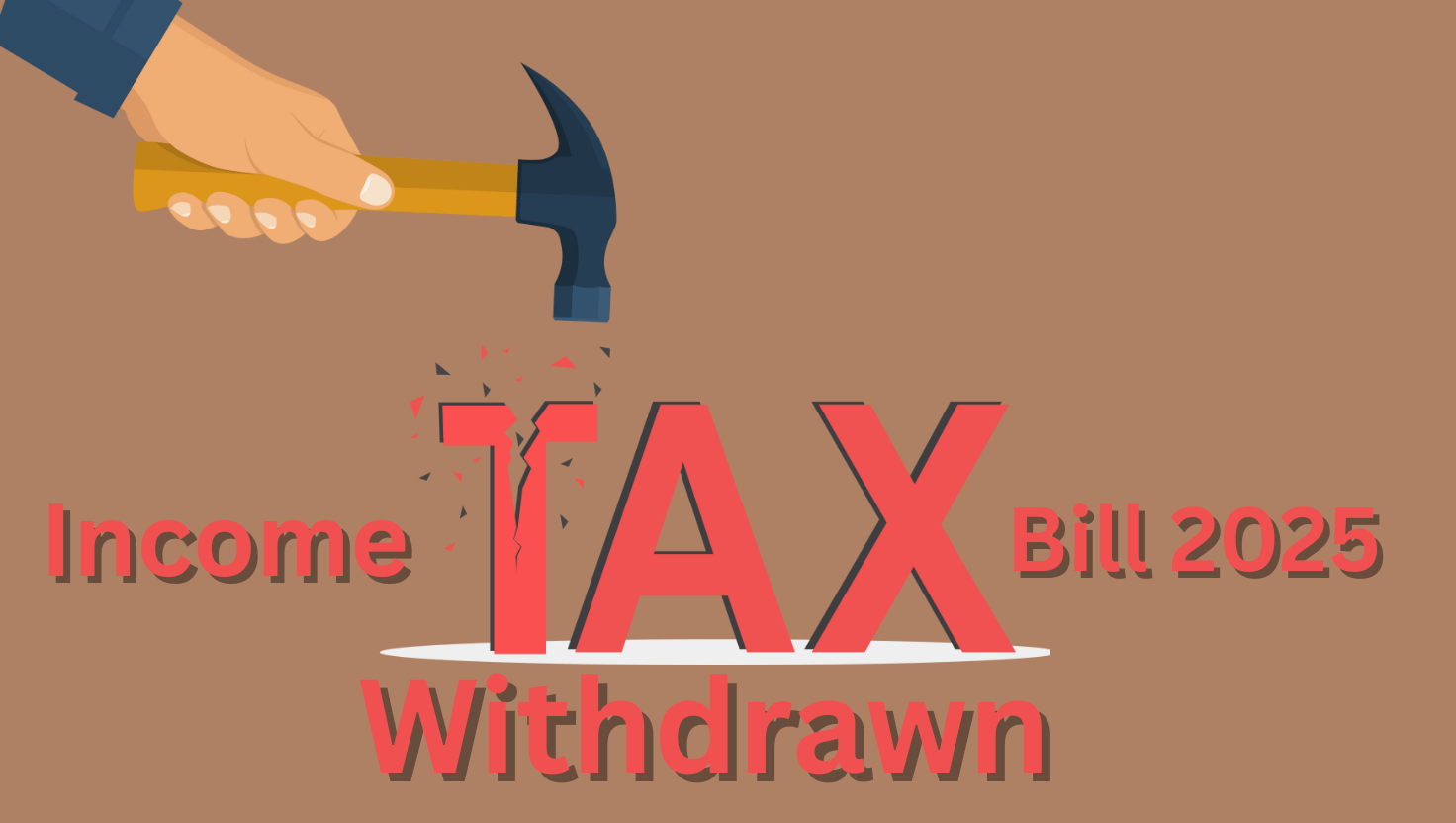

The Indian government withdrew the Income Tax Bill 2025, a revolutionary tax reform, on August 8, 2025. Why? Drafting errors and harsh clauses sparked outrage, risking taxpayer chaos. A revised bill, promising simpler compliance and fairer deductions, hits Parliament on August 11.

In a stunning move that has sent ripples through India’s financial landscape, the central government withdrew the much-anticipated Income-Tax Bill 2025 from the Lok Sabha on August 8, 2025. Finance Minister Nirmala Sitharaman’s announcement left taxpayers, businesses, and policymakers reeling: Why was a bill, hailed as a revolutionary overhaul of India’s tax system, abruptly shelved? Was it a fatal flaw, political maneuvering, or something more covert? With a revised version set to be tabled on August 11, 2025, incorporating 285 recommendations from a parliamentary committee, the suspense is palpable. What went wrong, and what does this mean for your taxes? Buckle up as we unravel the mystery behind the Income Tax Bill 2025 withdrawal, reveal the jaw-dropping reasons, and explore its game-changing implications for India’s 90 million+ taxpayers.

