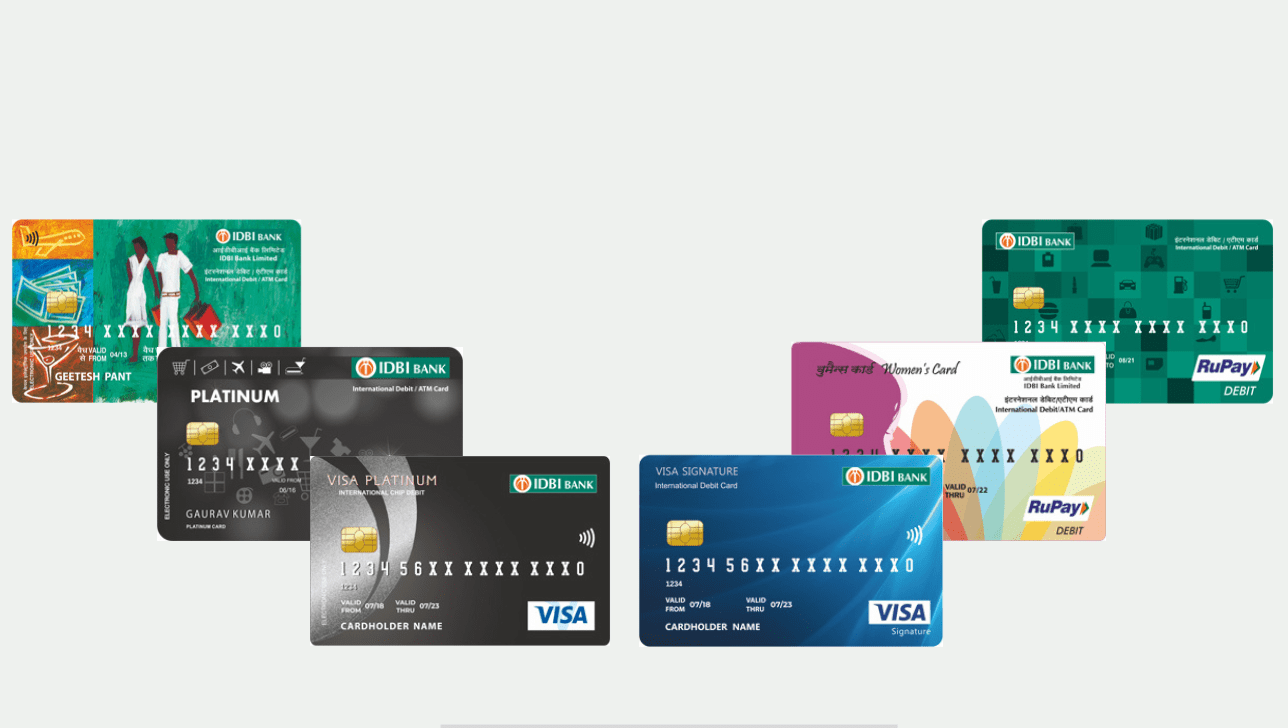

IDBI Bank offers a range of debit cards with varying insurance benefits tailored to meet diverse customer needs. These cards, including VISA and RuPay variants, provide features like personal accident cover, lost card liability protection, purchase protection, and coverage for lost baggage or household contents. The insurance benefits are designed to enhance security and provide financial protection, making IDBI debit cards a compelling choice for everyday transactions. Coverage typically requires the card to be active, meaning at least one or two transactions (financial or non-financial) within the last 90 days before an incident. Below is a detailed analysis of the insurance coverage, rewards, fees, pros, cons, and a comparison with peer banks.

Detailed Insurance Coverage by IDBI Debit Card

1. VISA Signature PayWave Debit Card

Insurance Coverage:

- Personal Accident Cover: ₹5 lakh

- Lost and Counterfeit Card Cover: ₹2 lakh

- Lost Checked Baggage: ₹50,000

- Purchase Protection: ₹20,000 (for 90 days)

- Fire and Burglary for Household Contents: ₹50,000

Overview

This premium card is designed for high-net-worth individuals, offering robust insurance benefits alongside high withdrawal and spending limits.

Eligibility

Requires at least two purchase transactions in the last 3 months prior to the event date for insurance claims to be processed.

Fees and Charges

- Joining Fee: ₹150 + taxes

- Annual Fee: ₹300 + taxes

2. RuPay Platinum Debit Card

Insurance Coverage:

- Personal Accident Cover: ₹5 lakh

- Lost and Counterfeit Card Cover: ₹1 lakh

- Lost Checked Baggage: ₹50,000

- Purchase Protection: ₹20,000 (for 90 days)

- Fire and Burglary for Household Contents: ₹50,000

Overview

A versatile card with strong insurance benefits, suitable for frequent travelers and shoppers, enhanced by RuPay’s network.

Eligibility

Requires at least one financial transaction in the last 90 days.

Fees and Charges

- Joining Fee: ₹150 + taxes

- Annual Fee: ₹400 + taxes

- Add-on Card Fee: ₹300

3. RuPay Women’s Debit Card

Insurance Coverage:

- Personal Accident Cover: ₹5 lakh

- Lost and Counterfeit Card Cover: ₹1 lakh

- Lost Checked Baggage: ₹50,000

- Purchase Protection: ₹20,000 (for 90 days)

- Fire and Burglary for Household Contents: ₹50,000

Overview

Tailored for women, this card combines convenience with comprehensive insurance coverage, similar to the RuPay Platinum card.

Eligibility

Requires at least one financial transaction in the last 90 days.

Fees and Charges

- Joining Fee: ₹150 + taxes

- Annual Fee: ₹400 + taxes

4. VISA Platinum PayWave Debit Card

Insurance Coverage:

- Personal Accident Cover: ₹5 lakh

- Lost and Counterfeit Card Cover: ₹1 lakh

- Lost Checked Baggage: ₹50,000

- Purchase Protection: ₹20,000 (for 90 days)

- Fire and Burglary for Household Contents: ₹50,000

Overview

- Offers enhanced usage limits and comprehensive insurance, ideal for Royale account holders who need international transaction capabilities.

Eligibility

Requires at least two purchase transactions in the last 3 months prior to the event date.

Fees and Charges

- Joining Fee: ₹150 + taxes

- Annual Fee: ₹400 + taxes

5. VISA Classic PayWave Debit Card

Insurance Coverage:

- Lost and Counterfeit Card Cover: ₹1 lakh

Overview

A basic card with limited insurance coverage, suitable for users seeking minimal charges and basic protections.

Eligibility

Requires active card usage, though specific transaction requirements are not detailed.

.

Fees and Charges

- Joining Fee: ₹150 + taxes

- Annual Fee: ₹220 + taxes

6. RuPay Classic Debit Card

Insurance Coverage:

- No specific insurance details provided in available data, but typically includes basic lost card liability protection.

Overview

A no-frills card for basic transactions with minimal insurance benefits compared to premium variants.

Eligibility

Likely requires active usage, similar to other IDBI cards.

Fees and Charges

- Joining Fee: ₹150 + taxes

- Annual Fee: ₹110 + taxes (free for the first year).

Review of IDBI Bank Debit Card Insurance Coverage

IDBI Bank’s debit card insurance offerings are competitive, particularly for premium cards like the VISA Signature and RuPay Platinum, which provide up to ₹5 lakh in personal accident cover and additional protections for baggage, purchases, and household contents. The requirement for active card usage (1-2 transactions in 90 days) ensures that only engaged customers benefit, which may limit accessibility for infrequent users. The insurance is provided through third-party insurers (e.g., Bajaj Allianz General Insurance), and IDBI Bank is not liable for claim settlements, which could lead to delays or disputes. Overall, the coverage is a valuable add-on, especially for frequent travelers and shoppers, but customers should review terms carefully due to potential exclusions (e.g., deliberate breach of law).

Rewards and Benefits

Rewards Program:

- VISA Signature PayWave: 1 loyalty point per ₹100 spent.

- RuPay Platinum: 2 loyalty points per ₹100 spent.

- RuPay Women’s: 2 loyalty points per ₹100 spent.

- VISA Platinum PayWave: 2 loyalty points per ₹100 spent.

- VISA Classic PayWave: 1 loyalty point per ₹100 spent.

- RuPay Classic: 1 loyalty point per ₹100 spent.

- Points can be redeemed for rewards like cashback, bill payments, or shopping, though specific redemption options are not detailed. Points are not awarded for certain transactions (e.g., government taxes, insurance premiums).

- Other Benefits:

- Airport Lounge Access: VISA Signature offers 4 complimentary visits per quarter at Indian lounges; RuPay Platinum and Women’s offer 2 visits per quarter.

- Contactless Payments: Available on VISA PayWave and RuPay cards for transactions up to ₹5,000 without PIN.

- Concierge Services: RuPay Women’s card includes personalized services like car rentals and hotel reservations.

- Merchant Discounts: Exclusive offers at select merchants for all cards.

- Global Acceptance: Cards are valid for domestic and international transactions at millions of ATMs and merchant establishments.

Pros and Cons

Pros

- Comprehensive Insurance: Premium cards offer up to ₹5 lakh personal accident cover and additional protections for baggage, purchases, and household contents.

- Rewards Program: Competitive loyalty points (up to 2 points per ₹100) enhance value for frequent users.

- Airport Lounge Access: Complimentary visits (2-4 per quarter) for premium cards add travel perks.