A Bold Vision Derailed: The Promise of the Income Tax Bill 2025

Introduced on February 13, 2025, the Income Tax Bill 2025 was poised to replace the six-decade-old Income-Tax Act of 1961. With over 600 pages, 536 sections, 23 chapters, and 16 schedules, it promised a seismic shift in India’s direct tax regime. Its goals? Simplify complex jargon, reduce litigation, and create a taxpayer-friendly system without altering tax slabs or rates. Key features included:

- Simplified Language: Shorter provisions, fewer provisos, and consolidated deductions for easier compliance.

- Lower Penalties: Reduced penalties for minor offences to foster trust.

- Digital Reforms: Enhanced powers for the Central Board of Direct Taxes (CBDT) to implement digital monitoring and introduce the “tax year” concept, replacing the confusing financial/assessment year split.

- Litigation Reduction: A “trust first, scrutinize later” approach, eliminating over 300 outdated provisions.

This came at a time when India’s tax landscape was booming. In FY 2024-25, 9.19 crore income tax returns (ITRs) were filed, a 36% jump from 6.72 crore in FY 2020-21. Gross direct tax collections hit a record Rs. 27.02 lakh crore, doubling from Rs. 12.31 lakh crore five years prior, driven by economic recovery and tech-driven enforcement like Faceless Assessment and Annual Information Statement (AIS). Yet, despite this momentum, the bill’s withdrawal has sparked intrigue. What could derail such a transformative reform?

The Plot Thickens: Why Was the Income Tax Bill 2025 Withdrawn?

Imagine a 31-member Select Committee, led by BJP MP Baijayant Panda, dissecting the bill for months. Their 4,500-page report, tabled on July 21, 2025, exposed a series of drafting errors and ambiguities that threatened to undermine the reform. Finance Minister Sitharaman cited “drafting corrections, phrase alignment, and cross-referencing issues” as reasons for the pullback, emphasizing the need to avoid “confusion from multiple versions.” But the real story lies in the specific flaws that forced the government’s hand. Here’s what we uncovered:

1. The TDS Refund Trap: Clause 263(1)(a)(ix)

A bombshell clause mandated that taxpayers file ITRs strictly within the due date to claim Tax Deducted at Source (TDS) refunds. Miss it—due to illness, tech issues, or oversight—and you’d lose your refund. With refunds surging 474% from FY 2013-14 to FY 2024-25, this “harsh” provision could have affected millions. The committee demanded its removal, arguing it clashed with the bill’s taxpayer-friendly ethos. The revised bill will reportedly eliminate Clause (ix), ensuring fairness for late filers.

2. Property Tax Ambiguities: Clause 21(2) and Clause 22

Clause 21(2) used vague phrasing—“in normal course”—to value vacant properties, risking disputes over deemed vs. actual rent. For instance, an empty house could be taxed on hypothetical income, hitting homeowners hard. The committee recommended deleting the phrase and clarifying valuation rules to prevent litigation.

Clause 22 further muddled the 30% standard deduction on house property income, failing to specify it applies post-municipal taxes. It also limited pre-construction interest deductions to self-occupied properties, excluding let-out ones—a blow to real estate investors. The revised bill promises to fix these, extending deductions to rented properties and ensuring clarity.

3. Pension Deduction Disparity: Clause 19

Non-employees were denied deductions on commuted pensions under “income from other sources,” unlike salaried taxpayers. This inequality sparked outrage, with the committee pushing for parity to uphold fairness. The revised bill is expected to level the playing field.

4. Commercial Property Misclassification: Clause 20(2)

The rigid wording of “occupied” in Clause 20(2) risked misclassifying temporarily unused commercial properties as house income, leading to erroneous taxation. A tweak to “as he may occupy” could safeguard businesses, especially in volatile markets. The committee’s recommendation is likely to be adopted.

5. Broader Drafting Woes

Beyond specific clauses, the bill suffered from inconsistent cross-referencing, misaligned phrases, and stakeholder feedback highlighting gaps. Lawyers and chartered accountants flagged these issues, warning of potential litigation. The committee’s 285 suggestions—covering General Anti-Avoidance Rules (GAAR), digital compliance, and non-profit provisions—prompted the government to withdraw the bill for a comprehensive overhaul.

6. Political Whispers or Strategic Move?

Opposition parties hinted at rushed drafting, suggesting political pressure forced the retreat. However, the government insists it’s about perfection, not politics. By incorporating stakeholder feedback and committee recommendations, the revised bill aims to deliver a “clear and updated” draft, avoiding the chaos of multiple versions.

The Revised Income Tax Bill 2025: What’s Coming?

Set to be tabled on August 11, 2025, the revised Income Tax Bill 2025 promises to address these flaws while retaining its core vision. Here’s what taxpayers can expect:

- Fixed Clauses: Removal of Clause 263(1)(a)(ix), renumbered sections, and clarified property valuation rules to reduce disputes.

- Non-Profit Provisions: Anonymous donations to purely religious trusts will retain tax exemptions, but those to mixed charitable-religious entities (e.g., trusts running hospitals) will be taxed, enhancing transparency.

- Simplified Compliance: Jargon-free language, tables, and formulas for clarity, with reduced penalties for minor offences.

- Digital Integration: Seamless integration with Faceless Assessment (launched 2019) and AIS (2021), plus extended Updated ITR filing to 48 months.

- GAAR Refinements: Context-based application to balance strict anti-avoidance rules with fairness for honest taxpayers.

- Tax Relief: No tax up to Rs. 12 lakh under the new regime, and up to Rs. 12.75 lakh for salaried taxpayers post-standard deduction (increased to Rs. 75,000).

A potential wildcard? Enhanced AI-driven monitoring via PROJECT INSIGHT, which could intensify scrutiny of digital transactions, cryptocurrencies, and offshore accounts. While this promises efficiency, it raises questions about privacy and compliance costs.

India’s Tax Landscape in 2025: Numbers That Stun

To understand the stakes, let’s dive into the latest data shaping India’s tax ecosystem:

- ITR Filings: 9.19 crore ITRs filed in FY 2024-25, up 36% from 6.72 crore in FY 2020-21, reflecting voluntary compliance.

- Tax Collections: Gross direct tax collections reached Rs. 27.02 lakh crore in FY 2024-25, doubling from Rs. 12.31 lakh crore in FY 2020-21. Personal income tax contributed significantly, though Q1 FY 2025-26 saw a 4% dip to Rs. 4.56 lakh crore.

- Refunds Surge: Refunds grew 474% over a decade, benefiting over 90 million PAN holders.

- GST Growth: Rs. 22.08 lakh crore collected in FY 2024-25, up 9.4%, signaling a robust economy.

- Challenges: Only Rs. 5.45 lakh crore collected by June 19, 2025, for FY 2025-26, underscoring the need for streamlined laws.

These figures highlight why the bill’s withdrawal is a high-stakes moment. A flawed law could disrupt growth, but a refined one could boost GDP by 1-2% through better compliance.

Implications for Taxpayers: Wins, Risks, and Surprises

The revised Income Tax Bill 2025 promises significant benefits but comes with hidden risks:

- Salaried Taxpayers: Easier filings, fairer deductions (e.g., pensions, property), and no tax up to Rs. 12.75 lakh post-deduction. Faster refunds reduce financial strain.

- Businesses: Clarified GAAR and reduced litigation lower compliance costs, vital in a post-pandemic economy.

- Non-Profits and NRIs: Tax exemptions for anonymous religious donations, but mixed trusts face scrutiny, impacting philanthropy. Global income taxation for Residents and Ordinarily Residents (ROR) remains, affecting NRIs.

- Risks: Enhanced AI scrutiny via PROJECT INSIGHT could increase audits for digital transactions, cryptocurrencies, and offshore accounts. Compliance costs may rise for businesses.

Economists predict the bill, if passed, could streamline compliance, reduce disputes, and align with Viksit Bharat goals, potentially adding 1-2% to GDP by 2030.

The Bigger Picture: A Tax System Reborn?

The Income Tax Bill 2025 withdrawal isn’t a setback—it’s a strategic pause to deliver a robust law. From its colonial roots in 1860 to today’s digital era, India’s tax system has evolved dramatically. The 1961 Act, with over 4,000 amendments, is a relic. The revised bill, set for April 1, 2026, aims to be a modern, transparent framework that empowers taxpayers and fuels economic growth.

But questions linger: Will the revised bill fully address GAAR ambiguities? Could new digital provisions spark privacy concerns? And what surprises might Parliament unveil on Monday? As India stands at the cusp of a tax revolution, one thing is clear: The Income Tax Bill 2025 could redefine your financial future.

Stay Tuned: The Lok Sabha’s August 11 session will reveal whether this bill lives up to its promise—or delivers new twists. What do you think the revised bill will bring? Share your thoughts below, and let’s decode India’s tax future together.