- Contactless Transactions: Secure and convenient for small transactions up to ₹5,000.

- Global Usability: Wide acceptance at ATMs and merchants worldwide.

- Security Features: EMV chip, PIN, and Verified by Visa/MasterCode protections reduce fraud risk.

Cons

- Active Usage Requirement: Insurance claims require 1-2 transactions in the last 90 days, which may exclude infrequent users.

- Limited Basic Card Coverage: VISA Classic and RuPay Classic offer minimal insurance benefits.

- Third-Party Insurance: Claims processed by third-party insurers may lead to delays or complications.

- Annual Fees: Non-waivable fees for premium cards (₹300-400) may deter cost-conscious users.

- Redemption Restrictions: Reward points exclude certain transactions, and redemption options are not fully detailed.

- International Transaction Fees: Currency exchange fees add costs for overseas usage.

Comparison with Peer Banks (Table)

Feature | IDBI VISA Signature PayWave | SBI Platinum Debit Card | ICICI Sapphire Debit Card | |

Personal Accident Cover | ₹5 lakh | ₹5 lakh (non-air), ₹50 lakh (air, if ticket purchased with card) | ₹3 crore (air, if ticket purchased with card) | Up to ₹2 crore (varies by account) |

Lost Card Liability | ₹2 lakh | Not specified | ₹50,000 | ₹50,000 |

Purchase Protection | ₹20,000 (90 days) | ₹50,000 (90 days) | ₹25,000 (90 days) | ₹25,000 (90 days) |

Lost Baggage Cover | ₹50,000 | Not specified | ₹50,000 | ₹50,000 |

Fire/Burglary Cover | ₹50,000 | Not specified | Not specified | Not specified |

Reward Points | 1 point/₹100 | Varies by program | 1 point/₹200 | 1 point/₹200 |

Airport Lounge Access | 4 visits/quarter (India) | None | 2 visits/quarter (India) | 2 visits/quarter (India) |

Annual Fee | ₹300 + taxes | ₹325 + taxes | ₹750 + taxes | ₹1,000 + taxes |

Contactless Payments | Yes (up to ₹5,000) | Yes (up to ₹5,000) | Yes (up to ₹5,000) | Yes (up to ₹5,000) |

Global Acceptance | Yes | Yes | Yes | Yes |

Analysis

- Insurance Coverage: IDBI’s VISA Signature and RuPay Platinum cards match or exceed peers in personal accident cover (₹5 lakh), but HDFC’s Platinum card offers significantly higher air accident cover (₹3 crore) if tickets are purchased with the card. ICICI’s coverage varies widely by account type.

- Rewards: IDBI’s RuPay Platinum and Women’s cards offer better reward rates (2 points/₹100) than HDFC and ICICI (1 point/₹200).

- Lounge Access: IDBI’s VISA Signature card provides more lounge visits (4/quarter) than HDFC and ICICI (2/quarter), while SBI offers none.

- Fees: IDBI’s fees (₹110-400) are lower than HDFC (₹750) and ICICI (₹1,000), making it more cost-effective.

- Unique Features: IDBI’s fire and burglary cover (₹50,000) is a differentiator not commonly offered by peers.

Best IDBI Debit Cards with Insurance Benefits

- VISA Signature PayWave Debit Card:

- Best for: High-net-worth individuals seeking premium benefits.

- Why: Offers the highest lost card liability cover (₹2 lakh), 4 lounge visits per quarter, and comprehensive insurance.

- RuPay Platinum Debit Card:

- Best for: Frequent travelers and shoppers.

- Why: Strong insurance coverage (₹5 lakh personal accident, ₹1 lakh lost card), 2 lounge visits per quarter, and 2 points per ₹100 spent.

- RuPay Women’s Debit Card:

- Best for: Women seeking tailored benefits.

- Why: Matches RuPay Platinum’s insurance and rewards, with added concierge services.

- VISA Platinum PayWave Debit Card:

- Best for: Royale account holders needing international usage.

- Why: Similar insurance to RuPay Platinum, with high withdrawal (₹1 lakh) and POS (₹2 lakh) limits.

Final Thought

IDBI Bank’s debit cards, particularly the VISA Signature, RuPay Platinum, and RuPay Women’s variants, offer robust insurance coverage, competitive rewards, and valuable travel perks like lounge access. While premium cards carry higher fees, their benefits justify the cost for frequent users. Compared to peers, IDBI stands out for lower fees and unique protections like fire and burglary cover. However, the active usage requirement and third-party insurance processing could be drawbacks. Customers should choose a card based on their spending habits, travel needs, and preference for rewards versus cost. For the most comprehensive insurance benefits, the VISA Signature PayWave and RuPay Platinum cards are top choices.